Economy

The Best Forex Pairs to Trade For Beginners in 2023: Experts’ Recommendations

If you’re new to Forex trading and want to know which currency pairs are good for trading in 2023, you’re in the right place! Traders Union (TU) experts have created a list of the best Forex pairs for beginners. They’ll explain what makes a currency pair good for trading, so you can start your Forex journey on the right path. Whether you want stability, liquidity, or volatility, the experts will guide you to the best Forex pairs to trade.

Currency pairs

TU’s analysts consider that understanding currency pairs is crucial for anyone new to Forex. These pairs, also called trading pairs, are used to exchange one country’s money for another. Each pair has two assets: the base currency and the quote currency. For example, in EUR/USD, the euro (EUR) is the base, and the U.S. dollar (USD) is the quote. The exchange rate informs you of the amount of the quoted currency required to purchase a single unit of the base currency. Currency pairs are always traded in pairs because one currency’s value depends on another.

Currency pairs categories

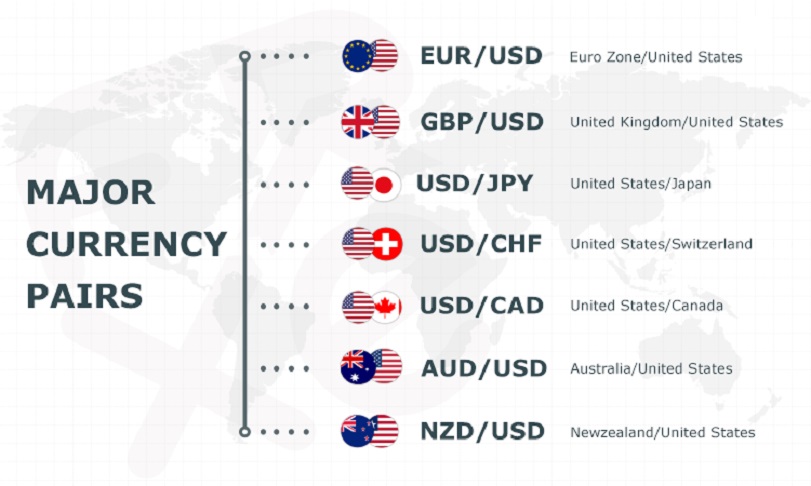

Currency pairs in the Forex market fall into three main categories: major pairs, crosses, and exotic pairs. According to analysts at Traders Union, you should be aware of the following information:

- Major currency pairs:

These are the most traded pairs, always including the U.S. dollar.

Examples include EUR/USD, USD/JPY, and GBP/USD.

Traders like them for high liquidity and tight spreads.

They reflect the strength of the U.S. dollar and react to global events.

- Cross currency pairs:

Also known as minor pairs, they don’t involve the U.S. dollar.

Examples are EUR/GBP and GBP/JPY.

Traders use them to speculate on major currency relationships.

While spreads can be wider, they offer trading opportunities based on regional insights.

- Exotic currency pairs:

These pairs mix major currencies with emerging or thinly traded currencies.

Examples include USD/SGD and EUR/TRY.

Exotics have lower liquidity, wider spreads, and higher volatility.

Experienced and risk-tolerant traders may find profit potential but need thorough research and risk management.

Keep in mind that different brokers and traders may slightly vary in how they classify these currency pairs.

Top currency pairs for beginner traders in Forex

For beginners in Forex trading, TU’s experts recommend starting with certain currency pairs that offer excellent learning and trading opportunities.

- EUR/USD

This pair combines the euro and the US dollar and is the most traded currency pair globally. It boasts low spreads, high liquidity, and stability, making it attractive for traders.

- USD/JPY

Pairing the US dollar with the Japanese yen, USD/JPY is driven by the yen’s influence in Asia and the dollar’s global prominence. It provides ample liquidity and narrow spreads.

- GBP/USD

Known as “Cable,” this pair includes the pound sterling and the US dollar. It represents a significant share of daily Forex transactions and is influenced by the relative strength of the British and American economies.

- AUD/USD

Pairing the Australian dollar with the US dollar, AUD/USD is influenced by commodity exports, especially metals and minerals. Interest rate differentials between Australia and the US also play a role.

- USD/CAD

Representing the US dollar against the Canadian dollar, USD/CAD is considered a commodity pair, closely tied to oil prices and economic indicators of both countries.

- USD/CHF

Combining the US dollar with the Swiss franc, USD/CHF is known as “Swissie” and is the seventh most traded currency pair worldwide. The Swiss franc’s value is influenced by the Swiss National Bank’s actions and economic data from Switzerland. Switzerland’s reputation for financial stability makes the CHF a popular safe-haven currency.

Conclusion

If you’re a newcomer to Forex trading, Traders Union has provided valuable insights into the best currency pairs for beginners in 2023. Understanding these pairs is fundamental, as they’re used to exchange one currency for another. Starting with the recommended pairs in this article, beginners can embark on their Forex journey with confidence and learning opportunities.

Economy

PAC Capital Promises Transformative Financial Solutions

Aduragbemi Omiyale

A Nigerian-based investment banking and advisory company, PAC Capital Limited, has promised transformative financial solutions that not only meet but exceed expectations of its clients.

This assurance was given by the Executive Director of PAC Capital, Mr Bolarinwa Sanni, after the firm was named as the Best Transaction Advisory Firm – Nigeria 2025 by the International Business Magazine Awards.

The award was in recognition of its consistent track record in structuring and executing high-impact transactions across various sectors, including infrastructure, energy, transport, and financial services.

This international recognition highlights the organisation’s commitment to excellence, innovation, and delivering value-driven advisory services.

“Winning this award reflects the strength of our advisory team and the boldness of the clients we serve.

“At PAC Capital, we are committed to delivering transformative financial solutions that not only meet but exceed expectations.

“This recognition inspires us to keep pushing boundaries and shaping Africa’s investment landscape,” Mr Sanni stated.

Also, the Managing Director of PAC Capital, Mr Humphrey Oriakhi, said, “This award is a strong validation of our efforts to lead with insight, integrity, and innovation in the transaction advisory space.

“We are truly honoured to be acknowledged on a global platform. I dedicate this achievement to our clients who trust us with their most strategic decisions and to our team whose dedication fuels our success.”

Economy

Ecobank CEO Calls for Increase Intra African Trade to Cushion Tariffs Impact

By Adedapo Adesanya

The chief executive of Ecobank Transnational Incorporated, Mr. Jeremy Awori, has called for an increase in intra-trade among African countries in response to recent tariff announcements by the US President, Mr Donald Trump.

Speaking in an interview with Bloomberg TV, Mr Awori noted that Mr Trump’s tariffs would replace the African Growth and Opportunity Act (AGOA), which about 30 African nations have relied on to develop export-driven industries, including textiles and apparel.

“Now more than ever we should be focusing as African countries on how do we trade more together, how do we create an easier framework for us to trade,” he said.

In 2023, sub-Saharan Africa exported $29 billion worth of goods to the U.S., making it the region’s fourth-largest market after China, the United Arab Emirates, and India.

According to him, while the US is not Africa’s biggest trading partner, the continent’s economies could still face indirect repercussions if the tariffs lead major partners like China to reduce demand for African exports.

The tariffs imposed on African nations vary widely, ranging from 10 per cent for countries like Benin, Kenya, and Cape Verde to as high as 50 per cent for Lesotho—the highest rate applied to any sovereign nation. Nigeria was hit with 14 per cent.

Mr Awori pointed out that the trade tensions reinforced the urgency for African nations to fast-track the implementation of the African Continental Free Trade Area (AfCFTA), which came into effect in October 2022.

He added that fully implementing the free trade accord and adding value to raw materials will ensure that the continent keeps “more of the benefits, creates more jobs and uplifts the lives and livelihoods of Africans.”

He emphasised that beyond tariff reductions, Africa must address non-tariff barriers such as restrictive visa policies and logistical challenges faced by landlocked countries.

The lender’s CEO noted that the new tariffs follow President Trump’s earlier decision to freeze aid to Africa, which Ecobank research suggests could push an additional six million people into extreme poverty.

Economy

Debt Servicing Gulps N13.12trn in 2024 Versus N12.3trn Allocated in Budget

By Aduragbemi Omiyale

Data from the Debt Management Office (DMO) showed that the Nigerian government used about N13.12 trillion to service the various debts in 2024.

Business Post reports that this was 68 per cent higher than the N7.8 trillion paid by Nigeria to pay interests on debts in 2023 and higher than the N12.3 trillion approved by the National Assembly for last in the 2024 Appropriation Act.

Over the weekend, the DMO revealed that the total debt of the country as of December 31, 2024, stood at N144.67 trillion versus N97.34 trillion a year earlier.

This comprised an external debt of N70.29 trillion and a domestic debt N74.38 trillion.

The agency stated that the significant increase in the debt service was due higher interest rates and increased domestic borrowing as well as rising global interest rates and the depreciation of the Naira, which has made dollar-denominated debt more expensive to service.

About N5.97 trillion was used to funds borrowed by the government from domestic investors, higher than the N5.23 trillion used for the same purpose in 2023 by 14.15 per cent, while N7.15 trillion was used for paying interest on foreign loans, higher than the N2.57 trillion in 2023 by 167 per cent.

Analysis showed that about N4.69 trillion was paid to local investors for giving the federal government money to fund the 2024 budget deficit from the sale of FGN bonds at the local capital market versus the N3.66 trillion recorded a year earlier.

Following the FGN bonds was treasury bills, which recorded the use of N747.15 billion for the payment of interest to investors compared with N326.12 billion in 2023.

Debt servicing for FGN Sukuk gulped N158.43 billion last year, the sum of N6.38 billion was used to pay interest to investors who subscribed to the monthly FGN savings bonds, and N2.18 billion was for FGN green bonds, with N265.86 billion for promissory note principal repayments.

In the 2025 budget, the federal government has allocated about N16 trillion for debt servicing.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN