General

Reps Seek ‘Bailout Out’ for Access Bank, Others to Prevent Mass Sacking

By Dipo Olowookere

The House of Representatives is considering ways the federal government can support big organisations in the country like Access Bank to pay their workers in order to prevent a mass sacking.

Some days ago, a video went viral showing the Group Managing Director of Access Bank Plc, Mr Herbert Wigwe, saying that the lender will possibly cut down its contract staff by 70 percent, while those to remain will likely suffer a 40 percent slash in their salaries, including himself.

Nigerians reacted to the issue and the Central Bank of Nigeria (CBN), with Bankers’ Committee, prevailed on the financial institution and others in the banking industry to put such plans aside.

At the plenary on Tuesday, the House of Reps debated the matter and said urgent steps must be taken to avert a massive job loss in the country.

The lower parliament described Access Bank as an institution “too big to fail” because of “its position as a significant employer of labour.”

The lawmakers said if Access Bank is allowed to “lay off 23,990 employees [on its payroll] ,” which it said “may be the biggest lay-offs by any Nigerian employer”, it will have an impact that will be “catastrophic especially when followed by other banks.”

“Such business decisions will cause more stress and shocks across economy which is already struggling with low oil prices.

“A secondary effect of such an action will be that it will affect the purchasing power of significant segments of the population which will certainly impact negatively on our macro-economy,” the lower legislative chamber of the National Assembly said.

The Reps stressed that to avert this looming crisis, steps must be taken quickly by the federal government to support big employers of labour like Access Bank through economic packages in terms of “income support, tax credits or tax deferrals, short-term work schemes, wage subsidies and tax moratoriums on loan payments.”

In view of this, the lawmakers resolved to “set up an ad-hoc committee to investigate, monitor and liaise with corporate institutions with a view to possible interventions to reduce the wage burden on such organisations.

The House also mandated the Committees on Banking and Currency, Labour, Employment and Productivity and Public Accounts to look into the Access Bank situation and report back to within two weeks for further legislative action.

General

National Grid, Mr Ibu Among Top Trending Searches by Nigerians in 2024

By Dipo Olowookere

Many events happened in 2024 in Nigeria but a few shook the nation because of their impact on residents of the country.

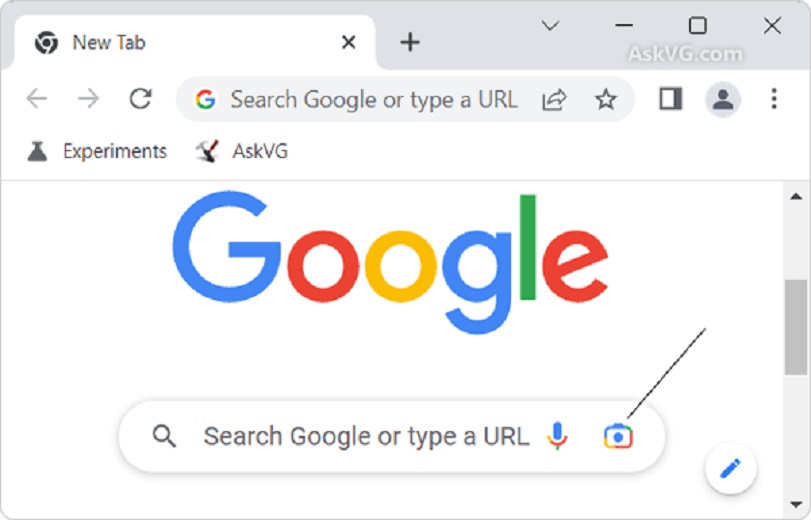

According to a report released by Google, the incessant collapse of the national grip, which plunged the nation into darkness, was among trending searches on its platform.

In the report made available to Business Post on Tuesday, the tech giant said this year’s results show a continued interest in the political and economic landscape, with searches related to the US elections, the new national anthem.

“The 2024 Year in Search offers a unique lens into the questions, interests, and conversations that shaped the lives of Nigerians this year.

“From cultural milestones to pressing concerns, these insights reflect how Search continues to be a valuable tool for users to navigate and better understand their world,” the Communications and Public Affairs Manager for Google West Africa, Taiwo Kola-Ogunlade, stated.

Google’s 2024 Year in Search for Nigeria showcased the most popular searches, notable individuals, actors, musicians, topics, questions, and other subjects that captured Nigerians’ attention in the year.

Google’s Year in Search is an annual analysis that reveals the top trending lists and also spotlights what the world searches to see, learn, and do.

The music scene in 2024 was marked by a surge in popularity for artists like Shallipopi and Khaid, who also featured prominently in the overall personalities list. The top trending song was “”I Don’t Care” by Boy Spyce”, followed closely by “Ozeba” and “Commas” by Ayra”. Nigerians also showed a keen interest in understanding the lyrics of various songs, with “Ogechi lyrics”, “Ozeba lyrics”, and “Omemma by Chandler Moore lyrics” leading the searches in the lyrics category.

This year, Nigerians continued to demonstrate a strong interest in entertainment with movies like “A Tribe Called Judah”, “Treasure In The Sky”, and “Damsel” topping the movie charts. The top TV series that captured the interest of Nigerian netizens included “Supacell”, “My Demon”, and “Queen of Tears”. In the culinary world, Nigerians explored diverse recipes with “Pornstar Martini recipe” leading the searches.

Concerns about personal well-being and global events were also reflected in search trends. Questions like “How much is dollar to naira today?”, “How to get perfectly defined curls for African hair?”, and “Who won the US presidential election?” topped the list of queries. Nigerians were curious about the meaning of words like “demure,” “steeze,” and “pet peeves,” turning to Search for answers.

General

Fiscal Responsibility Commission Backs Controversial Tax Reform Bills

By Adedapo Adesanya

The Fiscal Responsibility Commission (FRC) has expressed strong support for the controversial Tax Reform Bills currently before the National Assembly.

The bills, developed by the Presidential Fiscal Policy and Tax Reforms Committee on instruction by President Bola Tinubu, aim to improve fiscal governance, transform public revenue architecture boost economic growth.

The Chairman of the commission, Mr Victor Muruako, expressed the support of the organisation at an interaction with academics and journalists on the sidelines of the Fellowship Lecture and Investiture Ceremony of the Capital Market Academics of Nigeria (CMAN) on Monday in Abuja.

According to a statement by FRC’s Head of Strategic Communications Officer, Mr Bede Anyanwu on Tuesday, the agency revealed that a critical analysis of the bills showed that it does not contain any issue or item that could be said to be skewed to favour any region or section of the country.

“The bills rather create a more equitable distribution of resources amongst Nigeria’s federating states,” Mr Muruako added, noting that the analysis also confirmed that the proposed reforms are designed to benefit all Nigerians, particularly low-income earners and Micro Small and Medium Businesses (MSMBs).

Mr Muruako outlined some of the key benefits of the reforms, including tax relief for low-income earners: individuals earning less than N1.7 million annually will pay less income tax, exemption of tax on small businesses with turnovers below N50 million, and exemption of over 90 per cent of small businesses from profit tax payment.

It was stated that the new bills intend to simplify tax administration in the country and make it more transparent.

Increasing revenue for subnational governments as states and local governments will receive a larger share of VAT revenue, empowering them to provide better public services, and improving ease of doing business, noting that reforms will reduce the administrative burden on businesses and make it easier to comply with tax regulations.

The FRC explained that it is upbeat that the tax relief for low-income earners will enhance savings and capital formation at household levels.

The commission also expressed confidence that given the positive correlation between savings and investment, explaining that the increase in small household investments across the board would lead to improvements in the sustainable growth of the nation’s economy.

He also opined that the reduced tax burden on small businesses would give Micro-Small Medium Enterprises breathing space, and enable them to grow organically, hence contributing to a sustained increase in the nation’s GDP in the near future.

On the recent controversies over the bills, Mr Muruako praised President Tinubu for allowing room for further dialogue, appealing to all stakeholders across geopolitical zones to support the bills because their transformative potentials stand to benefit every Nigerian.

General

CSCS Gets Dual Management System Certifications

By Adedapo Adesanya

Central Securities Clearing System (CSCS) Plc has been awarded the ISO/IEC 27001:2022 and ISO 22301:2019 certifications by the globally renowned Management System Certification Body (MSECB).

According to a statement from the firm, the Managing Director of CSCS, Mr Haruna Jalo-Waziri, said the ISO 27001 is an internationally recognised benchmark for managing information security, ensuring robust protection against data breaches and IT disruptions.

The ISO 22301 standard is an international standard that establishes the requirements for business continuity management systems.

Mr Jalo-Waziri said this recognition underscores CSCS’s steadfast commitment to international best practices in information security management and business continuity.

He noted that the ISO/IEC 27001:2022 certification highlights CSCS’s adherence to stringent information security measures, ensuring robust protection against data breaches and IT disruptions.

Mr Jalo-Waziri said that the ISO 22301:2019 certification also confirms CSCS’s business continuity and readiness to respond to unexpected incidents, minimising disruptions and safeguarding stakeholders’ interests.

“Achieving these certifications is a testament to our deliberate and strategic focus on embedding a culture of excellence, resilience, and trustworthiness in our operations.

“It underscores our commitment to maintaining the highest standards of information security and business continuity in delivering value to our stakeholders.

“These certifications position CSCS alongside leading global organisations that prioritise the confidentiality, integrity, and availability of information systems.

“They further validate the organisation’s dedication to securing its clients’ trust and ensuring operational resilience,” he said.

The CSCS MD added these certifications not only reinforce the trust of its clients, stakeholders, and regulators but also to validate the hard work and dedication of its team.

He said, that as Nigeria’s premier financial market infrastructure, the firm remains resolute in its mission to enable market confidence through best-in-class services and practices.

According to him, receiving these certifications from MSECB strengthens CSCS’s reputation as a reliable partner and a leader in the financial market ecosystem.

He said that the certifications assure stakeholders that CSCS’s processes are periodically monitored to meet and exceed compliance requirements.

This achievement, Mr Jalo-Waziri said, was a significant milestone in CSCS’s journey to consistently deliver secure, resilient, and innovative solutions to the Nigerian capital market and beyond.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN