Economy

X-Raying the National Development Plan 2021-2025

By Jerome-Mario Chijioke Utomi

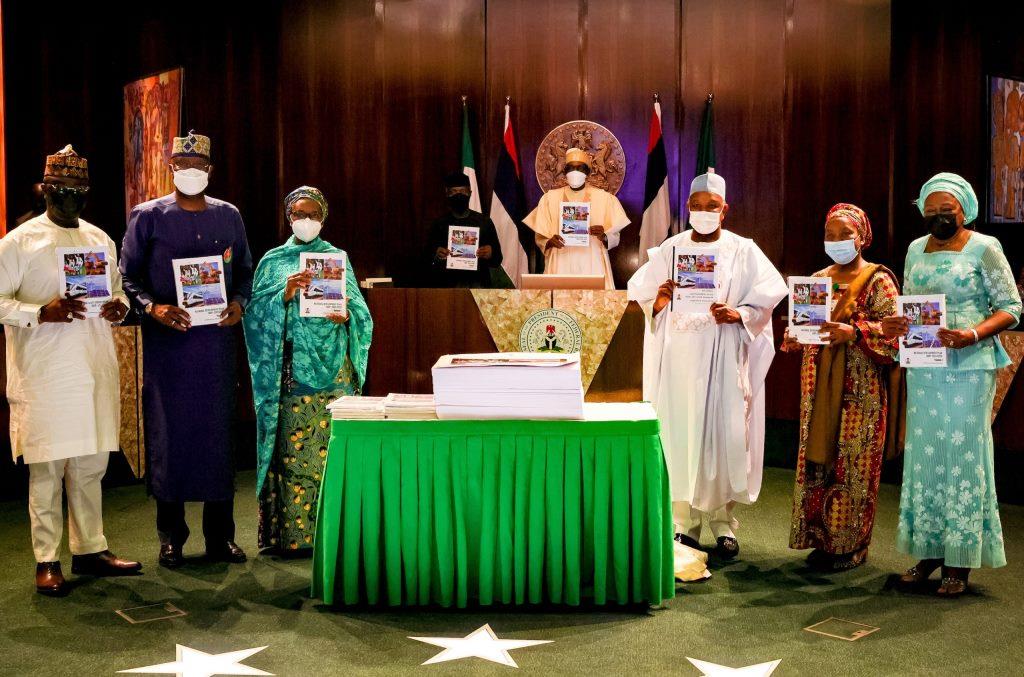

There exist some points that highlight as impressive the recent launch at the State House, Abuja, of the National Development Plan (NDP) 2021-2025, a successor plan to both the Economic Recovery and Growth Plan (ERGP 2017-2020) and the Vision 20:2020, by the President Muhammadu Buhari led federal government.

The plan, according to Minister of Finance, Budget and National Planning, Zainab Ahmed, sets the tone for Nigeria’s next economic destination and would prioritize robust infrastructure, economic stability, improved social indicators and living conditions of Nigerians.

First, infrastructural provisions enable development and also provide the services that underpin the ability of people to be economically productive.

Infrastructure investments, from what development professionals are saying, help stem economic losses arising from problems such as power outages or traffic congestion. The World Bank estimates that in Sub-Saharan Africa, closing the infrastructure quantity and quality gap relative to the world’s best performers could raise GDP growth per head by 2.6% per year.

Another practical particular that qualifies the development as exemplary is the new awareness that for the first time in our planning history as a nation, we are having three volumes of the plan.

According to the Minister, in the past, we have always had one volume, which is the plan itself. But this time, we have three volumes.

Volume One is the main plan, and that’s what will be accessible to the public. “Volume two is then a prioritized and sequential list of programmes and projects that will be fed into the annual budgets while Volume Three are the legislative imperatives,” the Minister stated.

Again, in line with the global belief that every government must find ways to create a sustainable economy, find a solution to the harmful effects of poverty upon the poor and upon those who are not poor but know that countless men and women are ravaged by hunger but choose to look away, the plan is laced with opportunities for inclusiveness for young people, women, people with special needs, and the vulnerable ones, mainstreaming women gender into all aspects of our social, economic and political activities.

Despite the validity of these claims, there are, however, reasons for Nigerians to feel concerned.

The major tragedy linked to this concern is that the nation Nigeria is reputed for changing economic plans with every change in leadership. This fear cannot be described as unfounded as we have as a country had several economic plans in the past. A huge sum of money has been injected into it but none achieved its targeted result. They were all aborted on the way by corruption, incompetence, change in administration and in some cases a combination of these factors.

As noted elsewhere, since independence in 1960, the country has demonstrated that there is no development plan which has achieved its core objective. There is always a disturbing laxity in marching plan targets with practical and unfailing consistency. The result is that the country remains one of the most politically and economically dis-articulated countries in the world.

In view of the above fact, how sure are we as Nigerians that the FG’s present moves will depart this old order?

In my view, what has all these years abbreviated Nigeria’s socio-economic growth, or accelerated development of other nations, is by no means a function of development plans but predicated on, and traceable to the existence of deformed leadership styles.

Take, as an illustration, for most of our political history, public office holders in Nigeria assume a self-sufficient attitude, despise others and view themselves as the exclusive possessor of what they have, as well as claim excellence not possessed.

Unfortunately, such characterizes the leadership’s sphere, not just in Nigeria but Africa as a continent. A factor that’s largely responsible for leaders’ inability to provide direction, protection, orientation, shape norms or manage conflicts in their various places of authority. The bitter truth is that no matter how good a plan or system of government may be, bad leaders must bring harm to their people.

This piece is not alone in this line of argument.

While underlying the problem of Nigeria’s underdevelopment exacerbated by the failure in the leadership system, Chinua Achebe, in his book The Trouble with Nigeria, remarked that there is nothing wrong with the Nigerian land or climate or water or air or anything else. But concluded that the trouble with Nigeria is simply and squarely a failure of leadership.

Looking ahead, two questions that are as important as the piece itself are; what strategy can the nation deploy to arrest such ugly narrative in ways that will make this recently developed national plan not end in shame like previous experience but bear the targeted result?

Two, how can the nation handlers effectively diversify the nation’s revenue sources, bearing in mind that such arrangement will reduce financial risks and increase national economic stability as a decline in particular revenue source might be offset by an increase in other revenue sources?

The above questions call on leaders in the country to reassess their priorities via the development of the ability to give every citizen a stake in the country and its future by subsidizing things that improve the earning powers of citizens- education, housing and public health and placement of emphasis on, and understanding that the economy would look after itself if democracy is protected; human rights are adequately taken care of, and the rule of law strictly adhered to.

Again, as the nation celebrates the National Development Plan 2021-2025, which we are yet to be sure if it will achieve the targeted result, one point we must not fail to remember is that Nigeria, according to a report, is the only, or among the few oil-producing countries without adequate metering to ascertain the accurate quantity of crude oil produced at any given time.

What the above tells us as a country is that there is more work to be done and more reforms to be made.

Finally, while it is evident, to use the words of the Minister, that the current plan has the future we all desire and will play a sizeable role in the product complexity space internationally and adopt measures to ease constraints that have hindered the economy from attaining its potential, particularly on the product mapping space. That notwithstanding, the masses must develop a keen interest in holding their leaders accountable.

Jerome-Mario Chijioke Utomi is the Programme Coordinator (Media and Public Policy), Social and Economic Justice Advocacy (SEJA), Lagos. He could be reached via [email protected]/08032725374.

Economy

Customs Oil and Gas Free Trade Zone in Rivers Collects N53.98bn Revenue

By Adedapo Adesanya

The Nigeria Customs Service (NCS) Oil and Gas Free Trade Zone Command in Rivers State says it has achieved a record-breaking revenue collection of N53.98 billion between January and November 2024, exceeding its annual target by 2.3 per cent and nearly doubling the N26.80 billion generated in 2023.

This was disclosed by the Customs Area Controller, Oil and Gas Free Trade Zone, Onne, Comptroller Seriki Usman, during a press briefing at the command’s headquarters, where he attributed the success to strategic collaboration with stakeholders, operational efficiency, and a focus on regulatory compliance.

He said, “A notable achievement of the command was its record-breaking revenue collection of N53.98 billion. This figure represents a 2.3 per cent increase over our annual target for 2024 and a remarkable 98.6% rise compared to the N26.80 billion collected in 2023.

“Our record-breaking revenue underscores the importance of effective trade facilitation and regulatory compliance. This achievement reflects the commitment of our officers, the collaboration with stakeholders, and the critical role of the Oil and Gas Free Trade Zone in driving Nigeria’s economic growth,” he said.

He explained that the Command successfully facilitated the export of key products such as refined sugar, fertiliser, liquefied natural gas, LNG, and crude oil from major facilities, including Bundu Sugar Refinery, Notore Chemical PLC, and Bonny Island.

“The seamless management of imports and exports within the free trade zone has enhanced operations for licensed enterprises,” he noted.

Speaking on the significance of these achievements, Comptroller Usman emphasized the need to maintain the momentum.

“This accomplishment is not just about numbers but about fostering trade growth, innovation, and creating a conducive environment for businesses to thrive within the free trade zone.”

On regulatory compliance, Comptroller Usman reassured Nigerians of the Command’s commitment to ensuring adherence to international trade regulations while fostering economic progress.

“Our focus remains on enhancing service delivery, promoting ease of doing business, and driving revenue generation that supports the nation’s development goals,” he said.

The command emphasized that collaboration with stakeholders, particularly the Oil and Gas Free Trade Zone Authority, has been pivotal in achieving these milestones, and called for continued partnership to sustain trade growth and improve service delivery.

As the year comes to a close, the command has reiterated its resolve to solidify its role as a critical revenue driver and trade facilitator in Nigeria’s oil and gas sector.

Mr Usman said the performance reflects the command’s vital role in strengthening Nigeria’s non-oil revenue base and its determination to remain a key player in the country’s economic transformation efforts.

“We remain committed to sustaining our achievements, fostering trust among stakeholders, and contributing significantly to the nation’s economic growth,” Comptroller Usman concluded.

Economy

FAAC Disburses 1.727trn to FG, States Local Councils in December 2024

By Modupe Gbadeyanka

The federal government, the 36 states of the federation and the 774 local government areas have received N1.727 trillion from the Federal Accounts Allocation Committee (FAAC) for December 2024.

The funds were disbursed to the three tiers of government from the revenue generated by the nation in November 2024.

At the December meeting of FAAC held in Abuja, it was stated that the amount distributed comprised distributable statutory revenue of N455.354 billion, distributable Value Added Tax (VAT) revenue of N585.700 billion, Electronic Money Transfer Levy (EMTL) revenue of N15.046 billion and Exchange Difference revenue of N671.392 billion.

According to a statement signed on Friday by the Director of Press and Public Relations for FAAC, Mr Bawa Mokwa, the money generated last month was about N3.143 trillion, with N103.307 billion used for cost of collection and N1.312 trillion for transfers, interventions and refunds.

It was disclosed that gross statutory revenue of N1.827 trillion was received compared with the N1.336 trillion recorded a month earlier.

The statement said gross revenue of N628.972 billion was available from VAT versus N668.291 billion in the preceding month.

The organisation stated that last month, oil and gas royalty and CET levies recorded significant increases, while excise duty, VAT, import duty, Petroleum Profit Tax (PPT), Companies Income Tax (CIT) and EMTL decreased considerably.

As for the sharing, FAAC disclosed that from the N1.727 trillion, the central government got N581.856 billion, the states received N549.792 billion, the councils took N402.553 billion, while the benefiting states got N193.291 billion as 13 per cent derivation revenue.

From the N585.700 billion VAT earnings, the national government got N87.855 billion, the states received N292.850 billion and the local councils were given N204.995 billion.

Also, from the N455.354 billion distributable statutory revenue, the federal government was given N175.690 billion, the states got N89.113 billion, the local governments had N68.702 billion, and the benefiting states received N121.849 billion as 13 per cent derivation revenue.

In addition, from the N15.046 billion EMTL revenue, FAAC shared N2.257 billion to the federal government, disbursed N7.523 billion to the states and transferred N5.266 billion to the local councils.

Further, from the N671.392 billion Exchange Difference earnings, it gave central government N316.054 billion, the states N160.306 billion, the local government areas N123.590 billion, and the oil-producing states N71.442 billion as 13 per cent derivation revenue.

Economy

Okitipupa Plc, Two Others Lift Unlisted Securities Market by 0.65%

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange recorded a 0.65 per cent gain on Friday, December 13, boosted by three equities admitted on the trading platform.

On the last trading session of the week, Okitipupa Plc appreciated by N2.70 to settle at N29.74 per share versus Thursday’s closing price of N27.04 per share, FrieslandCampina Wamco Nigeria Plc added N2.49 to end the session at N42.85 per unit compared with the previous day’s N40.36 per unit, and Afriland Properties Plc gained 50 Kobo to close at N16.30 per share, in contrast to the preceding session’s N15.80 per share.

Consequently, the market capitalisation added N6.89 billion to settle at N1.062 trillion compared with the preceding day’s N1.055 trillion and the NASD Unlisted Security Index (NSI) gained 19.66 points to wrap the session at 3,032.16 points compared with 3,012.50 points recorded in the previous session.

Yesterday, the volume of securities traded by investors increased by 171.6 per cent to 1.2 million units from the 447,905 units recorded a day earlier, but the value of shares traded by the market participants declined by 19.3 per cent to N2.4 million from the N3.02 million achieved a day earlier, and the number of deals went down by 14.3 per cent to 18 deals from 21 deals.

At the close of business, Geo-Fluids Plc was the most active stock by volume on a year-to-date basis with a turnover of 1.7 billion units worth N3.9 billion, followed by Okitipupa Plc with the sale of 752.2 million units valued at N7.8 billion, and Afriland Properties Plc with 297.3 million units sold for N5.3 million.

In the same vein, Aradel Holdings Plc remained the most active stock by value on a year-to-date basis with the sale of 108.7 million units for N89.2 billion, trailed by Okitipupa Plc with 752.2 million units valued at N7.8 billion, and Afriland Properties Plc with a turnover of 297.3 million units worth N5.3 billion.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN