Jobs/Appointments

Seplat CEO Roger Brown Emoluments Rise to N3.909bn

By Adedapo Adesanya

It was a good year for Seplat Energy in 2204, with the company making a series of transformative moves that significantly altered its scale and positioning in Nigeria’s oil and gas sector.

While the most notable development was the completion of its delayed $1.28 billion acquisition of ExxonMobil’s Nigerian shallow-water business, Mobil Producing Nigeria Unlimited (MPNU), its directors and workers also saw increases in their paychecks.

Its highest paid director and chief executive, Mr Roger Brown, received total emoluments of N3.909 billion, 135.8 per cent higher than the N1.658 billion he received in 2023.

Chairman of the company, Mr Udoma Udo Udoma, received total emoluments of N1.992 billion in 2024, 250.1 per cent higher than N569 million he got a year earlier.

Seplat also noted that its executive directors, Mr Samson Ezugworie and Mrs Eleanor Adaralegbe, who are its chief operating officer and chief financial officer, respectively, received total emoluments of N4.133 billion in 2024 versus N1.493 billion in 2023.

Also, its non-executive directors received N4.896 billion for their services in 2024 against N1.707 billion in 2023. These include Mr Bello Rabiu, Madame Nathalie Delapalme, Mr Olivier Cleret De Langavant, Dr Emma FitzGerald, Mr Ernest Ebi, Mrs Bashirat Odunewu, Mr Kazeem Raimi, Ms Koosum Kalyan, Mr Christopher Okeke, and Mr Babs Omotowa.

This is part of the wider workforce of 1,446 employees which received N71.718 billion as salaries and wages in 2024 compared with the N48.468 billion paid to the staff in its 2023 fiscal year, indicating a 47.97 per cent rise.

It is important to note that the amount paid as salaries and wages by Seplat to its staff members in 2024 does not include other emoluments, allowances, and pension contributions.

This was on the back of a significant improvement in its performance in the 2024 fiscal year, following the successful acquisition of the producing assets of MPNU.

Specifically, the company’s profit before tax rose by 98.4 per cent to $379.4 million (N561.4 billion) in 2024, compared with $191.2 million (N125.5 billion) in 2023, while its profit after tax grew by 16.9 per cent to $144.8million (N214.3 billion) in 2024, from $123.9 million (N81.4 billion) in 2023.

The increase in the salaries and wages of its staff in 2024 was largely as a result of a sharp rise in its workforce, from 588 staff in 2023 to 1,446 staff in 2024, representing a 146 per cent increase in its staff strength.

It is important to note that the acquisition was concluded in December 2024, meant that the increase in its workforce came about at that time. This also means that the new staff members from Mobil only received one month’s pay as Seplat’s staff in 2024.

Specifically, the sharp increase in its workforce, according to its 2024 annual reports and accounts, stemmed from its acquisition of the assets of MPNU in 2024, which saw 863 staff of Mobil joining its existing workforce.

Another factor which contributed to the rise in salaries and wages in 2024 was the declining value of the Naira against the Dollar, which was the currency in which the company denominated the emoluments.

Giving a breakdown of its workforce, Seplat Energy disclosed that in 2024, it has 47 junior staff, 1,022 senior staff, 332 managers and 45 senior management staff compared with 39 junior staff, 343 senior staff, 165 senior staff and 41 senior management staff in 2023.

To this end, the N71.718 billion salaries and wages received by the 1,446 staff, translated to an average salary of N49.6 million for each staff per annum, which is also an equivalent of N4.133 million per month, for each staff.

In comparison, the average yearly staff salaries and wages for its 588 staff in 2023 was N82.43 million per individual, while the average monthly salary was N6.87 million per staff.

In particular, the indigenous oil firm reported that in 2024, only a total of 395 staff earned below N118.37 million each, an equivalent of N9.833 million per month; while 425 staff members earned between N118.37 million and N295.936 million, translating to between (N9.833 million and N24.66 million monthly).

Also, staff members whose annual salaries and wages were within the range of N295.936 million and N443.904 (between N24.66 million and N36.992 million monthly) stood at 450, while 176 employees received above N443.904 billion as salaries and wages.

Jobs/Appointments

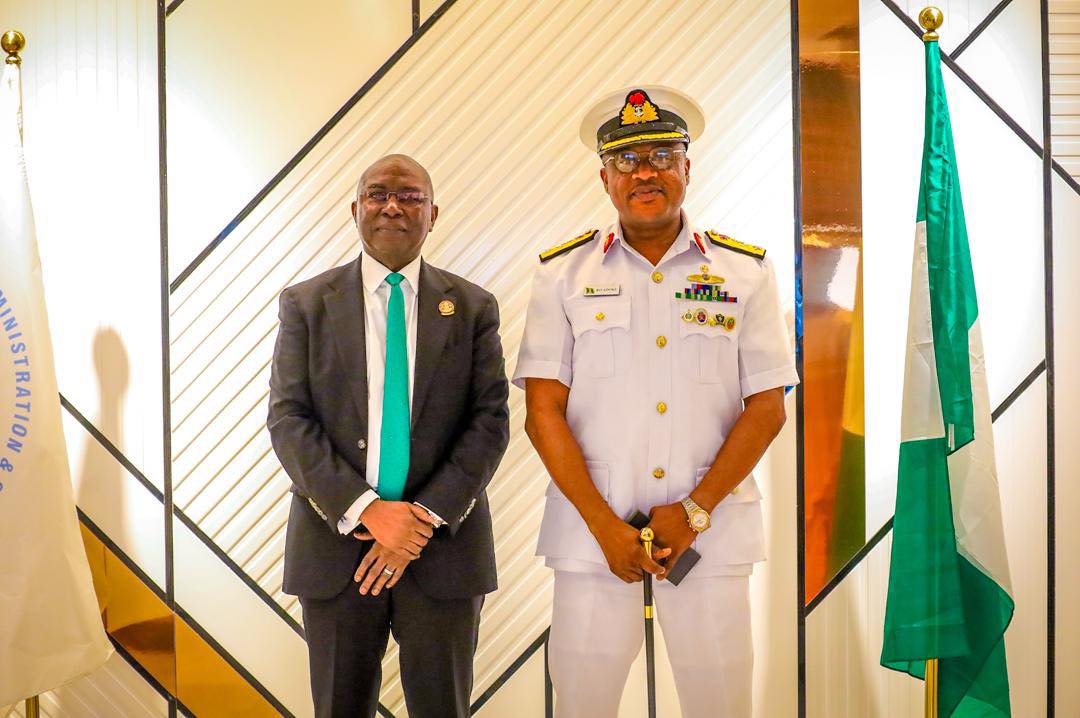

NIMASA Gets New Maritime Guard Commander

By Modupe Gbadeyanka

A new Commander of the Maritime Guard Command has been appointed for the Nigerian Maritime Administration and Safety Agency (NIMASA), and he is Commodore Reginald Odeodi Adoki.

His appointment was approved by the Chief of the Naval Staff, Vice Admiral Idi Abbas, a statement from NIMASA confirmed.

He was chosen to replace Commodore H.C Oriekeze, who has been redeployed by naval authorities.

Commodore Adoki, a principal Warfare Officer specialising in communication and intelligence, brings 25 years of experience in the Nigerian Navy covering training, staff and operations.

As a seaman, he has commanded NNS Andoni, NNS Kyanwa and NNS Kada. It was under his command that NNS Kada undertook her maiden voyage, sailing from the country of build (the United Arab Emirates) into Nigeria.

He was commissioned into the Nigerian Navy in 2000 with a BSc in Mathematics. He has since earned a Master’s in International Law and Diplomacy from the University of Lagos and an MSc in Terrorism, Security and Policing atthe University of Leicester, England.

He is currently pursuing a PhD in Defence and Security Studies at the National Defence Academy (NDA). He is a highly decorated officer with several medals for distinguished service.

Welcoming the new MGC Commander to the agency, the Director General of NIMASA, Mr Dayo Mobereola, expressed confidence in Mr Adoki’s addition to the team, emphasising that it will further strengthen the nation’s maritime security architecture given his vast experience in the industry.

The Maritime Guard Command domiciled in NIMASA was established as part of the resolutions of the Memorandum of Understanding (MoU) with the Nigerian Navy to assist NIMASA in strengthening operational efficiency in Nigeria’s territorial waters, especially through enforcement of security, safety and other maritime regulations.

Jobs/Appointments

Japaul Picks Henry Alakhume as Acting GMD

By Aduragbemi Omiyale

Mr Henry Alakhume has been appointed as the group managing director of Japaul Gold and Ventures Plc, a statement issued on Thursday disclosed.

In the notice signed by the company secretary, Chidimma Okolo, it was stated that the appointment of Mr Alakhume is effective today, February 12, 2026.

He is to fill the vacant position left by Mr Akinloye Daniel Oladapo, who resigned with effect from October 13, 2025, with no reason given for his decision to exit the post.

In the disclosure, it was said that Mr Alakhume would remain in office until a substantive GMD is announced by the organisation.

However, the board expressed confidence in the ability of the acting GMD to steer the ship of the company “during this transition period.”

He was described as an experienced executive director of the firm, who will “ensure continuity in leadership and support the company’s strategic objectives.”

“The board of Japaul Gold and Ventures Plc wishes to inform the Nigerian Exchange (NGX) Limited, its esteemed shareholders, and the general public of the appointment of Mr Henry Alakhume as the acting group managing director of the company.

“Mr Alakhume’s appointment takes effect from February 12, 2026, and he will serve in this capacity pending the appointment of a substantive group managing director.

“Mr Alakhume is an experienced executive of the company and has demonstrated strong leadership and operational expertise in his role as Chief Operating Officer.

“The board is confident that his appointment will ensure continuity in leadership and support the company’s strategic objectives during this transition period,” the statement said.

Jobs/Appointments

VFD Group Appoints Martins Akpore to Oversee Finance, Risk Management

By Adedapo Adesanya

Nigerian proprietary investment company, VFD Group Plc, has announced the appointment of Mr Martins Akpore as Group Head for Centralised Critical Functions (CCF).

In a statement issued on Wednesday, the company disclosed that Mr Akpore would oversee the group’s centralised functions, including Finance, Audit, Risk Management, Credit and Treasury, with immediate effect.

The appointment is expected to bolster VFD Group’s financial governance and strengthen coordination across its subsidiaries as the company advances its expansion and operational efficiency drive.

“We are pleased to announce the appointment of Martins Akpore as Group Head, Centralised Critical Functions at VFD Group Plc. In this expanded strategic role, Martins will lead and oversee the Group’s centralised functions spanning Finance, Audit, Risk Management, Credit, and Treasury, effective immediately.

“Martins brings to this role a strong professional foundation and deep expertise across core financial disciplines, underpinned by his credentials as a Chartered Accountant, Chartered Tax Professional, and Certified Treasury specialist, as well as globally recognised certifications in financial modelling and valuation. He currently serves as Group Head, Treasury, where he has played a key role in strengthening the Group’s financial and capital management capabilities across the ecosystem,” it said.

“In his new capacity, Martins will be responsible for driving cohesive strategy, governance, and execution across the Centralised Critical Functions, ensuring robust risk oversight, disciplined financial operations, and alignment with the Group’s strategic priorities. He will work closely with subsidiary leadership teams to enhance institutional standards, strengthen accountability, and support cross-ecosystem decision making on critical matters,” it added.

Speaking on the appointment, the Group Managing Director, Mr Nonso Okpala, emphasised the importance of collaboration and execution discipline in delivering the firm’s Vision 2026 ambitions. In line with this, Managing Directors and senior leaders across all subsidiaries are encouraged to partner closely with Mr Akpore to ensure alignment, responsiveness, and shared ownership in achieving the organisation’s objectives.

Formerly trading on the NASD Over-the-Counter (OTC) Securities Exchange, VFD Group made an exit in October 2023 and listed on the Nigerian Exchange (NGX) Limited to strengthen its market position, boost visibility, and create more avenues to source cheap funds for expansion and growth.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

Pingback: Seplat CEO Roger Brown Emoluments Rise to N3.909bn – PRIMA NEWS