Jobs/Appointments

Seplat Appoints Former SEC DG to Strengthen Board

By Dipo Olowookere

A foremost local energy company, Seplat Petroleum Development Company Plc, has taken a huge step to strengthen its board of directors with the appointment of the director-general of the Securities and Exchange Commission (SEC) from 2010 to 2015, Ms Arunma Oteh.

A statement issued by the company stated that Ms Oteh joins the board as an independent non-executive director of the company with effect from October 1, 2020. She was appointed to the board alongside Mr Xavier Rolet in the same capacity.

According to the Chairman of Seplat, Mr Bryant Orjiako, the appointment of the two “distinguished international business leaders” will be of great value to the company because of their expertise.

“Both Arunma Oteh and Xavier Rolet bring extensive expertise in the fields of regulation, capital markets and business governance and their knowledge and wisdom will be a great addition to our board.

“Seplat has a great future ahead and I look forward to the immense contribution they will make towards the continuing success of the company,” he said.

Seplat is an oil and gas firm listed on both the Nigerian Stock Exchange (NSE) and the London Stock Exchange (LSE).

Ms Arunma Oteh, who started her career in 1985 at Centre Point Investments Limited, a Nigerian investment bank, is a seasoned C-suite executive with several years of experience operating at the highest levels at major multilateral agencies, global financial institutions and in government.

She has been an academic scholar at University of Oxford since January 2019 and a member of the London Stock Exchange Africa Advisory Group since January 2020.

She served as Treasurer and Vice President of the World Bank from 2015 to 2018, leading a global team that managed the World Bank’s $200 billion debt portfolio as well as an asset portfolio of $200 billion for the World Bank Group and several public sector clients including 65 central banks.

She was responsible for a $600 billion derivatives portfolio used for hedging and risk management purposes.

Ms Oteh had oversight over a treasury operation with an annual cash flow of $7 trillion and led an extensive public sector financial advisory business, pioneering a number of innovative solutions such as the world’s first-ever pandemic bond in 2017 and blockchain public bond in 2018.

For Mr Xavier Rolet, he is an experienced CEO, co-founder, and entrepreneur named as one of the 100 Best CEOs in the World in the 2017 Harvard Business Review.

In his decade at the helm of the London Stock Exchange, the LSE’s market valuation rose from £800 million to more than £15 billion, transforming it into one of the world’s largest exchanges by market capitalisation.

He is currently the Chairman, board of directors at Phosagro PJSC, a member of the board of directors of the Saudi Stock Exchange Tadawul as an appointee of the Public Investment Fund and an Expert Adviser to the Shanghai Institute of Finance for the Real Economy.

Jobs/Appointments

NIMASA Gets New Maritime Guard Commander

By Modupe Gbadeyanka

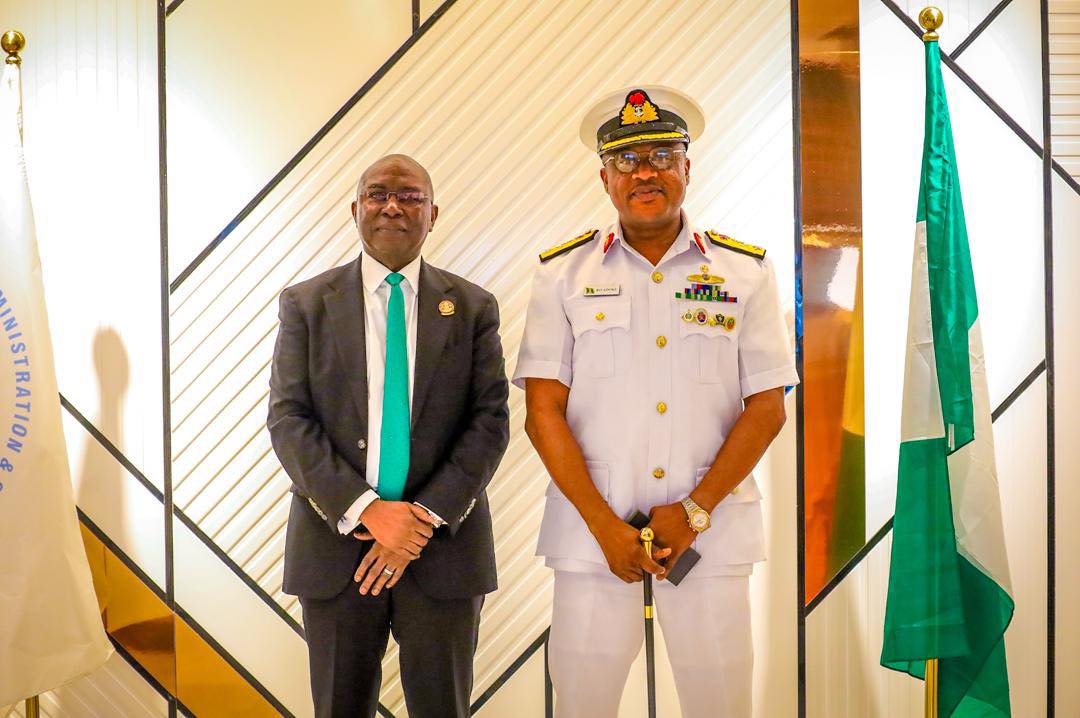

A new Commander of the Maritime Guard Command has been appointed for the Nigerian Maritime Administration and Safety Agency (NIMASA), and he is Commodore Reginald Odeodi Adoki.

His appointment was approved by the Chief of the Naval Staff, Vice Admiral Idi Abbas, a statement from NIMASA confirmed.

He was chosen to replace Commodore H.C Oriekeze, who has been redeployed by naval authorities.

Commodore Adoki, a principal Warfare Officer specialising in communication and intelligence, brings 25 years of experience in the Nigerian Navy covering training, staff and operations.

As a seaman, he has commanded NNS Andoni, NNS Kyanwa and NNS Kada. It was under his command that NNS Kada undertook her maiden voyage, sailing from the country of build (the United Arab Emirates) into Nigeria.

He was commissioned into the Nigerian Navy in 2000 with a BSc in Mathematics. He has since earned a Master’s in International Law and Diplomacy from the University of Lagos and an MSc in Terrorism, Security and Policing atthe University of Leicester, England.

He is currently pursuing a PhD in Defence and Security Studies at the National Defence Academy (NDA). He is a highly decorated officer with several medals for distinguished service.

Welcoming the new MGC Commander to the agency, the Director General of NIMASA, Mr Dayo Mobereola, expressed confidence in Mr Adoki’s addition to the team, emphasising that it will further strengthen the nation’s maritime security architecture given his vast experience in the industry.

The Maritime Guard Command domiciled in NIMASA was established as part of the resolutions of the Memorandum of Understanding (MoU) with the Nigerian Navy to assist NIMASA in strengthening operational efficiency in Nigeria’s territorial waters, especially through enforcement of security, safety and other maritime regulations.

Jobs/Appointments

Japaul Picks Henry Alakhume as Acting GMD

By Aduragbemi Omiyale

Mr Henry Alakhume has been appointed as the group managing director of Japaul Gold and Ventures Plc, a statement issued on Thursday disclosed.

In the notice signed by the company secretary, Chidimma Okolo, it was stated that the appointment of Mr Alakhume is effective today, February 12, 2026.

He is to fill the vacant position left by Mr Akinloye Daniel Oladapo, who resigned with effect from October 13, 2025, with no reason given for his decision to exit the post.

In the disclosure, it was said that Mr Alakhume would remain in office until a substantive GMD is announced by the organisation.

However, the board expressed confidence in the ability of the acting GMD to steer the ship of the company “during this transition period.”

He was described as an experienced executive director of the firm, who will “ensure continuity in leadership and support the company’s strategic objectives.”

“The board of Japaul Gold and Ventures Plc wishes to inform the Nigerian Exchange (NGX) Limited, its esteemed shareholders, and the general public of the appointment of Mr Henry Alakhume as the acting group managing director of the company.

“Mr Alakhume’s appointment takes effect from February 12, 2026, and he will serve in this capacity pending the appointment of a substantive group managing director.

“Mr Alakhume is an experienced executive of the company and has demonstrated strong leadership and operational expertise in his role as Chief Operating Officer.

“The board is confident that his appointment will ensure continuity in leadership and support the company’s strategic objectives during this transition period,” the statement said.

Jobs/Appointments

VFD Group Appoints Martins Akpore to Oversee Finance, Risk Management

By Adedapo Adesanya

Nigerian proprietary investment company, VFD Group Plc, has announced the appointment of Mr Martins Akpore as Group Head for Centralised Critical Functions (CCF).

In a statement issued on Wednesday, the company disclosed that Mr Akpore would oversee the group’s centralised functions, including Finance, Audit, Risk Management, Credit and Treasury, with immediate effect.

The appointment is expected to bolster VFD Group’s financial governance and strengthen coordination across its subsidiaries as the company advances its expansion and operational efficiency drive.

“We are pleased to announce the appointment of Martins Akpore as Group Head, Centralised Critical Functions at VFD Group Plc. In this expanded strategic role, Martins will lead and oversee the Group’s centralised functions spanning Finance, Audit, Risk Management, Credit, and Treasury, effective immediately.

“Martins brings to this role a strong professional foundation and deep expertise across core financial disciplines, underpinned by his credentials as a Chartered Accountant, Chartered Tax Professional, and Certified Treasury specialist, as well as globally recognised certifications in financial modelling and valuation. He currently serves as Group Head, Treasury, where he has played a key role in strengthening the Group’s financial and capital management capabilities across the ecosystem,” it said.

“In his new capacity, Martins will be responsible for driving cohesive strategy, governance, and execution across the Centralised Critical Functions, ensuring robust risk oversight, disciplined financial operations, and alignment with the Group’s strategic priorities. He will work closely with subsidiary leadership teams to enhance institutional standards, strengthen accountability, and support cross-ecosystem decision making on critical matters,” it added.

Speaking on the appointment, the Group Managing Director, Mr Nonso Okpala, emphasised the importance of collaboration and execution discipline in delivering the firm’s Vision 2026 ambitions. In line with this, Managing Directors and senior leaders across all subsidiaries are encouraged to partner closely with Mr Akpore to ensure alignment, responsiveness, and shared ownership in achieving the organisation’s objectives.

Formerly trading on the NASD Over-the-Counter (OTC) Securities Exchange, VFD Group made an exit in October 2023 and listed on the Nigerian Exchange (NGX) Limited to strengthen its market position, boost visibility, and create more avenues to source cheap funds for expansion and growth.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn