General

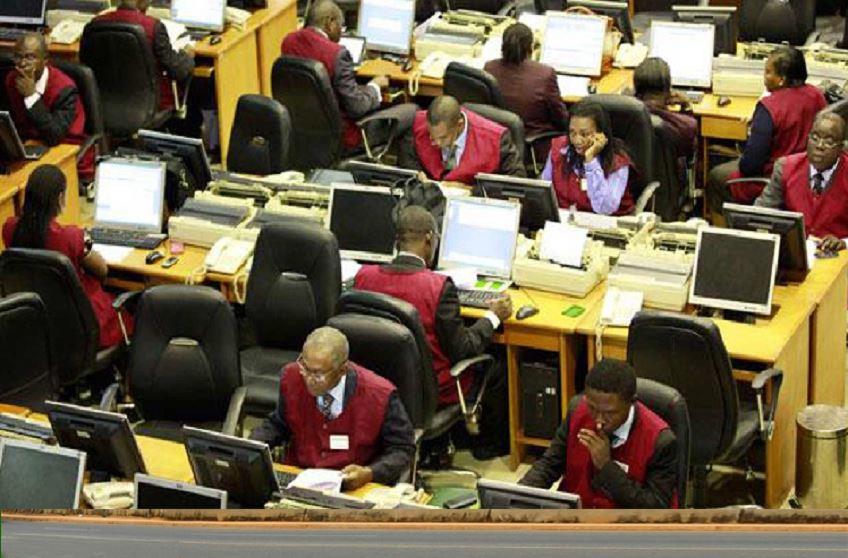

COVID-19: Consumer Goods Sector Hardest Hit—FBNQuest Survey

By Modupe Gbadeyanka

**Says Income Levels Down 30%

The income levels of consumers in Nigeria are down by an average of 30 percent since March 2020, while job opportunities are fast disappearing, a survey has revealed.

The study conducted by REACH Technologies, a Nigeria-based fintech, on behalf of FBNQuest, corroborates findings from the National Bureau of Statistics (NBS) COVID impact survey that consumers have fallen on harder times.

Another sticking point is that consumption of non-essentials has been cut drastically, with respondents stating that they have reduced spending on higher value category items by about 22 percent since about three months ago.

Although, overall consumption has reduced since the pandemic started, the least spending cuts were made on food and health, which respondents viewed as most essential.

It is now becoming clear that the consumer goods sector is among the hardest hit by the economic crisis brought about by the COVID-19 pandemic.

The fragility of household wallets has been laid bare, with statistics now pointing to even weaker consumer sentiments.

The knock-on effect of fading demand and weaker oil prices are also stifling earnings of consumer goods companies.

The market has responded sharply to these challenges by marking these companies down. Year-to-date, the consumer goods index is down -28% – the worst performing index, behind the broad market index’s -7 percent.

The consumer companies have also entered an exceptionally tough phase. Following the crude price collapse in March, accessing foreign exchange at higher interbank rates made obtaining raw materials more challenging.

The companies are only able to obtain dollars at rates of around N360-390/$ relative to N330-360/$ pre-oil collapse.

That aside, given that consumer wallets are under pressure, passing on price increases to combat heightened competition comes at a great cost.

Among the publicly-listed companies, Q2 results – most of which will have been published by late July) – will reflect more of the COVID-related challenges, given that the lockdown took effect in late March.

The other pressure point expected to be seen comes from FX losses booked by the listed companies in their financial statements as a result of the currency depreciation.

Essentially, information provided by REACH confirms that consumer sentiments have turned sourer, with only 3 percent of respondents claiming that they are benefiting from the pandemic.

More recently, the VAT increase in February and an impending hike in electricity tariffs potentially tightens the squeeze on disposable incomes further.

An acute downturn in spending is therefore increasingly likely this year. The IMF projects a GDP contraction 3.4 percent in 2020, while the labour ministry expects unemployment to rise to levels above 33.5 percent from 23 percent in Q3 2018 (last publication). Indeed, recent media reports are already pointing to job losses in key sectors.

A few sectors have gained considerable ground on the back of the pandemic. In this regard, the telecoms sector comes to mind considering that increases in remote communications and internet entertainment drove demand for data.

The consumer goods sector in marked contrast finds itself in the unenviable position of being hit hard. That said, investors need to ensure that their consumer goods exposures are tilted in favour of companies like Nestle Nigeria, which has a proven track record of handling this level of pressure based on historical precedent.

General

Tinubu Tasks Acting IGP Disu to Restore Peace, Strengthen Security Nationwide

By Modupe Gbadeyanka

The acting Inspector-General of Police (IGP), Mr Tunji Disu, has been charged to do everything within his powers to restore peace and strengthen security across the nation.

This task was given to the new police chief by President Bola Tinubu after being decorated at the State House in Abuja on Wednesday.

Mr Disu was chosen to succeed Mr Kayode Egbetokun on Tuesday. His appointment is expected to be approved by the Nigeria Police Council and confirmed by the Senate next week.

President Tinubu described Mr Disu’s appointment as coming at a critical moment, urging him to rebuild public confidence in the police’s capacity to do their job in collaboration with other security forces.

“I made this decision for you to assume this responsibility. I know your record. I saw the dedication you exhibited while you were in Lagos when I was governor,” the President said.

“Lead firmly but fairly, demand professionalism at every level and ensure that the safety of lives and property remains our highest priority. It’s a daunting challenge. I know you can do it. You have my word, you have my full support,” he added.

Mr Tinubu urged him to advance the security pillars of his administration’s Renewed Hope Agenda. He expressed confidence in the Acting IGP’s discipline, operational experience and leadership capacity.

“Nigeria is challenged with banditry, terrorism and other criminal activities. You will be part of the thinking and innovation to overcome them,” the President said, reaffirming his belief that Nigeria would prevail under a committed leadership.

The President also paid tribute to Mr Egbetokun, who was present with his spouse, saying, “We are a grateful nation. Nigeria appreciates your contribution to maintaining law and order.”

He urged Egbetokun to be ready to offer useful advice to his successor and wished him and his family peace, good health and success in future endeavours, noting,

“You have not succeeded without a good successor. His success will also be part of your legacy.”

Mr Tinubu urged all security stakeholders to work collectively to safeguard lives and property during this critical period.

General

Real Estate Sector Now Safe Haven for Fraudsters—EFCC

By Modupe Gbadeyanka

The chairman of the Economic and Financial Crimes Commission (EFCC), Mr Ola Olukoyede, has lamented how “people now defraud the government and individuals and invest in real estate.”

He raised this concern when he received the executives of the Association of Real Estate and Property Managers (AREAPM) in Edo State on Wednesday.

The EFCC chief, represented by the acting Zonal Director and Deputy Commander of the Commission, Mr Sa’ad Hanafi Sa’ad, warned real estate managers against money laundering.

“We have noted with grave concern that fraudsters are laundering money and hiding proceeds of crime through real estate and property. People now defraud the government and individuals and invest in real estate,” he stated.

He noted that the agency would continue to discharge its statutory mandate of bringing those who seek to circumvent the system to book.

“As a commission, we recognise the role of Real Estate and Property Managers. Property Managers are designated non-financial businesses and professions.

“So, we expect them to be professionals and uphold the relevant rules and regulations in the discharge of their duties,” he stated, adding that, “The commission will apply the laws when there is a breach of relevant rules and regulations.”

He assured the AREAPM executives of the organisation’s willingness to collaborate with them in dealing with fraud and criminality in the sector.

“We have a unit, the Land and Property Fraud Section, which attends to issues in that regard. So, when you have challenges, you can report to us,” he stated.

In his remarks, the chairman of AREAPM in Edo State, Mr Akpesiri Michael Egbonoje, stated that the essence of the visit was to seek areas of collaboration with the commission and work out ways of combating real estate financial crimes and fraud in the state.

“Part of our strategy is to familiarise ourselves with law enforcement agencies in the state and seek for collaborative relationships. As a body, we cannot do it alone; we need help in the areas of financial crimes.

“We have tried to sanitise the space, but we realised that your agency is at the apex when it comes to dealing with financial crimes.

“We believe that structured collaboration between AREARM and the EFCC will promote financial transparency, investor confidence, and accountability within the real estate sector.”

General

Coroner’s Court Fixes April 14 for Inquiry into Death of Chimamanda Adichie’s Son

By Adedapo Adesanya

The Coroner’s Court sitting at the Yaba Magistrate Court has announced April 14, 2026, for the commencement of an inquiry into the death of 21-month-old Nkanu Nnamdi Esege, son of renowned Nigerian author Chimamanda Ngozi Adichie and Dr Ivara Esege.

Magistrate Atinuke Adetunji fixed the date on Wednesday when the matter came up before the court.

The twin child, Nkanu, died on January 7, 2026, after receiving care at Atlantis Hospital and undergoing medical procedures at Euracare Multi-Specialist Hospital in Lagos.

The child was initially admitted to Atlantis Hospital in Lagos for what was described as a worsening but initially mild illness.

The family had sought initial care as arrangements were being made to transfer him to Johns Hopkins Hospital in the United States. Atlantis referred him to Euracare for pre-flight diagnostic procedures, including an MRI, lumbar puncture, and insertion of a central line.

However, the child passed away following the procedures.

His parents have alleged medical negligence and professional misconduct in connection with his death.

According to a leaked internal message sent privately to family members and close friends at the time, Ms Adichie blamed the staff of Euracare Multi-Specialist Hospital, located in Victoria Island, Lagos, for causing the demise of the lad.

“My son would be alive today if not for an incident at Euracare Hospital on January 6th,” she wrote in a broadcast message confirmed later on.

“We have now heard about two previous cases of this same anesthesiologist overdosing children. Why did Euracare allow him to keep working? This must never happen to another child,” she also wrote in the lengthy message.

The 48-year-old writer had her first child, a daughter, in 2016. In 2024, her twin boys were born using a surrogate.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn