General

1.6 million Nigerians Apply for New Consumer Credit Scheme

By Adedapo Adesanya

The federal government said about 1.6 million Nigerians have submitted applications for the Consumer Credit Scheme launched recently.

This is according to the Managing Director and Chief Executive Officer (CEO) of the Nigerian Consumer Credit Corporation (CREDICORP) when he appeared on Channels TV on Tuesday.

Last month, President Bola Tinubu launched the first phase of the Consumer Credit Scheme. The programme allows working citizens to access loans for important purchases.

Now, less than a month since the take-off of the scheme, the CREDICORP boss described the volume of applications received so far as overwhelming.

“It has been overwhelming. We didn’t expect the volume of applications or expressions of interest when we put out an EoI just like a week after I was appointed,” he said during the interview on Politics Today on Tuesday.

“As of today, we have about 1.6 million Nigerians who indicated interest, told us what they do, submitted their income information, and what they need credit for. We didn’t even expect that volume.

“So I think people have been listening to the utterances of the President and are quite expectant of this.”

The President appointed Mr Nwagba as CREDICORP boss on April 5 to spearhead the current administration’s drive to broaden consumer credit availability for working Nigerians interested.

About six weeks after his appointment, he said he was prepared to deliver the assignment.

“It is our job and we are prepared to take a systematic approach to ensure that we continue to go through the demography of Nigeria,” he added.

The Consumer Credit Scheme put together by Nigeria’s CreditCorp is in line with the Tinubu-led administration’s mandate to accelerate consumer credit access to 50 per cent of working Nigerians by 2030.

To achieve this, CrediCorp will fix the structural barriers to accessing consumer credit in Nigeria, and catalyze the market with capital, guarantees, and policy, according to a statement by the spokesman of the president, Mr Ajuri Ngelale.

President Tinubu believes every hardworking Nigerian should have access to social mobility, with consumer credit playing a pivotal role in achieving this vision.

According to CreditCorp, this scheme will help strengthen Nigeria’s credit reporting systems, ensuring every economically active citizen has a dependable credit score. “This score becomes personal equity they build, facilitating access to consumer credit”.

Also under this scheme, credit guarantees will be offered, and wholesale lending to financial institutions dedicated to broadening consumer credit access will be attained.

The scheme will also help promote responsible consumer credit “as a pathway to an improved quality of life, fostering a cultural shift towards growth and financial responsibility”.

General

Deep Blue Project: Mobereola Seeks Air Force Support

By Adedapo Adesanya

The Director General of the Nigerian Maritime Administration and Safety Agency (NIMASA), Mr Dayo Mobereola, is seeking enhanced cooperation between the agency and the Nigerian Air Force (NAF) with the aim of strengthening tactical air support within the Deep Blue project.

During a courtesy visit last week, Mr Mobereola told the Chief of Air Staff, Air Marshall S. K. Aneke at the NAF Headquarters in Abuja, that the Air Force was a strategic partner in enhancing maritime security in Nigeria and sustaining the momentum of the Deep Blue Project’s success.

According to the DG, “We are here to seek the Air Force’s support, given the importance of tactical air surveillance to the Deep Blue Project. Nigeria is the only African country with a record of zero piracy within the last 4 years. The Deep Blue Project platforms have been used to achieve zero piracy and sea robberies in the Gulf of Guinea, and we need your collaboration to sustain this momentum”.

He further emphasised that international trade depends on security, which is why vessels prefer to go to or transit through countries where they are secured. “With the traffic we have now, we need to show more security might through collaboration to strengthen our trade viability because of the risks attached to our route. We need these collaborations to sustain what we have achieved so far with the Deep Blue Project”.

The NIMASA DG expressed hope that the collaboration with the Nigeria Air Force will reduce response time.

On his part, the Chief of Air Staff, Air Marshall S.K. Aneke, noted that the Air Force desires to be “a very supportive and collaborative partner with NIMASA and is ready to match the Agency step by step and side by side to achieve the desired results.”

He noted that “collaboration between NIMASA and the Nigerian Air Force under the Deep Blue Project can be strengthened through a joint strategic framework, integrated command structures, and a standing steering committee to ensure shared objectives and accountability.

“Establishing a joint maritime domain awareness fusion cell will enable real-time intelligence sharing, synchronised surveillance, and faster response to maritime threats and ensure sustained operational effectiveness across Nigeria’s territorial waters and exclusive economic zone,” he said, according to a statement.

The Air Force Chief added that the Air Force can also support NIMASA outside the Deep Blue Project operations by providing its own ISR platforms, tactical air support, and rapid airborne deployment for interdictions and search and rescue missions.

While thanking the NIMASA DG for the basic trainings the Agency has provided the aircraft pilots under the Deep Blue Project, Air Marshall Aneke also highlighted areas of operational challenges needing NIMASA’s attention to include bridging the communication gap between NAF operators and NIMASA, higher level and in-depth maintenance trainings, readily available fueling of aircrafts to avoid delays on missions, and provision of flying kits among others.

He therefore pledged the Air Force’s collaboration and assured that the request by NIMASA has been noted and that things will begin to move at thrice its speed going forward.

General

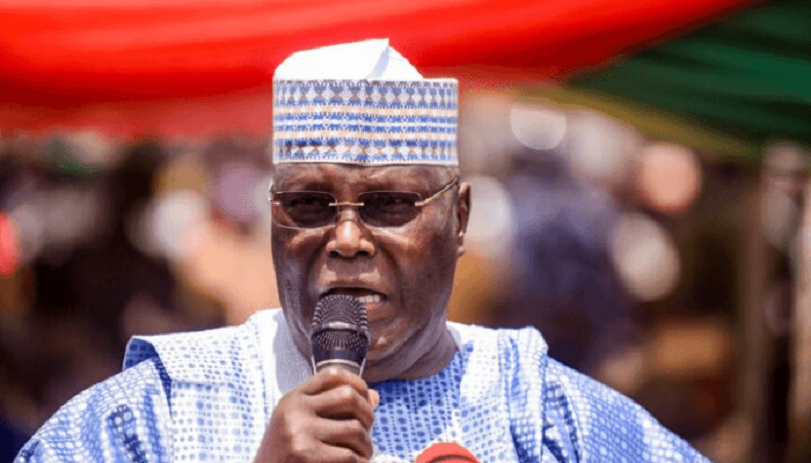

Nigeria’s Democracy Suffocating Under Tinubu—Atiku

By Modupe Gbadeyanka

Former Vice President, Mr Atiku Abubakar, has lambasted the administration of President Bola Tinubu for the turnout at the FCT Area Council elections held last Saturday.

In a statement signed by his Media Office, the Adamawa-born politician claimed that the health of Nigeria’s democracy under the current administration was under threat.

According to him, “When citizens lose faith that their votes matter, democracy begins to die. What we are witnessing is not mere voter apathy. It is a direct consequence of an administration that governs with a chokehold on pluralism. Democracy in Nigeria is being suffocated slowly, steadily, and dangerously.”

He warned that the steady erosion of participatory governance, if left unchecked, could inflict irreversible damage on the democratic fabric painstakingly built over decades.

“A democracy without vibrant opposition, without free political competition, and without public confidence is democracy in name only. If this chokehold is not released, history will record this era as the period when our hard-won freedoms were traded for fear and conformity,” he stressed.

Mr Atiku said the turnout for the poll was below 20 per cent, with the Abuja Municipal Area Council (AMAC) recording 7.8 per cent.

He noted that such civic participation in the nation’s capital, the symbolic heartbeat of the federation, is not accidental, as it is the predictable outcome of a political environment poisoned by intolerance, intimidation, and the systematic weakening of opposition voices.

The presidential candidate of the People’s Democratic Party (PDP) in the 2023 general elections stated that the ruling All Progressives Congress (APC) under Mr Tinubu has pursued a deliberate policy of shrinking democratic space, harassing dissenters, coercing defectors, and fostering a climate where alternative political viewpoints are treated as threats rather than contributions to national development.

He called on opposition parties and democratic forces across the country to urgently close ranks and forge a united front, declaring, “This is no longer about party lines; it is about preserving the Republic. The time to stand together to rescue and rebuild Nigeria is now.”

General

Nigeria Eyes Full Entry into Council of Palm Oil Producing Countries

By Adedapo Adesanya

Nigeria is set to validate a technical committee report geared towards transitioning the country from observer status to full membership of the Council of Palm Oil Producing Countries (CPOPC) in April.

Mr Abubakar Kyari, Minister of Agriculture and Food Security, said this when the council’s mission visited him over the weekend in Abuja, noting that the ministry had constituted a technical committee to consider how the country would seamlessly transit from observer country to membership in CPOPC based on its strategic importance in palm oil production.

“We are conscious of the fact that the palm oil value chain is very strategic for us and identified it as an export crop that can drive foreign exchange for the country and ensure good health in terms of consumption.

“We are conscious of the fact that we need the support of CPOPC countries to provide the country with a new variety of seeds that are climate-smart and resistant so that they can be produced by farmers in the country,” he said.

Mr Alphonsus Inyang, President, National Palm Produce Association of Nigeria (NPPAN), said being a member of CPOPC Nigeria would target over 10 million tonnes of oil palm between 2026 and 2050.

“We are also targeting 2.5 million hectares from among Nigeria households who are out to produce one hectare each, geared towards a N20 trillion annual economy within this period from among Nigeria households.

“We are working side by side with the big players who will be developing plantations,” he said.

The Secretary-General of CPOPC, Ms Izzana Salleh, said the council’s mission to Nigeria was to see how the country could transit from observer status to full membership, among others

She said that the status of the country as an observer nation since 2024 would expire by November.

Ms Salleh assured the country of the council’s readiness to support its vision to strengthen domestic production, enhance food security and build a competitive and sustainable palm oil supply chain.

The official emphasised that being a member of the council would strategically position Nigeria for a greater future regarding oil palm production.

According to her, the visit is to strengthen the council’s engagement with Nigeria, including potential membership in CPOPC.

She said: “The council’s mission to Nigeria aims to advance both Nigeria’s national ambitions and Africa’s collective voice in global agricultural discussions.

“CPOPC was established to promote cooperation among producing nations, empower smallholders, advance sustainability, and ensure fair, science-based global dialogue on vegetable oils.

She emphasised that being a member of the council would strategically position the country for greater future prospects regarding oil palm production and the value chain, as well as export.

“We are ready to support Nigeria’s vision to strengthen domestic production, enhance food security, and build a competitive and sustainable palm oil supply chain,” she said.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn