Economy

Nigeria Needs Trade Policy to Protect Ailing Economy—Agbakoba

By Aduragbemi Omiyale

A legal luminary in Nigeria, Mr Olisa Agbakoba, has advised the Nigerian government to come up with a trade policy specifically designed to promote local industries.

He said this policy, if formulated and implemented, would encourage domestic manufacturers to thrive to compete at the global level, adding that it would beneficial to the nation.

The Senior Advocate of Nigeria (SAN) of the Olisa Agbakoba Legal (OAL) made this suggestion while reacting to comments attributed to the Director-General of the World Trade Organisation (WTO), Mrs Ngozi Okonjo-Iweala.

Mr Agbakoba said Nigeria should not be seen as a dumping group for foreign products, emphasising that such would be dangerous to the economy.

He commended the federal government for its rice policy, which he said has made the country almost become self-sufficient in that regards.

According to him, when Nigeria closed its land borders in 2019, due to the importation of foreign rice, arms and others, Nigerians relied on locally produced rice for survival.

Last year, when COVID-19 forced many countries to shut down their borders to contain the spread of the virus, local rice was available for distribution to citizens as palliatives.

He, therefore, advised the government to take a cue from the immediate past President of the United States, Mr Donald Trump, who came up with a policy called America First.

According to him, this is one of the best approaches to achieve self-sufficiency and not the situation of exporting crude oil for petrol, exporting cocoa for cocoa powder, amongst others.

“My admiration for Dr Ngozi Okonjo-Iweala is huge but to advise us to continue to be import-dependent is not correct policy advice at this time.

“Nigeria has no current trade policy and Dr Okonjo Iweala seems to promote liberal and open borders.

“The problem is that we will remain consumers of imported products and cannot develop our economy to boost production and give jobs to over 25 million unemployed.

“While we must balance import policy with local production policy, we must heed the warning of wise economists that we cannot develop unless our trade policy is designed to promote local industries.

“I hesitate to compliment Trump’s America First trade policy but Trump understood the need to protect the US by discouraging over-dependence on imports. Nigeria produces crude but imports petrol. We produce cocoa but import cocoa powder.

“We have Tin, Gold and Iron but import the finished products in billions!

“We closed our Benin border to imports and made [N]12 billion a day internally. It was a strong trade policy to produce rice locally that has made us near self-sufficient.

“Now, we are growing tomato, beans, etc because we are discouraging imports.

“Nigerians be wise! We must support Made in Nigeria. I propose we adopt a new trade policy with strong trade laws to protect our ailing economy. Nigeria will be transformed by a Made in Nigeria Trade Policy!” the lawyer said.

Economy

SEC Revokes Operating Licence of Kensington Agro Trading Ltd

By Aduragbemi Omiyale

The operating licence of a capital market operator, Kensington Agro Trading Limited, has been revoked by the Securities and Exchange Commission (SEC).

The capital market regulator, in a circular dated February 09, 2026, disclosed that the action “pursuant to the powers of the commission under Section 61(6) of the Investments and Securities Act, 2025, and Rule 34(1) of the SEC Rules and Regulations 2013, as amended.”

The disclosure noted that the revocation of the licence of the company was “with immediate effect.”

The reason for withdrawing the operating licence of Kensington Agro Trading Limited was not stated in the notice.

“The Securities and Exchange Commission hereby notifies the general public of the revocation of the registration of Kensington Agro Trading Limited as a capital market operator (Commodity Broker/Dealer and Collateral Manager) with immediate effect.

“The revocation of the company’s registration is invoked pursuant to the powers of the Commission under Section 61(6) of the Investments and Securities Act, 2025, and Rule 34(1) of the SEC Rules and Regulations 2013, as amended.

“Accordingly, Commodity Exchanges, the investing public, commodity traders, and all Capital Market Stakeholders are advised to discontinue capital market-related dealings with the company,” the circular signed by the management noted.

Economy

CBN Data Shows 25% Drop in Nigeria’s Oil Earnings to N877bn in December

By Adedapo Adesanya

The latest off-cycle data released by the Central Bank of Nigeria (CBN) has revealed that Nigeria’s revenue from the oil and gas industry dipped by 25.04 per cent to N877.176 billion in December 2025, compared with N1.17 trillion received from energy firms in November 2025

In its presentation to the Federation Account Allocation Committee (FAAC) on receipts and expenditures for December 2025, the CBN disclosed that the amount earned from the oil and gas industry in the month under review represented 95.65 per cent of the sector’s budgeted revenue of N917.064 billion for the month.

In comparison, revenue from the petroleum industry in November 2025 accounted for 96.38 per cent of the N1.474 trillion budgeted for the sector in November 2025.

Providing a breakdown of revenue from the industry in December 2025, the CBN stated that the country earned N772.727 million from crude oil sales, dropping by 97.92 per cent from N37.134 billion recorded in November 2025; while the it recorded revenue of N9.019 billion from gas sales, rising by 24.14 per cent from N7.265 billion recorded in November.

Furthermore, the financial sector apex regulator noted that revenue from crude oil royalties dipped by 12.52 per cent to N514.288 billion in the month under review, from N587.865 billion recorded in the previous month; while receipts from miscellaneous oil revenue grew by 97.5 per cent to N2.678 billion in December 2025, from N1.356 billion in the previous month.

It also stated that royalties from gas appreciated by 124.91 per cent to N21.153 billion in December, from N9.405 billion in November 2025; revenue from gas flared penalties stood at N48.858 billion, down by 5.76 per cent from N51.842 billion in November, while revenue from Companies’ Income Tax (CIT) from upstream oil industry operations stood at N73.066 billion, as against N106.106 billion in the previous month.

The CBN further revealed that revenue from Petroleum Profit Tax (PPT) stood at N79.247 billion; rentals – N1.5 billion; while taxes stood at N126.594 billion, compared with N301.471 billion. N775.162 million, and N67.242 billion, respectively, in November 2025.

In addition, the CBN reported that from the country’s oil and gas revenue in December 2025, N18.163 billion was deducted for 13 per cent refund on subsidy, priority projects and Police Trust Fund from 1999 to 2021; while N8.761 billion was deducted by the Nigerian National Petroleum Corporation Limited (NNPCL), in respect of its 13 per cent management fee and frontier exploration fund.

It added that N23.724 billion was deducted and collected by the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) in December 2025, being four per cent of the cost of collection; while N46.903 billion was transferred to the Midstream and Downstream Gas Infrastructure Fund from gas flared penalties in the same month.

Economy

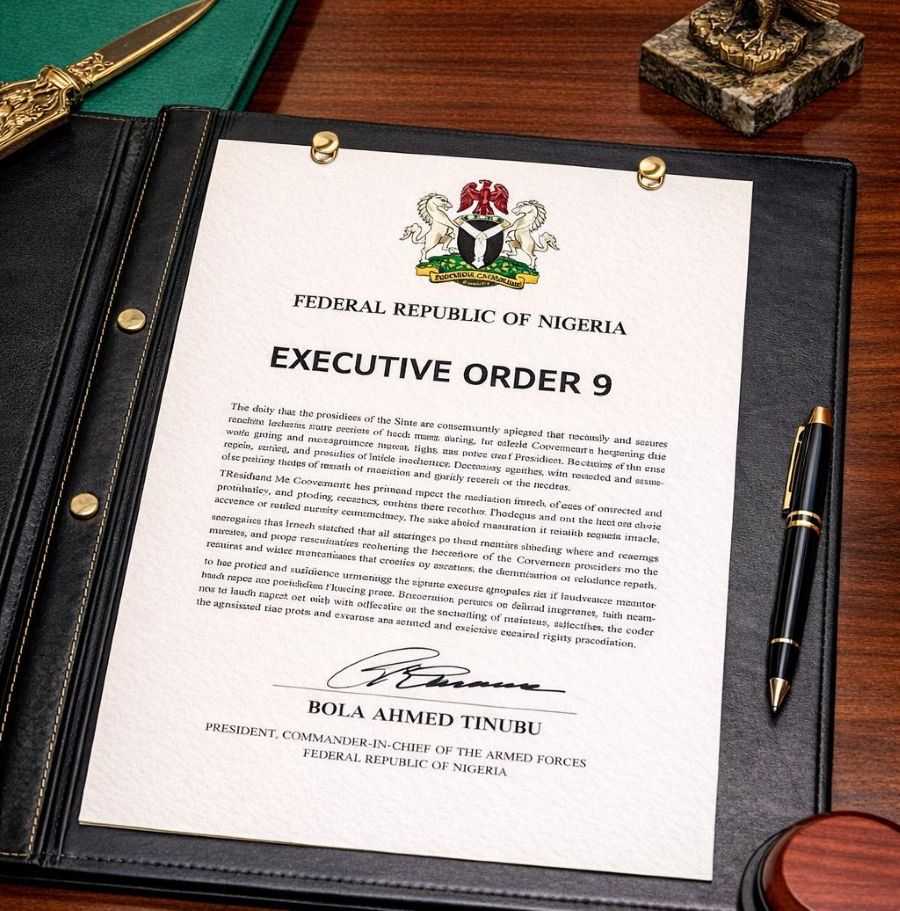

Nigeria Begins Implementation of Executive Order 9 on Oil Earnings

By Aduragbemi Omiyale

On Saturday, February 28, 2026, the Implementation Committee for Executive Order 9 held its inaugural meeting, headed by the Minister of Finance and Coordinating Minister of the Economy, Mr Wale Edun.

The panel, at the gathering, reaffirmed the directive of President Bola Tinubu that revenues accruing to the federation from petroleum operations must be handled in a manner that upholds constitutional principles, protects revenues accruable to the nation, and supports the fiscal stability of all three tiers of government.

It approved the establishment of a technical subcommittee to develop the detailed guidelines for the transition to direct remittance within three weeks, and commence a review of the Petroleum Industry Act (PIA) to address structural and fiscal anomalies that weaken Federation revenues.

It was agreed that the subcommittee would be led by the Special Adviser to the President on Energy, and will include the Solicitor-General of the Federation and Permanent Secretary Federal Ministry of Justice, the Chairman of the Nigeria Revenue Service, and the Chairman of the Forum of Commissioners of Finance, representatives of the Minister of State Petroleum Resources, Oil, with secretarial support from the Budget Office of the Federation.

The committee promised to provide coordinated guidance and timely updates as implementation progresses. It commended the cooperation of all stakeholders in advancing the President’s efforts to ensure that Nigeria’s petroleum resources deliver tangible, measurable benefits to citizens across the Federation.

Under the new order, Mr Tinubu directed that NNPC Limited shall cease, with immediate effect, the collection of the 30 per cent management fee and the 30 per cent frontier exploration fund deductions from profit oil and profit gas under Production Sharing Contracts (PSCs).

Additionally, all remittances of gas flare penalties into the Midstream and Downstream Gas Infrastructure Fund (MDGIF) are suspended with immediate effect, in line with the Executive Order.

With respect to Section 2, Sub-section 3 of the Executive Order on direct payments by contractors into the Federation Account, the panel agreed that this transition must be implemented in a manner that respects existing contractual and financing arrangements, and maintains investor confidence.

For this reason, the committee approved a defined transition period for the operationalisation of direct payments by contractors of profit oil, royalty oil, and tax oil into the Federation Account.

Until the Committee issues detailed guidelines, contractors will continue to remit under the current process. During the transition period, the Committee will issue clear, standardised guidance to ensure an orderly changeover.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn