Economy

UAC Nigeria Posts Decline in Q1 Revenue on MDS Re-Classification

By Modupe Gbadeyanka

The financial results of UAC of Nigeria Plc for the period ended March 31, 2020 have been released by the board of the company.

Details of the financial status of the firm indicated that revenue depreciated by 2.9 percent year-on-year to N19.5 billion on the back of the re-classification of MDS as an associate.

In the results, adjusting for MDS in Q1 2019, revenue increased by 4.7 percent as a result of growth in the Packaged Food & Beverages (+9.8 percent YoY) from improved product availability, and Animal Feeds & Other Edibles segment (+2.4% YoY) from volume growth in poultry feeds.

In addition, EBIT declined by 34.5 percent to N1.1 billion in Q1 2020 with EBIT margin falling 2.78 percent YoY to 5.8 percent.

EBIT declined 22.9 percent and margins compressed 2.07 percent after adjusting for MDS in Q1 2019. EBIT was mainly impacted by investments made in marketing and distribution in the Animal Feeds & Other Edibles and Packaged Food & Beverages and Paints. Increased investments were also made to strengthen management teams across portfolio companies.

The finance income decreased in the period by 25.1 percent on account of lower investment income yields compared to prior year, while finance costs declined by 10.8 percent due to lower average interest rates.

Share of profit of associate stood at N71 million following reclassification of the logistics business (MDS) as an associate.

The company’s gross profit declined by 4.4 percent to N4.2 billion in Q1 2020, with gross margin declining marginally by 0.33 percent to 21.7 percent.

However, gross profit increased by 5.5 percent after adjusting for MDS in Q1 2019 with margins down 0.15 percent.

It was observed that Packaged Food & Beverages (+312 bps) and Paints (+269 bps) reported margin improvements on account of raw material cost savings and reduced material losses.

The decline in operating profit, coupled with a 30.7 percent decline in net finance income, resulted in a Profit Before Tax decline of 30.5 percent to N1.7 billion in Q1 2020, with Profit Before Tax margin declining by 3.38 percent to 8.5 percent.

Profit after tax from continuing operations declined by 41.6 percent to N1.1 billion, while earnings per share from continuing operations was 27 kobo, down 38.7 percent from 44 kobo inQ1 2019.

In addition, profit from discontinued operations was N0.72 billion due to a N3.1 billion fair value gain on recognition of MDS as an investment in associate which offset a N2.6 billion loss from UPDC.

Loss from UPDC was on account of impairment of its investment in the UPDC REIT, leaving the total profit for the period at N1.9 billion in Q1 2020, an 87.1 percent improvement from N996 million reported in Q1 2019.

Earnings per share for the period was 85 kobo, up 268.7 percent from 23 kobo in Q1 2019.

UAC Nigeria said its Free Cash Flow for the period was a negative -N5.6 billion in Q1 2020, compared with negative -B5.2 billion in FY 2019.

It explained that this was impacted by CAPEX of N2.0 billion from the Packaged Food & Beverages segment and inventory purchases in the Animal Feeds & Other Edibles segment.

Gearing increased 0.54 percent from FY 2019 to 10.2 percent at the end of the quarter on account of increased short-term debt funding in the Animal Feeds & Other Edibles segment.

Economy

Nigerian Senate to Pass 2026 Budget March 17

By Adedapo Adesanya

The Senate, through its Committee on Appropriations, has fixed March 17, 2026, as the tentative date for the final consideration and passage of the N58.472 trillion 2026 Appropriation Bill.

This was made known after a special session on Friday, where February 2 to 13, 2026, was approved for the consideration of budget estimates at the committee level.

The committee equally fixed Monday, February 9, 2026, for a public hearing on the budget proposal.

Chairman of the committee, Mr Solomon Olamilekan Adeola, further disclosed that Thursday, March 5, 2026, has been scheduled for an interactive session between members of the committee and key economic managers of the federal government, including the Ministers of Finance and Coordinating Minister of the Economy, Mr Wale Edun, as well as the Minister of Budget and National Planning, Mr Atiku Bagudu.

According to him, February 16 to 23, 2026, has been earmarked for the submission of reports on budget defence by various standing committee chairmen, ahead of the presentation of the Appropriations Committee’s report to the Senate on March 17.

He disclosed that while the Senate leadership initially preferred the budget to be passed by March 12, 2026, he successfully appealed for an additional week to allow for more thorough scrutiny.

To aid detailed examination of the estimates, Senator Adeola said hard copies of the 2026 budget have been printed and distributed to chairmen and members of the Senate’s standing committees.

On December 19, 2025, President Bola Tinubu presented a budget proposal of N58.47 trillion for the 2026 fiscal year titled Budget of Consolidation, Renewed Resilience and Shared Prosperity to a joint session of the National Assembly.

The budget has a capital recurrent (non‑debt) expenditure standing at N15.25 trillion, and the capital expenditure at N26.08 trillion, while the crude oil benchmark was pegged at $64.85 per barrel.

Mr Tinubu said the expected total revenue for the year is N34.33 trillion, and the proposal is anchored on a crude oil production of 1.84 million barrels per day, and an exchange rate of N1,400 to the US Dollar.

In terms of sectoral allocation, defence and security took the lion’s share with N5.41 trillion, followed by infrastructure at N3.56 trillion, education received N3.52 trillion, while health received N2.48 trillion.

Economy

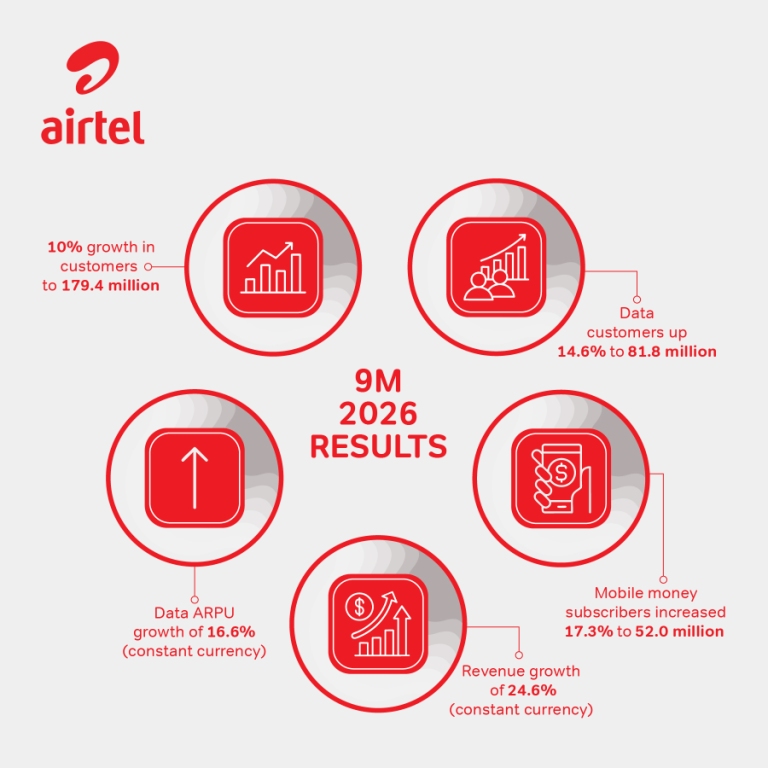

Airtel Africa Grows Earnings to $4.7bn in Nine Months

By Aduragbemi Omiyale

About $4.7 billion was generated by Airtel Africa Plc in nine-month period ended December 31, 2025, details of the company’s financial statements revealed.

The telco disclosed that in the period under review, mobile services revenue grew by 23.3 per cent in constant currency, as data revenues, the largest contributor to group revenues, increased by 36.5 per cent, with voice revenues growing by 13.5 per cent.

In the same vein, EBITDA grew by 35.9 per cent in reported currency to $2.3 billion, with EBITDA margins expanding further to 48.9 per cent from 46.2 per cent in the prior period.

The third quarter of the fiscal year witnessed a further sequential increase in EBITDA margins to 49.6 per cent, driving EBITDA growth of 31.0 per cent in constant currency and 40.8 per cent in reported currency.

The financial results showed that profit after tax of $586 million improved from $248 million in the prior period. Higher profit after tax in the current period was driven by higher operating profit and derivative and foreign exchange gains of $99 million versus the $153 million derivative and foreign exchange losses in the prior period.

Commenting, the chief executive of Airtel Africa, Mr Sunil Taldar, said, “These results highlight the strength of our strategy, with strong operating and financial trends across the business. During the quarter, we accelerated investment to enhance coverage and data capacity while also expanding our fibre network.

“Coupling this investment with innovative partnerships, strengthens our customer proposition and positions us to capture the considerable growth opportunity across our markets.

“Digitisation, technology innovation and embedding AI in our processes will also optimise the customer experience with increased digital offerings and closer integration of GSM and Airtel Money services allowing us to unlock the strong demand across our markets. Smartphone adoption continues to increase with penetration of 48.1 per cent, and we are seeing solid progress in the development of our home broadband business, reflecting the need for reliable, high-speed connectivity across our markets.

“Our push to enhance financial inclusion across the continent continues to gain momentum with our Mobile Money customer base expanding to 52 million, surpassing the 50 million milestone. Annualised total processed value of over $210 billion in Q3’26 underscores the depth of our merchants, agents and partner ecosystem, and remains a key player in driving improved access to financial services across Africa. We remain on track for the listing of Airtel Money in the first half of 2026.

“Disciplined execution on cost efficiency, alongside accelerating revenue growth has enabled another sequential improvement in our quarterly EBITDA margin to 49.6 per cent, – underpinning constant currency EBITDA growth of 31 per cent – and we remain focussed on driving further incremental margin improvements.

“Our strategic priorities remain clear: to keep investing in best in class connectivity, accelerate financial inclusion through our mobile money platform and deliver a great customer experience. These results reinforce our confidence in the long term potential of our markets and our ability to create value for all our stakeholders.”

Economy

Interest Rates May Remain Elevated Despite Inflation Cooling—PwC

By Adedapo Adesanya

According to PricewaterhouseCoopers (PwC), Nigeria’s benchmark interest rate is likely to remain elevated in 2026 even as inflation shows signs of easing.

Speaking at the PwC–BusinessDay Executive Roundtable on Nigeria’s 2026 budget and economic outlook in Lagos on Thursday, the Chief Economist and Head of Strategy at PwC, Mr Olusegun Zaccheaus, said expectations of aggressive interest rate cuts might be premature even with the core factor – inflation – seen cooling.

“Interest rates may remain elevated despite inflation cooling for most of 2025,” Mr Zaccheaus said. “Perhaps not by the 500 basis points some hope for, due to the need to manage liquidity.”

The Central Bank of Nigeria (CBN) had more than doubled its policy rate from 2022 levels in a bid to rein in inflationary pressures, before implementing a 50 basis-point cut in September that brought the monetary policy rate to 27 per cent.

The move followed a sharp moderation in inflation from its late-2024 peak. Inflation slowed to 15.15 per cent in December 2025, while the economy expanded by 3.98 per cent in the third quarter, its strongest quarterly growth in years.

At the last Monetary Policy Committee (MPC) meeting of the CBN in November 2025 voted to keep the interest steady.

The PwC official warned that warned that underlying risks, including exchange-rate volatility, fiscal pressures and global uncertainty, continue to complicate the outlook.

Mr Zaccheaus said that a major challenge for the apex bank will be to control the volume of money circulating in the economy.

He advised that liquidity management remains critical as excess cash can quickly undermine dis-inflation efforts particularly as the 2027 election cycle is around the corner.

He said that Nigeria typically experiences rapid growth in money supply ahead of election cycles, driven by increased government spending and political activity, adding that without careful coordination, such expansions risk fueling inflation and weakening investor confidence.

“The responsibility of the central bank is to ensure liquidity does not grow in a way that has a negative macroeconomic impact,” Mr Zaccheaus said.

He noted that a stable currency environment would support improved capital allocation and investment planning.

“FX stability is crucial,” Mr Zaccheaus said. “It gives investors confidence and allows businesses to plan. But that stability depends on disciplined policy execution.”

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn