Economy

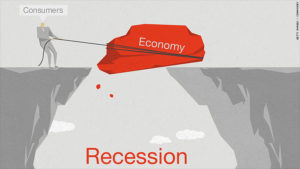

Nigeria Sets to Exit Recession in Q2

By Cordros Research

Last week, the National Bureau of Statistics (NBS) released Nigeria’s Gross Domestic Product (GDP) report for the first three months of 2017. The report showed that during the reference period, the economy contracted by 0.52 percent y/y (in real terms), 77 bps lower than Bloomberg’s compiled median estimate of 0.25 percent.

Having declined throughout 2016, the contraction in the first quarter of 2017 extends the country’s recessionary trend, and marks the fifth successive quarter of negative output growth rate.

Compared to the rate recorded in Q4-2016 (revised to -1.73 percent from -1.30 percent), Q1-2017 GDP growth rate is ahead by 121 bps, and also higher by 15 bps relative to the corresponding quarter of 2016 (revised to -0.67% from -0.36 percent). On a quarter-on-quarter basis, real GDP growth was -12.92 percent.

The slowdown in the rate of output contraction during the review period is attributable to the rebound in the non-oil sector–supported by sustained growth in Agriculture (3.39 percent y/y), modest rebound in Manufacturing (1.4 percent y/y), and tempered contraction in Services (-0.3 percent y/y vs. 1.6 percent y/y and 1.1 percent y/y respectively in Q4 and Q3-2016).

Suffice to say that the economy would have performed better, save for the significant drag from the oil sector (-11.64 percent y/y) which has remained in the negative growth region for six straight quarters.

The Oil Sector – Still Pressured

The oil sector extended contraction to the sixth consecutive quarter, recording a negative growth of 11.64 percent (vs. -17.70 percent in Q4-2016 and -4.81 percent in Q1-2016). Output from the sector continued to reflect constrained crude oil production, a fallout of the effects of series of militants’ attacks on crude oil and gas installations for the most of 2016.

For insight, the Forcados terminal (c.0.3mbpd) remained under force majeure during the three months period, while production from Bonga (c.0.2mbpd) was suspended in March due to the Turnaround Maintenance (TAM) carried out at the oil field by Shell Nigeria Exploration and Production Company (SNEPCo).

Specifically, the Statistics office estimated crude oil production during the review period to be 1.83mbpd. While this was an improvement over the 1.76mbpd achieved in the final quarter of 2016, it came in well-below both the 2.05mbpd recorded in the corresponding quarter of 2016 and the 2.2mbpd contained in the 2017 appropriation bill.

In contrast to the disappointing pattern in Q4-2016, the increased daily average oil production in Q1-2017 resulted in a growth of 14.86 percent q/q (compared to -9.1 percent q/q in Q4-2016) in the sector.

Noteworthy, the NBS’ reported domestic crude oil production (March 2017 figure is an estimate and is therefore subject to revisions) for the reference period varied with OPEC’s estimates based on direct communication (1.41mbpd) and secondary sources (1.55mbpd)

The Non-oil Sector Rebounds Modestly

The non-oil sector exited the negative growth region it retreated to in the last three months of 2016, growing by 0.72 percent y/y in Q1-2017 (compared to -0.33 percent y/y in Q4-2016 and -0.18 percent y/y in the corresponding quarter of 2016).

Output growth in this sector was supported by activities in the following subsectors: agriculture (particularly crop production), manufacturing, information and communication, transportation, and other services.

Indeed, this subdued the impact of the negative growth, albeit at a slower pace – recorded in Services (accounting for c.64 percent of the economy). On quarterly basis, the non-oil sector declined 14.92 percent, after growing by 5.27 percent q/q in Q4-2016.

Agriculture Fires On

Real growth in the agriculture sector remained positive, coming in at 3.39 percent y/y, 30 bps ahead of the 3.69 percent recorded in the equivalent quarter of 2016, albeit 65 bps below Q4-2016’s 4.03 percent.

Quarter-on-quarter, the sector contracted 27.38 percent (vs. 7.4 percent q/q in Q4-2016). Growth in the agriculture sector, during the review period, was limited by a 3 percent slowdown (from 4 percent in the final quarter of 2016) in Crop Production – which accounted for c.87 percent of the total output from the sector during the period.

Clearly, the sustained growth in this sector further reflected the knockon effect of renewed government commitment – in its diversification campaign – to the sector, evident in increased funding and support in the form of improved supply of seedlings, insecticides, and fertilizers. Particularly, the FGN halved fertilizer price during the review period.

It bears noting that the Central Bank of Nigeria’s Anchor Borrowers’ Programme (ABP) has significantly improved access to agric credit, coupled with notable gains from the Agricultural Credit Guarantee Scheme Fund (ACGSF).

Still on the impact of government policy, area planted has increased on the back of prevailing import restriction on certain agricultural products, which has heralded massive import substitution (amid currency weakness) and backward integration.

Manufacturing: Base Effect and Forex Liquidity to the Rescue

The manufacturing sector rebounded, exiting a four-quarter negative growth spree by recording real GDP growth of 1.36 percent y/y in the reference period, 836 bps higher than the -7.0 percent posted in Q1-2016, and 390 bps higher than Q4-2016’s -2.54 percent y/y.

Quarter-on-quarter, growth was negative 6.21 percent. The improvement in this sector, apart from (1) the favourable base effect, (2) relative step-up in power generation, and (3) possible gains from improved forex liquidity, following the apex bank’s renewed commitment in the form of frequent interventions, was driven by growth in Food, Beverage & Tobacco (4.07 percent y/y, compared to -2.7 percent y/y in Q4-2016) – the biggest component of the manufacturing sector (c.44 percent) – also reflective of the strong start to the year in the performance of top listed FMCG companies including NB, NESTLE, and DANGSUGAR.

Recording its second consecutive positive growth (after exiting recession in Q4-2016: 1.08 percent y/y) of 1.17 percent y/y, Textile, Apparel & Footwear – accounting for c.23 percent of manufacturing – also lifted the broad manufacturing sector.

Also positive for the sector was a rebound (following negative growth in all quarters of 2016) in Cement – the third largest component (c.9 percent) of manufacturing – at 1.83 percent y/y. The modest growth in Cement speaks to the fact that volume growth in the subsector remained tepid, largely constrained by price increase actions taken by cement producers, which consequently restrained private demand (corroborated by a decline in Real Estate: -3.10 percent y/y) – accounting for the largest proportion of domestic consumption. Suffice to say that growth in the subsector was partly boosted by an extension of the tenure of the 2016 budget’s capital spending projects until 5th May, 2017, allowing for an increased spend during the review period.

Services Coming Out of the Woods, Gradually

The services sector remained pressured, contracting by 0.3 percent y/y (vs. 1.6 percent y/y in Q4-2016), extending the sector’s decline to the fourth successive quarter. The slower pace of contraction was on the back of sector-wide growth as shown in Information and Communication (2.9 percent y/y), Transportation & Storage (10.5 percent y/y), Financial & Insurance (0.7 percent y/y), and Other Services (1.7 percent y/y).

The gain from the aforementioned subsectors (among others) was however subdued by declines in Trade (3.1 percent y/y) and Real Estate (3.1 percent y/y) – both collectively accounting for c.42 percent and c.27 percent respectively of the Services sector and overall economy. The negative growth in Real Estate is consistent with lingering low demand for properties, especially for non-residential and prime residential buildings, while Trade suffered amid naira exchange rate depreciation, the FGN’s import substitution policies, and lastly, the highly inflationary environment which weakened consumer purchasing power, and particularly affected trade at both the wholesale and retail segments.

Time to Exit Recession

Thus far in the second quarter of the year, leading indicators suggest positive expectation for output growth. April 2017 PMI figures clearly show expansion in manufacturing (51.1) activities while the non-manufacturing sector (49.5) missed growth by a whisker.

In addition, the latest edition of the Global Economic Conditions Survey revealed a rebound in Nigeria’s business confidence. We anchor growth in Q2-2017 on recovery in the oil sector (on less disruptive output) and stronger growth in the non-oil sector (on continued improvement in the foreign exchange space, commencement of capital releases, and continued growth in agriculture).

Overall, we estimate GDP growth of 1.8 percent y/y in the second quarter of the year.

Over Q2-2017, the oil sector is poised to benefit from improved and stable production. The peace deal between the FGN, and Niger Delta stakeholders and representatives of disaffected youth groups, if not compromised, has the potential of supporting oil production beyond current levels. The Nigerian National Petroleum Corporation (NNPC) stated recently that the restoration of peace to the oil-producing communities has enabled the organization to fast-track the repairs of all pipelines vandalized last year, and thus targets to ramp up output above the budget benchmark of 2.2mbpd by the end of Q2-2017.

For evidence, the Forcados terminal (c.0.3mbpd) has been reported to be operating at near capacity. In addition to the interactive engagement, the FGN’s plan to establish a specialized paramilitary force (comprising coastal patrol teams, Niger Delta subsidiary police, and other paramilitary agencies) in the petroleum industry this year in a bid to ensure zero vandalism of pipelines will be impactful.

Still on government effort at resolving and sustaining peace in the troubled Niger Delta Region, a new state-focused plan, also known as the ring fenced state approach, is being considered by the FGN. Also instructive is the passage of the Petroleum Industry Governance Bill (PIGB), yesterday, which has the potential of attracting fresh investments into the industry.

The non-oil sector should benefit from improved flow of crude oil revenue and continued growth in agriculture on continued focus from both private sector and the government. Stable crude oil production and relatively higher average prices (on OPEC’s commitment to its output cut agreement by way of extending the term of the deal), while bolstering the spending capacity of the fiscal authorities (in implementing the 2017 budget), should provide enough comfort for the monetary authority (to a certain degree) to sustain its frequent forex interventions. We think the CBN’s resolve to increasing the availability of dollars to large scale businesses and retail users, if uncompromised (by policies somersault), and assuming oil prices and production are unimpaired, will lessen the disruptive impact of FX shortage on the economy. In particular, services, trade and manufacturing sectors should benefit from the increased availability of the foreign exchange.

Growth in agriculture will remain strong in the second quarter, and by extension, the remaining part of the year. On crop production specifically, dry season harvest is underway across the country, with generally favorable results being reported in most areas.

Particularly, according to a FEWSNET report, early green harvest of yams and maize are expected to be near-normal. In addition, area cultivated has equally increased, driven by elevated staple food prices (reflected in higher food inflation rate: 19.30% y/y in April) and increased government funding and support.

Also, seasonal forecasts for the rainy season through September/October indicate likelihood for average to above-average cumulative precipitation. These, in addition to anticipated implementation of agriculture-related plans (e.g. recapitalization of the Bank of Agriculture for the provision of low-interest loans to farmers) in the ERGP, and a series of investments (both local and international), suggest increased yield on the horizon.

We look for stronger growth in the manufacturing sector, to be driven by (1) the CBN’s sustained commitment to forex stability, (2) fiscal stimulus from the 2017 appropriation bill which awaits presidential assent, following which the establishment of the FGN Satellite Industrial Centres (SICs) across the six geo-political zones of the country will commence, (3) potential gains from the recently launched Economic Recovery and Growth Plan (ERGP), (4) indications of improved consolidated refinery capacity utilization (25 percent in Q1-2017 vs. 11 percent in the corresponding quarter of 2016), and (5) sustained improvement in power generation, on the back of cessation of hostilities by militants in the Niger Delta, and the rise in water level at the various dams in the country.

Growth should rebound across the services sector, hinged on (1) government effort at improving the ease of doing business in Nigeria, as the Presidential Enabling Business Environment Council (PEBEC) rolled out and set to implement fresh reforms to consolidate and deepen the impact of its previous plan, (2) the recent approval, by the FGN, of the reduction of documentation requirements and timeline for import and export trade transactions to 48 hours, and (3) the CBN’s recent and sustained commitment to forex stability, particularly narrowing the spread between the official and parallel segments of the currency market rates, and creating a special window for SMEs.

Analyst for this report was Peter Moses (pe*********@*****os.com).

Economy

Champion Breweries Concludes Bullet Brand Portfolio Acquisition

By Aduragbemi Omiyale

The acquisition of the Bullet brand portfolio from Sun Mark has been completed by Champion Breweries Plc, a statement from the company confirms.

This marks a transformative milestone in the organisation’s strategic expansion into a diversified, pan-African beverage platform.

With this development, Champion Breweries now owns the Bullet brand assets, trademarks, formulations, and commercial rights globally through an asset carve-out structure.

The assets are held in a newly incorporated entity in the Netherlands, in which Champion Breweries holds a majority interest, while Vinar N.V., the majority shareholder of Sun Mark, retains a minority stake.

Bullet products are currently distributed in 14 African markets, positioning Champion Breweries to scale beyond Nigeria in the high-growth ready-to-drink (RTD) alcoholic and energy drink segments.

This expansion significantly broadens the brewer’s addressable market and strengthens its revenue base with an established, profitable portfolio that already enjoys strong brand recognition and consumer loyalty across multiple markets.

“The successful completion of our public equity raises, together with the formal close of the Bullet acquisition, marks a defining moment for Champion Breweries.

“The support we received from both existing shareholders and new investors reflects strong confidence in our long-term strategy to build a diversified, high-growth beverage platform with pan-African scale.

“Our focus now is on disciplined execution, integration, and delivering sustained value across markets,” the chairman of Champion Breweries, Mr Imo-Abasi Jacob, stated.

Through this transaction, Champion Breweries is expected to achieve enhanced foreign exchange earnings, expanded distribution leverage across African markets, integrated supply chain efficiencies, portfolio diversification into high‑growth consumer beverage categories, and strengthened presence in the RTD and energy drink segments.

The acquisition accelerates Champion Breweries’ transition from a regional brewing business to a multi-category consumer platform with continental reach.

Bullet Black is Nigeria’s leading ready-to-drink alcoholic beverage, while Bullet Blue has built a strong presence in the energy drink category across several African markets.

Economy

M-KOPA Nigeria Plans Expansion to Edo, Others After N231bn Credit Milestone

By Adedapo Adesanya

Emerging market fintech firm, M-KOPA, has announced plans to deepen its reach in Nigeria to the South South and South East regions, starting with Edo this year, after providing N231 billion in credit to over 1 million customers in the country.

The firm released its first Nigeria-focused Impact Report, which showed that Nigeria is M-KOPA’s fastest-growing market and fastest to reach the milestone.

Since its foray into the Nigerian market in 2019, M-KOPA has been working to dismantle barriers to financial inclusion by providing flexible smartphone financing and digital financial tools that align with how people in the informal economy earn and manage their money.

It operates in six states in the country, including Lagos, Ogun, and Oyo, among others.

The report highlights the company’s contribution to income generation, digital inclusion and economic opportunity for Every Day Earners across the country.

The report showed that M-KOPA has enabled 290,000 first-time smartphone users, while 56 per cent of agents accessed their first income opportunity through the platform.

It showed high income and livelihood gains among its users, with about 77 per cent of customers leveraging smartphones or digital loans obtained through the platform to generate income, indicating that access to financed devices is directly supporting micro-entrepreneurial activity and informal sector productivity.

Furthermore, 75 per cent of users report higher earnings since gaining access to M-KOPA’s services, suggesting measurable improvements in personal revenue streams. On the distribution side, 99 per cent of agents disclose increased earnings, reflecting positive spillover effects across the company’s value chain.

In addition, 81 per cent of long-term customers state that their household expenses have improved, pointing to enhanced financial stability and better consumption smoothing over time.

Speaking on the report, Mr Babajide Duroshola, General Manager, M-KOPA Nigeria, said, “Nigeria represents extraordinary potential, and we’re proud that it has become M-KOPA’s fastest-growing market. Our Impact Report shows that when Every Day Earners gain access to the right digital and financial tools, they use them to create stability and long-term progress for their families. This is about access that unlocks opportunity and sustained prosperity.”

On its expansion plans Nigeria-wide, the M-KOPA helmsman said, “Many of the states we are considering are already similar to the ones we are currently in proximity… So, there is proximity and similarity between these states, and that’s what we are going to do, starting with Edo.”

He noted that as M-KOPA Nigeria continues to expand, the focus remains on ensuring more everyday earners gain access to the digital and financial tools they need to build resilient, prosperous futures in Nigeria’s rapidly digitising economy.

Economy

Tinubu Okays Extension of Ban on Raw Shea Nut Export by One Year

By Aduragbemi Omiyale

The ban on the export of raw shea nuts from Nigeria has been extended by one year by President Bola Tinubu.

A statement from the Special Adviser to the President on Information and Strategy, Mr Bayo Onanuga, on Wednesday disclosed that the ban is now till February 25, 2027.

It was emphasised that this decision underscores the administration’s commitment to advancing industrial development, strengthening domestic value addition, and supporting the objectives of the Renewed Hope Agenda.

The ban aims to deepen processing capacity within Nigeria, enhance livelihoods in shea-producing communities, and promote the growth of Nigerian exports anchored on value-added products, the statement noted.

To further these objectives, President Tinubu has authorised the two Ministers of the Federal Ministry of Industry, Trade and Investment, and the Presidential Food Security Coordination Unit (PFSCU), to coordinate the implementation of a unified, evidence-based national framework that aligns industrialisation, trade, and investment priorities across the shea nut value chain.

He also approved the adoption of an export framework established by the Nigerian Commodity Exchange (NCX) and the withdrawal of all waivers allowing the direct export of raw shea nuts.

The President directed that any excess supply of raw shea nuts should be exported exclusively through the NCX framework, in accordance with the approved guidelines.

Additionally, he directed the Federal Ministry of Finance to provide access to a dedicated NESS Support Window to enable the Federal Ministry of Industry, Trade and Investment to pilot a Livelihood Finance Mechanism to strengthen production and processing capacity.

Shea nuts, the oil-rich fruits from the shea tree common in the Savanna belt of Nigeria, are the raw material for shea butter, renowned for its moisturising, anti-inflammatory, and antioxidant properties. The extracted butter is a principal ingredient in cosmetics for skin and hair, as well as in edible cooking oil. The Federal Government encourages processing shea nuts into butter locally, as butter fetches between 10 and 20 times the price of the raw nuts.

The federal government said it remains committed to policies that promote inclusive growth, local manufacturing and position Nigeria as a competitive participant in global agricultural value chains.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn