Economy

Obu-Okpella Mines Belongs to us—Dangote Insists

By Dipo Olowookere

The tussle over ownership of mining sites in Obu, Okpella in Edo State between BUA Group and Dangote Group may not end anytime soon.

Recently, BUA Group said it had obtained an order from a federal high court in Benin City affirming that it owns the site.

But Dangote Group, in a statement on Monday, slammed its competitors, describing its claims as false and insisting that the controversial mining sites do not belong to BUA Group as claimed.

In the statement, Dangote, which is the largest producer of cement in the country, said BUA’s claims were not only “unfounded and mischievous”, but were also “riddled with misrepresentations and deliberate distortions of facts.”

According to the Group Executive Director, Mr Devakumar Edwin, the Dangote Group through its lawyers had vigorously defended the Suit filed by the BUA Group seeking a perpetual Injunctive Order against further interferences with their purported fundamental rights to property and privacy.

Mr Edwin stressed that the group has appealed the high court judgment and until the appellate court rules, BUA cannot lay claim or even operate on the mining site.

Giving details of the case, Mr Edwin recalled that in 2014, the Dangote Group and AICO entered into an agreement for the transfer of 2541ML from AICO to Dangote Group.

“AICO thereafter applied to the Ministry of Mines for the approval of the Transfer vide a Mining Lease Transfer Form dated 11 July 2014.

“In 2016, the Ministry of Mines wrote to the Dangote Group to convey the approval of the Ministry for the Transfer/Assignment of 2541ML from AICO to Dangote Group with effect from 03 February 2016.

“Following the approval of the Ministry, the Dangote Group became the legal holder and owner of the Mining Lease No. 2541ML. The 2541ML Certificate was thereafter endorsed to reflect the transfer from AICO to the Dangote Group,” he explained.

Dangote Group, therefore, warned the general public and those working with BUA Group not to take any steps to enter, mine or interfere with the disputed mining leases pending the determination of the appeal and/or the 2 Suits pending before Umar J. as any such steps will be considered a contempt of court.

He noted that the Supreme Court in the case of Governor of Lagos State v. Chief Ojukwu (1986) 1 NWLR (pt. 18) 621), has held that, “Once a party is aware of a pending court process, even when the court has not made a specific injunctive order, parties are bound to maintain the status quo pending the determination of the court process.”

Mr Edwin insisting that BUA Group does not have any right to the mining sites even if BUA Group claims to have title pursuant to Mining Leases 18912 and 18913.

“However, as recently as 09 October 2019 while its wholly incompetent Fundamental Right Suit was still pending, the BUA Group through its subsidiary (Edo Cement Company Ltd) applied to the Director-General of Mining Cadastre Office & Centre, Abuja for the renewal of the said Mining Leases Nos. 18912 and 18913.

“In response to the BUA Group’s renewal applications, the Mining Cadastre Office, in Abuja in its letters dated 18 October 2019 wrote back to BUA Group to inform them in very categorical terms that the Mining Leases Nos 18912 and 18913 were non-existent and were not valid mineral titles,” he said.

Mr Edwin further explained that, “Interestingly and to show the character of the BUA Group, these supremely critical facts were never brought to the attention of the Federal High Court in the Fundamental Rights Suit even though the Mining Cadastre Office letters were written about eight months before the judgment of the court was delivered.

“In effect and significantly so, when that court was handing down its decision and issuing injunctive orders to protect BUA, BUA knew and was well aware, by virtue of the above-referenced letters, that its purported rights to the mining lease were non-existent!

“These facts were, however, mischievously and in a brazen display of mala fide concealed by the BUA Group from the court!

“Even these facts constitute sufficient proof that the BUA Group’s claim to Mining Leases Nos. 18912 and 18913 rest entirely on quicksand and is, therefore, invalid baseless and totally non-existent. The general public is advised to be guided accordingly,” Mr Edwin added.

Economy

Subscription for FGN Savings Bonds Opens for March 2026 at 13.9%

By Aduragbemi Omiyale

The Debt Management Office (DMO) has asked retail investors interested in investing in the FGN savings bonds to begin to talk to their financial advisers.

This is because subscription for the retail bonds for March 2026 has commenced and will close on Friday, March 6, according to a circular issued by the agency on Monday.

The debt office is selling two tenors of the debt instrument, with the shorter note maturing in two years’ time and the longer maturing a year later.

Details of the notice showed that the two-year paper is being offered at a coupon of 12.906 per cent, and the three-year paper at 13.906 per cent.

Both notes are sold at a unit price of N1,000, with a minimum subscription of N5,000 and in multiples of N1,000 thereafter, subject to a maximum subscription of N50 million. They can be purchased via approved stockbroking firms in Nigeria.

The FGN savings bond qualifies as a security in which trustees may invest under the Trustee Investment Act. It also serves as government securities within the meaning of the Company Income Tax Act (CITA) and the Personal Income Tax Act (PITA) for tax exemption for pension funds, amongst other investors.

It can be used as a liquid asset for liquidity ratio calculation for banks, and is listed on the Nigerian Exchange (NGX) Limited for trading at the secondary market.

The bond is backed by the full faith and credit of the Federal Government of Nigeria (FGN) and charged upon the general assets of the country.

Economy

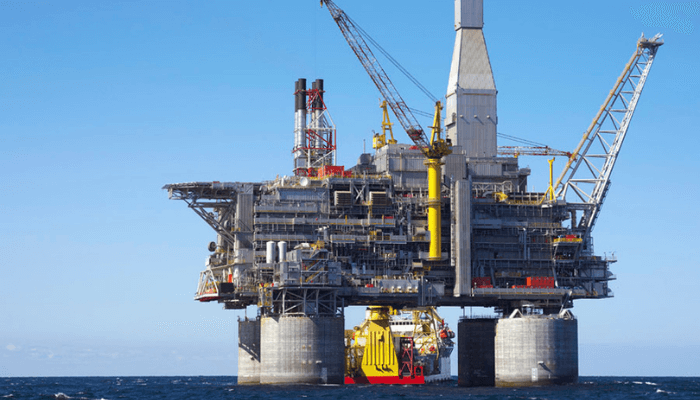

Nigeria Splits OPL 245 into Four Blocks for Eni, Shell

By Adedapo Adesanya

Nigeria has broken up the OPL 245 oil block into four new assets to be operated by Eni and Shell, potentially settling the future of the field at the centre of one of the oil industry’s biggest historic corruption trials.

According to Reuters, the agreement clears the way for the development of OPL 245, one of Nigeria’s biggest deepwater reserves that has remained untapped for almost three decades amid overlapping lawsuits in multiple countries.

The final contracts are expected to be signed starting Monday, the report said, citing a source familiar with the situation.

The Nigerian government had signalled for years that it was keen to find a solution that would bring the block into production. The source wished to remain anonymous as they are not authorised to comment on government policy before an official announcement.

Located in the Niger Delta’s deepwaters, the field has languished since its initial award in 1998 to Malabu Oil and Gas, a shadowy firm controlled by Mr Dan Etete, Nigeria’s oil minister at the time. The block is estimated to hold up to 9 billion barrels of oil equivalent in reserves—enough to rival Nigeria’s entire proven reserves if fully developed.

Mr Etete controversially awarded the lucrative licence to his own company for a nominal $20 million fee, sparking immediate controversy over conflicts of interest.

The saga escalated in 2011 when Malabu sold its rights to a Shell-Eni joint venture for $1.3 billion.

Italian and Nigerian prosecutors alleged that over $1 billion of that sum was siphoned off through bribes to politicians, middlemen, and Mr Etete himself, including hefty payments to then-President Goodluck Jonathan’s associates.

The two European energy giants and some of their former and current executives, including Eni CEO, Mr Claudio Descalzi, faced trial in Italy but all were acquitted in 2021, having denied all wrongdoing.

Shell and Eni have consistently denied wrongdoing, insisting the payments complied with due diligence.

The anti-graft agency, the Economic and Financial Crimes Commission (EFCC), has pursued parallel probes, recovering over $200 million in frozen funds, but progress stalled amid political shifts.

Operations at the Nigerian oil block have been halted for more than a decade by a series of trials and competing legal claims.

In 2023, the federal government withdrew civil claims totalling $1.1 billion against Eni, ending the long battle.

Economy

Dangote Refinery, NNPC Raise Petrol Pump Price by N100

By Modupe Gbadeyanka

The price of Premium Motor Spirit (PMS), otherwise known as petrol, has been increased by at least N100 per litre at the pump.

This followed the recent increase in the price of crude oil in the global market as a result of the bombardment of Iran by the United States and Israel over the weekend.

The air strikes killed the Supreme Leader of Iran, Mr Ayatollah Ali Khamenei, and several others.

Iran has responded by firing missiles at US facilities in some Gulf countries, including Saudi Arabia, Qatar, Kuwait, Bahrain, the UAE, and others.

Crude oil prices rose to about $80 per barrel on the market from about $70 per barrel before the Middle East crisis.

Oil marketers in Nigeria have responded to the tension and have raised the prices of petroleum products.

At most MRS Oil retail stations in Lagos, the new price notice showed an increase of about N100 per litre.

As of Monday, the price of PMS was N837 per litre, but on Tuesday morning, it had changed to N938 per litre, while at NNPC retail stations, it was N930 per litre instead of the previous N830 per litre.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn