Education

How to Select the Best Online Trading Platform for Your Investment Goals

Selecting the best online trading platform starts with knowing your investment goals and matching them to the right tools. The best platform fits personal strategy, trading style, and comfort level with risk while keeping fees low and execution simple. A clear goal helps narrow the choices among platforms that support stocks, ETFs, mutual funds, or crypto.

Each investor values different features. Some want research tools and education to make informed decisions, while others care more about speed, order types, or mobile access. By focusing on what matters most, investors can find a platform that supports progress instead of creating obstacles.

The following sections explain how to connect platform features to investment goals and what factors make a platform stand out. With the right knowledge, choosing an online trading platform becomes a straightforward step toward better investment results.

Aligning Platform Features With Your Investment Goals

A trading platform should fit the trader’s goals, experience, and preferred markets. Account types, asset range, and trading tools must align with how the trader manages risk and pursues returns. For example, a top-tier platform for online trading provides flexibility through account choices, broad asset coverage, and a focus on both control and accessibility.

Additionally, such platforms should provide features that allow traders to make informed decisions, such as advanced charting tools and real-time market data. A seamless user experience ensures that traders can navigate the platform with ease, enabling them to focus on their strategies without unnecessary distractions.

Identifying Your Investment Objectives

Every trader benefits from defining clear objectives before using any trading platform. Goals guide decisions about account type, instrument choice, and trade frequency. For example, a short-term trader often values low spreads and fast order execution, while a long-term investor may care more about stability and portfolio tracking tools.

Traders should separate needs like income generation, wealth growth, and capital preservation. This simple step helps decide whether to focus on active trading features or automated portfolio tools. Goals tied to frequent trading need strong charting and order types. Long-term investing benefits from dependable account management and planning features.

Setting realistic time frames and risk limits gives direction. Without such clarity, even the best platform can feel confusing and mismatched to its purpose.

Evaluating Investor Profiles and Experience Levels

Trader experience affects which features matter most. Beginners often need clear interfaces, education materials, and easy mobile access. A platform that simplifies order placement helps them gain confidence and avoid costly errors. Tools that automate some decisions, such as copy-trading or portfolio balancing, can provide structure.

Intermediate and advanced traders often need deeper analytics, customizable charts, and multiple trading platforms like MT4 or MT5. These tools support technical strategies and allow faster market responses. Traders managing larger accounts or complex positions benefit from customizable dashboards and transparent fee structures.

A suitable match balances comfort and control. The more experience a trader has, the more value they place on flexibility, speed, and precision.

Considering Account Types and Asset Availability

The account type shapes cost and accessibility. Some accounts feature zero or raw spreads, while others include fixed commissions that may simplify cost planning. The right choice depends on trading style and trade frequency rather than just headline prices.

Asset variety also matters. A platform offering Forex, indices, commodities, shares, and crypto pairs lets traders adjust portfolios as opportunities change. A broad selection can support diversification and reduce dependence on one market.

Convenient funding options and quick execution complete the picture. Together, these factors decide how well a platform supports different goals, from steady income pursuit to active market participation.

Necessary Factors in Choosing an Online Trading Platform

Each trading platform shapes how efficiently a trader can analyze markets, place orders, and manage accounts. Careful attention to usability, available assets, cost structure, and account protections allows traders to align technology and support with their investment goals.

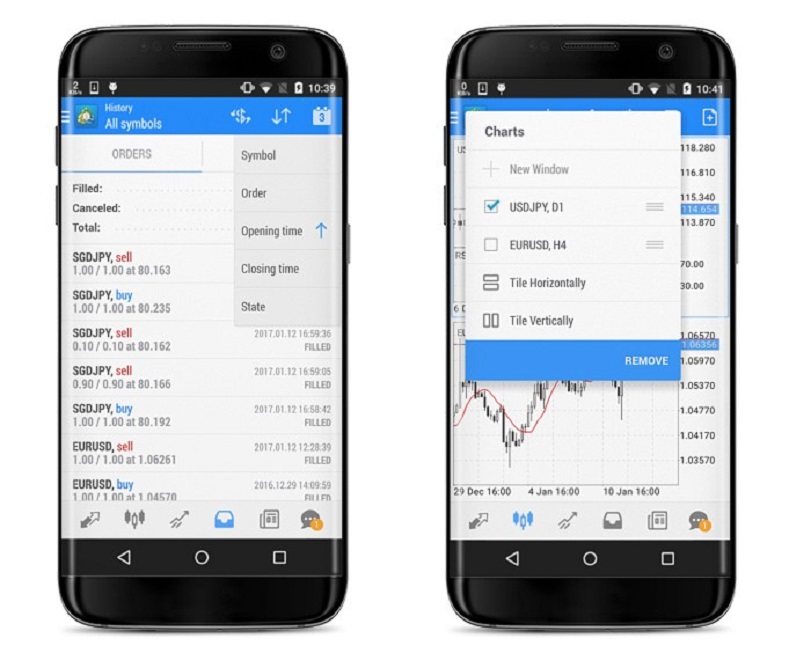

Platform User Experience and Accessibility

A functional and intuitive interface helps traders act quickly on market opportunities. An online broker should provide a clean dashboard, simple navigation menus, and customizable layouts that suit different trading styles. Clear watchlists, charting tools, and technical indicators allow analysis without confusion or delay.

Mobile and desktop platforms should both maintain a consistent design. Traders often rely on mobile apps for order execution, so stability and low downtime are important. Speed of logins, quick access to order types, and clear trade confirmations affect confidence in daily use.

Accessible educational resources such as video tutorials, basic webinars, and research and data tools can help users improve their skills. The ability to test a platform with a demo account before funding it offers insight into usability and execution quality. For traders who value convenience and clarity, interface design matters as much as cost.

Product Offerings and Supported Financial Instruments

An online trading platform must provide enough asset classes to match a trader’s strategy. Stocks, exchange-traded funds (ETFs), mutual funds, and options are standard choices. Some platforms also include commodities, bonds, or digital assets to support diversification.

Access to different order types, such as limit, stop, and trailing stop orders, allows traders more control over trade execution. Platforms that include margin trading or access to international markets give users broader exposure and strategy flexibility.

A diverse product lineup also helps investors adjust portfolios as goals change. Many stock brokers include research reports and screening tools that guide investors toward suitable securities. Educational content combined with strong product coverage supports both beginners and experienced traders in making informed choices.

Fee Structures and Commissions Analysis

Trading costs directly affect returns. Many online brokers now advertise commission-free trades on stocks and ETFs, though hidden charges can still appear in other areas. Traders should review all account fees, including inactivity fees, transfer fees, and withdrawal charges.

Commissions on options, mutual funds, or futures may differ by platform. Some brokers also generate revenue through payment for order flow, which can influence execution quality. Evaluating how quickly trades execute and whether spreads stay competitive reveals a more complete picture of cost.

A simple fee table can help users compare platforms:

- Trading commissions: Zero or low for common products

- Account minimum: Varies, often no minimum for standard accounts

- Inactivity fees: Charged after long idle periods on some accounts

Choosing low fees is helpful, but not at the expense of slower order execution or poor trading tools. Balance is key to maintaining value.

Account Security, Regulation, and Customer Support

A secure trading environment protects funds and personal information. Platforms should use strong encryption and two-factor authentication for every account. Regulation by agencies such as the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA) adds an important layer of oversight and transparency.

Traders should verify the broker’s registration status and review its history of compliance before depositing funds. Platforms that handle transfers through the Automated Customer Account Transfer process also add convenience by simplifying movement between brokers.

Customer service plays an equally important role. Responsive customer support through chat, phone, or email can prevent small issues from turning into major problems. Support teams that provide fast answers, clear explanations, and accessible hours add value beyond fees or features. In a market that moves by the second, reliable service and strong protections help build trust in the trading platform.

Conclusion

Selecting the best online trading platform depends on understanding goals, trading style, and the type of assets a person plans to manage. Each feature, from pricing to account options, directly affects outcomes and ease of use.

Security, speed, and clear fee structures help traders make smarter decisions. Platforms that align with user needs give more control, fewer surprises, and smoother execution during active market hours.

Before opening an account, traders should confirm the regulations, test the platform’s usability, and compare costs. Small differences in order execution or available research tools may influence long-term performance.

By focusing on safety, functionality, and cost transparency, investors improve their chances of consistent progress with fewer obstacles.

Education

Hallos Launches Learning247 Summit

By Adedapo Adesanya

Live-learning and creator-economy platform, Hallos, as part of its expansion drive, has unveiled plans to equip millions of youths and women with digital skills and monetisation opportunities through the Learning247 Hallos Summit, aimed at integrating Nigeria’s South-East into the rapidly expanding global creator economy.

At a sensitisation and stakeholder engagement forum in Enugu, the organisation also called for stronger strategic partnerships with government agencies, educational institutions, development organisations, media houses and private-sector stakeholders to advance the creator economy as a credible engine for mass employment, youth prosperity and inclusive economic growth.

The chief executive of Hallos, Mr Alexander Oseji Uzoma, renewed the call for increased investment in internet penetration, reliable power supply, digital infrastructure, creative studios and youth-focused innovation hubs across Nigeria, especially the South-East.

Describing the creator economy as one of the most accessible and scalable employment frontiers globally, he noted that with basic tools such as a smartphone, internet access and creative skills, young people can build audiences, monetise knowledge and generate sustainable income without heavy capital investment or long career pathways.

According to Mr Uzoma, the creator economy offers low-barrier entry into diverse professions, including content creation, social media influencing, live tutoring and digital coaching, video production, podcasting, graphic design, music and performance arts, digital marketing, merchandise design, e-commerce and community management. These activities support a broader value chain spanning production, distribution, technology and management.

The Hallos co-founder also explained that global projections place the creator economy in the hundreds of billions of dollars, with millions of creators worldwide earning sustainable incomes, stressing that Hallos is focused on localising these opportunities to ensure African youths can participate meaningfully and compete globally.

He further noted that Hallos operates a live-learning and creator-focused platform that integrates education, gamified quizzes, merchandising and voluntary fan donations into a single ecosystem. Through the platform, creators can host live learning sessions and masterclasses, earn from quizzes and challenges, sell branded merchandise, receive voluntary donations, build communities around their expertise and organise monetisable podcasts.

Mr Uzoma said the creator economy, driven by social media platforms, streaming services, digital commerce and content monetisation tools, has evolved into a major global industry capable of generating wealth, creating jobs and expanding export earnings.

He stressed that social media should no longer be viewed as a recreational space but as a viable business environment for wealth creation.

“The focus should not just be on content creation alone but on building businesses around content. It is about value creation and structured digital entrepreneurship,” he said.

He disclosed that Hallos intends to reach about 10 million youths nationwide, with over 5,000 already engaged across its programmes, while placing strong emphasis on bridging the gender gap by empowering women and girls through targeted digital training, mentorship and access to monetisation platforms.

As the digital economy continues to expand, Hallos said the creator economy stands out as a practical and scalable solution to youth unemployment, offering low entry barriers and global earning potential.

The company reaffirmed its commitment to bridging the gap between talent and income, enabling young Africans to earn well above minimum wage through creativity, knowledge and structured participation in the global digital economy.

Education

Bayero University PG Students to Enjoy Dangote’s N1.5bn Scholarship

By Modupe Gbadeyanka

Post-graduate students of Bayero University Kano (BUK) will benefit from a scholarship worth about N1.5 billion from the Aliko Dangote Foundation (ADF).

The businessman put down the funds to support eligible MBA, entrepreneurship, and management postgraduate students of the institution under an initiative known as MHF Dangote Graduate Business Scholarship.

At a ceremony on Tuesday, the foundation and the school signed a Memorandum of Understanding (MoU) at the auditorium of the Dangote Business School, Kano.

The deal is to provide N300 million annually over five years as scholarship awards to the beneficiaries, who will receive N150,000 each per session, beginning with the 2024/25 academic session. This is equivalent to 50 per cent of the current N300,000 fee paid by the post-graduate students. There are 1,225 students in the Business School (696 fresh and 529 returning students).

One of the beneficiaries, Mr Khalid Bababubu, who is into manufacturing and specialises in MBA, Finance and Investment, thanked the organisation for the gesture.

“We are happy to be beneficiaries of this initiative. Education is the bedrock of national development, and we will not take this scholarship for granted,” he said.

A representative of ADF, Ms Mariya Aliko Dangote, said, “Our vision at the Foundation is to build human capital that translates into economic opportunity.

“Strengthening business and entrepreneurship education is critical to turning knowledge into enterprise, innovation, and jobs. This scholarship deepens our commitment to Dangote Business School by investing directly in the next generation of business leaders and change-makers.”

On his part, the Vice Chancellor of Bayero University Kano, Prof. Haruna Musa, said, “This support comes at a critical time for many families. Beyond financial relief, it strengthens the Business School’s role as a centre for developing entrepreneurial and management talent, particularly for women who are increasingly taking leadership roles in enterprise.”

It was explained that newly admitted students will receive automatic tuition reductions during registration, and returning students who have already paid in full will receive rebates. The N300 million allocation is structured to cover all eligible postgraduate students based on current enrolment capacity.

Any unutilised balance in the first year will be retained within the Dangote Business School development envelope to strengthen learning infrastructure and digital academic capacity, ensuring continued enhancement of the academic environment.

The MHF Dangote Graduate Business Scholarship is distinct from ADF’s recently announced nationwide STEM education interventions.

Education

Entries for InterswitchSPAK 8.0 Begin, Over N40m up for Grabs

By Aduragbemi Omiyale

Senior secondary school students across Nigeria have been invited to apply and demonstrate their academic excellence on a national stage in the eighth edition of the prestigious national science competition known as InterswitchSPAK.

The contest is organised by Interswitch, Africa’s leading technology company focused on creating solutions that enable individuals and communities prosper.

Registration for InterswitchSPAK 8.0 via www.interswitchspak.com has opened and will close on Friday, May 24, 2026. For the first time, in addition to group registrations through schools, parents can also register their individual children for the competition.

This year’s edition features a scholarship pool exceeding N40 million, with Interswitch expanding the prize structure to ensure broader impact.

The overall winner will receive a N15 million tertiary scholarship, including monthly stipends. The first runner-up will be awarded a N10 million scholarship, including monthly stipends; while the second runner-up will receive a N5 million scholarship, also including monthly stipends. All scholarships are payable over 5 years. Also, the top 9 finalists will all receive brand new laptops and other exciting prizes.

In addition to the top prizes, Season 8 introduces enhanced rewards for student finalists ranked 4th to 9th, as well as increased recognition for teachers supporting qualifying students from 1st to 9th place. This expanded structure reinforces Interswitch’s commitment to rewarding academic excellence and recognising the critical role educators play in shaping student success.

“At Interswitch, we strongly believe that Nigeria’s future will be shaped by how well we nurture today’s young minds. InterswitchSPAK goes beyond competition; it is a long-term commitment to empowering students and supporting teachers who are laying the foundation for innovation, problem-solving, and national development.

“As we launch Season 8, we remain focused on creating opportunity, rewarding merit, and inspiring excellence across Nigeria,” the Executive Vice President for Group Marketing and Communications at Interswitch, Ms Cherry Eromosele, said.

Designed to empower young minds in the Science, Technology, Engineering, and Mathematics (STEM) areas, InterswitchSPAK identifies, nurtures, and rewards students while equipping them with the skills and knowledge required to excel in STEM fields and drive innovation.

Over the past seven seasons, InterswitchSPAK has positively impacted thousands of students across the country, offering full university scholarships, mentorship opportunities, and national recognition for outstanding academic performance.

Beyond these rewards, the programme has consistently reinforced the importance of STEM education as a critical driver of innovation, problem-solving, and sustainable national development.

Through a transparent, technology-enabled selection process, InterswitchSPAK has also promoted educational equity by providing students from diverse socio-economic backgrounds with equal access to opportunity, ensuring that performance and merit remain central to success.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn