Jobs/Appointments

Digital Finance Practitioners Elect Leaders for Lagos Chapter

By Modupe Gbadeyanka

The Lagos State Chapter of the Association of Digital Finance Practitioners (ADFP) in Nigeria has been launched, with leaders elected to steer the ship for the next year.

The new executives emerged after a keenly contested election that took place virtually from November 27 to 28, 2021, producing Abubakar Shehu, Director VAS, Gateway and Broadband Sales at Globacom as President.

Other elected members of the committee included Adedoyin Samo, Group Head, HR & Admin., Zedcrest Capital Limited, elected as Vice President; ‘Nifemi Oluboyede, Product Manager – credit, Kuda Digital Bank elected as Secretary; Lukmon Oloyede, Head, Product Marketing & Brand Communication, Zedvance Finance Limited emerged as Publicity Secretary; Yemi Kehinde, Group Head, Zedcrest Capital Limited as Legal Officer and Amarachi Wogu, Head, Channel Delivery, Inclusive Banking at Heritage Bank Plc as Welfare Officer.

In his acceptance speech, Mr Shehu commended the electoral committee for a free and fair election and the event organizing committees for hosting a successful historic event.

“As we consult with the board of trustees to fulfil the objectives of the ADFP, we promise to do our best to make the association a force to reckon with in the industry as we promote financial inclusion and advocate for more stakeholders’ policies and regulations that would deepen the DFS ecosystem in Nigeria,” he said.

Before the inauguration of the new executives, an interactive panel session was held on The Role of Country Association in Capacity Building for DFS Design and Delivery.

The panelislts – Folasade Femi-Lawal, AGM, Card & Messaging Business, FirstBank Nigeria; Stanley Jacob, Director, Country Business Development, MasterCard Nigeria; Kayode Olubiyi, Head, Physical Digital Bank, UBA; Kayode Kalejaiye, Head, Digital Products & Innovation, International Digital Financial Services at Essex, UK emphasized the importance of having a community of practice for exchange of knowledge, collaboration and networking in the DFS ecosystem.

According to Kayode Olubiyi, investing in capacity building should be encouraged by all institutions and regulators as the financial sector continues to evolve.

“The entire world is struck by digital transformation and is becoming more interconnected by the day using digital technologies. Digital finance has brought together people from different fields.

“To build sustainable financial products, design policies and provide appropriate regulation, we need stakeholders’ engagement – and this includes capacity building and knowledge sharing,” he said.

Folasade Femi-Lawal, in the same vein, stated that one of the major ways to bridge the talent gap in the industry is to upskill employees.

She said “export of talent is happening all over the world especially and it is important to we build a pool of talent that would quickly fill the industry gap. Despite the export of talent in Africa, many organizations across the world are still looking forward to extending their footprint in Africa.

“So, we need the ADFP to be at the forefront of talent development for the future. Undertaking the Certificate in Digital Money (CIDM) and the Leading Digital Money Markets (LDMM), and other Digital Frontiers Institute (DFI) qualifications certified by the Fletcher School at Tufts University, USA should be encouraged by all institutions especially for those in the financial sector and other related job roles.”

According to Stanley Jacob, ADFP is already producing leaders that are passionate about financial innovation. He charged the newly elected executives of ADFP Lagos to be a major driver of DFS innovation and to collaborate with innovation hubs, banking and finance institutions and other key stakeholders in Nigeria to bridge the talent gap.

Formulated by the Alumni of the Digital Frontiers Institute (DFI) Community of Practice (COP) members, the ADFP Lagos was created to catalyse the capacity of Nigerian Digital Finance Service (DFS) practitioners towards ensuring a greater level of financial inclusion and digital inclusiveness for all. It also seeks to promote digital transformation, ethical work culture within the DFS ecosystem, and contribute to sustainable development.

While delivering the keynote address at the event held on Saturday, December 11, the Chief Executive Officer, Alliance of Digital Finance Associations (The Alliance), Sarah Corley, stated that the inauguration of the Lagos Chapter of ADFP would, no doubt, deepen the DFS ecosystem in Nigeria through the exchange of knowledge, information and promotion of industry best practices.

“ADFP Nigeria is one of the founding members of the Alliance and I am personally happy that we are coming together globally to share a mutual passion about digital finance and to talk about change.

“It’s not just about learning but about how we can use that knowledge to improve digital financial services and better the lives of many people that are financially excluded by enabling them to have access to credit, insurance, loans and other financial services.”

“We are all part of a big ecosystem that include researchers, bankers, product managers etc. We all know that the banking and finance industry will not remain the same in the next 20 years. So, if we are saying Digital Finance is a profession, then we need a professional association to belong with. We should have associations that practitioners can be part of to make an impact and that is the role ADFP would fill,” Corley said.

Since 2016, Nigeria has had over 300 professionals trained in different aspects of digital financial services design and delivery across the domains of operations, technology, and regulation. Such knowledge and skillset cannot guarantee the anticipated impact if not well harnessed.

To achieve this, the country-level Community of Practice was set up to coordinate professional knowledge discourse and practice among DFS enthusiasts undertaking the CIDM, LDMM and other courses.

Graduates of these courses alongside other specialized courses have today become members of alumni networks in over 21 countries across the globe. These alumni networks which have grown into legally registered country associations, continue to play a significant role in deepening the DFS ecosystem through expansive and inclusive professional membership development opportunities, while also contributing to the growth of financial inclusion and the digital economy.

Nigeria has the rare privilege of having two chapters of the alumni network (Lagos and Abuja) under the Association of Digital Finance Practitioners (ADFP), Nigeria. It is the vision of ADFP to be a world-class professional association that will contribute to the evolution and development of the DFS ecosystem.

ADFP in Nigeria is a founding member of the Global Alliance of Digital Finance Associations (ADFA) and registered under the provisions of the Companies and Allied Matters Act CAP C20 LFN 2004.

As a professional association of certified and experienced industry practitioners and academia, AFDP is guided by a constitution under an advisory oversight of a board of trustees. ADFP is run by an executive team with years of experience in both industry and academia.

Jobs/Appointments

Court Sanctions CHI Limited for Wrongful Employment Termination

By Modupe Gbadeyanka

The termination of the employment of one Mr Bodunrin Akinsuroju by CHI Limited has been declared as unlawful by the National Industrial Court of Nigeria.

Delivering judgment on the matter, Justice Sanda Yelwa of the Lagos Judicial Division of the court held that the sacking of Mr Akinsuroju did not comply strictly with the provisions of the contract of employment and the Employee Handbook.

Consequently, the company was directed to pay him the sum of N2 million as general damages for wrongful termination and N200,000 as costs of action, while Mr Akinsuroju was ordered to return the company’s properties in his possession or pay their assessed market value.

Justice Yelwa found that the contract agreement between both parties clearly required either party to give 30 days’ notice or payment in lieu of notice after confirmation of appointment, and there was no evidence that the employee was given the required notice or paid salary in lieu of notice.

The judge held that failure to comply with this fundamental term amounted to a breach of the contract of employment, thereby rendering the termination wrongful.

Mr Akinsuroju had claimed that the allegation of misconduct against him was unfounded and not established, maintaining that the disciplinary committee proceedings were prejudicial and that the termination of his employment was without justifiable cause and without compliance with the agreed terms of his employment.

In defence, CHI Limited contended that it had the right to terminate the employment of Mr Akinsuroju and that the termination was lawful and in accordance with the contract of employment and the Code of Conduct.

In opposition, counsel to Mr Akinsuroju submitted that the alleged breaches were not proved and that the termination letter took immediate effect without the requisite 30 days’ notice or payment in lieu of notice as stipulated in the letter of appointment and the Employee Handbook, urging the court to hold that the termination was wrongful and to grant the reliefs sought.

Jobs/Appointments

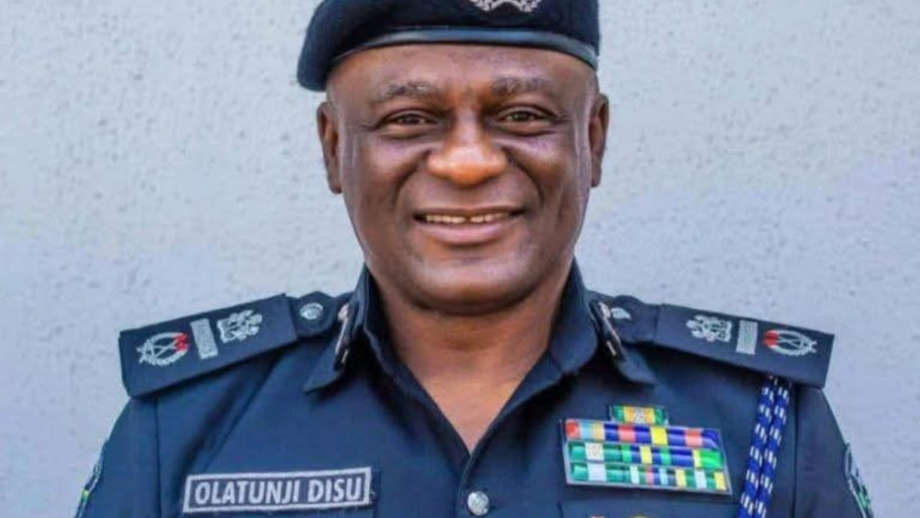

Tinubu Appoints Tunji Disu as Acting Inspector General of Police

By Modupe Gbadeyanka

President Bola Tinubu on Tuesday appointed Mr Tunji Disu as the acting Inspector General of Police (IGP), following the resignation of Mr Kayode Egbetokun.

Mr Disu, an Assistant Inspector General of Police (AIG), was recently moved to the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos.

A statement today by the Special Adviser to the President on Information and Strategy, Mr Bayo Onanuga, disclosed that the President would convene a meeting of the Nigeria Police Council shortly to formally consider the appointment of Mr Disu as substantive IGP, after which his name will be transmitted to the Senate for confirmation.

Mr Tinubu expressed confidence that Mr Disu’s experience, operational depth, and demonstrated leadership capacity would provide steady and focused direction for the Nigeria Police Force during this critical period.

He reiterated his administration’s unwavering commitment to enhancing national security, strengthening institutional capacity, and ensuring that the Nigeria Police Force remains professional, accountable, and fully equipped to discharge its constitutional responsibilities.

Mr Egbetokun was said to have resigned from the position due to pressing family considerations.

President Tinubu, who accepted the resignation letter, expressed his profound appreciation for Mr Egbetokun’s decades of distinguished service to the Nigeria Police Force and the nation. He acknowledged his dedication, professionalism, and steadfast commitment to strengthening internal security architecture during his tenure.

Appointed in June 2023, Mr Egbetokun was serving a four-year term scheduled to conclude in June 2027, in line with the amended provisions of the Police Act.

The statement disclosed that his replacement was in view of the current security challenges confronting the nation, and acting in accordance with extant laws and legal guidance.

Jobs/Appointments

Tunji Disu to Become New IGP as Egbetokun Quits

By Adedapo Adesanya

Mr Tunji Disu, an Assistant Inspector General of Police (AIG), has reportedly replaced Mr Kayode Egbetokun as the new Inspector General of Police (IGP).

Mr Egbetokun resigned from the position on Tuesday after he was said to have held a meeting with President Bola Tinubu on Monday night at the Presidential Villa in Abuja.

President Tinubu appointed Mr Egebtokun as the 22nd IGP on June 19, 2023, with his appointment confirmed by the Nigeria Police Council on October 31, 2023.

Appointed as IGP at the age of 58, Mr Egbetokun was due for retirement on September 4, 2024, upon reaching the mandatory age of 60, but his tenure was extended by the President, creating controversies, which trailed him until his exit from the force today.

Although the police authorities are yet to comment on the matter or issue an official statement about his resignation, the move came amid reports suggesting that Mr Egbetokun has left the position.

Mr Egbetokun’s tenure was marred by a series of controversies; he recently initiated multiple charges against activist Mr Omoyele Sowore and his publication, SaharaReporters, after Mr Sowore publicly described him as an “illegal IGP.”

The dispute escalated into protracted legal battles, with the Federal High Court issuing injunctions restricting further publications relating to the former police chief and members of his family. Critics interpreted these court actions as attempts to stifle dissent and weaken press freedom.

His replacement, Mr Disu, was posted to oversee the Force Criminal Investigation Department (FCID) Annex, Alagbon, Lagos, some days ago.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn