Economy

X-Raying the National Development Plan 2021-2025

By Jerome-Mario Chijioke Utomi

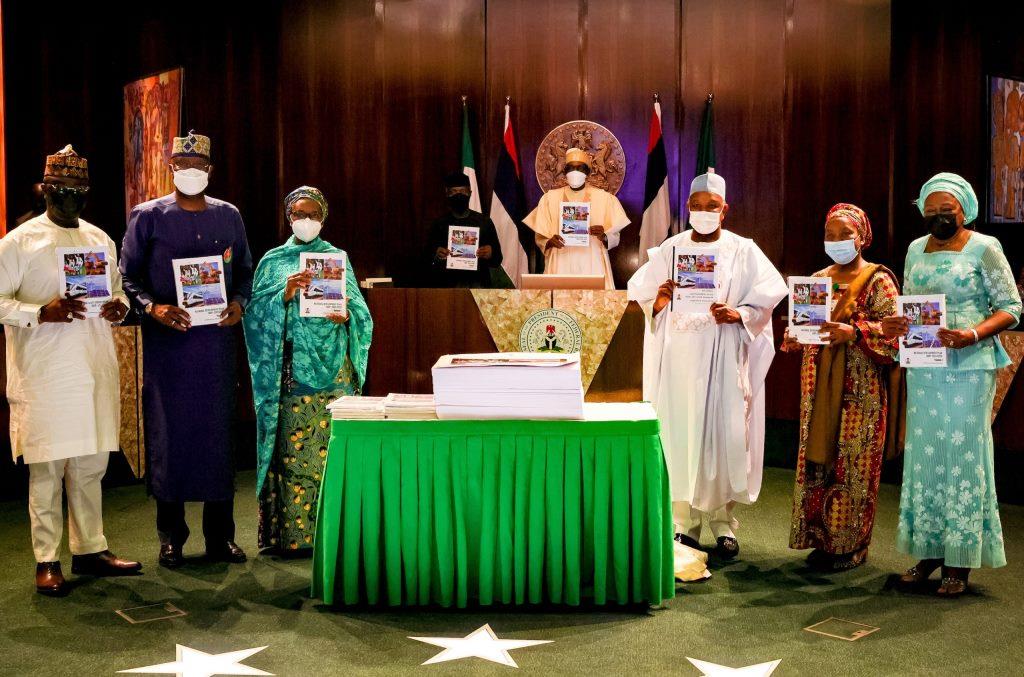

There exist some points that highlight as impressive the recent launch at the State House, Abuja, of the National Development Plan (NDP) 2021-2025, a successor plan to both the Economic Recovery and Growth Plan (ERGP 2017-2020) and the Vision 20:2020, by the President Muhammadu Buhari led federal government.

The plan, according to Minister of Finance, Budget and National Planning, Zainab Ahmed, sets the tone for Nigeria’s next economic destination and would prioritize robust infrastructure, economic stability, improved social indicators and living conditions of Nigerians.

First, infrastructural provisions enable development and also provide the services that underpin the ability of people to be economically productive.

Infrastructure investments, from what development professionals are saying, help stem economic losses arising from problems such as power outages or traffic congestion. The World Bank estimates that in Sub-Saharan Africa, closing the infrastructure quantity and quality gap relative to the world’s best performers could raise GDP growth per head by 2.6% per year.

Another practical particular that qualifies the development as exemplary is the new awareness that for the first time in our planning history as a nation, we are having three volumes of the plan.

According to the Minister, in the past, we have always had one volume, which is the plan itself. But this time, we have three volumes.

Volume One is the main plan, and that’s what will be accessible to the public. “Volume two is then a prioritized and sequential list of programmes and projects that will be fed into the annual budgets while Volume Three are the legislative imperatives,” the Minister stated.

Again, in line with the global belief that every government must find ways to create a sustainable economy, find a solution to the harmful effects of poverty upon the poor and upon those who are not poor but know that countless men and women are ravaged by hunger but choose to look away, the plan is laced with opportunities for inclusiveness for young people, women, people with special needs, and the vulnerable ones, mainstreaming women gender into all aspects of our social, economic and political activities.

Despite the validity of these claims, there are, however, reasons for Nigerians to feel concerned.

The major tragedy linked to this concern is that the nation Nigeria is reputed for changing economic plans with every change in leadership. This fear cannot be described as unfounded as we have as a country had several economic plans in the past. A huge sum of money has been injected into it but none achieved its targeted result. They were all aborted on the way by corruption, incompetence, change in administration and in some cases a combination of these factors.

As noted elsewhere, since independence in 1960, the country has demonstrated that there is no development plan which has achieved its core objective. There is always a disturbing laxity in marching plan targets with practical and unfailing consistency. The result is that the country remains one of the most politically and economically dis-articulated countries in the world.

In view of the above fact, how sure are we as Nigerians that the FG’s present moves will depart this old order?

In my view, what has all these years abbreviated Nigeria’s socio-economic growth, or accelerated development of other nations, is by no means a function of development plans but predicated on, and traceable to the existence of deformed leadership styles.

Take, as an illustration, for most of our political history, public office holders in Nigeria assume a self-sufficient attitude, despise others and view themselves as the exclusive possessor of what they have, as well as claim excellence not possessed.

Unfortunately, such characterizes the leadership’s sphere, not just in Nigeria but Africa as a continent. A factor that’s largely responsible for leaders’ inability to provide direction, protection, orientation, shape norms or manage conflicts in their various places of authority. The bitter truth is that no matter how good a plan or system of government may be, bad leaders must bring harm to their people.

This piece is not alone in this line of argument.

While underlying the problem of Nigeria’s underdevelopment exacerbated by the failure in the leadership system, Chinua Achebe, in his book The Trouble with Nigeria, remarked that there is nothing wrong with the Nigerian land or climate or water or air or anything else. But concluded that the trouble with Nigeria is simply and squarely a failure of leadership.

Looking ahead, two questions that are as important as the piece itself are; what strategy can the nation deploy to arrest such ugly narrative in ways that will make this recently developed national plan not end in shame like previous experience but bear the targeted result?

Two, how can the nation handlers effectively diversify the nation’s revenue sources, bearing in mind that such arrangement will reduce financial risks and increase national economic stability as a decline in particular revenue source might be offset by an increase in other revenue sources?

The above questions call on leaders in the country to reassess their priorities via the development of the ability to give every citizen a stake in the country and its future by subsidizing things that improve the earning powers of citizens- education, housing and public health and placement of emphasis on, and understanding that the economy would look after itself if democracy is protected; human rights are adequately taken care of, and the rule of law strictly adhered to.

Again, as the nation celebrates the National Development Plan 2021-2025, which we are yet to be sure if it will achieve the targeted result, one point we must not fail to remember is that Nigeria, according to a report, is the only, or among the few oil-producing countries without adequate metering to ascertain the accurate quantity of crude oil produced at any given time.

What the above tells us as a country is that there is more work to be done and more reforms to be made.

Finally, while it is evident, to use the words of the Minister, that the current plan has the future we all desire and will play a sizeable role in the product complexity space internationally and adopt measures to ease constraints that have hindered the economy from attaining its potential, particularly on the product mapping space. That notwithstanding, the masses must develop a keen interest in holding their leaders accountable.

Jerome-Mario Chijioke Utomi is the Programme Coordinator (Media and Public Policy), Social and Economic Justice Advocacy (SEJA), Lagos. He could be reached via je*********@***oo.com/08032725374.

Economy

Champion Breweries Concludes Bullet Brand Portfolio Acquisition

By Aduragbemi Omiyale

The acquisition of the Bullet brand portfolio from Sun Mark has been completed by Champion Breweries Plc, a statement from the company confirms.

This marks a transformative milestone in the organisation’s strategic expansion into a diversified, pan-African beverage platform.

With this development, Champion Breweries now owns the Bullet brand assets, trademarks, formulations, and commercial rights globally through an asset carve-out structure.

The assets are held in a newly incorporated entity in the Netherlands, in which Champion Breweries holds a majority interest, while Vinar N.V., the majority shareholder of Sun Mark, retains a minority stake.

Bullet products are currently distributed in 14 African markets, positioning Champion Breweries to scale beyond Nigeria in the high-growth ready-to-drink (RTD) alcoholic and energy drink segments.

This expansion significantly broadens the brewer’s addressable market and strengthens its revenue base with an established, profitable portfolio that already enjoys strong brand recognition and consumer loyalty across multiple markets.

“The successful completion of our public equity raises, together with the formal close of the Bullet acquisition, marks a defining moment for Champion Breweries.

“The support we received from both existing shareholders and new investors reflects strong confidence in our long-term strategy to build a diversified, high-growth beverage platform with pan-African scale.

“Our focus now is on disciplined execution, integration, and delivering sustained value across markets,” the chairman of Champion Breweries, Mr Imo-Abasi Jacob, stated.

Through this transaction, Champion Breweries is expected to achieve enhanced foreign exchange earnings, expanded distribution leverage across African markets, integrated supply chain efficiencies, portfolio diversification into high‑growth consumer beverage categories, and strengthened presence in the RTD and energy drink segments.

The acquisition accelerates Champion Breweries’ transition from a regional brewing business to a multi-category consumer platform with continental reach.

Bullet Black is Nigeria’s leading ready-to-drink alcoholic beverage, while Bullet Blue has built a strong presence in the energy drink category across several African markets.

Economy

M-KOPA Nigeria Plans Expansion to Edo, Others After N231bn Credit Milestone

By Adedapo Adesanya

Emerging market fintech firm, M-KOPA, has announced plans to deepen its reach in Nigeria to the South South and South East regions, starting with Edo this year, after providing N231 billion in credit to over 1 million customers in the country.

The firm released its first Nigeria-focused Impact Report, which showed that Nigeria is M-KOPA’s fastest-growing market and fastest to reach the milestone.

Since its foray into the Nigerian market in 2019, M-KOPA has been working to dismantle barriers to financial inclusion by providing flexible smartphone financing and digital financial tools that align with how people in the informal economy earn and manage their money.

It operates in six states in the country, including Lagos, Ogun, and Oyo, among others.

The report highlights the company’s contribution to income generation, digital inclusion and economic opportunity for Every Day Earners across the country.

The report showed that M-KOPA has enabled 290,000 first-time smartphone users, while 56 per cent of agents accessed their first income opportunity through the platform.

It showed high income and livelihood gains among its users, with about 77 per cent of customers leveraging smartphones or digital loans obtained through the platform to generate income, indicating that access to financed devices is directly supporting micro-entrepreneurial activity and informal sector productivity.

Furthermore, 75 per cent of users report higher earnings since gaining access to M-KOPA’s services, suggesting measurable improvements in personal revenue streams. On the distribution side, 99 per cent of agents disclose increased earnings, reflecting positive spillover effects across the company’s value chain.

In addition, 81 per cent of long-term customers state that their household expenses have improved, pointing to enhanced financial stability and better consumption smoothing over time.

Speaking on the report, Mr Babajide Duroshola, General Manager, M-KOPA Nigeria, said, “Nigeria represents extraordinary potential, and we’re proud that it has become M-KOPA’s fastest-growing market. Our Impact Report shows that when Every Day Earners gain access to the right digital and financial tools, they use them to create stability and long-term progress for their families. This is about access that unlocks opportunity and sustained prosperity.”

On its expansion plans Nigeria-wide, the M-KOPA helmsman said, “Many of the states we are considering are already similar to the ones we are currently in proximity… So, there is proximity and similarity between these states, and that’s what we are going to do, starting with Edo.”

He noted that as M-KOPA Nigeria continues to expand, the focus remains on ensuring more everyday earners gain access to the digital and financial tools they need to build resilient, prosperous futures in Nigeria’s rapidly digitising economy.

Economy

Tinubu Okays Extension of Ban on Raw Shea Nut Export by One Year

By Aduragbemi Omiyale

The ban on the export of raw shea nuts from Nigeria has been extended by one year by President Bola Tinubu.

A statement from the Special Adviser to the President on Information and Strategy, Mr Bayo Onanuga, on Wednesday disclosed that the ban is now till February 25, 2027.

It was emphasised that this decision underscores the administration’s commitment to advancing industrial development, strengthening domestic value addition, and supporting the objectives of the Renewed Hope Agenda.

The ban aims to deepen processing capacity within Nigeria, enhance livelihoods in shea-producing communities, and promote the growth of Nigerian exports anchored on value-added products, the statement noted.

To further these objectives, President Tinubu has authorised the two Ministers of the Federal Ministry of Industry, Trade and Investment, and the Presidential Food Security Coordination Unit (PFSCU), to coordinate the implementation of a unified, evidence-based national framework that aligns industrialisation, trade, and investment priorities across the shea nut value chain.

He also approved the adoption of an export framework established by the Nigerian Commodity Exchange (NCX) and the withdrawal of all waivers allowing the direct export of raw shea nuts.

The President directed that any excess supply of raw shea nuts should be exported exclusively through the NCX framework, in accordance with the approved guidelines.

Additionally, he directed the Federal Ministry of Finance to provide access to a dedicated NESS Support Window to enable the Federal Ministry of Industry, Trade and Investment to pilot a Livelihood Finance Mechanism to strengthen production and processing capacity.

Shea nuts, the oil-rich fruits from the shea tree common in the Savanna belt of Nigeria, are the raw material for shea butter, renowned for its moisturising, anti-inflammatory, and antioxidant properties. The extracted butter is a principal ingredient in cosmetics for skin and hair, as well as in edible cooking oil. The Federal Government encourages processing shea nuts into butter locally, as butter fetches between 10 and 20 times the price of the raw nuts.

The federal government said it remains committed to policies that promote inclusive growth, local manufacturing and position Nigeria as a competitive participant in global agricultural value chains.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn