Economy

SEC Assures Ponzi Scheme Operators Sleepless Nights

By Aduragbemi Omiyale

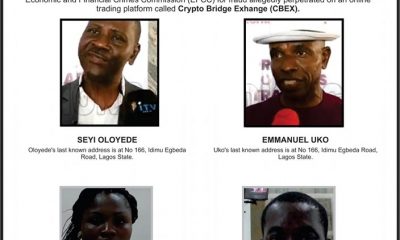

Ponzi scheme operators have been promised many sleepless nights and be frustrated out of the capital market.

The Director-General of the Securities and Exchange Commission (SEC), Mr Lamido Yuguda, said relevant agencies would be partnered with to flush them out of the system.

Speaking over the weekend, Mr Yuguda urged Nigerians to only do business with registered capital market operators, who can be verified on the website of the commission.

“We have their list on the SEC website and we have always said that if you go to an operator or when an operator approaches you, you must confirm that he is a licensed operator with the SEC.

“We have our numbers on how to reach our offices in the zones and we have done a lot of sensitizations in terms of seminars, webinars all in an effort to discourage people from going to Ponzi schemes.

“Unfortunately, a lot of people continue to patronize this Ponzi schemes, we have had cases that have been reported to us, our enforcement department and the police unit have been on many of these cases that have been reported to us trying to resolve them,” the SEC DG was quoted as saying in a statement made available to Business Post.

Mr Yuguda emphasized that it is not very difficult to identify a Ponzi scheme as they usually promise unreasonably high returns just to lure people.

“I will like to use this opportunity to say that it is not very difficult to recognize a Ponzi scheme and the people that go to Ponzi scheme many of them are probably aware that there is a type of risk that they are taking because when somebody tells you that I will pay you a 10 per cent per month on your investments, that means if you invest a million naira, every month you get 10% of that which is N100,000.00. If you see something like this, it is probably too good to be true. Because when you compound the annual rate of return, you find out that it is way higher than any decent investments can give you.

“There are people who think they can be amongst the first people to go in and probably go out before it collapses but you may be taking a huge risk because you do not know if you are the first, maybe the 1000th and could be that it is your own money that could get trapped. It is important for investors to understand the tale-tell signs of a Ponzi scheme and to alert the commission if they need some clarity,” he said.

The SEC chief disclosed that the agency has been working with other agencies of the government in terms of reducing the access of Ponzi schemes to the advertising platforms, the print media or electronic media i.e. the radio and television.

“These collaborations are very important because Ponzi schemes are cancers to the capital market, a lot of money has been lost and it is unacceptable to continue to have this kind of investment losses by people.

“In terms of the synergies between the Commission and the law enforcement on the fight against Ponzi schemes, I can say that there is very good synergy and harmony between the SEC and the law enforcement agencies.

“It is worthy to mention that the SEC has a detachment of the Nigeria Police working directly with the SEC on capital market matters including Ponzi schemes and we have a good collaboration with the Nigerian Financial Intelligence Unit, the EFCC especially on the fight against money laundry and Ponzi schemes,” Mr Yuguda stated.

He stated that the commission has stepped up enlightenment on Ponzi schemes to ensure the message gets to the street while also working with various state government, local government and different agencies of government including non-governmental organizations to make sure that the message gets to the nooks and crannies of our country.

“This is something that is depriving a lot of households of hard earned money. Money that could be used for a lot of other meaningful activities and needs are now surrendered to fraudsters essentially. When they come to you trying to convince you, they actually come in the form of very honest people, giving you all sort of promises in terms of financial return but once they get your money the story begins to change,” he disclosed.

The DG reiterated the commission’s commitment to continue to strive and fulfil its mandate of protecting investors and creating an enabling environment for market operations.

Economy

State Visit: CPPE, LCCI Urge Tinubu to Pursue Trade Expansion with UK

By Adedapo Adesanya

The Centre for the Promotion of Private Enterprise (CPPE) and the Lagos Chamber of Commerce and Industry (LCCI) have called for trade expansion ahead of President Bola Tinubu’s state visit to the United Kingdom.

In separate communications, the organisations urged President Tinubu to deepen economic ties as he visits the UK on the invitation of the King of England, King Charles III. His state visit to the UK next week will mark Nigeria’s first such visit to the UK in 37 years, when Military President Ibrahim Babangida was head of state.

The chief executive of CPPE, Mr Muda Yusuf, said the planned visit by Mr Tinubu to the UK is significant on multiple fronts.

“At a time of shifting global alliances and economic realignments, the visit presents both opportunity and responsibility.

“It is expected that leading Nigerian business figures will accompany the President, creating a platform for expanding trade flows, deepening investment partnerships, promoting Nigeria as a destination for capital, and strengthening financial-sector linkages.

“The UK remains a major source of portfolio flows, development finance, and private-sector investment into Nigeria. Structured engagements during the visit could unlock opportunities in infrastructure, energy, financial services, technology, manufacturing, and agribusiness,” Mr Yusuf stated.

On her part, the Director General of the LCCI, Mrs Chinyere Almona, noted that the visit represents a historic opportunity to recalibrate Nigeria–UK relations from traditional diplomacy to focused economic diplomacy.

“At a time when Nigeria is implementing bold macroeconomic reforms, this visit should be leveraged to secure concrete commitments on trade expansion, long-term investment, and cooperation on the business environment.

“From the perspective of the Lagos Chamber of Commerce and Industry, the overriding objective should be to translate goodwill into measurable economic outcomes that strengthen Nigeria’s productive base and export capacity,” she said.

According to her, recent data underscore the strategic importance of the UK to Nigeria’s economy, noting that in Q3 2025, Nigeria recorded capital importation of approximately US$6.01 billion, representing a significant year-on-year surge.

“Notably, the United Kingdom emerged as Nigeria’s largest source of capital inflows, accounting for about US$2.94 billion, or nearly half of total inflows during the quarter. These inflows were driven predominantly by portfolio investment, particularly into the financial and banking sectors, reflecting renewed foreign investor confidence following Nigeria’s macroeconomic adjustments.

“On the trade front, total trade in goods and services between Nigeria and the UK stood at approximately £8 billion in the 12 months to mid-2025,” she said.

She said, however, that the relationship remains structurally imbalanced, with UK exports to Nigeria significantly exceeding Nigeria’s exports to the UK.

“Ultimately, the economic agenda of this state visit should be guided by Nigeria’s most pressing challenges: export diversification, inflation-induced cost pressures, infrastructure deficits, and the need for stable long-term capital,” Mrs Almona said in an interview with Nairametrics.

Economy

Preference for Foreign Currencies in Domestic Transactions Threat to Financial System—EFCC

By Dipo Olowookere

The Economic and Financial Crimes Commission (EFCC) has frowned on the use of foreign currencies for financial transactions in Nigeria, saying this could disrupt the nation’s stability.

The acting Zonal Director of the agency in Ilorin, Mrs Victoria Ugo-Ali, informed the Central Bank of Nigeria (CBN) that the EFCC chairman, Mr Ola Olukoyede, is determined to curb the increasing preference for foreign currencies in domestic transactions, describing the practice “as a serious threat to the stability of the nation’s financial system.”

Speaking during a courtesy visit to the Branch Controller of the Ilorin Branch of the central bank, Mr Monga Muhammed, on Tuesday, Mrs Ugo-Ali noted that “many economic and financial crimes are perpetrated through financial institutions,” stressing the importance of timely intelligence and reports on suspicious transactions.

She called on the apex bank to continue providing the commission with relevant financial intelligence that would aid investigations and help curb money laundering and other financial crimes.

She also reiterated that the growing preference for foreign currencies in local transactions undermines the value of the naira and weakens public confidence in the national currency.

In his response, Mr Muhammed commended the Zonal Director and the management team of the EFCC for the visit, promising to sustain and deepen the already cordial relationship between the two organisations.

He described the engagement as the first of its kind and expressed optimism that it would further strengthen the cooperation between both institutions.

“At our end here, we will continue to partner with you because we carry out complementary functions. While your duty is to tackle economic and financial crimes, our responsibility, primarily as the apex bank, is to stabilise the economy and regulate financial institutions. We will not fail in that regard,” he said.

The CBN Branch Controller further disclosed that the apex bank had put several measures in place to address naira abuse and the dollarisation of the economy.

According to him, the CBN has the capacity to track currency in circulation and would not hesitate to apply appropriate sanctions against individuals or organisations found trading illegally in the nation’s currency.

Economy

SUNU Plans N9.3bn Rights Issue for Recapitalisation

By Adedapo Adesanya

SUNU Assurances Nigeria Plc has taken steps to raise N9.3 billion through a rights issue by offering 2,075,285,714 ordinary shares of 50 Kobo each at the price of N4.50.

The new shares would be allotted to shareholders in the ratio of five new ordinary shares for every 14 ordinary shares held as of February 12, 2026.

Proceeds from the exercise would be used by the company to meet the new minimum capital requirements of the National Insurance Commission (NAICOM).

The non-life insurer is preparing to raise fresh equity capital from the capital market to meet the N15 billion minimum capital requirement introduced under the Nigerian Insurance Industry Reform Act (NIIRA) 2025, with a July 2026 compliance deadline.

According to the company’s chairman, Mr Kyari Abba Bukar, the capital plan is a proactive move to strengthen solvency, expand underwriting capacity and maintain competitive positioning in a tightening regulatory environment.

“This is a growth initiative. We are positioning early to meet the new benchmark and enhance our capacity to underwrite larger and more complex risks,” he said.

On his part, the chief executive, Mr Samuel Ogbodu, underscored the company’s dividend track record, noting that SUNU has paid dividends consistently over the past three to four years.

“We have maintained steady growth in premium income, profitability and governance standards over the last decade. Our shareholders have been rewarded, and we project continuity in value delivery,” Mr Ogbodu said.

The SUNU Group, as the majority shareholder with approximately 83 per cent equity interest, has decided to reduce its stake to comply with the free float requirements of the Nigerian Exchange (NGX) Limited. The exchange’s rule book said listed firms must float 20 per cent for the general investing public.

This strategic review of the company’s ownership structure aligns with the group’s long-term growth objectives and its commitment to supporting market development.

He said that while the parent company possesses the financial capacity to fully recapitalise the business, the board has determined that existing shareholders and new Nigerian investors shall be afforded the opportunity to participate in the next phase of the company’s growth.

This decision underscores SUNU’s commitment to broadening Nigerian participation in the ownership structure of the Company, Mr Ogbodu added.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn