General

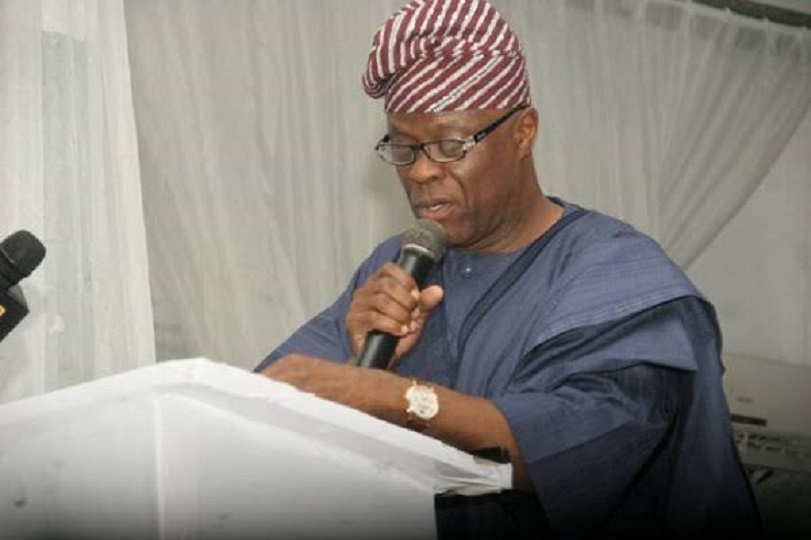

Edun Expresses Worry Over Africa’s $74bn Debt Servicing Burden

By Adedapo Adesanya

The Minister of Finance and Co-ordinating Minister of the Economy, Mr Wale Edun, has called for necessary steps to manage ballooning debt and its servicing on the continent.

This is as he expressed gratitude for the continuous support from the African Development Bank (AfDB) at the launch of the Debt Management Forum for Africa (DeMFA) and its inaugural policy dialogue on Monday in Abuja.

According to the African Economic Outlook Report (AEO) 2024, in 2024, African countries are expected to spend around $74 billion on debt service, up from $17 billion in 2010, of which $40 billion is owed to private creditors, representing 54 per cent of total debt service.

The Nigerian finance minister emphasised that the partnership had transformed into a mutually beneficial collaboration over the years, leading to critical grants, loans, and capacity-building initiatives targeted at improving the economic landscape of African nations.

Mr Edun highlighted the significance of the DeMFA, which aims to address public debt challenges on the continent specifically.

He commended the AfDB for establishing the initiative, noting that while the World Bank had provided support in debt management for decades, the launch of a forum dedicated solely to Africa was a welcome development for the 54 countries in the continent.

The minister identified two issues facing African nations: the escalating levels of debt and debt service, which had constrained fiscal space for governments and the limited access to affordable funding in both domestic and international markets.

He said there was an urgency to mobilise large capital pools to tackle social and economic challenges, including unemployment, infrastructure deficits, climate change and meeting the social development goals.

Mr Edun stressed that DeMFA must be structured to build on the foundations laid by previous initiatives, offering a comprehensive approach tailored specifically to the needs and realities of Africa.

The finance minister urged DeMFA to focus on ensuring the long-term sustainability of public debt across Africa.

“As a forum, it must actively contribute to the continuous and sustainable management of public debt, helping nations avoid recurring debt crises and fostering development.

“By working together, we can overcome these challenges and accelerate Africa’s growth trajectory,” he added.

Mr Edun commended the AfDB for its leadership in the initiative and expressed optimism about its potential to transform debt management practices across the continent.

“On behalf of all stakeholders, I wish the AfDB success in this endeavour and look forward to seeing its impact on Africa’s development,” he said.

General

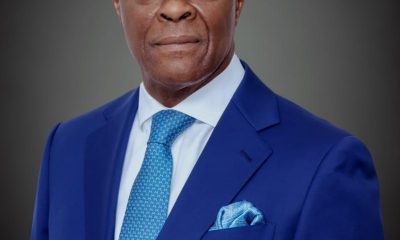

Violence Mars APC Ward Congress in Oluyole

By Modupe Gbadeyanka

The ward congress of the All Progressives Congress (APC) in Oluyole Local Government Area of Oyo State on Saturday left several party members injured after a violence clash erupted.

According to reports, one of the injured persons was Mr Idowu Oyawale, who served as the campaign Director General of a House of Representatives member in the last general elections, Ms Tolulope Akande-Sadipe.

It was disclosed that he sustained severe injuries during the exercise and is currently receiving treatment at an undisclosed hospital.

The ward congress was organised by the ruling party to elect ward executives across the local government’s wards.

However, it was disrupted at Olomi Ward 7 by suspected heavily-armed political thugs allegedly linked to a member of the party.

It was claimed that the thugs invaded the congress venue at Olomi Basic School 1, dispersing party members and officials supervising the exercise, with stones, clubs and other weapons.

Eyewitnesses said tensions escalated unprovoked over delegates’ lists and ward executive positions. The disagreement reportedly degenerated into physical altercations before the violent attacks on some party members.

It was learnt that security operatives led a tactical team to restore order, peace, and disperse the attackers.

Reacting to the incident, some party leaders and elders condemned the violence, describing it as unfortunate and capable of undermining the credibility of the internal democratic process.

The leaders have called on party chieftains and President Bola Tinubu to immediately order an investigation into the violent attacks.

General

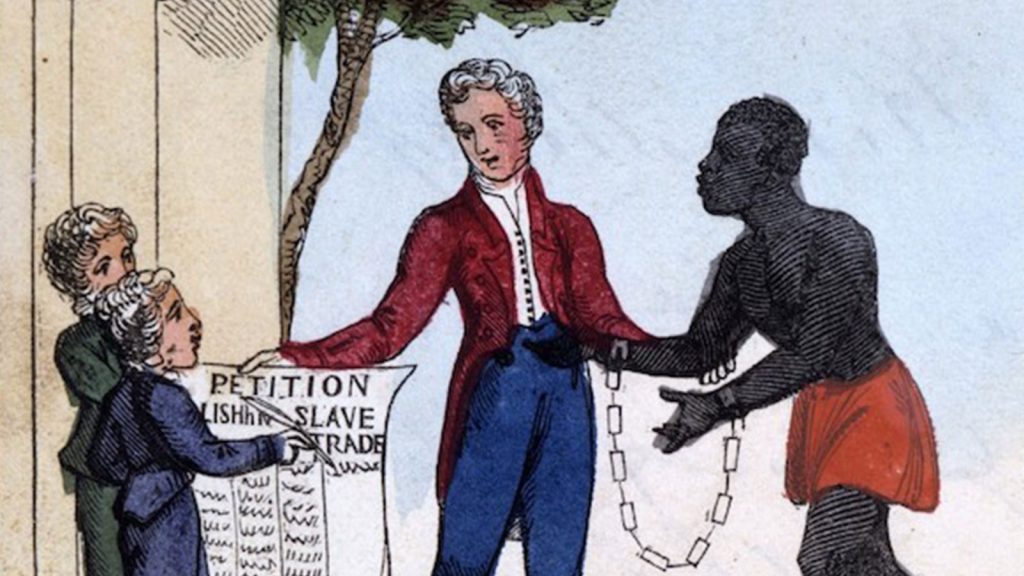

A Call For United African Front on Slavery and Reparations

By Princess Yanney

One message stood out; one particular briefing gave clarity and hope for better days ahead. Africa will be heard; willingly or unwillingly, and the resolution thereof will no longer be a hope for years to come, but a reality to actualise. At a press conference during the 39th AU Summit in Addis Ababa, Ghana’s President John Dramani Mahama urged African leaders to adopt a common continental strategy on the legacy of slavery and racialised chattel enslavement, which he described as “the gravest crime against humanity.”

In this context, one must understand; Reparations matter because colonialism was not simply an episode of foreign rule. It was an economic system. African land was seized, labour was coerced, institutions were reshaped to serve external interests, and entire economies were redesigned around the export of raw materials.

Long before independence, the transatlantic slave trade had already stripped the continent of people, skills and social stability, creating permanent demographic and developmental damage. Colonial rule then consolidated this destruction into a durable global structure of inequality.

President Mahama explained that Ghana’s proposed AU resolution, which received broad support from member states, was carefully drafted with extensive consultations involving the AU Committee of Experts on Reparations, legal experts, academic institutions and diaspora organisations. He said the resolution’s wording was deliberately chosen to reflect historical accuracy, legal credibility, and moral clarity.

“Ghana has undertaken extensive consultations to strengthen the resolution. We’ve engaged with UNESCO, the Global Group of Experts on Reparations, the Pan-African Lawyers Union, academic institutions, the African Union Committee of Experts on Reparations and the African Union Legal Experts Reference Group. We hosted the inaugural joint meeting of the African Union Committee of Experts on Reparations and the African Union Legal Experts Reference Group in Accra earlier this month to further refine the text of the resolution. We also began engagement with the diaspora at the Ghana Diaspora Summit held in December last year.”

Hence, come March 25, the resolution will be presented by one man, who will echo the voice of millions of African people and people of African descent. Because truly, a united Africa demanding reparations is not an Africa asking to be included in an unequal system, but rather, an Africa asserting its right to help redesign it. President Mahama stressed that the initiative goes beyond symbolism, providing a legal and moral foundation for reparatory justice and sustained engagement with the global community. The resolution is designed to facilitate dialogue with the United Nations and international partners while affirming Africa’s demand for recognition and accountability for centuries of exploitation and injustice.

“Informal consultations on the draft text are expected to take place between 23rd February and 12th March 2026. Our objective is simple: to build a broad consensus behind this resolution. The initiative is not directed at any nation; it is directed towards truth, recognition and reconciliation.”

He reiterated. Truth is, a united Africa is a strong global force that cannot be stopped or interrupted. But a divided Africa is an Africa liable to imperialism and Western domination. It is therefore a priority for all African people to join hands and stand together to ensure the aims of these resolutions are achieved.

“We call upon all member states to support and co-sponsor this resolution. The adoption of this resolution will not erase history, but it will acknowledge it. The trafficking in enslaved Africans and racialised chattel enslavement were foundational crimes that have shaped the modern world, and their consequences continue to manifest in structural inequality, racial discrimination and economic disparity.

Recognition is not about division; it is about moral courage. Adoption of the resolution will not be the end. Following the adoption, Ghana will continue engagement with the United Nations Secretary General, the African Union Commission, relevant UN bodies and interested member states,” said John Dramani Mahama as he called for unity.

The importance of today’s reparations consensus lies in its recognition that Africa’s underdevelopment is not an internal failure to be corrected through aid, reforms or external advice. It is the historical and continuing outcome of dispossession. Reparations, therefore, respond to a concrete injury, not an abstract moral wrong. Again, Reparations matter because colonialism was not simply an episode of foreign rule. It was an economic system. African land was seized, labour was coerced, institutions were reshaped to serve external interests, and entire economies were redesigned around the export of raw materials.

Long before independence, the transatlantic slave trade had already stripped the continent of people, skills and social stability, creating permanent demographic and developmental damage. Colonial rule then consolidated this destruction into a durable global structure of inequality. Which is why today’s fight, today’s struggle, is of utmost importance. It is a correction of a historical inhumane error. One that has to be amended and corrected, beginning with recognition.

“This is about a sustained dialogue on reparatory justice and healing. Distinguished ladies and gentlemen, this initiative presents us with a historic opportunity, an opportunity to affirm the truth of our history, an opportunity to recognise the gravest injustice in human history, and an opportunity to lay a stronger foundation for genuine reconciliation and equality. While the past cannot be undone, it can be acknowledged, and acknowledgement is the first step towards justice.” – John Dramani Mahama expressed to the media and all who were gathered to witness the briefing under the theme, “Ancestral Debt, Modern Justice: Africa’s United Case For Reparations”.

General

APC’s Maikalangu Wins Abuja Municipal Area Council Election

By Adedapo Adesanya

The Independent National Electoral Commission (INEC) has announced the candidate of the All Progressives Congress (APC), Mr Christopher Maikalangu, as the winner of the Abuja Municipal Area Council (AMAC) election, held on Saturday.

The results for the keenly observed municipal chairmanship poll were announced at the INEC area office in Karu at about 4:30 a.m on Sunday.

The Collation Officer for AMAC, Mr Andrew Abue, said that Mr Maikalangu, who is the incumbent AMAC chairman, was returned elected, having scored the highest number of votes cast, 40,295 out of the total number of valid votes of 62,861 in the election.

“That Maikalangu of the APC, having certified the requirements of the law, is hereby declared the winner and is returned elected,” he declared.

Mr Abue stated that the African Democratic Congress (ADC) came second with 12,109 votes, while the Peoples Democratic Party (PDP) polled 3,398 votes.

According to him, a professor, the rejected votes were 2,336, and the total valid votes were 62,861, while the total votes cast were 65,197.

He added that the number of registered voters in AMAC was 837,338, while the total number of accredited voters was 65,676.

According to him, the scores of the political parties and their candidates that contested the AMAC chairmanship election are:

Agbon Vaniah of the Accord (A) – 403 votes

Nemiebika Tamunomiesam of the Action Alliance (AA) – 108 votes

Paul Ogidi of African Democratic Congress (ADC) – 12,109 votes

Richard Elizabeth of the Action Democratic Party (ADP) – 588 votes

Christopher Maikalangu of the All Progressives Congress (APC) – 40,295 votes

Eze Chukwu of the All Progressives Grand Alliance (APGA) – 1,111 votes

Chukwu Promise of the Allied Peoples Movement (APM) – 122 votes

Ugoh Michael of the Action Peoples Party(APP) – 32 votes

Thomas Happiness of the Boot Party (BP) – 43 votes

Jibrin Alhassan of the New Nigeria Peoples Party (NNPP) – 1,694 votes

Samson Usani of the National Rescue Movement (NRM) – 73 votes

Dantani Zanda of the Peoples Democratic Party (PDP) – 3,398 votes

Iber Shimakaha of the Peoples Redemption Party (PRP) – 90 votes

Simon Obinna of the Social Democratic Party (SDP) – 2,185 votes

Madaki Robert of the Young Progressives Party (YPP) – 421 votes

Swani Buba of the Zenith Labour Party (ZLP) – 189 votes.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn