Economy

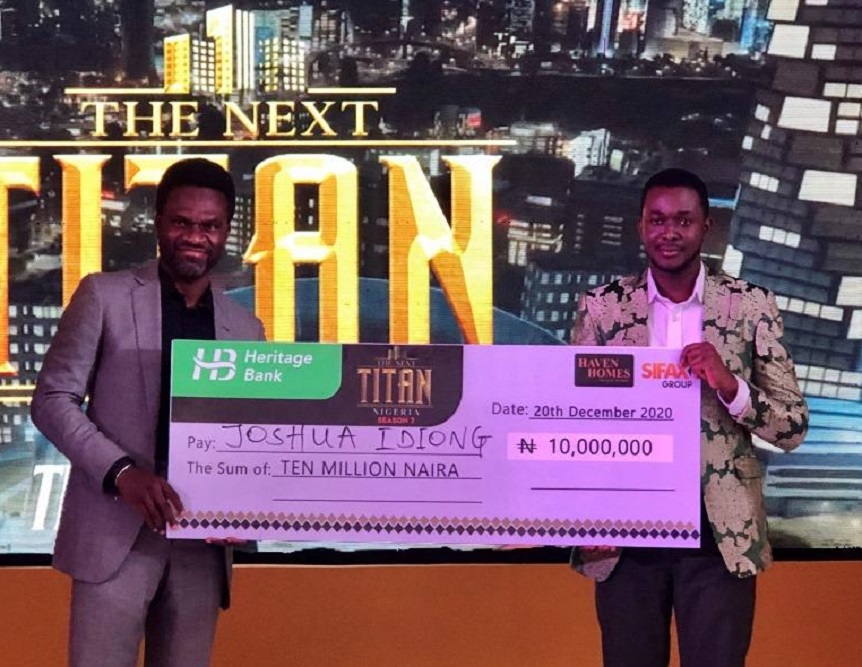

Palm Oil Investor Gets N10m from Heritage Bank

By Aduragbemi Omiyale

An investor in the palm oil industry, Mr Joshua Joseph Idiong, has received N10 million from Heritage Bank and the fund is expected to boost his business.

Mr Idiong is into the oil palm processing business. He is the chief executive of the Akwa Ibom State-based Josult Oil Processing Company.

He was one of the contestants of the prestigious The Next Titan Season 7. In fact, he won the edition of the programme themed The Unstoppable.

The Next Titan is an entrepreneurial reality show sponsored by Heritage Bank and aimed to support Micro, Small and Medium Enterprises (MSMEs).

Mr Idiong, who is a graduate of Federal University of Technology Owerri (FUTO) with Bachelor Degree in Environmental Science, emerged winner after competing with Ifeanyi Nkwonta, Chidinma Eriobu and Ifeoma Benjamin at the grand finale in Lagos.

Idiong’s entry on the show was amongst the 18,000 entries, followed by online auditions before the top 16 moved into the Titan House for 10 weeks to compete against top-notch young entrepreneurs in real-life entrepreneurial tasks.

They were grilled by a panel of judges who are technocrats with the perfect blend of entrepreneurial requisite skills comprising Kyari Bukar, co-founder/CEO of Trans-Sahara Investment; Lilian Olubi, CEO of Primera Africa Securities Ltd; Chris Parkes, Chairman/CEO of CPMS Africa and Tonye Cole, co-founder of Sahara Group.

The winner, who highly commended Heritage Bank for its continued supports to entrepreneurs and sponsorship of the Next Titan, said, “Heritage Bank is an amazing bank that has stood strong on this show. My love for Heritage Bank stems from the fact that this is my second time on this show but before I came in, I have learnt so much from the show.

“This means that Heritage Bank is truly affecting the lives and businesses of entrepreneurs positively, alongside the viewers. This is a bank that has differentiated itself from other banks in boosting the strength of SMES in Nigeria.”

Speaking at the grand finale, MD/CEO of Heritage Bank, Mr Ifie Sekibo, stated that the programme easily aligns with the primary focus of the management of Heritage Bank to promote every laudable entrepreneurial idea meant to broaden economic horizon of the country for the benefit of citizens and other residents of Nigeria.

Mr Sekibo who was represented by the Divisional Head, Corporate Communications, Mr Fela Ibidapo, further affirmed, “as a catalytic institution in the empowering of entrepreneurs in the MSME sector, Heritage Bank has continued to make relentless efforts in this space to empower entrepreneurs in Nigeria through championing several empowerment schemes like the HB Innovation Lab Accelerator programme (HB-LAB), Ynspyre Account, Youth Innovative Entrepreneurship Development Programme (YIEDP), Centre for Values in Leadership (CVL) on Young Entrepreneurship Business Training Programme (YEBTP), Young Entrepreneurs and Students (YES) Grant and Nigerian Youth Professional Forum (NYPF), Big Brother Nigeria, Lagos Comic Con, amongst others.”

The Executive Producer of The Next Titan, Mr Mide Kunle-Akinlaja, in his address explained that the project was created and designed as a deliberate attempt to provoke the spirit of entrepreneurship of young Nigerians, not only the contestants on the show but another multitude of aspiring entrepreneurs who can watch the show on TV.

He said that Season 7 was designed to search for business ideas that are immune to any pandemic, innovations that break boundaries and technologies that can survive any lockdown.

“It does not matter what your business idea is all about or its focus, but you must be able to prove that your business has what it takes in terms of ideas or technologies to survive any future pandemic or lockdown,” he said.

Economy

Nigeria Eyes Oil Windfall as Brent Hits $80 on US-Israel-Iran Conflict

By Adedapo Adesanya

Nigeria could face a windfall from rising oil prices as Brent crude, the international crude benchmark, hit $80 per barrel on Monday as the United States and Israel air strikes on Iran plunged the Middle East into crisis.

Following the action, which commenced on Saturday, most tanker owners, oil majors and trading houses have suspended crude oil, fuel and liquefied natural gas shipments via the Strait of Hormuz, responsible for around 20 per cent of global oil flows.

Energy analysts and investment banks expect oil prices to surge this week to $90, with a chance of hitting $100 per barrel if disruptions to traffic in the crucial Strait of Hormuz persist.

As of press time, oil prices had already spiked by 10 per cent to above $80 per barrel for Brent. This could have a positive ripple effect for Nigeria, which is an oil-producing country despite challenges to production, as it uses the Brent crude price to gauge the value of its crude grades, including Bonny Light, Qua Iboe, Forcados, Escravos, among others.

Nigeria, which depends on crude for over 80 per cent of export earnings and a substantial share of government revenue, could see elevated prices translate to higher foreign exchange earnings, stronger reserves, and improved balance of payments.

Seeing the scale of the conflict and the already disrupted traffic through the Strait of Hormuz, analysts expect further spikes at least this week. This could mean higher oil export receipts, which could boost Nigeria’s foreign exchange liquidity, which can support the Naira and reduce FX volatility if the gains translate into actual FX inflows.

However, the country is plagued by volatile oil production, with oil output below the 1.5 million quota ascribed by the Organisation of the Petroleum Exporting Countries and its allies (OPEC). Latest data released last month showed that Nigeria’s production increased to 1.45 million barrels per day in January 2026 from 1.42 million barrels per day in December 2025.

Meanwhile, eight members of OPEC+, excluding Nigeria, on Sunday agreed to raise output by 206,000 barrels per day from April, a modest increase representing less than 0.2 per cent of global demand.

Analysts See Oil Prices at $90 a barrel in the Near Term

Citigroup expects Brent Crude to trade in the $80 to $90 per barrel range over at least the coming week in the bank’s base case.

“Our baseline view is that the Iranian leadership changes, or that the regime changes sufficiently as to stop the war within 1-2 weeks, or the US decides to de-escalate, having seen a change in leadership and set back Iran’s missiles and nuclear program over the same time frame,” analysts at Citigroup wrote in a note carried by Bloomberg.

Goldman Sachs sees an $18 a barrel real-time risk premium in oil prices. However, if only 50 per cent of flows through the Strait of Hormuz are halted for a month, the war risk premium to prices would moderate to $4 per barrel, according to Goldman.

Wood Mackenzie sees disruption in flows to push oil to above $100 per barrel.

“Higher oil and gas prices are certain as the closure of the Strait of Hormuz threatens to disrupt 15% of global oil supply and 20% of global LNG supply, with oil prices potentially exceeding $100/bbl if tanker flows are not quickly restored,” it said in a press release.

Rystad expects prices to rise by $20 to about $92 a barrel.

Economy

OPEC+ Agrees Modest Oil Output Boost as US War on Iran Disrupts Shipments

By Adedapo Adesanya

The Organisation of the Petroleum Exporting Countries and allies (OPEC+) has agreed to begin a modest increase in oil production of 206,000 barrels per day from April, just as the US-Israel war on Iran disrupted flows from key members of the group in the Middle East.

In a virtual meeting on Sunday, Saudi Arabia, Russia, Iraq, the United Arab Emirates, Kuwait, Kazakhstan, Algeria and Oman reviewed global supply and demand conditions before deciding to start unwinding part of their additional voluntary production cuts first announced in April 2023.

The countries agreed on a production adjustment of 206,000 barrels per day for April 2026, marking the first step in easing a 1.65 million barrels per day voluntary reduction introduced nearly three years ago.

In a statement issued after the talks, the group said low oil inventories and stable economic prospects justified a cautious return of supply to the market.

The 1.65 million barrels per day cut, announced in April 2023, was introduced alongside a separate 2.2 million barrels per day voluntary reduction unveiled in November 2023 as part of broader efforts by the OPEC+ alliance to stabilise prices amid economic uncertainty and fluctuating demand.

The eight producers stressed that the 1.65 million barrels per day could be restored “in part or in full” depending on evolving market conditions, and reiterated their readiness to pause or reverse the unwinding if necessary.

“The countries will continue to closely monitor and assess market conditions,” the statement said, adding that flexibility would remain central to the group’s strategy.

The move signals confidence among the core OPEC+ members that supply constraints have successfully supported prices while preventing excessive stockpiling. Analysts note that Brent crude prices have remained relatively firm in recent months, supported by disciplined output management and resilient Asian demand.

However, the producers underscored that the adjustment does not mark a full return to pre-cut production levels. They reaffirmed their commitment to the 2022 Declaration of Cooperation, the framework binding OPEC members and non-OPEC allies such as Russia, and said compliance would continue to be monitored by the Joint Ministerial Monitoring Committee (JMMC).

The group also confirmed that countries which have overproduced since January 2024 would fully compensate for excess output. Compensation plans are expected to be reviewed monthly.

OPEC+, which accounts for roughly 40 per cent of global crude supply, has repeatedly adjusted output since the Covid-19 pandemic in response to demand shocks, geopolitical tensions and inflationary pressures.

The eight countries will hold monthly meetings to assess market developments, conformity and compensation levels, with their next gathering scheduled for April 5, 2026.

Meanwhile, oil, gas and other shipments from the Middle East via the Strait of Hormuz have come to a halt since Saturday after shipowners received a warning from Iran saying the area was closed for navigation.

Economy

NASD Exchange Rises 1.22% on Sustained Bargain-Hunting

By Adedapo Adesanya

Strong appetite for unlisted stocks further raised the NASD Over-the-Counter (OTC) Securities Exchange by 1.22 per cent on Friday, February 27.

Data revealed that the NASD Unlisted Security Index (NSI) was up by 49.41 points to 4,083.87 points from 4,034.46 points, and lifted the market capitalisation by N19.56 billion to N2.433 trillion from N2.413 trillion.

The volume of securities bought and sold by investors increased by 243.0 per cent to 4.5 million units from 1.3 million units, and the number of deals grew by 15.8 per cent to 44 deals from 38 deals, while the value of securities went down by 19.7 per cent to N82.5 million from N102.8 million.

Central Securities Clearing System (CSCS) Plc ended the session as the most active stock by value on a year-to-date basis with 35.0 million units valued at N2.1 billion, followed by Okitipupa Plc with 6.3 million units worth N1.1 billion, and Geo-Fluids Plc with 122.8 million units transacted for N480.4 million.

Resourcery Plc ended the day as the most traded stock by volume on a year-to-date basis with 1.05 billion units sold for N408.7 million, followed by Geo-Fluids Plc with 122.8 million units valued at N480.4 million, and CSCS Plc with 35.0 million units traded for N2.1 billion.

There were six price gainers yesterday led by FrieslandCampina Wamco Nigeria Plc, which added N9.02 to close at N111.46 per unui compared with the previous day’s N102.44 per unit, Nipco Plc appreciated by N6.00 to N284.00 per share from N278.00 per share, CSCS Plc recouped N1.87 to sell at N70.12 per unit versus Thursday’s value of N68.25 per unit, Geo-Fluids Plc improved by 17 Kobo to close at N3.18 per share versus N3.01 per share, Industrial and General Insurance (IGI) Plc advanced by 5 Kobo to sell at N50 Kobo per unit versus the preceding day’s 45 Kobo per unit, and Acorn Petroleum Plc chalked up 2 Kobo to settle at N1.34 per share, in contrast to the previous day’s N1.32 per share.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn