Economy

The Best Forex Pairs to Trade For Beginners in 2023: Experts’ Recommendations

If you’re new to Forex trading and want to know which currency pairs are good for trading in 2023, you’re in the right place! Traders Union (TU) experts have created a list of the best Forex pairs for beginners. They’ll explain what makes a currency pair good for trading, so you can start your Forex journey on the right path. Whether you want stability, liquidity, or volatility, the experts will guide you to the best Forex pairs to trade.

Currency pairs

TU’s analysts consider that understanding currency pairs is crucial for anyone new to Forex. These pairs, also called trading pairs, are used to exchange one country’s money for another. Each pair has two assets: the base currency and the quote currency. For example, in EUR/USD, the euro (EUR) is the base, and the U.S. dollar (USD) is the quote. The exchange rate informs you of the amount of the quoted currency required to purchase a single unit of the base currency. Currency pairs are always traded in pairs because one currency’s value depends on another.

Currency pairs categories

Currency pairs in the Forex market fall into three main categories: major pairs, crosses, and exotic pairs. According to analysts at Traders Union, you should be aware of the following information:

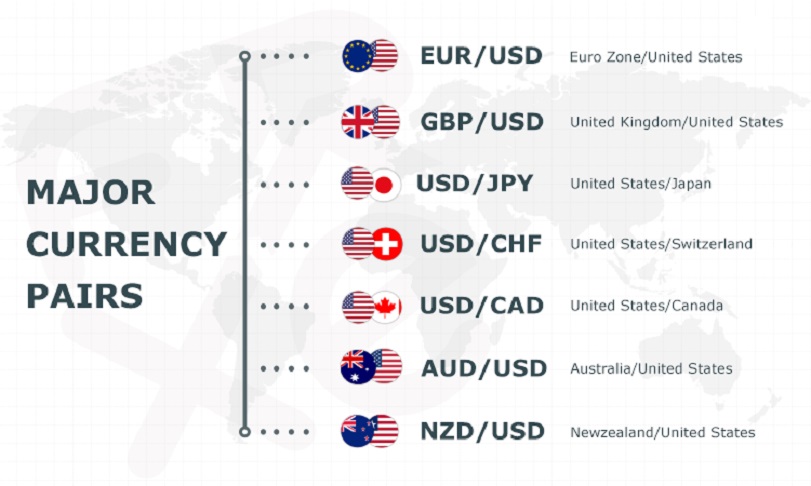

- Major currency pairs:

These are the most traded pairs, always including the U.S. dollar.

Examples include EUR/USD, USD/JPY, and GBP/USD.

Traders like them for high liquidity and tight spreads.

They reflect the strength of the U.S. dollar and react to global events.

- Cross currency pairs:

Also known as minor pairs, they don’t involve the U.S. dollar.

Examples are EUR/GBP and GBP/JPY.

Traders use them to speculate on major currency relationships.

While spreads can be wider, they offer trading opportunities based on regional insights.

- Exotic currency pairs:

These pairs mix major currencies with emerging or thinly traded currencies.

Examples include USD/SGD and EUR/TRY.

Exotics have lower liquidity, wider spreads, and higher volatility.

Experienced and risk-tolerant traders may find profit potential but need thorough research and risk management.

Keep in mind that different brokers and traders may slightly vary in how they classify these currency pairs.

Top currency pairs for beginner traders in Forex

For beginners in Forex trading, TU’s experts recommend starting with certain currency pairs that offer excellent learning and trading opportunities.

- EUR/USD

This pair combines the euro and the US dollar and is the most traded currency pair globally. It boasts low spreads, high liquidity, and stability, making it attractive for traders.

- USD/JPY

Pairing the US dollar with the Japanese yen, USD/JPY is driven by the yen’s influence in Asia and the dollar’s global prominence. It provides ample liquidity and narrow spreads.

- GBP/USD

Known as “Cable,” this pair includes the pound sterling and the US dollar. It represents a significant share of daily Forex transactions and is influenced by the relative strength of the British and American economies.

- AUD/USD

Pairing the Australian dollar with the US dollar, AUD/USD is influenced by commodity exports, especially metals and minerals. Interest rate differentials between Australia and the US also play a role.

- USD/CAD

Representing the US dollar against the Canadian dollar, USD/CAD is considered a commodity pair, closely tied to oil prices and economic indicators of both countries.

- USD/CHF

Combining the US dollar with the Swiss franc, USD/CHF is known as “Swissie” and is the seventh most traded currency pair worldwide. The Swiss franc’s value is influenced by the Swiss National Bank’s actions and economic data from Switzerland. Switzerland’s reputation for financial stability makes the CHF a popular safe-haven currency.

Conclusion

If you’re a newcomer to Forex trading, Traders Union has provided valuable insights into the best currency pairs for beginners in 2023. Understanding these pairs is fundamental, as they’re used to exchange one currency for another. Starting with the recommended pairs in this article, beginners can embark on their Forex journey with confidence and learning opportunities.

Economy

Grey to Cut Cross-Border Payment Costs with New USD Offering

By Adedapo Adesanya

A cross-border payments solutions company, Grey has expanded its business banking platform to include US Dollar corporate accounts, bulk international payments, and USDC stablecoin support, all integrated into a single system.

The company is positioning itself as a low-cost, faster alternative to traditional international banking, particularly for businesses in emerging markets as it enables companies to open US Dollar accounts, receive global payments, and send payouts to 170+ countries, including bulk transfers, within minutes.

Grey aims to solve common cross-border payment challenges, particularly the high transfer costs that often range between 6 and 7 per cent of transaction value, prolonged settlement cycles that can stretch across several days, and the limited access many businesses face when trying to open and operate foreign currency accounts. In addition, companies frequently contend with hidden intermediary fees and poor foreign exchange transparency, both of which undermine cost predictability and effective cash flow management.

By integrating USD business accounts and USDC stablecoin functionality into its platform, Grey enhances its value proposition around faster settlement, clearer pricing structures, improved cost efficiency, and broader global accessibility. The expanded capabilities enable businesses to manage international transactions with greater speed, transparency, and operational control.

“Businesses may operate without borders today, but access to reliable global banking remains uneven, particularly for companies in high-growth markets,” said Mr Idorenyin Obong, Co-founder and Chief Executive Officer of Grey. “We’re closing that gap and enabling businesses to move money faster, with greater transparency and control, wherever their clients or partners are based.”

“When payments are delayed, or costs are unpredictable, growth stalls,” added Mr Joseph Femi Aghedo, Chief Operating Officer and Co-founder of Grey. “Grey eliminates those friction points, giving businesses a faster, simpler way to manage payroll, supplier payments, and partner payouts across borders. Adding USD and stablecoin capabilities makes these benefits accessible to even more customers.”

Established in Africa in 2020, Grey has a presence in key markets, including the United States, the United Kingdom, and Europe, and has recently expanded its services and operations into Latin America and Southeast Asia.

Since its inception, the company has consistently enhanced its services to empower digital nomads worldwide, regardless of location. Grey’s offerings include multi-currency accounts, low-cost international money transfers, a virtual USD card, expense management tools, and robust security measures.

Economy

Quidax, Lisk to Unlock Stablecoins, On-chain Financial Opportunities

By Aduragbemi Omiyale

A partnership designed to expand access to stablecoins and on-chain financial opportunities for everyday users and businesses has been entered into between Quidax and Lisk.

The partnership provides a critical gateway for the developer community, as builders on the Lisk network can now leverage Quidax’s robust digital asset infrastructure to access stablecoins and local currencies at competitive rates.

This institutional-grade infrastructure is designed to power “future-forward” financial products, ranging from neobanks and cross-border payment platforms to regional exchanges and global fintech solutions. It will also allow Quidax customers to trade and move value seamlessly using USDT, USDC, LSK, and Ether (ETH) on the Lisk network.

The collaboration will also accelerate the adoption of Web3 solutions that solve real-world financial challenges for millions of customers across Africa by combining Quidax’s deep local liquidity and compliant framework with Lisk’s scalable L2 technology.

In 2024, Quidax became the first crypto exchange to receive a provisional operating license from Nigeria’s Securities and Exchange Commission (SEC).

“The partnership with Lisk enables us to extend our platform to serve more people and cater to the increasing demand from products and services that want to integrate our stablecoin and digital assets product to build products across Africa,” the Chief Infrastructure Officer at Quidax, Mr Morris Ebieroma, said.

Also commenting, the Ecosystem Lead for Africa at Lisk, Ms Chidubem Emelumadu, said, “Africa represents one of the most critical frontiers for blockchain innovation, where the demand for reliable and inclusive financial tools is urgent.

“Our partnership with Quidax expands access to stablecoins and on-chain financial opportunities for everyday users and businesses. At the same time, it gives founders building on Lisk the critical infrastructure they need to create solutions that can scale meaningfully across the continent,” she added.

Economy

Customs Urges Freight Forwarders to Adopt Automated Licence, Permit System

By Adedapo Adesanya

The Nigeria Customs Service (NCS) has urged freight forwarders to adopt its automated Licence and Permits Processing system to reduce the cost of doing business.

This advice was given by the Assistant Comptroller-General of Customs, Mr Muhammed Babadede, during a stakeholders’ engagement on automation held in Lagos on Monday.

He noted that the reform responds to longstanding demands for faster, more transparent and simpler procedures for industry stakeholders, disclosing that Comptroller-General of Customs, Mr Bashir Adeniyi, has approved the full automation of the service’s licences and permits processes.

“For years, stakeholders dealt with paperwork, long queues and uncertainty from manual processing. Those days are coming to an end.

“This sensitisation is across all zones. The goal is to ensure stakeholders understand the automated system before implementation,” Mr Babadede said.

He said automation would enable applications and renewals from offices or mobile phones, eliminating visits to customs formations, assuring stakeholders of a fair and consistent process, and reducing errors associated with manual documentation.

He said automation would improve record-keeping, supervision and service delivery without increasing pressure on officers.

The Deputy Comptroller-General, Tariff and Trade, CK Naigwan, also represented by Mr Babadede, reiterated management’s commitment to seamless implementation.

Meanwhile, the Comptroller of Customs for Licence and Permit Unit, Mrs Ngozika Anozie, praised the Comptroller-General for driving innovation within the Service, saying the automation aligns Customs procedures with global best practice and strengthens institutional efficiency.

According to her, the reform reflects the three-point agenda of the Chairman of the World Customs Organisation, Mr Adeniyi, centred on consolidation, collaboration and innovation.

She said the system would enhance the ease of doing business in the maritime sector and boost national revenue generation.

“Automation will cut business costs and reduce travel risks for stakeholders

“They will no longer travel repeatedly to Abuja, paying for transport, hotels and feeding to process licences and permits,” she said, adding that the platform would automatically reject fake documents and accept genuine submissions, curbing fraudulent practices.

“The CGC is determined to sanitise the system, and we are committed to achieving that objective,” Mrs Anozie said.

On his part, the Assistant Superintendent of Customs, Mr Ibrahim Usman, said the Licence and Permit Unit operates under the Tariff and Trade Department.

He explained that the unit ensures proper issuance of licences and permits and compliance with import regulations.

Mr Usman said all licences and permits expire on December 31 of their issuance year.

He added that the portal would become fully operational after nationwide sensitisation, with stakeholders duly informed.

Customs Area Controller, Tincan Island Command, Mr Frank Onyeka, thanked stakeholders for their continued support.

He urged them to take the exercise seriously to achieve seamless processing across Customs operations.

Stakeholders raised concerns about online payment integration and potential technical disruptions.

Officials addressed the questions and pledged continued engagement to ensure smooth implementation nationwide.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn