Media OutReach

Aon Forecasts 11.1 Percent Increase in Employee Medical Plan Costs for Businesses in Asia Pacific

Medical trend rates in the APAC region rank second-highest globally, according to report

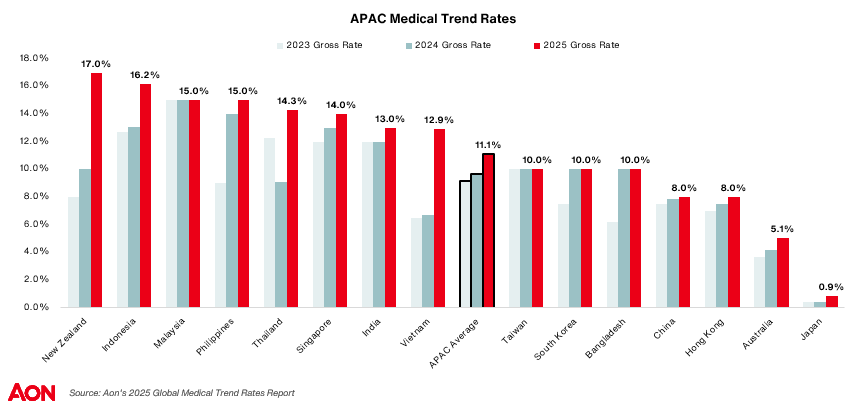

SINGAPORE – Media OutReach Newswire – 22 January 2025 – Aon plc (NYSE: AON), a leading global professional services firm, has released its 2025 Global Medical Trend Rates Report. The report forecasts a projected 11.1 percent rise in the Asia Pacific region (APAC), which is higher than the global projected increase for 2024 of 9.7 percent, which represented the highest increase forecasted in 10 years.

Trend rate figures represent the percentage increase in medical plan costs per employee – both insured and self-insured. Knowing estimated costs in advance can help organisations budget and adjust their benefits philosophy in response, ensuring programs are sustainable.

This year’s report projects APAC will experience the second highest year-over-year trend rate increase after the Middle East and Africa, which has the highest trend rate of any region at 15.5 percent.

| Forecasted Medical Trend Rate from 2024 to 2025 | ||

| 2024 | 2025 | |

| Asia Pacific | 9.7% | 11.1% |

| Global | 10.1% | 10.0% |

| Europe | 10.4% | 8.9% |

| North America | 7.6% | 8.8% |

| Latin America and Caribbean | 11.7% | 10.7% |

| Middle East and Africa | 15.1% | 15.5% |

“The biggest rise in medical utilisation and inflation are now behind us in APAC, but recovery in insurer profitability is expected to keep medical trend rates in the double digits for 2025 and 2026,” said Alan Oates, head of global benefits for Asia Pacific at Aon.

“The high medical trend rate can also be attributed to a higher incidence of cancer and chronic conditions than before the COVID-19 pandemic. Managing the impact of medical inflation therefore should be a top priority for all southeast Asia markets and especially important in New Zealand, Papua New Guinea, Thailand and Vietnam, which are seeing 50 to over 100 percent increases compared to last year,” Oates explained.

The survey further revealed that prescription and specialty medications, including weight loss medication, innovations in medical technology, and geopolitical factors, are significantly impacting medical trend rates in APAC and around the world. In addition, support for emotional health as the fastest-growing claim in Aon’s APAC client portfolio, wellbeing initiatives designed to mitigate stress, along with other plan enhancements, are also contributing to the double-digit medical trend.

“Although most insurers are still raising premiums, we are seeing a slight drop in some markets where risk appetites are returning among insurance providers that were quick to take corrective measures in previous renewal periods. As these insurance providers can now offer competitive pricing terms, we are encouraging clients to test the market as there is increasing value in doing so,” said Marina Sukhikh, professional services industry practice leader, global benefits for Asia Pacific at Aon.

How are Companies Addressing Rising Costs?

Wellbeing programs, plan design changes, alternative financing, data and analytics and flexible benefits are among the top strategies employers are expected to undertake in 2025 to affordably promote a healthy workforce.

Sukhikh said, “Aon has observed growing co-investment in wellbeing initiatives by employers and insurers. Greater investment is being matched with greater scrutiny into investment return, and wellbeing programs are increasingly being integrated and aligned with prevention strategies. For example, more initiatives are targeting physical inactivity, poor stress management, hypertension, high cholesterol and other risk factors driving chronic conditions that lead to adverse future claims.”

“We are encouraging clients to seek a more integrated value-based outcome from insurers where they are cooperating in the sharing of data, investment in wellbeing and offering creative solutions for design and financing. Sophisticated analytics tools, such as Aon’s Health Risk Analyzer, are helping companies leverage a growing volume of multi-source data, not just to identify and mitigate today’s risks but to accurately predict and prepare for the risks of tomorrow. Technology is helping us identify under-served populations and anticipate opportunities faster than ever,” added Sukhikh.

According to Aon’s 2024 Global Benefits Trends Study, employers in around 60 percent of countries are expected to use flexible benefit plans to address diverse workforce needs while controlling overall benefit costs. Meanwhile, one in three are actively considering alternative benefits financing arrangements, such as multinational pooling, global underwriting and captives.

“More than at any point in the last 10 years we have observed employers taking steps to reduce plan design due to affordability. Flexibility and choice have been a valuable tool in design change because employees generally place a greater value on shorter-term flexibility and choice than they do on longer-term core benefits. Alternative funding will not materially reduce cost, which is generally determined by claims and scale, but it can smooth cost volatility over a longer period than is possible with direct insurance and that is helpful in this volatile market,” Oates added.

Read Aon’s 2025 Global Medical Trend Rates Report.

About the report:

The report is based on insights from 112 Aon offices that broker, administer, or advise on employer-sponsored medical plans in each of the countries covered in the report. The findings reflect the medical trend expectations of Aon professionals based on their interactions with clients and carriers represented in the portfolio of the firm’s medical plan business in each location.

As employer-sponsored medical plans become a larger part of total rewards spend and pressure mounts to accurately forecast and manage costs, this report is a valuable resource for organisations to plan global budgets and benefits strategies for 2025 and beyond.

Read Aon’s 2025 Global Medical Trend Rates Report.

Hashtag: #Aon

The issuer is solely responsible for the content of this announcement.

About Aon

![]() Aon plc (NYSE: AON) exists to shape decisions for the better — to protect and enrich the lives of people around the world. Through actionable analytic insight, globally integrated Risk Capital and Human Capital expertise, and locally relevant solutions, our colleagues provide clients in over 120 countries with the clarity and confidence to make better risk and people decisions that protect and grow their businesses.

Aon plc (NYSE: AON) exists to shape decisions for the better — to protect and enrich the lives of people around the world. Through actionable analytic insight, globally integrated Risk Capital and Human Capital expertise, and locally relevant solutions, our colleagues provide clients in over 120 countries with the clarity and confidence to make better risk and people decisions that protect and grow their businesses.

Follow Aon on ![]() LinkedIn,

LinkedIn, ![]() X,

X, ![]() Facebook and

Facebook and ![]() Instagram. Stay up-to-date by visiting Aon’s

Instagram. Stay up-to-date by visiting Aon’s ![]() newsroom and sign up for news alerts

newsroom and sign up for news alerts ![]() here.

here.

Disclaimer

The information contained in this document is solely for information purposes, for general guidance only and is not intended to address the circumstances of any particular individual or entity. Although Aon endeavours to provide accurate and timely information and uses sources that it considers reliable, the firm does not warrant, represent or guarantee the accuracy, adequacy, completeness or fitness for any purpose of any content of this document and can accept no liability for any loss incurred in any way by any person who may rely on it. There can be no guarantee that the information contained in this document will remain accurate as on the date it is received or that it will continue to be accurate in the future. No individual or entity should make decisions or act based solely on the information contained herein without appropriate professional advice and targeted research.

Media OutReach

From Wardrobe Staple to 10-Year Icon: XIXILI’s Seamless Panties Get a Colour Update

The Secret to a Decade of Loyalty

A decade of consistent customer trust speaks for itself. XIXILI’s seamless panties have earned a loyal following of women who return to the same style, year after year.

Whether it’s a breathable cotton panty for everyday basics or a sleek seamless style for fitted outfits, comfort remains the priority. The appeal comes down to the essentials: no visible panty lines, no adjusting throughout the day, and lightweight comfort that holds up from morning to night. For women juggling busy schedules, that kind of reliability makes all the difference.

“Our customers tell us these are the panties they don’t have to think about,” says Tara Tan, spokesperson for XIXILI. “They just work. That’s why women keep coming back.”

Designed for Every Body, Built to Last

The Full Coverage Mid-Rise Knitted Boyleg Panty delivers moderate coverage with a relaxed fit, suited for those who want fuss-free comfort. The High-Waist Knitted Boyleg Panty sits higher on the waist with gentle tummy smoothing, a go-to for wearing beneath tailored pieces and fitted silhouettes.

The Lightweight Seamless Microfiber Panty remains the star of the range. Its soft microfiber construction sits flat against the skin, creating an invisible finish under any outfit. A bestseller for ten consecutive years, this fan-favourite now comes in new colours, giving loyal fans a reason to refresh their collection.

The Foundation of Every Outfit

What sits beneath an outfit often sets the tone for the entire day. It’s the layer no one sees but everyone feels, allowing women to move through their routines with confidence, whether at work, running errands, or out with friends.

XIXILI’s decade-long bestseller continues to deliver on that promise. With new colours now available, updating the essentials is as effortless as the panties themselves.

To discover the full panties collection, visit XIXILI’s website to shop online with delivery to Singapore, or find your nearest XIXILI boutique across Malaysia.

Hashtag: #XIXILI #SGLingerie

https://www.xixili-intimates.com/sg/![]() https://www.facebook.com/XIXILI.OfficialFanPage/

https://www.facebook.com/XIXILI.OfficialFanPage/![]() https://www.instagram.com/xixili_intima/

https://www.instagram.com/xixili_intima/![]() https://www.tiktok.com/@xixili_intima?

https://www.tiktok.com/@xixili_intima?![]() https://www.youtube.com/user/xixilipage

https://www.youtube.com/user/xixilipage

The issuer is solely responsible for the content of this announcement.

About XIXILI

A proudly Malaysian brand, XIXILI offers fashion lingerie and shapewear that combines elegance with all-day comfort. With one of the most inclusive sizing ranges between A to I cups and 65 to 110cm band sizes, XIXILI designs for every body type. The brand is known for its expert fitters, premium materials, and dedication to helping women feel confident and supported.

XIXILI is also the first Malaysian lingerie brand to launch a 3D Avatar Try-On Tool, enabling women to virtually try on lingerie tailored to their unique body type and measurements. From everyday basics to occasion-ready pieces, XIXILI celebrates the beauty of real bodies, every day.

Media OutReach

Huawei, Meralco, and SANXING Ningbo Launch Intelligent Distribution Solution and Lighthouse Initiative

Communication, digitalization, and AI: Emerging cornerstones of future power systems that will accelerate the intelligent evolution of distribution networks

David Sun, CEO of Huawei’s Electric Power Digitalization BU, highlighted four drivers for energy transition: green energy and diversity, resilient grids, transparent distribution, and load electrification. He called for policy changes toward dispatch-market coordination. He also emphasized that communication, digitalization, and AI are becoming core production systems, requiring stronger capabilities in digital transformation, cybersecurity, and sustainable development.

At the forum, Mr. Sun unveiled the White Paper on Communication Target Networks for the Future Power System, introducing a pioneering architecture that features an intelligent and robust main network, integrated medium-voltage and transparent low-voltage networks, high-speed secure connectivity, and space-ground integration. The paper also outlines key tech trends, from optical and wireless to carrier and satellite communications, and underscores their transformative value.

Huawei highlighted its focus on intelligence and digitalization, working with industry players to drive power transformation. Global industry leaders also shared their insights: Al’Louise van Deventer (Technology and Engineering General Manager, Eskom) on future-ready digital practices; Momar Awa Sall (Transmission Grid Director, Senelec) on private wireless networks accelerating power modernization; Deniz COSKUN (Deputy General Manager, TEİAŞ) on restructuring communication networks for grid resilience; and Andy Liu (Overseas Solutions and Marketing Director, SANXING Ningbo) on the application of Huawei IDS.

Global industry leaders and partners join to explore the future of power systems

Power distribution networks are evolving from mechanized to automated and intelligent systems, driving technological and business model innovation. Despite creating new challenges for O&M, they have unlocked further opportunities for improving grid reliability and resource allocation.

At the forum, Huawei, Meralco, and SANXING Ningbo, unveiled the IDS that delivers four core capabilities—reliable communication, edge computing, cloud-edge collaboration, and low-voltage transparency—based on a cloud-pipe-edge-pipe-device architecture. It enables an intelligent low-voltage (400 V) distribution network with controllable line loss, visualized distribution rooms, and manageable renewables, transforming fragmented digital silos into open, integrated digital systems. The three companies also announced a lighthouse showcase initiative, sharing replicable and scalable digital transformation best practices.

Advancing digital and intelligent integration for a greener, more reliable grid

Communication, digitalization, and AI are at the heart of future power systems. Huawei will deepen R&D in digital, intelligent technologies, integrating advanced intelligence into power production. Together with global partners, Huawei is committed to developing with the power industry toward greater reliability, stronger security, and a low-carbon future.

Hashtag: #Huawei

The issuer is solely responsible for the content of this announcement.

Media OutReach

Thailand Unveils Public–Private Alliance to Lead Asia’s Wellness Economy Revolution BDMS Wellness Clinic Rises as National Orchestrator of a Science-Powered, Luxury-Integrated Wellness Ecosystem

A Multi-Sector Coalition at Unprecedented Scale

Led and orchestrated by BDMS Wellness Clinic, this alliance represents one of the most holistic cross-industry coalitions in Thailand’s health and tourism landscape. As the central integrator, BDMS Wellness Clinic unites public agencies, aviation leaders, hospitality icons, financial institutions, and global biotechnology innovators into a single, strategically aligned Wellness Ecosystem. Key national partners include the Thailand Convention and Exhibition Bureau (TCEB), Thailand Privilege Card Co., Ltd., and the Thai Spa Association, with regional connectivity strengthened by Bangkok Airways. The luxury and lifestyle dimension features Sri panwa Phuket, CELES SAMUI, Mövenpick BDMS Wellness Resort Bangkok, Dusit Thani Bangkok, King Power Corporation, Siam Piwat Co., Ltd., and Lancôme by L’Oréal Thailand.

Healthcare infrastructure and precision diagnostics are reinforced by National Healthcare Systems (N Health), enabling advanced laboratory networks, cross-border clinical data integration, and continuity of care. This capability is further elevated through collaboration with global medical and biotechnology leaders — Straumann Group in advanced dental innovation, Illumina in genomic sequencing, Abbott in precision diagnostics, and Gene Solutions in next-generation molecular testing.

Through this convergence of genomics, biomarker analytics, regenerative technology, and preventive medicine, BDMS Wellness Clinic delivers data-driven health optimization—from early disease detection and biological age assessment to personalized longevity programs. Together, under BDMS Wellness Clinic’s leadership, these partners form a fully integrated, science-powered ecosystem that transforms preventive care into measurable outcomes—firmly positioning Thailand at the forefront of Asia’s Wellness Economy.

From Healthcare Provider to National Orchestrator

BDMS Wellness Clinic has evolved beyond the traditional role of a healthcare provider to become the strategic integrator of Thailand’s Wellness Ecosystem—serving as the “National Orchestrator” uniting public institutions, private enterprises, academia, and global partners under one coordinated vision. Its mission extends far beyond treatment: to optimize healthspan, precise longevity science, and build a sustainable ecosystem where wellness becomes both a national economic engine and a form of diplomatic soft power. By synchronizing infrastructure, policy, aviation, hospitality, finance, and biotechnology, BDMS Wellness Clinic is repositioning Thailand from a destination known primarily for leisure and elective care into a global epicenter of evidence-based preventive medicine and measurable health optimization.

BDMS Wellness Clinic with Wellness Literacy: The Foundation of Sustainable Global Leadership

Sustainable global leadership demands more than world-class facilities—it requires a new generation of visionaries, scientists, and industry leaders equipped to redefine the future of health. BDMS Wellness Clinic has therefore launched a transformative Wellness Literacy strategy designed to cultivate world-class human capital, elevate professional standards, and shape a knowledge-driven ecosystem that positions Thailand at the forefront of preventive medicine and longevity science in Asia and beyond.

Through strategic alliances with leading institutions—including Thammasat University and King Mongkut’s Institute of Technology Ladkrabang (KMITL) in Thailand, as well as the University of Sharjah (UAE) and Singapore Management University (SMU)—BDMS Wellness Clinic is co-developing advanced curricula in preventive medicine, longevity science, and wellness management. These collaborations are establishing a new Asian benchmark for preventive healthcare education while producing a future-ready workforce for the global wellness economy. Beyond academia, BDMS Wellness Clinic is empowering entrepreneurs and industry operators nationwide, equipping hospitality, spa, and lifestyle businesses with measurable wellness standards—elevating Thailand’s entire value chain to international levels of excellence.

From Thailand to the World: BDMS Wellness Clinic’s Global Wellness Network

Extending its ecosystem beyond national borders, BDMS Wellness Clinic has forged strategic alliances with Neem Hospital—a leading private healthcare institution in the Sultanate of Oman known for its integrated clinical services and patient-centered care—and the MODAWI Platform, a digital health coordination platform that streamlines medical referrals, clinical data exchange, and cross-border care navigation.

Together, these partnerships establish a seamless referral and clinical integration network linking the GCC region with BDMS Wellness Clinic services. By combining hospital-based clinical excellence with digital health infrastructure, the model ensures continuity of care across borders—enabling patients to transition smoothly from initial consultation in the Middle East to advanced diagnostics, genomics, and longevity programs.

The Proof of Concept: “The Journey Within”

The flagship initiative, “The Journey Within,” translates vision into execution—serving as the living blueprint of the Wellness Ecosystem envisioned by BDMS Wellness Clinic. Anchored in three seamlessly integrated pillars—Travel, Stay, and Scientific Wellness—the concept redefines how a nation can deliver holistic, outcome-driven health experiences.

- Travel: Luxury aviation partnerships, streamlined entry facilitation, and curated collaborations with lifestyle partners—ensuring effortless arrival and a seamless transition into an elevated wellness journey.

- Stay: Curated luxury hospitality designed to immerse guests in restorative comfort and elevated living.

- Scientific Wellness: Technological diagnostics, genomics, and precision-driven longevity programs delivering measurable health transformation.

For more information about The Journey Within, click https://bdmswellness.co/40LNk4v

Hashtag: #BDMSWellnessClinic #สุขภาพที่ดีเริ่มที่การป้องกัน #LiveLongerHealthierHappier #PreventiveMedicine #LifestyleMedicine #ScientificWellness #WellnessHubThailand

![]() https://www.bdmswellness.com/en

https://www.bdmswellness.com/en![]() https://www.linkedin.com/company/bdmswellnessclinic/

https://www.linkedin.com/company/bdmswellnessclinic/![]() https://www.facebook.com/bdmswellnessclinicinternational

https://www.facebook.com/bdmswellnessclinicinternational![]() https://www.instagram.com/bdmswellnessinternational/?hl=en

https://www.instagram.com/bdmswellnessinternational/?hl=en

The issuer is solely responsible for the content of this announcement.

BDMS Wellness Clinic

BDMS Wellness Clinic, a pivotal entity within the Bangkok Dusit Medical Services (BDMS) network—Thailand’s leading operator of private hospitals—embodies a forward-thinking approach to healthcare, prioritizing prevention over cure. Specializing in early detection and prevention of diseases, our clinic offers a holistic suite of services, including advanced dental care and fertility treatments. Leveraging cutting-edge science and technology, BDMS Wellness Clinic not only anticipates future health challenges but also enhances the quality of life, marking its stature as Asia’s premier healthcare facility dedicated to elevating both mental and physical well-being.

For more details:

Facebook: Facebook.com/BDMSWellnessClinic

Instagram: @BDMSWellness

Media Inquiries: Media Inquiries: Please contact Marketing and Communication Department, BDMS Wellness Clinic Co. Ltd.

Chanokphat Pawangkanan 098-369-5963 Email: ch***********@**********ss.com

Sasiwimol Techawanto 092-807-5893 Email: ![]() Sa**********@**********ss.com

Sa**********@**********ss.com

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn