General

Reps Seek ‘Bailout Out’ for Access Bank, Others to Prevent Mass Sacking

By Dipo Olowookere

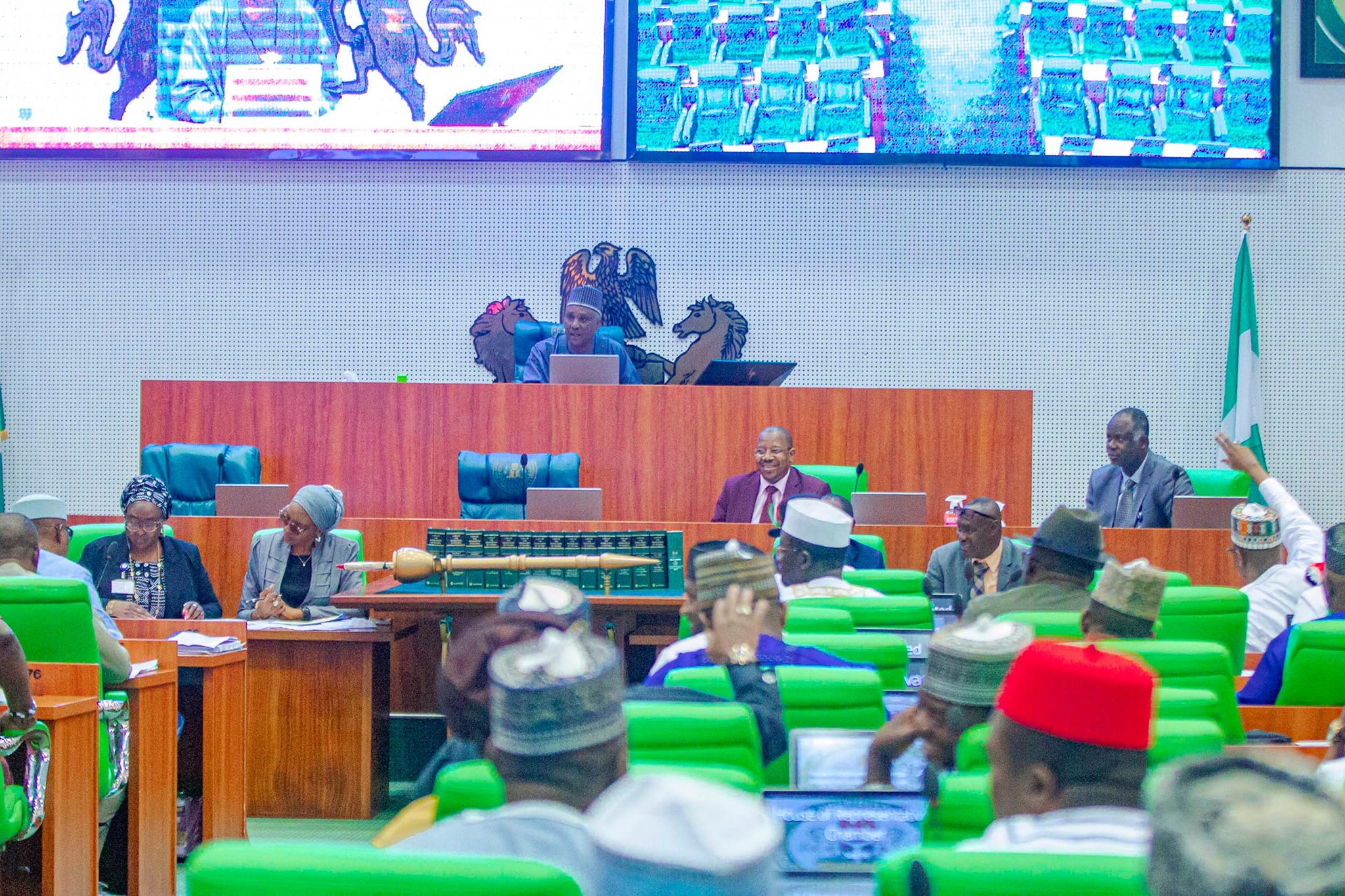

The House of Representatives is considering ways the federal government can support big organisations in the country like Access Bank to pay their workers in order to prevent a mass sacking.

Some days ago, a video went viral showing the Group Managing Director of Access Bank Plc, Mr Herbert Wigwe, saying that the lender will possibly cut down its contract staff by 70 percent, while those to remain will likely suffer a 40 percent slash in their salaries, including himself.

Nigerians reacted to the issue and the Central Bank of Nigeria (CBN), with Bankers’ Committee, prevailed on the financial institution and others in the banking industry to put such plans aside.

At the plenary on Tuesday, the House of Reps debated the matter and said urgent steps must be taken to avert a massive job loss in the country.

The lower parliament described Access Bank as an institution “too big to fail” because of “its position as a significant employer of labour.”

The lawmakers said if Access Bank is allowed to “lay off 23,990 employees [on its payroll] ,” which it said “may be the biggest lay-offs by any Nigerian employer”, it will have an impact that will be “catastrophic especially when followed by other banks.”

“Such business decisions will cause more stress and shocks across economy which is already struggling with low oil prices.

“A secondary effect of such an action will be that it will affect the purchasing power of significant segments of the population which will certainly impact negatively on our macro-economy,” the lower legislative chamber of the National Assembly said.

The Reps stressed that to avert this looming crisis, steps must be taken quickly by the federal government to support big employers of labour like Access Bank through economic packages in terms of “income support, tax credits or tax deferrals, short-term work schemes, wage subsidies and tax moratoriums on loan payments.”

In view of this, the lawmakers resolved to “set up an ad-hoc committee to investigate, monitor and liaise with corporate institutions with a view to possible interventions to reduce the wage burden on such organisations.

The House also mandated the Committees on Banking and Currency, Labour, Employment and Productivity and Public Accounts to look into the Access Bank situation and report back to within two weeks for further legislative action.

General

Egbin Power Commissions 80 New Staff Housing Units

By Modupe Gbadeyanka

In further demonstration of its unwavering commitment to its workforce, Nigeria’s foremost power generation company, Egbin Power Plc, has unveiled 80 new residential housing units for employees within its plant premises in Egbin, Lagos State.

This comprises 40 fully furnished three-bedroom apartments and 40 furnished studio apartments, all designed to contemporary standards.

The units feature modern infrastructure and thoughtfully planned utilities, creating a safe, comfortable, and conducive living environment that supports both employee productivity and family well-being.

This strategic investment underscores the company’s philosophy that a well-supported workforce is fundamental to sustained operational excellence.

The new housing units are part of a holistic strategy to cultivate a stable, motivated, and future-ready workforce.

This strategy extends beyond infrastructure to encompass robust career development and recognition. Over the past three years, Egbin Power has promoted 112 employees across various cadres, reinforcing a culture that rewards merit, performance, and long-term dedication

“At Egbin Power, our people are our most valuable asset. Even amidst the prevailing liquidity and operational realities within the broader power sector, our focus on employee welfare has remained deliberate and consistent.

“This significant expansion of our residential estate is a tangible expression of that commitment.

“It is one of several key initiatives aimed at ensuring our employees feel genuinely supported, allowing them to thrive both personally and professionally,” the chief executive of Egbin Power, Mr Mokhtar Bounour, said.

Initiated in 2025 and completed in January 2026, this project is the latest milestone in Egbin Power’s structured and ongoing approach to enhancing employee welfare. It reflects the energy firm’s dedication to fostering a culture where every team member feels valued, secure, and motivated.

General

NGX Group, CSCS, WIMBIZ to Ring Bell for Gender Equality

By Aduragbemi Omiyale

On Tuesday, March 10, 2026, at the Nigerian Exchange Group House in Lagos, the role of capital markets in promoting gender equality will be reemphasised through the closing gong ceremony in commemoration of International Women’s Day 2026.

The ceremony is part of the global Ring the Bell for Gender Equality campaign, which mobilises stock exchanges worldwide to expand women’s participation in the economy and advance gender-inclusive practices.

In Nigeria, the NGX Group is partnering with the Central Securities Clearing System (CSCS) Plc and Women in Management, Business and Public Service (WIMBIZ) to make it memorable under the theme Rights. Justice. Action. For ALL Women and Girls.

Dignitaries expected at the ceremony include the Minister of State for Foreign Affairs, Mrs Bianca Odumegwu-Ojukwu; the First Lady of Imo State, Mrs Chioma Uzodimma; the Executive Commissioner for Legal and Enforcement at the Securities and Exchange Commission (SEC), Ms Frana Chukwuogor; foremost actor, Ms Funke Akindele; a Director at the NGX Group, Ms Ojinnika Olaghere; and another staffer of NGX Group, Mrs Fatima Wali-Abdulrahman, alongside board members of NGX Group, regulators, capital market stakeholders, and industry leaders.

NGX Group is joining other exchanges worldwide in sounding the NGX Gong to underscore the importance of inclusive leadership, equal opportunities, and stronger market accountability in advancing gender equality.

General

IWD: Dolapo Akanbi-Alade of Pathway Holdings Urges Stronger Inclusion of Women in Finance

By Adedapo Adesanya

The Executive Director/GCOO of Pathway Holdings Limited, Mrs Dolapo Akanbi-Alade, has called for increased inclusion of Nigerian women in finance as the world marks International Women’s Day 2026.

International Women’s Day 2026 is marked every March 8, and this year’s theme is Give To Gain.

In a statement shared with Business Post, Mrs Akanbi-Alade noted that while International Women’s Day highlights the need for gender equality, significant progress requires deliberate policies and systems that expand women’s access to finance and leadership opportunities.

She emphasised that many Nigerian women and women-led businesses still face limited access to finance, highlighting the urgent need for targeted inclusion initiatives.

“At Pathway Holdings, we empower women and give access to investment advisory, asset management, and lending solutions for institutions, high-net-worth individuals, and businesses. Ensuring that women and women-led enterprises can access these opportunities is critical to building a more inclusive financial system,” she added.

Mrs Akanbi-Alade said, “Women’s access to finance is not only a social responsibility but essential for national productivity and economic growth’’. She co-founded the following companies:

Pathway Asset Management Limited is registered and regulated by the Securities and Exchange Commission, Nigeria, as a Fund and Portfolio Manager. The product range includes Pathway Fixed Deposit Notes, Privately Managed Notes, Pathway Private Portfolio Management, Investment Advisory, and Mutual Funds, which will be launched soon.

Pathway Advisors Limited is registered and regulated by the Securities and Exchange Commission (SEC) as an Issuing House and financial adviser. Pathway Advisors’ services cover Mergers and Acquisitions (M&A), Capital-Raising, Financial Advisory, Rating Advisory, and Project and Structure Finance.

Fundbox Financial Services Limited is a wholly owned micro-lending company providing short-term personal and SME finance loans to salaried individuals, self-employed personnel, and small businesses. They offer services which include Cars4Cash, SME Loans, Personal Loans, and Group Employee Loans. Fundbox has successfully disbursed a wide range of loans to both corporate and individual clients, supporting their financial needs and business growth.

Pathway Holdings Limited is a notable investment holding firm focusing on private market investments, including private equity, private credit, and infrastructure. Pathway creates customised investment solutions for institutional investors and individuals, leveraging its extensive experience and local footprint.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn