Feature/OPED

Why Dokpesi Should Be PDP National Chairman

By Edwin Emeka

The socio-economic and political realities in Nigeria today are telling on everyone. While some are bold enough to admit it or express their disappointments with the situation, others are still pretending that all is well or that things will soon get better. But these are hopes and expectations devoid of clear and intelligible explanations.

Governance is a process and whereby the process lacks coherent strategy, the entire process becomes susceptible to uncertainties. Whereas uncertainty is a mortal enemy to investors because investors only invest their money in economies where policies are stable, where rule of law is supreme and where catastrophic risks can be minimized and possibly foreclosed for greater productivity. So, uncertainty does not inspire confidence and does not influence positive decisions.

In the prelude to the 2015 general elections, many investors; foreign and domestic alike pulled out their investments from Nigeria. While some went to neighbouring countries where policies are more stable, others waited patiently to see what the outcome of the election would be because the pre-election rhetoric is too strong and nerve-racking.

After the elections, it happened that the candidate of the main opposition party, retired General Muhammadu Buhari won the election with a congratulatory call coming from his main challenger, Dr Goodluck Jonathan who at the time was Nigeria’s president.

After all said and done, Nigerians and investors alike waited patiently to see what policy the new government will articulate and pursue.

Six months after inauguration, there were no cabinet ministers to articulate and implement new government policies. So, investors have to wait till November to have Ministers with portfolios.

Two years after inauguration, the country still does not have clear policy that will boost investors’ confidence in the system and make them to commit their resources in to the economy which will create loss of jobs.

Because of the initial unguarded utterances of the current regime which made many to believe that it was going to pursue and implement socialist economic principles as against the known mixed economic practices, some investors who strongly believed in Nigeria and do not want to leave resorted to liquid investments as against fundamental investments.

One of the surest ways of pulling economies out of recession is by implementing the ‘Keynesian Economic Theory.’ This economic theory was developed by a ‘British Economist,’ John Maynard Keynes during the ‘Great Depression’ of the 1930’s.

Keynes, in his theory, advocated for increased government expenditures and lowering of taxes to stimulate demand and pull the global economy out of depression.

Subsequently, Keynesian economics became the economic model that could prevent economic slumps by influencing aggregate demand through activist stabilization and economic intervention policies by governments.

But instead of pursuing these economic principles to the later so as to pull the country out of recession, the current government did otherwise by saving government money and increasing taxes in the midst of great recession. The government action is a household economic principles recommended for individuals and families and not for a nation.

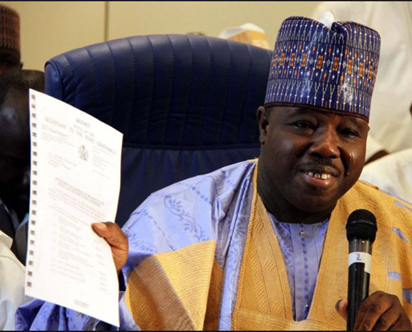

While the government was faltering in its economic operations, the main opposition party was embroiled in a 14-month leadership crisis which gave no hope of alternative or shadow government to the people until the landmark Supreme Court ruling which ended the 14 months leadership tussles and bestowed legitimacy on the Ahmed Makarfi led faction of the PDP.

While the two elephants of the party were fighting, ordinary Nigerians and investors bear the brunt as there were no robust and vibrant opposition party that will checkmate the activities of the ruling party. As a result, so many waters passed through the bridge unchecked and unnoticed.

Months after the Supreme Court ended the leadership tussle in the party, vibrant opposition activity is still lacking in the party as what we have is a quasi-opposition PDP. This was why the former Military Head of States, General Abdulsalami Abubakar recently tongue-lashed the party when he said: ”I must say it is very sad that you (PDP) have not played your role properly in opposition. May be you (PDP) is still suffering from the shock of defeat, but I thought at least six months down the line, it would have been enough to come out of the shock to really face the governance.”

Having conquered the shadowy phase, the next phase that will send strong message to Nigerians and at the same time rekindle hope and confidence in the economy is the viability of Nigeria’s main opposition party and this has to do with the choice of who becomes the national chairman of the party at the December convention.

Already, the party in their wisdom have zoned the two vital positions in the party to the North and the South respectively. The choice of who becomes the Presidential candidate has been zoned to the north while the chairmanship position has been zoned to the south ahead of the December convention.

However, the choice of who becomes the national chairman of the PDP matters because it is a call to national sacrifice and not a call for tea party. Also, the party need tested, trusted and verified war-horse for the epic battle that is coming in 2019. Epic battle in the sense that the PDP and the APC will be making another history; because if the PDP wins the race in 2019, it will be the first former ruling party in Nigeria reclaiming its ruling status and vice versa.

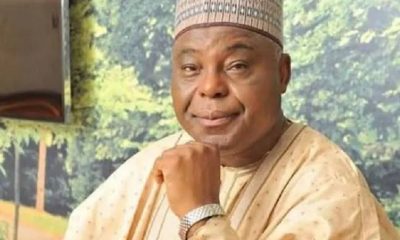

Among the individuals who have indicated interest to vie for the post of the national chairman, it is only High Chief Raymond Dokpesi that has what it takes to lead the PDP to victory in 2019. This is because, any other person will over disturb party elders, leaders and governors for fund for publicity because publicity is very expensive as it is the life blood of opposition politics in any democracy.

In fact, one of the reasons the PDP as presently constituted have not played active and vibrant opposition politics is because it lacks enough money for publicity. The PDP governors who would have funded it are having problems with the payment of workers salary and wages as well as other infrastructural challenges confronting them. But, High Chief Raymond Dokpesi already have the connection, mobilization, clout and other relevant paraphernalia as a media guru which he will deploy to the party’s advantage without putting the financial burden on party members.

Hence, whether anybody likes it or not, the APC propaganda machinery is heavily funded for any task as the case may be.

Therefore, it is only High Chief Raymond Dokpesi, a tested, trusted and seasoned media guru that even the APC with all of its propaganda machinery will still catch cold when he Sneezes that can lead the PDP to victory in 2019.

Finally, the party elders, leaders and stakeholders who truly want the PDP to return to power in 2019 should not look beyond High Chief Raymond Dokpesi for national chairmanship position of the party in the December convention.

Edwin Emeka transiently writes from Kogi State.

Feature/OPED

How Christians Can Stay Connected to Their Faith During This Lenten Period

It’s that time of year again, when Christians come together in fasting and prayer. Whether observing the traditional Lent or entering a focused period of reflection, it’s a chance to connect more deeply with God, and for many, this season even sets the tone for the year ahead.

Of course, staying focused isn’t always easy. Life has a way of throwing distractions your way, a nosy neighbour, a bus driver who refuses to give you your change, or that colleague testing your patience. Keeping your peace takes intention, and turning off the noise and staying on course requires an act of devotion.

Fasting is meant to create a quiet space in your life, but if that space isn’t filled with something meaningful, old habits can creep back in. Sustaining that focus requires reinforcement beyond physical gatherings, and one way to do so is to tune in to faith-based programming to remain spiritually aligned throughout the period and beyond.

On GOtv, Christian channels such as Dove TV channel 113, Faith TV and Trace Gospel provide sermons, worship experiences and teachings that echo what is being practised in churches across the country.

From intentional conversations on Faith TV on GOtv channel 110 to true worship on Trace Gospel on channel 47, these channels provide nurturing content rooted in biblical teaching, worship, and life application. Viewers are met with inspiring sermons, reflections on scripture, and worship sessions that help form a rhythm of devotion. During fasting periods, this kind of consistent spiritual input becomes a source of encouragement, helping believers stay anchored in prayer and mindful of God’s presence throughout their daily routines.

To catch all these channels and more, simply subscribe, upgrade, or reconnect by downloading the MyGOtv App or dialling *288#. You can also stream anytime with the GOtv Stream App.

Plus, with the We Got You offer, available until 28th February 2026, subscribers automatically upgrade to the next package at no extra cost, giving you access to more channels this season.

Feature/OPED

Turning Stolen Hardware into a Data Dead-End

By Apu Pavithran

In Johannesburg, the “city of gold,” the most valuable resource being mined isn’t underground; it’s in the pockets of your employees.

With an average of 189 cellphones reported stolen daily in South Africa, Gauteng province has become the hub of a growing enterprise risk landscape.

For IT leaders across the continent, a “lost phone” is rarely a matter of a misplaced device. It is frequently the result of a coordinated “snatch and grab,” where the hardware is incidental, and corporate data is the true objective.

Industry reports show that 68% of company-owned device breaches stem from lost or stolen hardware. In this context, treating mobile security as a “nice-to-have” insurance policy is no longer an option. It must function as an operational control designed for inevitability.

In the City of Gold, Data Is the Real Prize

When a fintech agent’s device vanishes, the $300 handset cost is a rounding error. The real exposure lies in what that device represents: authorised access to enterprise systems, financial tools, customer data, and internal networks.

Attackers typically pursue one of two outcomes: a quick wipe for resale on the secondary market or, far more dangerously, a deep dive into corporate apps to extract liquid assets or sellable data.

Clearly, many organisations operate under the dangerous assumption that default manufacturer security is sufficient. In reality, a PIN or fingerprint is a flimsy barrier if a device is misconfigured or snatched while unlocked. Once an attacker gets in, they aren’t just holding a phone; they are holding the keys to copy data, reset passwords, or even access admin tools.

The risk intensifies when identity-verification systems are tied directly to the compromised device. Multi-Factor Authentication (MFA), widely regarded as a gold standard, can become a vulnerability if the authentication factor and the primary access point reside on the same compromised device. In such cases, the attacker may not just have a phone; they now have a valid digital identity.

The exposure does not end at authentication. It expands with the structure of the modern workforce.

65% of African SMEs and startups now operate distributed teams. The Bring Your Own Device (BYOD) culture has left many IT departments blind to the health of their fleet, as personal devices may be outdated or jailbroken without any easy way to know.

Device theft is not new in Africa. High-profile incidents, including stolen government hardware, reinforce a simple truth: physical loss is inevitable. The real measure of resilience is whether that loss has any residual value. You may not stop the theft. But you can eliminate the reward.

Theft Is Inevitable, Exposure is Not

If theft cannot always be prevented, systems must be designed so that stolen devices yield nothing of consequence. This shift requires structured, automated controls designed to contain risk the moment loss occurs.

Develop an Incident Response Plan (IRP)

The moment a device is reported missing, predefined actions should trigger automatically: access revocation, session termination, credential reset and remote lock or wipe.

However, such technical playbooks are only as fast as the people who trigger them. Employees must be trained as the first line of defence —not just in the use of strong PINs and biometrics, but in the critical culture of immediate reporting. In high-risk environments, containment windows are measured in minutes, not hours.

Audit and Monitor the Fleet Regularly

Control begins with visibility. Without a continuous, comprehensive audit, IT teams are left responding to incidents after damage has occurred.

Opting for tools like Endpoint Detection and Response (EDR) allows IT teams to spot subtle, suspicious activities or unusual access attempts that signal a compromised device.

Review Device Security Policies

Security controls must be enforced at the management layer, not left to user discretion. Encryption, patch updates and screen-lock policies should be mandatory across corporate devices.

In BYOD environments, ownership-aware policies are essential. Corporate data must remain governed by enterprise controls regardless of device ownership.

Decouple Identity from the Device

Legacy SMS-based authentication models introduce avoidable risk when the authentication channel resides on the compromised handset. Stronger identity models, including hardware tokens, reduce this dependency.

At the same time, native anti-theft features introduced by Apple and Google, such as behavioural theft detection and enforced security delays, add valuable defensive layers. These controls should be embedded into enterprise baselines rather than treated as optional enhancements.

When Stolen Hardware Becomes Worthless

With POPIA penalties now reaching up to R10 million or a decade of imprisonment for serious data loss offences, the Information Regulator has made one thing clear: liability is strict, and the financial fallout is absolute. Yet, a PwC survey reveals a staggering gap: only 28% of South African organisations are prioritising proactive security over reactive firefighting.

At the same time, the continent is battling a massive cybersecurity skills shortage. Enterprises simply do not have the boots on the ground to manually patch every vulnerability or chase every “lost” terminal. In this climate, the only viable path is to automate the defence of your data.

Modern mobile device management (MDM) platforms provide this automation layer.

In field operations, “where” is the first indicator of “what.” If a tablet assigned to a Cape Town district suddenly pings on a highway heading out of the city, you don’t need a notification an hour later—you need an immediate response. An effective MDM system offers geofencing capabilities, automatically triggering a remote lock when devices breach predefined zones.

On Supervised iOS and Android Enterprise devices, enforced Factory Reset Protection (FRP) ensures that even after a forced wipe, the device cannot be reactivated without organisational credentials, eliminating resale value.

For BYOD environments, we cannot ignore the fear that corporate oversight equates to a digital invasion of personal lives. However, containerization through managed Work Profiles creates a secure boundary between corporate and personal data. This enables selective wipe capabilities, removing enterprise assets without intruding on personal privacy.

When integrated with identity providers, device posture and user identity can be evaluated together through multi-condition compliance rules. Access can then be granted, restricted, or revoked based on real-time risk signals.

Platforms built around unified endpoint management and identity integration enable this model of control. At Hexnode, this convergence of device governance and identity enforcement forms the foundation of a proactive security mandate. It transforms mobile fleets from distributed risk points into centrally controlled assets.

In high-risk environments, security cannot be passive. The goal is not recovery. It is irrelevant, ensuring that once a device leaves authorised hands, it holds no data, no identity leverage, and no operational value.

Apu Pavithran is the CEO and founder of Hexnode

Feature/OPED

Daniel Koussou Highlights Self-Awareness as Key to Business Success

By Adedapo Adesanya

At a time when young entrepreneurs are reshaping global industries—including the traditionally capital-intensive oil and gas sector—Ambassador Daniel Koussou has emerged as a compelling example of how resilience, strategic foresight, and disciplined execution can transform modest beginnings into a thriving business conglomerate.

Koussou, who is the chairman of the Nigeria Chapter of the International Human Rights Observatory-Africa (IHRO-Africa), currently heads the Committee on Economic Diplomacy, Trade and Investment for the forum’s Nigeria chapter. He is one of the young entrepreneurs instilling a culture of nation-building and leadership dynamics that are key to the nation’s transformation in the new millennium.

The entrepreneurial landscape in Nigeria is rapidly evolving, with leaders like Koussou paving the way for innovation and growth, and changing the face of the global business climate. Being enthusiastic about entrepreneurship, Koussou notes that “the best thing that can happen to any entrepreneur is to start chasing their dreams as early as possible. One of the first things I realised in life is self-awareness. If you want to connect the dots, you must start early and know your purpose.”

Successful business people are passionate about their business and stubbornly driven to succeed. Koussou stresses the importance of persistence and resilience. He says he realised early that he had a ‘calling’ and pursued it with all his strength, “working long weekends and into the night, giving up all but necessary expenditures, and pressing on through severe setbacks.”

However, he clarifies that what accounted for an early success is not just tenacity but also the ability to adapt, to recognise and respond to rapidly changing markets and unexpected events.

Ambassador Koussou is the CEO of Dau-O GIK Oil and Gas Limited, an indigenous oil and natural gas company with a global outlook, delivering solutions that power industries, strengthen communities, and fuel progress. The firm’s operations span exploration, production, refining, and distribution.

Recognising the value of strategic alliances, Koussou partners with business like-minds, a move that significantly bolsters Dau-O GIK’s credibility and capacity in the oil industry. This partnership exemplifies the importance of building strong networks and collaborations.

The astute businessman, who was recently nominated by the African Union’s Agenda 2063 as AU Special Envoy on Oil and Gas (Continental), admonishes young entrepreneurs to be disciplined and firm in their decision-making, a quality he attributed to his success as a player in the oil and gas sector. By embracing opportunities, building strong partnerships, and maintaining a commitment to excellence, Koussou has not only achieved personal success but has also set a benchmark for future generations of African entrepreneurs.

His journey serves as a powerful reminder that with determination and vision, success is within reach.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn