Economy

The Best Beginner-Friendly USDT Trading Platform for Profitable Trading in Nigeria

Discover the best beginner-friendly USDT trading platform in Nigeria. Learn how to trade USDT profitably with our comprehensive guide on the Breet app.

The US Dollar holds the top spot in the traditional finance market, and if we’re going to revolutionise the world as we know it now, we need an equivalent of the US Dollar in the crypto market. This is where Tether (USDT) comes in.

Tether (USDT) is a stablecoin pegged to the US dollar, designed to maintain a 1:1 value ratio. This stability makes it a popular choice for traders looking to avoid the volatility associated with other cryptocurrencies.

The growing interest in cryptocurrency trading in Nigeria has spurred the need for platforms that cater to beginners and ensure a seamless trading experience. This guide will help you understand why USDT trading is advantageous in Nigeria and how to choose the best platform for your needs.

Why Trade USDT in Nigeria?

Nigeria’s economic situation is extremely volatile, and inflation is at an all-time high. Due to these challenges, it’s become a matter of urgency for Nigerians to preserve the value of their money. USDT, being pegged to the US Dollar, offers this hedge against inflation.

By trading USDT, Nigerian crypto traders can protect the value of their money, avoid currency devaluation, participate in the global crypto market with more stability, and eventually spend in Naira.

Criteria for Choosing a Beginner-Friendly USDT Trading Platform

- Ease of Use

A user-friendly interface is crucial for beginners. The platform should offer a simple registration and verification process, making it easy to start trading without technical difficulties.

- Security Features

Robust security measures are essential to protect your investments. Look for platforms that offer two-factor authentication (2FA), encryption, and biometric protection to safeguard your assets.

- Customer Support

24/7 customer support is vital for addressing any issues promptly. Ensure the platform provides multiple support channels, such as live chat, email, and phone support.

- Fees and Charges

A transparent fee structure is important. Compare trading, deposit, and withdrawal fees across platforms to find one that offers competitive rates without hidden costs.

- Educational Resources

Educational resources like tutorials, webinars, and guides are invaluable for beginners. They help you understand trading basics and develop effective strategies.

Top USDT Trading Platform in Nigeria: The Breet App

Breet is a leading USDT trading platform in Nigeria, known for its user-friendly interface and robust security features. Designed with beginners in mind, Breet simplifies the trading process, making it accessible to everyone.

Here’s a Step-by-Step Guide to Start Trading USDT with Breet in Nigeria

Setting Up an Account

- Registration: Download the Breet app and sign up with your email address.

- Verification: Complete the verification process by submitting the required documents and following the prompts.

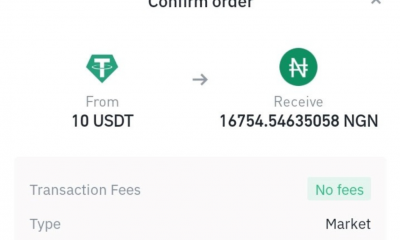

Converting USDT to Naira

- Send USDT to your wallet: On the Breet homepage, click on “Crypto-to-cash” and copy your pre-generated wallet address.

- Conversion process: Breet will detect the incoming transaction and begin to process it. You don’t need to do anything at this point; just wait for the blockchain confirmation to be completed.

Withdrawing Funds

- Withdraw USDT: After the required blockchain confirmation, your transaction has been successfully processed! Now you can withdraw into your bank account.

Conclusion

Choosing the right USDT trading platform is essential for a profitable trading experience. The Breet app stands out as a beginner-friendly option with its user-friendly interface, strong security measures, and comprehensive customer support.

Trading USDT in Nigeria offers a stable and profitable opportunity. By following the steps outlined and utilising the tips provided, you can start your trading journey with confidence and maximise your potential returns.

Ready to start trading USDT? Download the Breet app today and take your first step towards profitable trading in Nigeria!

Economy

NUPENG Seeks Clarity on New Oil, Gas Executive Order

By Adedapo Adesanya

The National Union of Natural and Gas Workers (NUPENG) has expressed deep concern over the Executive Order by President Bola Tinubu mandating the Nigerian National Petroleum Company (NNPC) Limited to remit directly to the federation account.

In a statement signed by its president, Mr William Akporeha, over the weekend in Lagos, the union noted that the absence of detailed public engagement had naturally generated tension within the sector and heightened restiveness among workers, who are anxious to know how the new directive may affect their employment, welfare and job security, especially as it affects NNPC and other major operations in the oil and gas sector.

It pointed out that the industry remained the backbone of Nigeria’s economy, contributing significantly to national revenue, foreign exchange earnings, and employment.

The NUPENG president affirmed that any policy shift, particularly one introduced through an Executive Order, has far-reaching consequences for regulatory frameworks, Investment decisions, operational standards, and labour relations within the sector.

According to him, “there is an urgent need for clarity on the scope and objectives of the Executive Order -What precise reforms or adjustments does it introduce? “Its implications for the Petroleum Industry Act -Does the Order amend, interpret, or expand existing provisions under PIA?

“Impact on workers and existing labour agreements-Will it affect job security, conditions of service, Collective Bargaining agreements or ongoing restructuring processes within the industry? “Effects on indigenous participation and local content development -How will it affect Nigerian companies and employment opportunities for citizens?”

He warned that without proper consultation and explanation, misinterpretations of the Executive Order may spread across the industry, potentially destabilising operations and undermining industrial harmony that stakeholders have worked hard to sustain.

“Though our union remains committed to constructive engagement, national development and stability of the oil and gas sector, however, we are duty-bound and constitutionally bound to protect the rights and welfare and job security of our members whose livelihoods depend on a clear, fair and predictable policy framework,” Mr Akporeha further stated.

Economy

Uzoka-Anite Warns Against Inflation Risks from Oil, Gas Earnings Surge

By Adedapo Adesanya

The Minister of State for Finance and chairman of the Federation Account Allocation Committee (FAAC), Mrs Doris Uzoka-Anite, has cautioned that a projected surge in oil and gas revenues following President Bola Tinubu’s latest executive order could trigger inflationary pressures and exchange rate volatility if not carefully managed.

She said that the recent executive order mandating the direct remittance of certain oil sector revenues to the federation account would provide regulatory clarity and significantly strengthen revenues accruing to the federation account, but warned that sudden liquidity injections into the economy may complicate monetary policy coordination with the Central Bank of Nigeria and erode the real value of allocations to federal, state and local governments.

While addressing members of FAAC in Abuja, Mrs Uzoka-Anite commended President Tinubu on the order, describing the development as a structural fiscal correction aimed at restoring constitutional discipline to petroleum revenue management and enhancing distributable income across the three tiers of government.

She said that the revenue outlook was improving due to ongoing structural reforms introduced by the Federal Government.

According to her, the newly implemented tax reform measures are broadening the tax base, improving compliance and enhancing administrative efficiency.

“Also, the executive order signed by Mr President on February 13 is reinforcing revenue discipline in the oil and gas sector and reducing leakages,” she said.

The minister said that the order suspends the 30 per cent allocation to the Frontier Exploration Fund (FEF) and suspends the 30 per cent management fee on oil and gas profit payable to NNPC Limited.

She said that the order also directed that gas flare penalties be paid into the federation account, and mandated full remittance of petroleum revenues without unconstitutional deductions.

Mrs Uzoka-Anite said that the reform marks a shift from a retention-based oil revenue model to a gross remittance, federation-first model.

“The implications for FAAC are very significant; more oil and gas profit will now flow directly into the federation account.

“Gas flare penalties will become distributable revenue, and previously retained management fees will no longer reduce remittable inflows,” she said.

She said that the reforms were expected to result in higher monthly gross inflows into the federation account, and increased allocations to federal, state and local governments.

The minister said that a retrospective audit of the FFF, the Midstream and Downstream Gas Infrastructure, was due, and NNPC management fee deductions could lead to recoveries that may provide a one-off fiscal boost.

She welcomed the improved revenue outlook and cautioned against the risks associated with sudden liquidity injections.

“Experience shows that when revenues rise sharply and are distributed fully and immediately, large liquidity injections can increase inflationary pressures, complicate monetary management and reduce the real purchasing power of allocations,” she said.

She said that excess aggregate demand, exchange rate pressure, asset price distortions and inflationary risks could arise if increased inflows were not carefully managed.

Mrs Uzoka-Anite said that to mitigate such risks, she proposed phased disbursement of one-off recoveries.

She suggested that retrospective recoveries be staggered rather than injected into the economy in bulk, with a portion temporarily warehoused in a stabilisation buffer.

She also recommended strengthening the excess crude and stabilisation buffer mechanism to channel part of incremental inflows into a fiscal stabilisation window.

“This could offset revenue shortfalls in weaker months and reduce procyclicality in spending.

According to her, enhanced coordination with the CBN would be pursued to align fiscal injections with liquidity management tools and support open market operations where necessary.

Mrs Uzoka-Anite urged states and federal Ministries, Departments and Agencies (MDAs) to prioritise capital expenditure over recurrent expenditure.

She called for investment in infrastructure, agriculture, energy and other productive sectors, and avoid unsustainable wage or consumption spikes.

“Productive spending expands supply capacity and mitigates inflation,” she said.

She also announced plans to introduce monthly revenue transparency dashboards, production-to-remittance reconciliation reporting, and clear reporting of incremental inflows arising from tax reforms and the executive order.

The junior finance minister said that the reforms presented an opportunity to deepen fiscal federalism, enhance distributable revenue, restore constitutional clarity and strengthen trust among tiers of government.

She also advised that increased revenue must not translate into fiscal complacency.

“We must resist the temptation to treat incremental inflows as permanent windfalls. We should reduce debt burdens, clear arrears responsibly, build buffers and invest in growth-enhancing sectors,” she said.

Economy

Dangote Refinery Shares to be Available to Public in Five Months

By Adedapo Adesanya

The chairman of Dangote Group, Mr Aliko Dangote, has said that within the next five months, Nigerians should be able to purchase shares of Dangote Petroleum and Refinery.

Mr Dangote made this revelation on Sunday during a tour of the facility by the chief executive of the Nigerian National Petroleum Company (NNPC) Limited, Mr Bayo Ojulari, alongside members of the company’s executive management.

The $20 billion refinery is the largest single-train refinery in the world with 650,000 barrels per day refining capacity. There are efforts to boost the capacity to 1.4 million barrels per day soon.

Speaking with journalists, Mr Dangote said, “And the other issue is that they (NNPC) are holding 7.25 per cent of the shares that we have here, which is more than the shares Elon Musk has in Tesla. And they are holding that on behalf of Nigerians,” he said.

“So individually, Nigerians too will have an opportunity in the next, maybe a maximum of four to five months. There will actually be an opportunity to buy the shares.”

He added that shareholders will have the option to receive their dividends in either naira or dollars, as the refinery also earns in dollars.

Commenting on Mr Ojulari’s visit, the billionaire businessman said the NNPC, represented by Mr Ojulari and its management team, was not just a guest but a shareholder.

“Today is really our best day ever” at the facility. I know NNPC invested in us when we were not really sure whether the refinery would be successful.

“So that’s the kind of level of confidence. But right now, the relationship with the new set of people that we have at NNPC, I think the sky is the limit, and we will cooperate and also make sure that we work together to make sure that we make Nigerians proud.”

Speaking on prospects of partnership with NNPC in the upstream sector, he said, “We have block 71, 72, but we’re going to look much deeper”.

“Most likely, depending on our own discussions with them, we will partner with them, maybe in some of the upstream. They, too, will partner with us here because here is not just a refinery, it’s an industrial hub.

“And that’s why we’re doing linear alkaline benzene, which is a raw material for detergents, ” he added.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn