Feature/OPED

The Options Before Nigeria

By Michael Owhoko

In the midst of sustained challenge for restructuring and other sundry agitations in Nigeria, there is iota of hope, if only the ruling class is prepared to do the needful, writes Michael Owhoko

Nigeria has been through quite a lot in recent times than at any other time in its political history, but at this very moment, aside the almost resolved security challenges facing Nigeria, issues relating to self-determination and restructuring are some of the burning issues that the government of the day is grappling to manage.

As it is, close observer will easily say the incumbent leadership of the federal government is not favourably disposed to restructuring, whereas, sentiments have easily been aroused by proponents and opponents of the restructuring debate. Unfortunately, while the civil society and geopolitical interests have been calling for some changes in the Nigerian constitution as a way to perfect and strengthen the union that constitutes Nigeria, the citizenry are not adequately motivated to fully join the clamour either because of lack of clear understanding of the issues at stake or are overwhelmed by economic concerns.

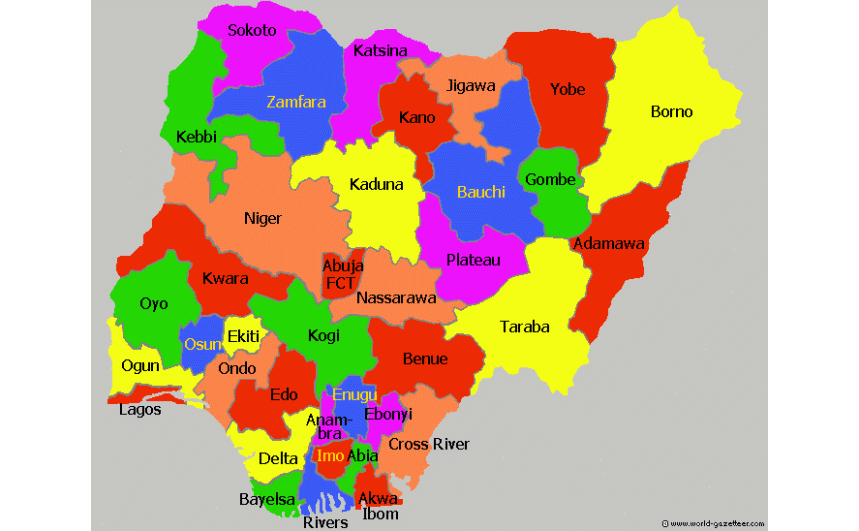

First, either for or against restructuring as currently being canvassed, it is obvious that the people of the South and the North are not on the same page. Nigerian must understand that as a multi-ethnic society with diverse cultural dissimilarities, the country qualifies as a sociologically complex society, posing a serious challenge to the country’s continued existence as one united nation. This makes it imperative as a matter of necessity to do the needful and embark on a constitutional amendment that will give birth to a restructured new Nigeria.

Secondly, in discussing issues relating to the Nigerian structure, which evidently, is defective, and the sustained clamour for a truly federal constitution, primordial sentiments must be avoided because as things stand, objectivity is being overwhelmed by emotions depending on who is looking at what issues and the side of the divide on which he or she is rooted. The overall consequence of this will be unhelpful to decision-making process, as emphasis may be on sectional rather than national interest, even at the highest level of governance.

In reality, the Northern Protectorate, which comprises mainly the Hausa-Fulani people and the Southern Protectorate, made up of the Yoruba, Igbo and the Niger Deltans, are initially district nations with separate cultural peculiarities before they were merged by the British colonial masters strictly for business and administrative purposes in the 1914 amalgamation.

Though the motive was not clear, but it is certainly not unconnected with achieving cost efficiency without passing the incidence of the cost of administration to the home country. This was so because the Northern Region was already experiencing budget deficit at the time when the Southern Protectorate had a robust budget with surplus.

From the onset, not many Nigerians were happy about the forced marriage. In fact, in one of his reactions to the Nigerian nationhood, the leader of the Northern People’s Congress (NPC), the Sardauna of Sokoto, late Sir Ahmadu Bella once said: “The mistake of 1914 has come to light and I shall like to go no further again.” Likewise, the leader of the Action Group (AG), late Chief Obafemi Awolowo also said: “Nigeria is not a nation. It is a mere geographical expression. There are no Nigerians in the same sense as there are English, Welsh, or French. The word Nigeria is a mere distinctive appellation to distinguish those who live within the boundaries of Nigeria and those who do not.

Chief Awolowo, in his book, The Peoples’ Republic, further confirmed the brittleness of the Nigerian state when he said, “It is incontestable that the British not only made Nigeria, but also hand it to us whole on their surrender of power. But the Nigeria, which they handed over to us, had in it the forces of its own disintegration. It is up to contemporary Nigerian leaders to neutralize these forces, preserve the Nigerian inheritance, and make all our people free, forward-looking and prosperous. “

The two men were apparently referring to the unhealthy amalgamation of 1914, and from then till now the Nigerian people themselves have not shown signs of willingness to unite, a confirmation that Nigeria is only a British intention and except other viable options are explored, the fragile peace in the country can still snowball into total disintegration because the country is surely on the precipice.

The most reliable option available to Nigeria is a federal system of government as practised in the country in the first republic from 1960 till 1966. I say this because the fear of Nigeria’s founding fathers has always been that the colonial masters failed to take into consideration the ethnic and cultural differences which ultimately shape peoples’ perception and decisions, hence as it is today, the allegiance of Nigeria’s founding fathers was to their respective regions, and by extension, current leadership, though surreptitiously.

Nigeria purportedly operates a federal system of government today, but the main defect is the absence of the features of that form of government, namely, autonomy of the federating units. This is conspicuously missing as evident from the dependency structure between the states and the centre. In a truly federal system, certain characteristics pertaining to the federating units are present, and some these include state-owned constitution, regional police, coat of arm, and so on.

This level of autonomy allows the units to adopt peculiar and independent style of administration to address their specific needs incidental to their culture, values and heritage. Then there is also something very vital that true federalism guarantees and that is fiscal federalism. This defines and provides the framework of financial relationship between the centre (federal government) and the rest of the states.

Chief among what proponents of restructuring are actually calling for and which are well enumerated in my book: Nigeria on the Precipice: Issues, Options and Solutions – Lessons for Emerging Heterogeneous Democratic Societies , is a constitution that promotes fiscal federalism under which each region is at liberty to generate its own resources and discharge its statutory responsibilities within the limit of its resources, while also maintaining its status as an autonomous state within the federation.

Truth is, researchers, analysts and well-meaning Nigerians have collectively agreed that the bane of Nigeria’s problem is the transition from federal system to the unitary system as perpetrated by the military during their illegal incursions into politics in 1966.

It was during that period that the principle of derivation, an element of fiscal federalism, which was designed to ensure equity by way of compensation to the area from where mineral resources are extracted, was abandoned, whereas, when cocoa, groundnut and oil palm were sources of revenue in the country, the principle of derivation was applied. This was why the western, northern and eastern regions benefited from 50 percent derivation as provided for by the 1963 constitution.

Now, the challenge is, the Nigerian economy is largely dependent on oil, hence it occupies a place of prominence in the country’s revenue matrix but unfortunately, the exploration of oil in the Niger Delta region has not only had very negative effects on the environment, but the abrogation of the derivation principle has stripped it of its due share of national revenue, making the people of the region to have less to show for the quantum of wealth being taken out of their land. The derivation principle is currently pegged at a minimum of 13 percent.

Currently, Nigeria is draped with unresolved national issues that are capable of relapsing into an albatross around its neck because these issues are also the forces pulling apart the people of the country. Every ethnic group and every section has one grievance or the other against the Nigerian state. As indicated in my book and in consonance with other opinionated Nigerians, the resentments are as a result of the flawed process that led to the emergence of Nigeria as a country.

The somewhat reluctance of government to address these challenges is exacerbating concomitant frustration in the country and this is slowly but gradually killing the spirit of patriotism with regrettable decline in commitment towards national unity without which there cannot be any meaningful progress. For instance, the Biafra agitation is nothing but one of the symptoms of discontent, so too the militancy in the Niger Delta Region is an indication of frustration in the Niger Delta.

The long and short of this article is that the Nigerian nation is not working, particularly due to the application of wrong solutions induced by insincerity and hypocrisy and as a result, the future of the country is bleak, and, this explains why the clamour for restructuring is gaining unprecedented dimension more than at any time in history.

There is no rocket science to it. The way for Nigeria to go is true federalism, which guarantees fiscal federalism, and implicitly, financial autonomy. This will ensure equity in the administration of revenue because the pattern of revenue sharing formula has remained a bone of contention between federal and state governments. In such circumstance, the principle of derivation serves as a mechanism against revenue injustice, but where true federalism fails to be accepted, confederalism becomes the other available option.

Also, the steady escalation of tension in the country can be doused if the ruling class can throw pride to the wind and chart the path of peace and honour in their approach to resolving the current challenges facing the country by conducting a referendum. Through a referendum, the people can actively participate in deciding which system of government to adopt. Referendum is a political instrument for resolving political questions. It is an aggregation of the wish of the people.

Nigeria has the potential to grow capacity for global relevance, but suppression of the wishes of the people is capable of frustrating this hope. So, let us concede ethic and sectional pride and allow the country to be repositioned through restructuring to enthrone justice and equity aimed at achieving peace, happiness and progress.

Michael Owhoko, author, Nigeria on The Precipice: Issues, Options and Solutions – Lessons for Emerging Heterogeneous Democratic Societies, wrote from Lagos.

Feature/OPED

How Christians Can Stay Connected to Their Faith During This Lenten Period

It’s that time of year again, when Christians come together in fasting and prayer. Whether observing the traditional Lent or entering a focused period of reflection, it’s a chance to connect more deeply with God, and for many, this season even sets the tone for the year ahead.

Of course, staying focused isn’t always easy. Life has a way of throwing distractions your way, a nosy neighbour, a bus driver who refuses to give you your change, or that colleague testing your patience. Keeping your peace takes intention, and turning off the noise and staying on course requires an act of devotion.

Fasting is meant to create a quiet space in your life, but if that space isn’t filled with something meaningful, old habits can creep back in. Sustaining that focus requires reinforcement beyond physical gatherings, and one way to do so is to tune in to faith-based programming to remain spiritually aligned throughout the period and beyond.

On GOtv, Christian channels such as Dove TV channel 113, Faith TV and Trace Gospel provide sermons, worship experiences and teachings that echo what is being practised in churches across the country.

From intentional conversations on Faith TV on GOtv channel 110 to true worship on Trace Gospel on channel 47, these channels provide nurturing content rooted in biblical teaching, worship, and life application. Viewers are met with inspiring sermons, reflections on scripture, and worship sessions that help form a rhythm of devotion. During fasting periods, this kind of consistent spiritual input becomes a source of encouragement, helping believers stay anchored in prayer and mindful of God’s presence throughout their daily routines.

To catch all these channels and more, simply subscribe, upgrade, or reconnect by downloading the MyGOtv App or dialling *288#. You can also stream anytime with the GOtv Stream App.

Plus, with the We Got You offer, available until 28th February 2026, subscribers automatically upgrade to the next package at no extra cost, giving you access to more channels this season.

Feature/OPED

Turning Stolen Hardware into a Data Dead-End

By Apu Pavithran

In Johannesburg, the “city of gold,” the most valuable resource being mined isn’t underground; it’s in the pockets of your employees.

With an average of 189 cellphones reported stolen daily in South Africa, Gauteng province has become the hub of a growing enterprise risk landscape.

For IT leaders across the continent, a “lost phone” is rarely a matter of a misplaced device. It is frequently the result of a coordinated “snatch and grab,” where the hardware is incidental, and corporate data is the true objective.

Industry reports show that 68% of company-owned device breaches stem from lost or stolen hardware. In this context, treating mobile security as a “nice-to-have” insurance policy is no longer an option. It must function as an operational control designed for inevitability.

In the City of Gold, Data Is the Real Prize

When a fintech agent’s device vanishes, the $300 handset cost is a rounding error. The real exposure lies in what that device represents: authorised access to enterprise systems, financial tools, customer data, and internal networks.

Attackers typically pursue one of two outcomes: a quick wipe for resale on the secondary market or, far more dangerously, a deep dive into corporate apps to extract liquid assets or sellable data.

Clearly, many organisations operate under the dangerous assumption that default manufacturer security is sufficient. In reality, a PIN or fingerprint is a flimsy barrier if a device is misconfigured or snatched while unlocked. Once an attacker gets in, they aren’t just holding a phone; they are holding the keys to copy data, reset passwords, or even access admin tools.

The risk intensifies when identity-verification systems are tied directly to the compromised device. Multi-Factor Authentication (MFA), widely regarded as a gold standard, can become a vulnerability if the authentication factor and the primary access point reside on the same compromised device. In such cases, the attacker may not just have a phone; they now have a valid digital identity.

The exposure does not end at authentication. It expands with the structure of the modern workforce.

65% of African SMEs and startups now operate distributed teams. The Bring Your Own Device (BYOD) culture has left many IT departments blind to the health of their fleet, as personal devices may be outdated or jailbroken without any easy way to know.

Device theft is not new in Africa. High-profile incidents, including stolen government hardware, reinforce a simple truth: physical loss is inevitable. The real measure of resilience is whether that loss has any residual value. You may not stop the theft. But you can eliminate the reward.

Theft Is Inevitable, Exposure is Not

If theft cannot always be prevented, systems must be designed so that stolen devices yield nothing of consequence. This shift requires structured, automated controls designed to contain risk the moment loss occurs.

Develop an Incident Response Plan (IRP)

The moment a device is reported missing, predefined actions should trigger automatically: access revocation, session termination, credential reset and remote lock or wipe.

However, such technical playbooks are only as fast as the people who trigger them. Employees must be trained as the first line of defence —not just in the use of strong PINs and biometrics, but in the critical culture of immediate reporting. In high-risk environments, containment windows are measured in minutes, not hours.

Audit and Monitor the Fleet Regularly

Control begins with visibility. Without a continuous, comprehensive audit, IT teams are left responding to incidents after damage has occurred.

Opting for tools like Endpoint Detection and Response (EDR) allows IT teams to spot subtle, suspicious activities or unusual access attempts that signal a compromised device.

Review Device Security Policies

Security controls must be enforced at the management layer, not left to user discretion. Encryption, patch updates and screen-lock policies should be mandatory across corporate devices.

In BYOD environments, ownership-aware policies are essential. Corporate data must remain governed by enterprise controls regardless of device ownership.

Decouple Identity from the Device

Legacy SMS-based authentication models introduce avoidable risk when the authentication channel resides on the compromised handset. Stronger identity models, including hardware tokens, reduce this dependency.

At the same time, native anti-theft features introduced by Apple and Google, such as behavioural theft detection and enforced security delays, add valuable defensive layers. These controls should be embedded into enterprise baselines rather than treated as optional enhancements.

When Stolen Hardware Becomes Worthless

With POPIA penalties now reaching up to R10 million or a decade of imprisonment for serious data loss offences, the Information Regulator has made one thing clear: liability is strict, and the financial fallout is absolute. Yet, a PwC survey reveals a staggering gap: only 28% of South African organisations are prioritising proactive security over reactive firefighting.

At the same time, the continent is battling a massive cybersecurity skills shortage. Enterprises simply do not have the boots on the ground to manually patch every vulnerability or chase every “lost” terminal. In this climate, the only viable path is to automate the defence of your data.

Modern mobile device management (MDM) platforms provide this automation layer.

In field operations, “where” is the first indicator of “what.” If a tablet assigned to a Cape Town district suddenly pings on a highway heading out of the city, you don’t need a notification an hour later—you need an immediate response. An effective MDM system offers geofencing capabilities, automatically triggering a remote lock when devices breach predefined zones.

On Supervised iOS and Android Enterprise devices, enforced Factory Reset Protection (FRP) ensures that even after a forced wipe, the device cannot be reactivated without organisational credentials, eliminating resale value.

For BYOD environments, we cannot ignore the fear that corporate oversight equates to a digital invasion of personal lives. However, containerization through managed Work Profiles creates a secure boundary between corporate and personal data. This enables selective wipe capabilities, removing enterprise assets without intruding on personal privacy.

When integrated with identity providers, device posture and user identity can be evaluated together through multi-condition compliance rules. Access can then be granted, restricted, or revoked based on real-time risk signals.

Platforms built around unified endpoint management and identity integration enable this model of control. At Hexnode, this convergence of device governance and identity enforcement forms the foundation of a proactive security mandate. It transforms mobile fleets from distributed risk points into centrally controlled assets.

In high-risk environments, security cannot be passive. The goal is not recovery. It is irrelevant, ensuring that once a device leaves authorised hands, it holds no data, no identity leverage, and no operational value.

Apu Pavithran is the CEO and founder of Hexnode

Feature/OPED

Daniel Koussou Highlights Self-Awareness as Key to Business Success

By Adedapo Adesanya

At a time when young entrepreneurs are reshaping global industries—including the traditionally capital-intensive oil and gas sector—Ambassador Daniel Koussou has emerged as a compelling example of how resilience, strategic foresight, and disciplined execution can transform modest beginnings into a thriving business conglomerate.

Koussou, who is the chairman of the Nigeria Chapter of the International Human Rights Observatory-Africa (IHRO-Africa), currently heads the Committee on Economic Diplomacy, Trade and Investment for the forum’s Nigeria chapter. He is one of the young entrepreneurs instilling a culture of nation-building and leadership dynamics that are key to the nation’s transformation in the new millennium.

The entrepreneurial landscape in Nigeria is rapidly evolving, with leaders like Koussou paving the way for innovation and growth, and changing the face of the global business climate. Being enthusiastic about entrepreneurship, Koussou notes that “the best thing that can happen to any entrepreneur is to start chasing their dreams as early as possible. One of the first things I realised in life is self-awareness. If you want to connect the dots, you must start early and know your purpose.”

Successful business people are passionate about their business and stubbornly driven to succeed. Koussou stresses the importance of persistence and resilience. He says he realised early that he had a ‘calling’ and pursued it with all his strength, “working long weekends and into the night, giving up all but necessary expenditures, and pressing on through severe setbacks.”

However, he clarifies that what accounted for an early success is not just tenacity but also the ability to adapt, to recognise and respond to rapidly changing markets and unexpected events.

Ambassador Koussou is the CEO of Dau-O GIK Oil and Gas Limited, an indigenous oil and natural gas company with a global outlook, delivering solutions that power industries, strengthen communities, and fuel progress. The firm’s operations span exploration, production, refining, and distribution.

Recognising the value of strategic alliances, Koussou partners with business like-minds, a move that significantly bolsters Dau-O GIK’s credibility and capacity in the oil industry. This partnership exemplifies the importance of building strong networks and collaborations.

The astute businessman, who was recently nominated by the African Union’s Agenda 2063 as AU Special Envoy on Oil and Gas (Continental), admonishes young entrepreneurs to be disciplined and firm in their decision-making, a quality he attributed to his success as a player in the oil and gas sector. By embracing opportunities, building strong partnerships, and maintaining a commitment to excellence, Koussou has not only achieved personal success but has also set a benchmark for future generations of African entrepreneurs.

His journey serves as a powerful reminder that with determination and vision, success is within reach.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn