General

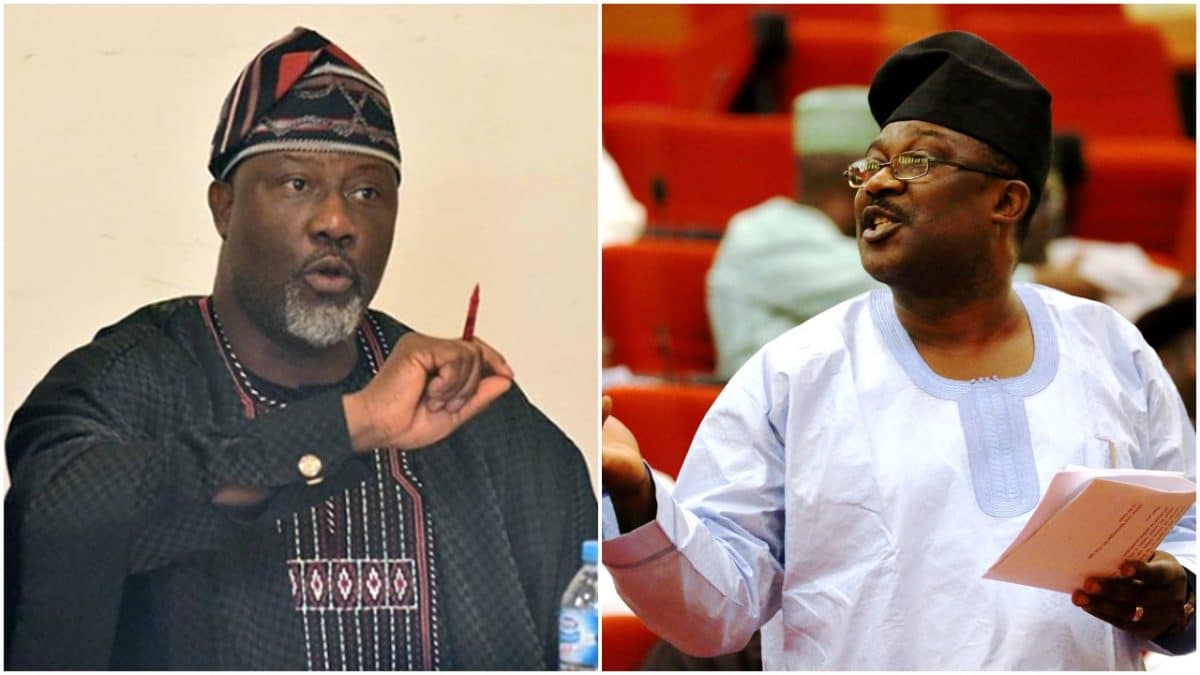

Dino Melaye Returns to PDP, Dumps APC

By Dipo Olowookere

The lawmaker representing Kogi West Senatorial District, Mr Dino Melaye, has finally abandoned the All Progressives Congress (APC) to rejoin the Peoples Democratic Party (PDP).

The embattled Senator announced his defection on Wednesday on the floor of the Senate.

Mr Melaye was one of the new PDP members who joined APC in 2014 ahead of the 2015 general elections, which eventually kicked out the PDP as the ruling party.

The Kogi State lawmaker has been having it rough lately with the ruling APC government, especially with his state governor, Mr Yahaya Bello, over the control of the party at the state level.

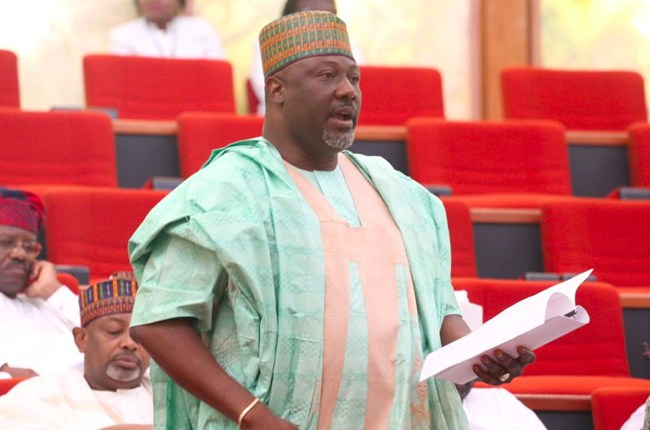

Mr Melaye had been at the National Hospital, Abuja receiving treatment. However, he appeared at the Senate today on crutches and a neck brace to announce his defection to the PDP.

Recall that the police, while taking him to Lokoja, Kogi State few weeks ago from Abuja, to face trial, alleged that the lawmaker jumped out of the police vehicle.

General

IWD: Akanbi-Alade of Pathway Holdings Urges Stronger Inclusion of Women in Finance

By Adedapo Adesanya

The Executive Director/GCOO of Pathway Holdings Limited, Mrs Dolapo Akanbi-Alade, has called for increased inclusion of Nigerian women in finance as the world marks International Women’s Day 2026.

International Women’s Day 2026 is marked every March 8, and this year’s theme is Give To Gain.

In a statement shared with Business Post, Mr Akanbi-Alade noted that while International Women’s Day highlights the need for gender equality, significant progress requires deliberate policies and systems that expand women’s access to finance and leadership opportunities.

She emphasised that many Nigerian women and women-led businesses still face limited access to finance, highlighting the urgent need for targeted inclusion initiatives.

“At Pathway Holdings, we empower women and give access to investment advisory, asset management, and lending solutions for institutions, high-net-worth individuals, and businesses. Ensuring that women and women-led enterprises can access these opportunities is critical to building a more inclusive financial system,” she added.

Mrs Akanbi-Alade said, “Women’s access to finance is not only a social responsibility but essential for national productivity and economic growth’’. She co-founded the following companies:

Pathway Asset Management Limited is registered and regulated by the Securities and Exchange Commission, Nigeria, as a Fund and Portfolio Manager. The product range includes Pathway Fixed Deposit Notes, Privately Managed Notes, Pathway Private Portfolio Management, Investment Advisory, and Mutual Funds, which will be launched soon.

Pathway Advisors Limited is registered and regulated by the Securities and Exchange Commission (SEC) as an Issuing House and financial adviser. Pathway Advisors’ services cover Mergers and Acquisitions (M&A), Capital-Raising, Financial Advisory, Rating Advisory, and Project and Structure Finance.

Fundbox Financial Services Limited is a wholly owned micro-lending company providing short-term personal and SME finance loans to salaried individuals, self-employed personnel, and small businesses. They offer services which include Cars4Cash, SME Loans, Personal Loans, and Group Employee Loans. Fundbox has successfully disbursed a wide range of loans to both corporate and individual clients, supporting their financial needs and business growth.

Pathway Holdings Limited is a notable investment holding firm focusing on private market investments, including private equity, private credit, and infrastructure. Pathway creates customised investment solutions for institutional investors and individuals, leveraging its extensive experience and local footprint.

General

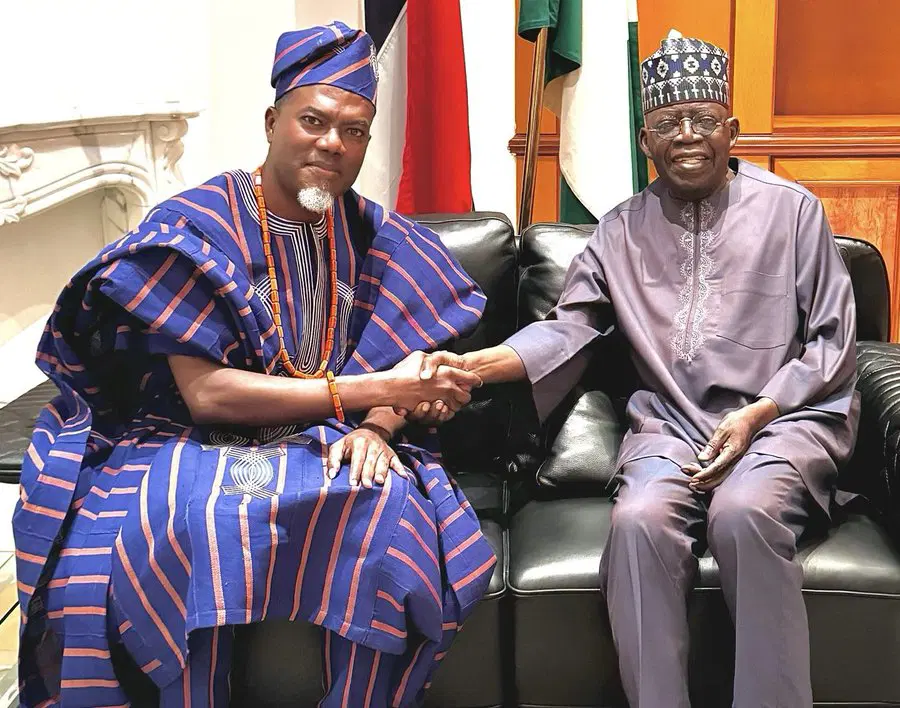

Ambassadors: Tinubu Moves Kayode Are to US, Omokri to Mexico, FFK to Germany

By Adedapo Adesanya

President Bola Tinubu has approved the postings of 65 ambassadors-designate and high commissioners to various countries and the United Nations, including the former head of the Department of State Services (DSS), Mr Lateef Kayode Are, who is to serve in the United States.

The Special Adviser to the President on Information and Strategy, Mr Bayo Onanuga, disclosed on Friday that 31 non-career and 34 career ambassadors have been assigned to their duty posts.

The Senate had confirmed all 65 nominees in December 2025 following screening by the Committee on Foreign Affairs.

The Ministry of Foreign Affairs has been directed to immediately commence an induction programme for the envoys, who will assume duties after receiving agrément from their host countries.

Below is the full list of postings:

NON-CAREER AMBASSADORS

1. Senator Grace Bent — Togo (Lomé)

2. Senator Ita Enang — South Africa

3. Ikpeazu Victor — Spain

4. Nkechi Linda Ufochukwu — Israel (Tel Aviv)

5. Mahmud Yakubu — Qatar

6. Paul Oga Adikwu — Vatican City Holy See

7. Vice Admiral Ibok-Ete Ekwe Ibas — Philippines

8. Reno Omokri — Mexico

9. Engr. Abasi Braimah — Hungary (Budapest)

10. Mrs Erelu Angela Adebayo — Portugal

11. Barr. Oluwayimika Ayotunwa — Japan (Tokyo)

12. Ifeanyi Lawrence Ugwuanyi — Greece (Athens)

13. Barr. Chioma Priscilla Ohakim — Poland (Warsaw)

14. Aminu Dalhatu — United Kingdom (High Commissioner)

15. Lt. Gen. Abdulrahman Bello Dambazau — China (Beijing)

16. Tasiu Musa Maigari — Gambia

17. Olufemi Pedro — Australia

18. Barr. Muhammed Ubandoma Aliyu — Argentina

19. Lateef Kayode Are — United States

20. Amb. Joseph Sola Iji — Russia

21. Senator Jimoh Ibrahim — United Nations (Permanent Representative)

22. Femi Fani-Kayode — Germany

23. Prof. Isaac Folorunso Adewole — Canada (Ottawa)

24. Fatima Florence Ajimobi — Austria

25. Mrs Lola Akande — Sweden

26. Ayodele Oke — France

27. Yakubu N. Gambo — Saudi Arabia

28. Senator Prof. Nora Ladi Daduut — South Korea (Seoul)

29. Barr. Joe-Kyari Okocha, SAN — Ireland (Dublin)

30. Dr Kulu Haruna Abubakar — Tunisia (Tunis)

31. Hon. Jerry Samuel Manwe — Trinidad and Tobago (Port of Spain)

CAREER AMBASSADORS

32. Ambassador Nwabiola Ezenwa Chukwumeka — Côte d’Ivoire

33. Besto Maimuna Ibrahim — Niger (Niamey)

34. Monica Okwuchukwu Enebechi — São Tomé and Príncipe

35. Ambassador Mohammed Mahmud Lele — Algeria (Algiers)

36. Endoni Syndoph Paebi — Burkina Faso (Ouagadougou)

37. Ahmed Mohammed Monguno — Egypt (Cairo)

38. Ambassador Jane Adams — Jamaica (Kingston)

39. Ambassador Clark-Omeru Alexandra — Zambia (Lusaka)

40. Chima Geoffrey Lioma David — Mali (Bamako)

41. Ambassador Odumah Yvonne Ehinosen — Equatorial Guinea (Malabo)

42. Ambassador Wasa Segun Ige — Lebanon (Beirut)

43. Ruben Abimbola Samuel — Italy (Rome)

44. Ambassador Onaga Ogechukwu Kingsley — Mozambique (Maputo)

45. Ambassador Magaji Umar — DR Congo (Kinshasa)

46. Ambassador Muhammad Saidu Dahiru — India (New Delhi)

47. Ambassador Abdussalam Habu Zayyad — Senegal (Dakar)

48. Ambassador Shehu Ilu Barde — Ghana (Accra)

49. Ambassador Aminu Nasir — Ethiopia

50. Abubakar Musa — Chad (N’Djamena)

51. Ambassador Haidara Mohammed Idris — Netherlands (The Hague)

52. Ambassador Bako Adamu Umar — Morocco (Rabat)

53. Ambassador Sulu Gambari Olatunji Ahmed — Malaysia

54. Ambassador Romata Mohammed Omobolanle — Tanzania

55. Ambassador Shaga John Shamah — Botswana

56. Hamza Mohammed Salau — Iran (Tehran)

57. Ambassador Ibrahim Danlami — Kenya

58. Ibrahim Adeola Mopelola — Benin (Cotonou)

59. Ambassador Ayeni Adebayo Emmanuel — Belgium (Brussels)

60. Ambassador Akande Wahab Adekola — Switzerland (Berne)

61. Ambassador Arewa Esther — Namibia (Windhoek)

62. Ambassador Gergadi Joseph John — Gabon (Libreville)

63. Ambassador Luther Ogbomode Ayo-Kalata — Sierra Leone

64. Danladi Yakubu Nyaku — Sudan (Khartoum)

65. Bello Dogon-Daji Haliru — Thailand (Bangkok)

Mr Onanuga noted that the Ministry of Foreign Affairs has already received agrément from the United Kingdom for High Commissioner-designate Aminu Dalhatu, and from France for Ambassador Ayodele Oke.

Nominations of the remaining 62 envoys have been conveyed to their respective host countries pending agreement.

General

In Celebration of International Women’s Month, CANAL+ and MultiChoice Celebrate African Women

Across Africa and beyond, women continue to shape and elevate the stories that define our societies. In celebration of International Women’s Month, CANAL+ pays tribute to the storytellers, athletes, mothers, creators, leaders and icons whose voices inspire millions of households across the continent.

The African entertainment industry is driven by women, actresses, directors, screenwriters and producers who bring depth and authenticity to every production. From captivating telenovelas and popular comedies to powerful drama series, female talent remains at the heart of the stories most loved by viewers on CANAL+ Group of channels. In sport, women redefine competition and excellence – on the field, behind the mic or in leadership. From football to tennis and athletics, women in sport don’t just participate, they elevate the game and inspire the next generation.

CANAL+ and its subsidiary MultiChoice have chosen to celebrate them through a dedicated campaign: “We are… because she is.” A 90-second spot, produced in both French and English versions, will be broadcast on the Group’s channels and social media platforms in more than 35 countries across Africa.

Watch the promo below

Throughout International Women’s Month, DStv and GOtv will spotlight female‑led films, series, reality shows and global cultural moments that reflect the brilliance and complexity of modern womanhood.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn