General

TotalEnergies to Unveil 70,000bpd Ima Gas Field Project in 2026

By Adedapo Adesanya

TotalEnergies Limited has announced plans to unveil its shallow water 70,000 barrels per day Ima gas field project in Nigeria by 2026.

The Country Chairman/Managing Director of TotalEnergies Nigeria, Mr Matthieu Bouyer, disclosed this in Abuja at the Nigeria Oil and Gas (NOG) Energy Week 2025 during a panel session tagged Pragmatically Achieving Energy Abundance.

Mr Bouyer said the project would feed the Nigeria Liquefied Natural Gas (NLNG), one of the largest LNG plants in the world, saying the company was committed to increasing oil and gas production in a sustainable manner.

“Ima is another gas-field project offshore, which we intend to unveil in the coming year. It is a 70,000 barrels per day field; so that is already 140 barrels per day to accumulate by the two gas projects.

“So, that is significant; NLNG is one of the largest plants in the world, and today I think it is starting to get more gas,” he stated, noting that the firm had been careful of emissions while growing energy.

“We have been investing significantly in the past 15 years in Nigeria with a big project such as Egina,OML 13/2018, Ikike OML 99/2022, and Akpo West OML 130/2009, which we started in 2024.

“We have been drilling continuously up to this time on our deep offshore in the past two and a half years.

“So, the commitment to the country is undeniable, and we believe in Nigeria, in the resources, in the country, and we believe that there is a great future in Nigeria.

“In 2024, we inaugurated the Ubeta OML 58 project; Ubeta is a significant gas lag field onshore, which will supply gas to Nigeria Liquefied NG, and to the domestic market,” he added.

Mr Bouyer disclosed that the Ubeta project within the OML 58 concession is designed for processing subsequent export to NLNG and domestic gas parties through the Obite-Ubeta-Rumuji (OUR) or Gas Transmission System -1 (GTS) pipelines, describing the Ubeta field as significant as it would produce more or less 70,000 barrels per day.

He added that its Final Investment Decision (FID) showed a clear demonstration of good rule and regulation in place in the country.

“So, by doing this, we demonstrate the commitment, and we are of course keen to go all over the chain, up to NLNG.

“We have more, and to be able to unlock this more, we need to demonstrate this competitiveness,’’ he said.

He thanked the Nigerian National Petroleum Company (NNPC) Limited and the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), for exhibiting the trust in them.

The managing director said the company had been active in the exploration sphere, and that two years ago made a discovery called ENTPON, an oil discovery which it made on the offshore, and currently progressing and maturing the assessment.

He said it deployed technology to achieve less emission, as it was the first company in Nigeria to stop all routine gas flaring.

Mr Adewale Fayemi, Managing Director, TotalEnergies Renewable DG Nigeria, highlighted the roles of renewables in the future energy mix.

He called for a national electrification plans with clear commercial priorities and independent regulators without political obstructions.

Mr Fayemi, represented by Omotayo Hassan, General Manager, Renewables, TotalEnergies Renewable DG Nigeria, said that the firm focused on the off-grid solar power generation.

He called for the creation of enabling business environment.

“We need to have national electrification plans that have clear commercial priorities because that drives investor confidence; the reality is that investors go to places where they can get their money back.

“The regulator has to be independent, without any political influence or political obstruction.

“It is important that the community, gender, young people are interested in the projects that you do because it provides resilience for those projects.

“We need to strongly look at long-term local currency financing. It is a must. Forex issues have always been a problem, and that has to happen.

“Fragmentation chases away investors; so, that is also something that needs to be dealt with,’’ he said.

General

NERC Unveils 3-Step Guide for Resolving Electricity Complaints

By Adedapo Adesanya

The Nigerian Electricity Regulatory Commission (NERC) has introduced a streamlined three-step process to help electricity consumers address common issues like power outages, estimated billing, faulty meters, and voltage fluctuations.

In a public advisory shared on its X handle on Tuesday, the electricity sector regulator emphasised that customers should begin by contacting their respective electricity Distribution Companies (DisCos), which serve as the primary point of contact for technical and billing problems.

Consumers are urged to secure a complaint reference number and maintain records of all interactions for efficient follow-up.

The advisory outlines the process as follows: “Contact your DisCo’s customer care – This is the first step for all technical or billing issues;

“Escalate to State Electricity Regulator (SER) – If unresolved, and the consumer is in a state that has transitioned to an SER;

“Reach NERC Call Centre – For consumers in non-transitioned states or needing further assistance. Contact options include 0201 344 4331, 0908 899 9244, or [email protected],” it said.

“We’re here to make sure your complaint is heard and addressed,” the advisory concluded, aiming to empower consumers amid ongoing challenges in Nigeria’s power sector.

This guidance comes as electricity consumers continue to grapple with service disruptions and billing disputes, highlighting NERC’s efforts to improve accountability across DisCos and state regulators.

General

Senate Passes Electoral Act Amendment Bill After Mild Row

By Adedapo Adesanya

The Senate passed the Electoral Act, 2022 (Repeal and Re-Enactment) Bill 2026 on Tuesday after overcoming a rowdy session that saw lawmakers at loggerheads.

The issue in the upper chamber stemmed from a division over Clause 60 raised by Mr Enyinnaya Abaribe, a member of the opposition party, African Democratic Congress (ADC), from Abia South.

The Senate President, Mr Godswill Akpabio, stated that he believed the demand had previously been withdrawn, but several opposition senators immediately objected to that claim.

Citing Order 52(6), the Deputy Senate President, Mr Barau Jibrin, argued that it would be out of order to revisit any provision on which the Senate President had already ruled.

This submission sparked another uproar in the chamber, during which Mr Sunday Karimi had a brief face-off with Mr Abaribe.

The Senate Leader, Mr Opeyemi Bamidele, then reminded lawmakers that he had sponsored the motion for rescission, underscoring that decisions previously taken by the Senate are no longer valid, maintaining that, consistent with his motion, Mr Abaribe’s demand was in line.

Mr Akpabio further suggested that the call for division was merely an attempt by Mr Abaribe to publicly demonstrate his stance to Nigerians. He sustained the point of order, after which the Abian lawmaker rose in protest and was urged to formally move his motion.

Rising under Order 72(1), Mr Abaribe called for a division on Clause 60(3), specifically concerning the provision that if electronic transmission of results fails, Form EC8A should not serve as the sole basis, calling for the removal of the proviso that allows for manual transmission of results in the event of network failure.

During the division, Mr Akpabio directed senators who supported the caveat to stand. He then asked those opposed to the caveat to rise, to which 15 opposition senators stood.

However, when the votes were counted, the Senate President announced that 15 senators did not support the proviso, while 55 senators voted in support.

Earlier, proceedings in the Senate were momentarily stalled as lawmakers began clause-by-clause consideration of the Electoral Act, 2022 (Repeal and Re-Enactment) Bill 2026, following a motion to rescind the earlier amendment.

The motion to rescind the bill was formally seconded on Tuesday, paving the way for the upper chamber to dissolve into the committee of the whole for detailed reconsideration and reenactment of the proposed legislation.

During the session, the Senate President, Godswill Akpabio, reeled out the clauses one after the other for deliberation.

However, the process stalled when at clause 60, Mr Abaribe raised a point of order, drawing immediate attention on the floor.

This soon caused the session to move into a closed-door session.

Before rescinding the Electoral Act, the red chamber raised concerns over the timing of the 2027 general elections and technical inconsistencies in the legislation.

Rising under Order 52(6) of the Senate Standing Orders, the Senate leader, Opeyemi Bamidele, moved the motion to reverse the earlier passage of the bill and return it to the Committee of the Whole for fresh deliberations.

He explained that the development follows the announcement by the Independent National Electoral Commission (INEC) of a timetable fixing the 2027 general elections for February 2027, after consultations with the leadership of the National Assembly.

He stated that stakeholders had raised concerns that the proposed date conflicts with the provisions of the amended law, particularly the requirement that elections be scheduled not later than 360 days before the expiration of tenure.

He further noted that upon critical review of the passed bill, the 360-day notice requirement prescribed in Clause 28 could result in the scheduling of the 2027 Presidential and National Assembly elections during the Ramadan period.

According to him, holding elections during Ramadan could negatively affect voter turnout, logistical coordination, stakeholder participation, and the overall inclusiveness and credibility of the electoral process.

The motion also highlighted discrepancies discovered in the Long Title and several clauses of the bill, including Clauses 6, 9, 10, 22, 23, 28, 29, 32, 42, 47, 51, 60, 62, 64, 65, 73, 77, 86, 87, 89, 93, and 143. The identified issues reportedly affected cross-referencing, serial numbering, and internal consistency within the legislation.

General

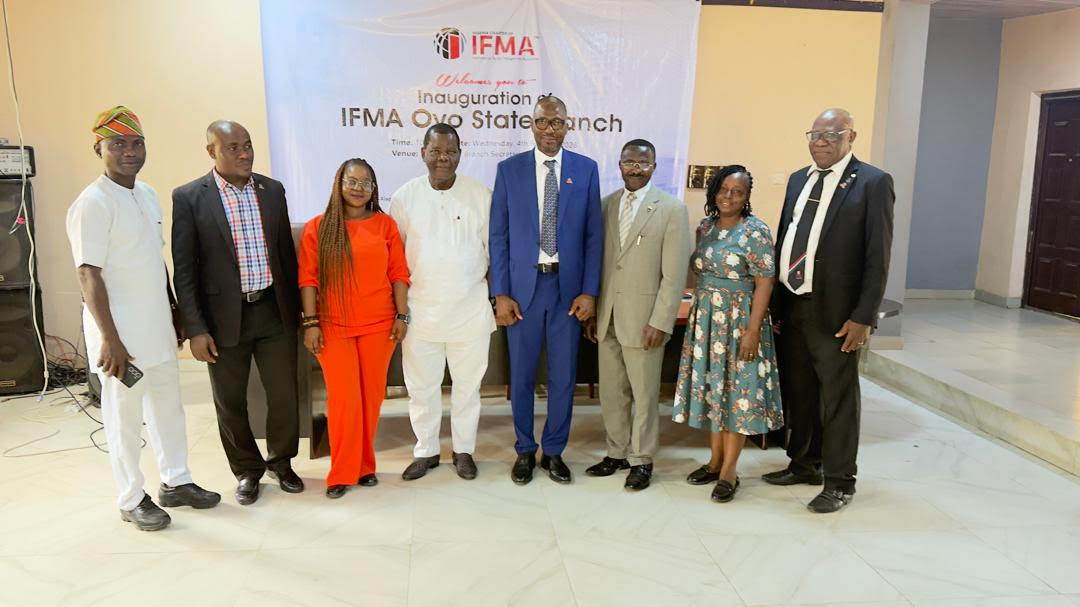

IFMA Nigeria Gets Branch in Oyo, Picks Adejumo Olusola Babatunde as Coordinator

By Modupe Gbadeyanka

A new branch of the International Facility Management Association (IFMA) Nigeria Chapter has been established in Oyo State, with Mr Adejumo Olusola Babatunde chosen as Coordinator.

The organisation set up an arm in the South-West state in a bid to expand its footprint in the country. Mr Babatunde will be assisted by other executive committee members, including Mr Ajiboye Olusola Akeem as Secretary, and Mrs Adeniran Olaide as Treasurer.

At the inauguration of the branch at the Nigerian Society of Engineers (NSE) Secretariat in the Akobo area of Ibadan, the Oyo State capital, the president of IFMA Nigeria, Mr Sheriff Daramola, expressed delight at the successful inauguration of the branch and commended members for their commitment to the growth of facility management in Nigeria.

He highlighted IFMA’s global heritage, noting that the association is supporting over 25,000 members in more than 140 countries worldwide. Mr Daramola emphasised IFMA’s strong global network, the world’s largest and most widely recognised association for facility management professionals, headquartered in the United States and its growing influence in Africa, the Middle East and Europe.

“IFMA members have taken positions of authority across federal, state, and private institutions; IFMA Nigeria is positioned to ensure our professionals are the first choice for global investors entering the Nigerian market,” he stated.

The Legal Adviser of IFMA, Nigeria, Mr Sola Fatoki, who shared this sentiment, said, “Since 1997, when IFMA Nigeria was established, the association has equipped facility management professionals with integrated knowledge spanning human behaviour, infrastructure, and the built environment.”

He encouraged engineers, architects, surveyors, ITC, Technology innovators, data analysts and allied professionals to see IFMA as their professional home and outlined the functions and responsibilities of branch executive committees.

In his remarks, Mr Babatunde expressed gratitude to the national council for the opportunity to serve and pledged to ensure the success of the branch, focusing on unity and the professional advancement of stakeholders in the region.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn