Economy

Nigerian Manufacturers Demand Urgent Slash in 27.5% Interest Rate

By Aduragbemi Omiyale

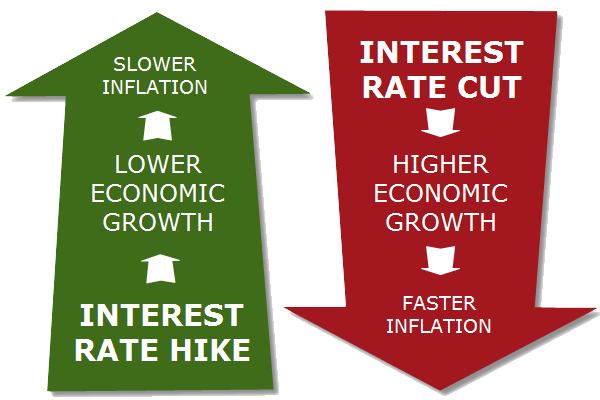

The Central Bank of Nigeria (CBN) has been asked to urgently cut the Monetary Policy Rate (MPR), currently at 27.5 per cent, because it is not helping the economy.

This call was made by the Manufacturers Association of Nigeria (MAN) in a statement signed its Director General, Mr Segun Ajayi-Kadir.

On Tuesday, the Governor of the CBN, Mr Yemi Cardoso, after the Monetary Policy Committee (MPC) meeting in Abuja, announced that members agreed to retain the Monetary Policy Rate (MPR) at 27.5 per cent after it was fixed at that rate in November 2024.

Reacting to this, Mr Ajayi-Kadir said the rigid stance of the MPC has continued to create unintended consequences that might deepen the parlous performance of the productive sector and earnestly, “beseech the CBN to urgently reconsider its monetary stance.”

He accused the central bank was to seeking to attract speculative foreign portfolio investors at the expense of Nigeria’s manufacturing base, which is now choked by unsustainable borrowing costs.

“A nation that woos foreign portfolio investors at the expense of its real sector may unwittingly be aspiring to build prosperity on the back of volatility.

“We are disturbed by the implicit prioritisation of short-term foreign capital inflows over the long-term health of domestic industries.

“While maintaining a high interest rate of 27.5 percent may temporarily attract speculative foreign portfolio investors, it is doing so at the expense of Nigeria’s manufacturing base, which is now choked by unsustainable borrowing costs,” he said.

Mr Ajayi-Kadir pointed out that what was evident now in the Nigerian economy was the contrast between the widening profitability of the banking sector buoyed by elevated interest margins and manufacturers’ shrinking margins, rising debts, and declining productivity, declaring that this was an economic paradox that must be urgently addressed.

“The current monetary policy trajectory risks turning banks into vaults of idle wealth, while the real economy—where jobs are created and value is added—faces suffocation,” said Mr Ajayi-Kadir, who warned that “a society that rewards intermediaries over producers invites long-term decline,” describing access to affordable credit as “the oxygen that sustains industrial growth,” adding that no economy has ever grown by starving its manufacturers of oxygen.

He further argued that recent disinflationary trends provided justification for the CBN to cut rates as the improvement in the real interest rates has given financial investors higher inflation-adjusted returns.

“Maintaining a high nominal interest rate under current inflation conditions is neither necessary nor justifiable, and will only prolong the pain for manufacturers and consumers alike,” he stated.

“A nation cannot industrialise on the back of prohibitively expensive credit. With the benchmark interest rate held at 27.5 per cent, Nigeria has become the 6th most expensive country to source credit as local manufacturers grapple with an average lending rate of over 37 per cent.

“This policy posture is not only inflationary, but is suffocating the capacity of the manufacturing sector.

“Compounded by other limiting factors, our members—small, medium and even large-scale—are finding it increasingly difficult to stay afloat, expand production lines, or even meet basic operational costs,” Mr Ajayi-Kadir disclosed.

He stated that domestic production would fall with highly-priced credit, which he said could constrain the country to “imports poverty” by relying on extensive importation of manufactured goods.

“Our concerns go beyond the debilitating impact on our numbers business. The ‘Nigeria First Policy,’ which seeks to strengthen local industry and reduce import dependence, may be under severe threat.

“At the heart of its successful implementation lies access to affordable financing to boost capacity utilisation. Unfortunately, the current interest rate regime constrains finance costs for our members, surging by over 44 per cent from N1.43 trillion in 2023 to N2.06 trillion in 2024 and rising.

“This represents a sharp increase that has directly depressed productivity and led to underutilisation of industrial capacity,” the DG stated, noting that high cost of credit has not only diminished the flow of investments into the manufacturing sector but has also dulled the return on existing investments, with Small and Medium Industries hit the hardest.

Economy

Customs Urges Freight Forwarders to Adopt Automated Licence, Permit System

By Adedapo Adesanya

The Nigeria Customs Service (NCS) has urged freight forwarders to adopt its automated Licence and Permits Processing system to reduce the cost of doing business.

This advice was given by the Assistant Comptroller-General of Customs, Mr Muhammed Babadede, during a stakeholders’ engagement on automation held in Lagos on Monday.

He noted that the reform responds to longstanding demands for faster, more transparent and simpler procedures for industry stakeholders, disclosing that Comptroller-General of Customs, Mr Bashir Adeniyi, has approved the full automation of the service’s licences and permits processes.

“For years, stakeholders dealt with paperwork, long queues and uncertainty from manual processing. Those days are coming to an end.

“This sensitisation is across all zones. The goal is to ensure stakeholders understand the automated system before implementation,” Mr Babadede said.

He said automation would enable applications and renewals from offices or mobile phones, eliminating visits to customs formations, assuring stakeholders of a fair and consistent process, and reducing errors associated with manual documentation.

He said automation would improve record-keeping, supervision and service delivery without increasing pressure on officers.

The Deputy Comptroller-General, Tariff and Trade, CK Naigwan, also represented by Mr Babadede, reiterated management’s commitment to seamless implementation.

Meanwhile, the Comptroller of Customs for Licence and Permit Unit, Mrs Ngozika Anozie, praised the Comptroller-General for driving innovation within the Service, saying the automation aligns Customs procedures with global best practice and strengthens institutional efficiency.

According to her, the reform reflects the three-point agenda of the Chairman of the World Customs Organisation, Mr Adeniyi, centred on consolidation, collaboration and innovation.

She said the system would enhance the ease of doing business in the maritime sector and boost national revenue generation.

“Automation will cut business costs and reduce travel risks for stakeholders

“They will no longer travel repeatedly to Abuja, paying for transport, hotels and feeding to process licences and permits,” she said, adding that the platform would automatically reject fake documents and accept genuine submissions, curbing fraudulent practices.

“The CGC is determined to sanitise the system, and we are committed to achieving that objective,” Mrs Anozie said.

On his part, the Assistant Superintendent of Customs, Mr Ibrahim Usman, said the Licence and Permit Unit operates under the Tariff and Trade Department.

He explained that the unit ensures proper issuance of licences and permits and compliance with import regulations.

Mr Usman said all licences and permits expire on December 31 of their issuance year.

He added that the portal would become fully operational after nationwide sensitisation, with stakeholders duly informed.

Customs Area Controller, Tincan Island Command, Mr Frank Onyeka, thanked stakeholders for their continued support.

He urged them to take the exercise seriously to achieve seamless processing across Customs operations.

Stakeholders raised concerns about online payment integration and potential technical disruptions.

Officials addressed the questions and pledged continued engagement to ensure smooth implementation nationwide.

Economy

Oyedele Links Nigeria’s Stock Market Surge to Fiscal Reforms

By Adedapo Adesanya

The Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Mr Taiwo Oyedele, has linked the surge in the nation’s stock market to ongoing fiscal reforms aimed at strengthening investor confidence and stabilising the economy.

Speaking at the 3rd PUU Capital Market Colloquium on Monday in Abuja, Mr Oyedele described the ongoing reforms as one of the most consequential fiscal resets in Nigeria’s modern history, noting that they are designed to build trust in the economy, stimulate inclusive growth, and foster a more investment-friendly environment.

According to him, the impact of these reforms is already visible on the trading floor of the Nigerian Exchange (NGX) Limited. As of mid-February 2026, the All-Share Index recorded a 25.3 per cent return within the first seven weeks of the year, while market capitalisation crossed the psychological N100 trillion mark in January before reaching an all-time high of over N125 trillion by February 20.

On January 13, 2026, the index reached an all-time high of 165,837.33 points, extending a rally that had already delivered a 51.2 per cent return in 2025, the strongest performance in nearly two decades.

Mr Oyedele linked the strong performance to structural reforms that had improved transparency, enhanced foreign exchange liquidity, and provided greater predictability in tax administration.

“The results of these policies are already evident on the trading floor. As of mid-February 2026, the Nigerian Stock Exchange (NGX) showed exceptional performance with the All-Share Index (ASI) recording a robust 25.3 per cent return in just the first seven weeks of the year, with market capitalisation crossing the psychological N100 trillion mark in January, and reaching an all-time high of over N125 trillion by 20 February 2026.

“Confidence continues to grow from both foreign and domestic investors, driven by the structural reforms and strong performance in key sectors like energy, industrial and financial services,” he said.

He explained that historically, Nigeria’s tax system had been fragmented and costly to comply with, discouraging investment and limiting efficient capital allocation.

“To address this, the new tax framework provides a unified, transparent and predictable environment where businesses can plan effectively, and investors can price risk appropriately,” he said.

He outlined several provisions in the new tax laws aimed at deepening the capital market. These include a full Capital Gains Tax exemption on proceeds reinvested in Nigerian shares within the same year, higher tax-exempt thresholds for small and retail investors, and a legal framework to reduce corporate income tax from 30 per cent to 25 per cent.

Other measures include the removal and reduction of certain transaction taxes, such as stamp duties on share transfers and withholding tax on bonus shares, as well as provisions that protect foreign investors from being taxed on naira gains without accounting for foreign exchange losses.

He emphasised that the ultimate goal is not merely to celebrate rising market indices but to translate financial market growth into tangible economic development, including financing for infrastructure, factories, innovation and job creation.

Economy

Unlisted Securities Shed 0.21% on Profit-taking

By Adedapo Adesanya

It was a bad day for the NASD Over-the-Counter (OTC) Securities Exchange on Monday, February 23, after it slumped 0.21 per cent at the close of business.

This pullback was influenced by profit-taking by investors in four securities, which overpowered the gains recorded by six others.

According to data, Central Securities Clearing System (CSCS) Plc dipped N3.79 to sell at N67.21 per unit compared with the previous N71.00 per unit, UBN Property Plc lost 13 Kobo to close at N1.98 per share versus N2.11 per share, Resourcery Plc fell 3 Kobo to 36 Kobo per unit from 39 Kobo per unit, and Geo-Fluids Plc depreciated 1 Kobo to close at N3.31 per share versus N3.32 per share.

As a result, the bourse’s market capitalisation went down by N5.04 billion to N2.384 trillion from N2.389 trillion, and the NASD Unlisted Security Index (NSI) decreased by 8.42 points to 3,985.90 points from 3,994.32 points.

Business Post reports that NIPCO Plc rose N23.00 to N253.00 per unit from N230.00 per unit, MRS Oil Plc added N14.50 to close at N214.50 per share versus N200.00 per share, FrieslandCampina Wamco Nigeria Plc grew by N1.85 to N93.40 per unit from N91.55 per unit, NASD Plc soared 40 Kobo to N51.28 per share from N50.88 per share, First Trust Mortgage Bank Plc advanced by 12 Kobo to N1.32 per unit from N1.20 per unit, and Food Concepts Plc improved by 6 Kobo to N3.76 per share from N3.70 per share.

As for the trading data, the volume of securities jumped 99.7 per cent to 7.3 million units from 3.7 million units, but the value depleted by 26.8 per cent to N61.8 million from N84.5 million, and the number of deals slipped 7.1 per cent to 39 deals from 42 deals.

At the close of trades, CSCS Plc was the most active stock by value (year-to-date) with 32.9 million units sold for N1.9 billion, followed by Geo-Fluids Plc with 120.6 million units valued at N473.4 million, and Resourcery Plc with 1.05 billion units exchanged for N408.7 million.

Resourcery Plc closed the session as the most active stock by volume (year-to-date) with 1.05 billion units worth N408.7 million, followed by Geo-Fluids Plc with 120.6 million units valued at N473.4 million, and CSCS Plc with 32.9 million units traded for N1.9 billion.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn