Economy

Rising External Borrowing Costs of Nigeria, Others Worry World Bank

By Adedapo Adesanya

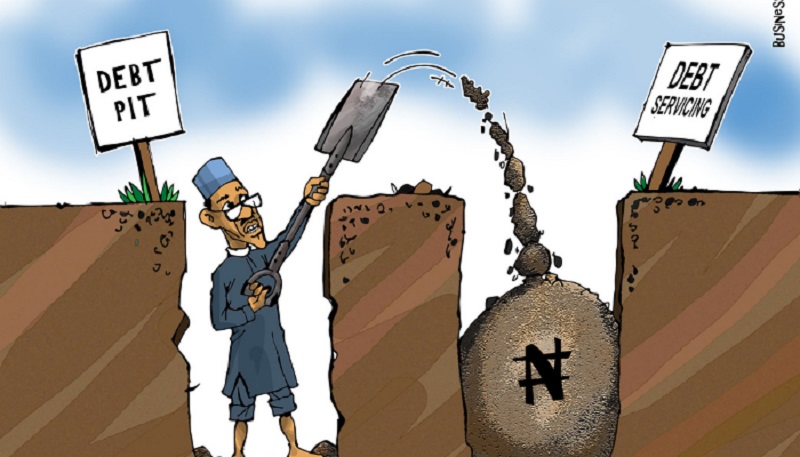

The World Bank has expressed worry over the rising external borrowing costs of Nigeria and other African countries, especially those in sub-Saharan Africa (SSA), noting that in the last 12 years, the region has used about 16.5 per cent of revenue to service debts as against 5 per cent in 2010.

In a press release titled African Governments Urgently Need to Restore Macro-Economic Stability and Protect the Poor in a Context of Slow Growth, High Inflation, the global lender said, “Debt is projected to stay elevated at 58.6 per cent of GDP in 2022 in SSA.

“African governments spent 16.5 per cent of their revenues servicing external debt in 2021, up from less than 5 per cent in 2010. Eight out of 38 IDA-eligible countries in the region are in debt distress, and 14 are at high risk of joining them.

“At the same time, high commercial borrowing costs make it difficult for countries to borrow on national and international markets while tightening global financial conditions are weakening currencies and increasing African countries’ external borrowing costs,” it stated.

According to the bank, it is crucial to increase the effectiveness of current resources and to maximize taxes in light of the current difficult situation.

The biannual analysis of the near-term regional macroeconomic outlook showed that economic growth in Sub-Saharan Africa (SSA) is set to decelerate from 4.1 per cent in 2021 to 3.3 per cent in 2022, a downward revision of 0.3 per cent.

This is mainly due to the slowdown in global growth, including flagging demand from China for commodities produced in Africa.

Due to decreased corporate investments and consumer consumption, the war in Ukraine is impacting on economic activity and aggravating already high inflation.

The report that 29 of the 33 SSA nations having information as of July 2022 had inflation rates exceeding 5 per cent, while 17 nations experienced double-digit inflation.

The bank said, “Global headwinds are slowing Africa’s economic growth as countries continue to contend with rising inflation, hindering progress on poverty reduction. The risk of stagflation comes at a time when high-interest rates and debt are forcing African governments to make difficult choices as they try to protect people’s jobs, purchasing power, and development gains.”

Due to recent economic shocks, instability, and war, and extreme weather, hunger has drastically grown throughout SSA.

The World Bank spoke about the growing debt to GDP ratio, particularly in the high inflationary environment.

Economy

Nigerian Exchange Sheds 0.92%

By Dipo Olowookere

The Nigerian Exchange (NGX) Limited depreciated by 0.92 per cent on Tuesday after the Central Bank of Nigeria (CBN) slashed the benchmark interest rate by 0.5 per cent to 26.50 per cent at the end of its first Monetary Policy Committee (MPC) meeting for 2026.

Sell-offs mainly occurred in the consumer goods and insurance sectors, shedding 4.74 per cent and 1.31 per cent, respectively.

However, bargain-hunting remained in the others, with the industrial goods index gaining 1.92 per cent, the banking counter grew by 1.23 per cent, and the energy sector soared by 0.15 per cent.

When the bourse ended for the session, the All-Share Index (ASI) gave up 1,779.03 points to close at 194,484.52 points compared with the previous day’s 196,263.55 points, and the market capitalisation declined by N1.142 trillion to N124.827 trillion from N125.969 trillion.

DAAR Communications depreciated by 10.00 per cent to N2.25, Tantalizers also declined by 10.00 per cent to N4.86, BUA Foods shrank by 9.99 per cent to N760.60, Ellah Lakes slumped 9.96 per cent to N10.40, and Japaul lost 9.95 per cent to trade at N3.80.

Conversely, Jaiz Bank appreciated by 10.00 per cent to N12.76, Infinity Trust Mortgage Bank went up by 9.83 per cent to N19.00, FCMB gained 9.72 per cent to close at N13.55, Fortis Global Insurance chalked up 9.09 per cent to finish at 72 Kobo, and Sterling Holdco grew by 7.50 per cent to N8.60.

A total of 27 stocks ended on the gainers’ chart and 40 stocks finished on the losers’ table, indicating a negative market breadth index and weak investor sentiment.

Yesterday, investors bought and sold 1.1 billion equities worth N53.4 billion in 72,218 deals compared with the 1.3 billion equities valued at N31.5 billion in 95,091 deals recorded a day earlier.

This showed that the value of transactions went up by 69.52 per cent, the volume of trades declined by 15.39 per cent, and a slip in the number of deals by 24.05 per cent.

During the session, Japaul was the most active stock with 102.4 million units worth N399.8 million, Access Holdings exchanged 97.9 million units valued at N2.6 billion, Fortis Global Insurance traded 75.2 million units for N54.1 million, Zenith Bank sold 67.6 million units valued at N6.2 billion, and FCMB transacted 46.4 million units worth N612.2 million.

Economy

Naira Further Falls to N1.355/$1 at Official FX Market

By Adedapo Adesanya

The woes of the Nigerian Naira in the Nigerian Autonomous Foreign Exchange Market (NAFEX) further continued on Tuesday, February 24.

During the session, the domestic currency weakened against the United States Dollar by N6.13 or 0.45 per cent to N1,355.37/$1 from the N1,349.24/$1 it was traded in the previous trading day.

The local currency also moved southwards on Tuesday in the same market window against the Pound Sterling after it lost N6.39 to trade at N1,828.26/£1 versus Monday’s closing price of N1,821.87/£1, and against the Euro, it depreciated by N4.94 to close at N1,596.36/€1, in contrast to the preceding session’s N1,591.42/€1.

Similarly, the Naira crashed against the US Dollar at the GTBank FX counter yesterday by N4 to settle at N1,361/$1 versus the N1,357/$1 it was exchanged a day earlier, and at the parallel market, it remained unchanged at N1,365/$1.

The fall of the Naira coincided with the Central Bank of Nigeria (CBN) buying US Dollars from the market to slow down the rapid rise of the nation’s legal tender. Latest information showed that last week, the apex bank bought about $189.80 million to reduce excess Dollar supply and control how fast the Naira was gaining value.

The rationale was to keep foreign investors from pulling their money out of Nigeria’s fixed-income market. If they sell their investments, it could increase demand for US Dollars and lead to more Dollar outflow from the economy.

Meanwhile, Mr Yemi Cardoso, the Governor of the CBN, said Nigeria’s gross external reserves have risen to $50.45 billion – the highest level in 13 years, while speaking after the 304th meeting of the monetary policy committee (MPC) of the CBN held on February 23 and 24.

The committee also reduced interest rates by 50 basis points to 26.50 per cent from 27 per cent after inflation eased in January 2026.

As for the cryptocurrency market, losses on concerns by embattled software businesses that artificial intelligence (AI) tools will destroy their business models continued and overturned some rallies on Tuesday.

Binance Coin (BNB) lost 2.1 per cent to sell for $585.41, Cardano (ADA) dropped 1.8 per cent to trade at $0.2595, Dogecoin (DOGE) went down by 1.5 per cent to $0.0920, Bitcoin (BTC) shrank by 1.2 per cent to $64,098.80, Litecoin (LTC) slipped 1.1 per cent to $51.31, Ripple (XRP) slumped 0.6 per cent to $1.35, and Ethereum (ETH) declined by 0.4 per cent to $1,857.75.

However, Solana (SOL) appreciated by 0.2 per cent to sell at $78.95. while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) traded flat at $1.00 each.

Economy

Oil Slides as Iran Signals Willingness to Seal US Nuclear Deal

By Adedapo Adesanya

Oil depreciated on Tuesday after Iran said it was prepared to take any necessary steps to clinch a deal with the United States ahead of nuclear talks later this week, with Brent futures shedding 72 cents or 1.0 per cent to trade at $70.77 per barrel, and the US West Texas Intermediate (WTI) futures declining by 68 cents or 1.0 per cent to $65.63 a barrel.

Iran, the third-biggest crude producer in the Organisation of the Petroleum Exporting Countries (OPEC), and the US will hold a third round of nuclear talks on Thursday in Geneva, Switzerland.

America wants Iran to give up its nuclear programme, which the country has denied trying to develop an atomic weapon.

Meanwhile, Iran’s deputy foreign minister said on Tuesday that it was ready to take any necessary steps to reach a deal with the US.

However, the US State Department is pulling out non-essential government personnel and their families from its embassy in Beirut, Lebanon, as concerns mount about the risk of a military conflict with Iran.

The US has deployed a vast naval force near the Iranian coast ahead of possible strikes on the Islamic Republic. The American president, on February 19, said he was giving Iran about 10 to 15 days to make a deal.

Also, the US began collecting a temporary new 10 per cent global import tariff on Tuesday, but President Trump’s administration was working to increase it to 15 per cent, a development that has led to confusion after the country’s Supreme Court ruling.

On the supply front, trading houses and buyers of Venezuelan oil have chartered the first very large crude carriers to export from the South American country since a supply deal began between the US and Venezuela. This is set to speed up shipments from March while boosting deliveries to India.

The European Commission will submit a legal proposal to permanently ban Russian oil imports on April 15.

The American Petroleum Institute (API) estimated that crude oil inventories in the United States rose by 11.4 million barrels in the week ending February 20, after falling by 609,000 barrels in the week prior. Official data from the US Energy Information Agency (EIA) will be released later on Wednesday.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn