Economy

Nigeria’s Economy to Grow 3% in 2024—PWC

By Adedapo Adesanya

Consultancy firm, PricewaterhouseCoopers (PwC), has forecast that recent developments will see Nigeria’s economy grow by 2.8 per cent in 2023 and by 3 per cent in 2024.

In its latest report, it showed that the Nigerian gross domestic product (GDP) would slow, a move that started the first quarter of the year with through to the end and expand at virtually the same rate next year,

“The marginal growth in GDP by 2.5 per cent in Q2 2023 from 2.3 per cent in Q1 2023 was caused by the lingering effect of the cash crunch. PwC projects a 2.8 per cent growth rate for Nigeria in 2023 and 3 per cent in 2024,” the company said.

That marginal projection could be part of the chain reaction from enforcing fiscal reforms in Nigeria, according to the professional services firm.

The forecast from PwC is slightly lower than that of the International Monetary Fund (IMF), which put Nigeria’s GDP growth rate at 2.9 per cent and that of 2024 at 3.3 per cent.

The 2024, as the IMF projected, falls behind the emerging market and developing economies average, but is way ahead of that of Africa’s most industrialised economy South Africa.

The World Bank also expects a 2.9 per cent growth in the country this year.

PwC noted that the manufacturing, Information and Communication Technology (ICT) and finance & insurance sectors together contributed 45 per cent of company income tax and value-added tax in the first quarter, and this is worrying because it means revenue receipt is not broadly spread across the 21 sectors of the economy.

“This may have implications for reaching the targeted tax to GDP of 18 per cent by 2026 and government revenue generation capacity in the short to medium term,” it stated.

The federal government has set a target of a tax-to-GDP ratio of 18 per cent within the next three years.

Nigeria currently has a tax-to-GDP of 10.8 per cent and President Bola Tinubu has vowed to boost this above African peers like Cote d’Ivoire, Cameroon, and Senegal among others, who have between 15 per cent and 16 per cent.

The firm also warned that Nigeria may have to turn to foreign investors even as it claimed it is not considering the option at the moment.

Debt servicing currently gulps 96 per cent of government revenue with the country’s total debt standing at N87.4 trillion as of June. After securitising the Ways & Means credit from the Central Bank of Nigeria (CBN) in June, a devaluation of the Naira created more worries for the country.

Economy

Oil Prices Climb on Worries of Possible Iran-US Conflict

By Adedapo Adesanya

Oil prices settled higher on Friday as traders worried that this week’s talks between the US and Iran had failed to reduce the risk of a military conflict between the two countries.

Brent crude futures traded at $68.05 a barrel after going up by 50 cents or 0.74 per cent, and the US West Texas Intermediate (WTI) crude futures finished at $63.55 a barrel due to the addition of 26 cents or 0.41 per cent.

Iran and the US held negotiations in Muscat, the capital of Oman, on Friday to overcome sharp differences over Iran’s nuclear programme.

It was reported that the talks had ended with Iran’s foreign minister saying negotiators will return to their capitals for consultations and the talks will continue.

Regardless, the meeting kept investors anxious about geopolitical risk, as Iran wanted to stick to nuclear issues while the US wanted to discuss Iran’s ballistic missiles and support for armed groups in the region.

Any escalation of tension between the two nations could disrupt oil flows, since about a fifth of the world’s total consumption passes through the Strait of Hormuz between Oman and Iran.

Saudi Arabia, the United Arab Emirates, Kuwait and Iraq export most of their crude via the strait, as does Iran, which is a member of the Organisation of the Petroleum Exporting Countries (OPEC).

According to Reuters, Iran objected to the presence of any US Central Command (CENTCOM) or other regional military officials, saying that would jeopardise the process.

The current confrontation was sparked by more than two weeks of unrest in Iran that saw authorities launch a deadly crackdown that killed thousands of civilians and shocked the world. As reports of the deaths trickled out of Iran, US President Donald Trump threatened to strike Iran if any of the tens of thousands of protesters arrested were executed.

Meanwhile, Kazakhstan’s planned oil exports could fall by as much as 35 per cent this month via its main route through Russia, as the country’s top oil company, Tengiz oilfield, slowly recovers from fires at power facilities in January.

ING analysts have pointed out Iran’s neighbour, Iraq, and a disagreement with the US as another bullish factor for oil prices. It seems Iraqi politicians favour Mr Nouri al-Maliki as the country’s next Prime Minister, but the US thinks Mr al-Maliki is too close to Iran. President Trump has already threatened the oil producer with consequences if he emerges as PM.

Economy

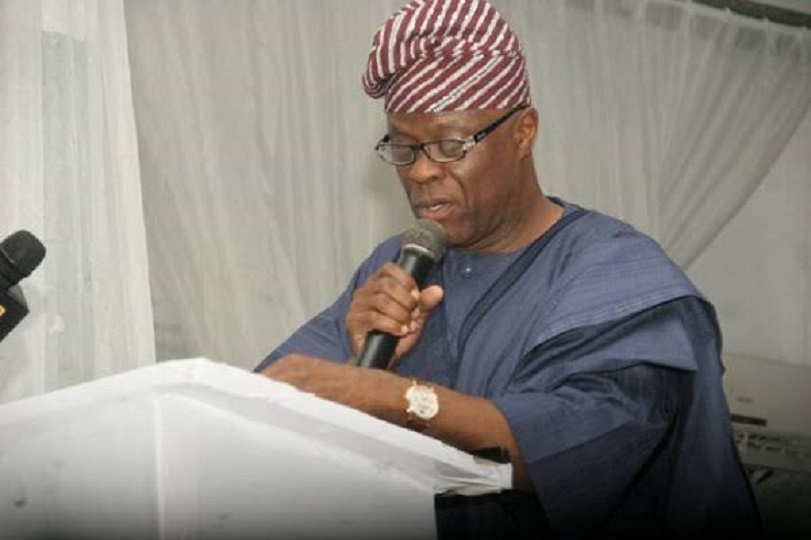

Adedeji Urges Nigeria to Add More Products to Export Basket

By Adedapo Adesanya

The chairman of the Nigeria Revenue Service (NRS), Mr Zacch Adedeji, has urged the country to broaden its export basket beyond raw materials by embracing ideas, innovation and the production of more value-added and complex products

Mr Adedeji said this during the maiden distinguished personality lecture of the Faculty of Administration, Obafemi Awolowo University (OAU), Ile-Ife, Osun State, on Thursday.

The NRS chairman, in the lecture entitled From Potential to Prosperity: Export-led Economy, revealed that Nigeria experienced stagnation in its export drive over three decades, from 1998 to 2023, and added only six new products to its export basket during that period.

He stressed the need to rethink growth through the lens of complexity by not just producing more of the same stuff, lamenting that Nigeria possesses a high-tech oil sector and a low-productivity informal sector, as well as lacking “the vibrant, labour-absorbing industrial base that serves as a bridge to higher complexity,” he said in a statement by his special adviser on Media, Dare Adekanmbi.

Mr Adedeji urged Nigeria to learn from the world by comparative studies of success and failure, such as Vietnam, Bangladesh, Indonesia, South Africa, and Brazil.

“We are not just looking at numbers in a vacuum; we are looking at the strategic choices made by nations like Vietnam, Indonesia, Bangladesh, Brazil, and South Africa over the same twenty-five-year period. While there are many ways to underperform, the path to success is remarkably consistent: it is defined by a clear strategy to build economic complexity.

“When we put these stories together, the divergence is clear. Vietnam used global trade to build a resilient, complex economy, while the others remained dependent on natural resources or a single low-tech niche.

“There are three big lessons here for us in Nigeria as we think about our roadmap. First, avoiding the resource curse is necessary, but it is not enough. You need a proactive strategy to build productive capabilities,” he stated, adding that for Nigeria, which is at an even earlier stage of development and even less diversified than these nations, the warning is stark.

“Relying solely on our natural endowments isn’t just a path to stagnation; it’s a path to regression. The global economy increasingly rewards knowledge and complexity, not just what you can dig out of the ground. If we want to move from potential to prosperity, we must stop being just a source of raw materials and start being a source of ideas, innovation, and complex products,” the taxman stated.

He added that President Bola Tinubu has already begun the difficult work of rebuilding the economy, building collective knowledge to innovate, produce, and build a resilient economy.

Economy

Nigeria Inaugurates Strategy to Tap into $7.7trn Global Halal Market

By Adedapo Adesanya

President Bola Tinubu on Thursday inaugurated Nigeria’s National Halal Economy Strategy to tap into the $7.7 trillion global halal market and diversify its economy.

President Tinubu, while inaugurating the strategy, called for disciplined, inclusive, and measurable action for the strategy to deliver jobs and shared prosperity across the country.

Represented by Vice-President Kashim Shettima, he described the unveiling of the strategy as a signal of Nigeria’s readiness to join the world in grabbing a huge chunk of the global halal economy already embraced by leading nations.

“As well as to clearly define the nation’s direction within the market, is expected to add an estimated $1.5 billion to the nation’s Gross Domestic Product (GDP) by 2027. It is with this sense of responsibility that I formally unveil the Nigeria National Halal Economy Strategy.

“This document is a declaration of our promise to meet global standards with Nigerian capacity and to convert opportunity into lasting economic value. What follows must be action that is disciplined, inclusive, and measurable, so that this Strategy delivers jobs, exports, and shared prosperity across our nation.

“It is going to be chaired by the supremely competent Minister of Industry, Trade and Investment.”

The president explained that the halal-compliant food exports, developing pharmaceutical and cosmetic value chains would position Nigeria as a halal-friendly tourism destination, and mobilising ethical finance at scale,” by 2030.

“The cumulative efforts “are projected to unlock over twelve billion dollars in economic value.

“While strengthening food security, deepening industrial capacity, and creating opportunities for small-and-medium-sized enterprises across our states,” he added.

Allaying concerns by those linking the halal with religious affiliation, President Tinubu pointed out that the global halal economy had since outgrown parochial interpretations.

“It is no longer defined solely by faith, but by trust, through systems that emphasise quality, traceability, safety, and ethical production. These principles resonate far beyond any single community.

“They speak to consumers, investors, and trading partners who increasingly demand certainty in how goods are produced, financed, and delivered. It is within this broader understanding that Nigeria now positions itself.”

Tinubu said many advanced Western economies had since “recognised the commercial and ethical appeal of the halal economy and have integrated it into their export and quality-assurance systems.”

President Tinubu listed developed countries, including the United Kingdom, France, Germany, the Netherlands, the United States, Canada, Australia, and New Zealand.

“They are currently among the “leading producers, certifiers, and exporters of halal food, pharmaceuticals, cosmetics, and financial products.”

He stated that what these developed nations had experienced is a confirmation of a simple truth, that “the halal economy is a global market framework rooted in standards, safety, and consumer trust, not geography or belief.”

The president explained that the Nigeria national halal economy strategy is the result of careful study and sober reflection.

He added that it was inspired by the commitment of his administration of “to diversify exports, attract foreign direct investment, and create sustainable jobs across the federation.

“It is also the product of deliberate partnership, developed with the Halal Products Development Company, a subsidiary of the Saudi Public Investment Fund.

“And Dar Al Halal Group Nigeria, with technical backing from institutions such as the Islamic Development Bank and the Arab Bank for Economic Development in Africa.”

The Minister of Industry, Trade and Investment, Mrs Jumoke Oduwole, said the inauguration of the strategy was a public-private collaboration that has involved extensive interaction with stakeholders.

Mrs Oduwole, who is the Chairperson, National Halal Strategy Committee, said that the private sector led the charge in ensuring that it is a whole-of-government and whole-of-country intervention.

The minister stressed that what the Halal strategy had done for Nigeria “is to position us among countries that export Halal-certified goods across the world.

The minister said, “We are going to leverage the African Continental Free Trade Area (AfCFTA) to ensure that we export our Halal-friendly goods to the rest of Africa and beyond to any willing markets; participation is voluntary. “

She assured that as the Chairperson, her ministry would deliver on the objectives of the strategy for the prosperity of the nation.

The Chairman of Dar Al-Halal Group Nigeria L.td, Mr Muhammadu Dikko-Ladan, explained that the Halal Product Development Company collaborated with the group in developing the strategy.

“In addition to the strategy, an export programme is underway involving the Ministry of Trade and Investment, through which Nigerian companies can be onboarded into the Saudi Arabian market and beyond.£

Mr Dikko-Ladan described the Strategy as a landmark opportunity for Nigeria, as it creates market access and attracts foreign direct investment.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn