Media OutReach

Bitcoin is now a ‘safe-haven coin’ of the crypto market, Octa broker says

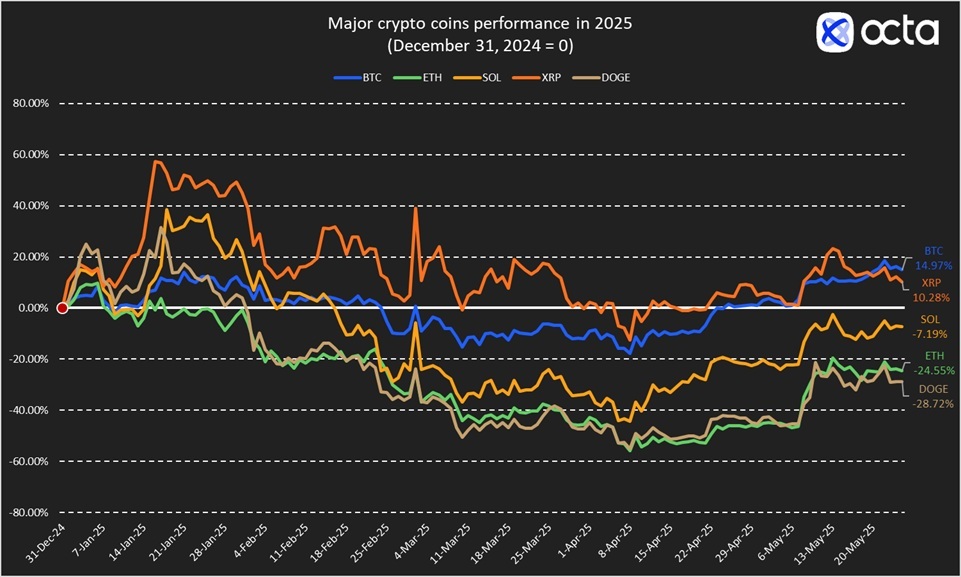

Most recently, Bitcoin has managed to recover and even set a new all-time high, surpassing the critical $110,000 mark on 21 May. At the same time, other crypto majors—notably, Ethereum and XRP—continue to trade substantially below their recent peaks (see the chart below). As capital retreated from riskier altcoins, investor sentiment has soured, prompting Coinbase to warn of an emerging ‘crypto winter’ scenario. Global broker Octa, active in digital asset transactions, sees this as a decisive phase of risk reallocation, with traders seeking clarity before any meaningful return to risk.

Several stress points are converging:

- Venture capital (VC) funding, though up from Q4 2024, remains 50–60% below 2021–22 levels.

- Liquidity conditions are tightening, particularly for smaller projects.

- Macro headwinds—including rising global tariffs and macroeconomic uncertainty—have paralysed risk appetite.

More speculative corners of the market, such as tokens used for Decentralized Physical Infrastructure Networks (DePINs), memecoins and coins used for Artificial Intelligence (AI) agents, have been hardest hit. Their underperformance highlights growing investor caution.

Kar Yong Ang, a financial market analyst at Octa broker, explains: ‘As of right now, the market clearly sees more value in Bitcoin vs the rest of the crypto universe. The global macroeconomic situation is highly unstable, with tariffs drama still unfolding and rising protectionism potentially threatening the U.S. dollar’s reserve currency status. As a result, investors’ capital has migrated from high-risk crypto space like alt-coins into relatively low-risk Bitcoin. In fact, Bitcoin has become a sort of “safe-haven coin” of the crypto market’.

Indeed, broader financial markets have become increasingly concerned about the deteriorating U.S. twin deficits (fiscal and trade), both of which are on an unsustainable trajectory. The yields on the U.S. 20-year government bonds rose above 5.15% on 22 May, almost a two-year high, while the U.S. Dollar Index (DXY) dropped below the critical 100 mark, reflecting eroding confidence in the USD’s safe-haven status. Furthermore, ratings agency Moody’s downgraded the U.S. sovereign rating, one notch down from ‘Aaa’ to ‘Aa1’ due to concerns about the nation’s growing debt. Concurrently, most cryptocurrencies continue to act as high-beta proxies for global sentiment, and in today’s global macroeconomic environment, that sensitivity is proving to be a significant headwind. Tariff disputes between the U.S. and China, macroeconomic uncertainty, and declining equity market performance are all contributing to a reduction in overall risk appetite, thereby negatively impacting most cryptocurrencies. However, Bitcoin appears to be a major exception in this regard.

Kar Yong Ang explains: ‘At first, the BTC rally appeared to be highly speculative: the market had positively reacted to Trump’s softer stance towards the Federal Reserve (Fed) Chairman and U.S.-China trade deal. Later, however, Bitcoin became the only major crypto coin to set a new all-time high. It suggests a continuing flight to perceived safety within the crypto universe, while alt-coin flows remain diminished’.

Still, the ongoing macroeconomic uncertainty and potential failure of the U.S. to resolve its trade tensions with China and the European Union (EU) could act as an immediate catalyst, potentially triggering a renewed bearish phase for Bitcoin. Just recently, U.S. President Donald Trump’s threat to impose 50% tariffs on the EU triggered a classical risk-off move—a sell-off in BTCUSD and a rally in XAUUSD.

Traders and long-term investors should keep a close eye on:

- the total market cap, excluding BTC

- fluctuations in VC funding

- headlines impacting regulatory frameworks in the U.S., EU, and Southeast Asia

- any news related to the ongoing trade disputes and the possibility of trade negotiations.

Tactical patience will be essential this summer. Rushing in to buy Bitcoin now may be unwise, but carefully buying the dips is more reasonable. Key levels to watch are 105,000, 98,000, 94,000, 89,000, and 84,000.

___

Disclaimer: This content is for general informational purposes only and does not constitute investment advice, a recommendation, or an offer to engage in any investment activity. It does not take into account your investment objectives, financial situation, or individual needs. Any action you take based on this content is at your sole discretion and risk. Octa and its affiliates accept no liability for any losses or consequences resulting from reliance on this material.

Trading involves risks and may not be suitable for all investors. Use your expertise wisely and evaluate all associated risks before making an investment decision. Past performance is not a reliable indicator of future results.

Availability of products and services may vary by jurisdiction. Please ensure compliance with your local laws before accessing them.

Hashtag: #Octa

The issuer is solely responsible for the content of this announcement.

Octa

![]() Octa is an international CFD broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools.

Octa is an international CFD broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools.

The company is involved in a comprehensive network of charitable and humanitarian initiatives, including improving educational infrastructure and funding short-notice relief projects to support local communities.

In Southeast Asia, Octa received the ‘Best Trading Platform Malaysia 2024’ and the ‘Most Reliable Broker Asia 2023’ awards from Brands and Business Magazine and International Global Forex Awards, respectively.

Media OutReach

From Wardrobe Staple to 10-Year Icon: XIXILI’s Seamless Panties Get a Colour Update

The Secret to a Decade of Loyalty

A decade of consistent customer trust speaks for itself. XIXILI’s seamless panties have earned a loyal following of women who return to the same style, year after year.

Whether it’s a breathable cotton panty for everyday basics or a sleek seamless style for fitted outfits, comfort remains the priority. The appeal comes down to the essentials: no visible panty lines, no adjusting throughout the day, and lightweight comfort that holds up from morning to night. For women juggling busy schedules, that kind of reliability makes all the difference.

“Our customers tell us these are the panties they don’t have to think about,” says Tara Tan, spokesperson for XIXILI. “They just work. That’s why women keep coming back.”

Designed for Every Body, Built to Last

The Full Coverage Mid-Rise Knitted Boyleg Panty delivers moderate coverage with a relaxed fit, suited for those who want fuss-free comfort. The High-Waist Knitted Boyleg Panty sits higher on the waist with gentle tummy smoothing, a go-to for wearing beneath tailored pieces and fitted silhouettes.

The Lightweight Seamless Microfiber Panty remains the star of the range. Its soft microfiber construction sits flat against the skin, creating an invisible finish under any outfit. A bestseller for ten consecutive years, this fan-favourite now comes in new colours, giving loyal fans a reason to refresh their collection.

The Foundation of Every Outfit

What sits beneath an outfit often sets the tone for the entire day. It’s the layer no one sees but everyone feels, allowing women to move through their routines with confidence, whether at work, running errands, or out with friends.

XIXILI’s decade-long bestseller continues to deliver on that promise. With new colours now available, updating the essentials is as effortless as the panties themselves.

To discover the full panties collection, visit XIXILI’s website to shop online with delivery to Singapore, or find your nearest XIXILI boutique across Malaysia.

Hashtag: #XIXILI #SGLingerie

https://www.xixili-intimates.com/sg/![]() https://www.facebook.com/XIXILI.OfficialFanPage/

https://www.facebook.com/XIXILI.OfficialFanPage/![]() https://www.instagram.com/xixili_intima/

https://www.instagram.com/xixili_intima/![]() https://www.tiktok.com/@xixili_intima?

https://www.tiktok.com/@xixili_intima?![]() https://www.youtube.com/user/xixilipage

https://www.youtube.com/user/xixilipage

The issuer is solely responsible for the content of this announcement.

About XIXILI

A proudly Malaysian brand, XIXILI offers fashion lingerie and shapewear that combines elegance with all-day comfort. With one of the most inclusive sizing ranges between A to I cups and 65 to 110cm band sizes, XIXILI designs for every body type. The brand is known for its expert fitters, premium materials, and dedication to helping women feel confident and supported.

XIXILI is also the first Malaysian lingerie brand to launch a 3D Avatar Try-On Tool, enabling women to virtually try on lingerie tailored to their unique body type and measurements. From everyday basics to occasion-ready pieces, XIXILI celebrates the beauty of real bodies, every day.

Media OutReach

Huawei, Meralco, and SANXING Ningbo Launch Intelligent Distribution Solution and Lighthouse Initiative

Communication, digitalization, and AI: Emerging cornerstones of future power systems that will accelerate the intelligent evolution of distribution networks

David Sun, CEO of Huawei’s Electric Power Digitalization BU, highlighted four drivers for energy transition: green energy and diversity, resilient grids, transparent distribution, and load electrification. He called for policy changes toward dispatch-market coordination. He also emphasized that communication, digitalization, and AI are becoming core production systems, requiring stronger capabilities in digital transformation, cybersecurity, and sustainable development.

At the forum, Mr. Sun unveiled the White Paper on Communication Target Networks for the Future Power System, introducing a pioneering architecture that features an intelligent and robust main network, integrated medium-voltage and transparent low-voltage networks, high-speed secure connectivity, and space-ground integration. The paper also outlines key tech trends, from optical and wireless to carrier and satellite communications, and underscores their transformative value.

Huawei highlighted its focus on intelligence and digitalization, working with industry players to drive power transformation. Global industry leaders also shared their insights: Al’Louise van Deventer (Technology and Engineering General Manager, Eskom) on future-ready digital practices; Momar Awa Sall (Transmission Grid Director, Senelec) on private wireless networks accelerating power modernization; Deniz COSKUN (Deputy General Manager, TEİAŞ) on restructuring communication networks for grid resilience; and Andy Liu (Overseas Solutions and Marketing Director, SANXING Ningbo) on the application of Huawei IDS.

Global industry leaders and partners join to explore the future of power systems

Power distribution networks are evolving from mechanized to automated and intelligent systems, driving technological and business model innovation. Despite creating new challenges for O&M, they have unlocked further opportunities for improving grid reliability and resource allocation.

At the forum, Huawei, Meralco, and SANXING Ningbo, unveiled the IDS that delivers four core capabilities—reliable communication, edge computing, cloud-edge collaboration, and low-voltage transparency—based on a cloud-pipe-edge-pipe-device architecture. It enables an intelligent low-voltage (400 V) distribution network with controllable line loss, visualized distribution rooms, and manageable renewables, transforming fragmented digital silos into open, integrated digital systems. The three companies also announced a lighthouse showcase initiative, sharing replicable and scalable digital transformation best practices.

Advancing digital and intelligent integration for a greener, more reliable grid

Communication, digitalization, and AI are at the heart of future power systems. Huawei will deepen R&D in digital, intelligent technologies, integrating advanced intelligence into power production. Together with global partners, Huawei is committed to developing with the power industry toward greater reliability, stronger security, and a low-carbon future.

Hashtag: #Huawei

The issuer is solely responsible for the content of this announcement.

Media OutReach

Thailand Unveils Public–Private Alliance to Lead Asia’s Wellness Economy Revolution BDMS Wellness Clinic Rises as National Orchestrator of a Science-Powered, Luxury-Integrated Wellness Ecosystem

A Multi-Sector Coalition at Unprecedented Scale

Led and orchestrated by BDMS Wellness Clinic, this alliance represents one of the most holistic cross-industry coalitions in Thailand’s health and tourism landscape. As the central integrator, BDMS Wellness Clinic unites public agencies, aviation leaders, hospitality icons, financial institutions, and global biotechnology innovators into a single, strategically aligned Wellness Ecosystem. Key national partners include the Thailand Convention and Exhibition Bureau (TCEB), Thailand Privilege Card Co., Ltd., and the Thai Spa Association, with regional connectivity strengthened by Bangkok Airways. The luxury and lifestyle dimension features Sri panwa Phuket, CELES SAMUI, Mövenpick BDMS Wellness Resort Bangkok, Dusit Thani Bangkok, King Power Corporation, Siam Piwat Co., Ltd., and Lancôme by L’Oréal Thailand.

Healthcare infrastructure and precision diagnostics are reinforced by National Healthcare Systems (N Health), enabling advanced laboratory networks, cross-border clinical data integration, and continuity of care. This capability is further elevated through collaboration with global medical and biotechnology leaders — Straumann Group in advanced dental innovation, Illumina in genomic sequencing, Abbott in precision diagnostics, and Gene Solutions in next-generation molecular testing.

Through this convergence of genomics, biomarker analytics, regenerative technology, and preventive medicine, BDMS Wellness Clinic delivers data-driven health optimization—from early disease detection and biological age assessment to personalized longevity programs. Together, under BDMS Wellness Clinic’s leadership, these partners form a fully integrated, science-powered ecosystem that transforms preventive care into measurable outcomes—firmly positioning Thailand at the forefront of Asia’s Wellness Economy.

From Healthcare Provider to National Orchestrator

BDMS Wellness Clinic has evolved beyond the traditional role of a healthcare provider to become the strategic integrator of Thailand’s Wellness Ecosystem—serving as the “National Orchestrator” uniting public institutions, private enterprises, academia, and global partners under one coordinated vision. Its mission extends far beyond treatment: to optimize healthspan, precise longevity science, and build a sustainable ecosystem where wellness becomes both a national economic engine and a form of diplomatic soft power. By synchronizing infrastructure, policy, aviation, hospitality, finance, and biotechnology, BDMS Wellness Clinic is repositioning Thailand from a destination known primarily for leisure and elective care into a global epicenter of evidence-based preventive medicine and measurable health optimization.

BDMS Wellness Clinic with Wellness Literacy: The Foundation of Sustainable Global Leadership

Sustainable global leadership demands more than world-class facilities—it requires a new generation of visionaries, scientists, and industry leaders equipped to redefine the future of health. BDMS Wellness Clinic has therefore launched a transformative Wellness Literacy strategy designed to cultivate world-class human capital, elevate professional standards, and shape a knowledge-driven ecosystem that positions Thailand at the forefront of preventive medicine and longevity science in Asia and beyond.

Through strategic alliances with leading institutions—including Thammasat University and King Mongkut’s Institute of Technology Ladkrabang (KMITL) in Thailand, as well as the University of Sharjah (UAE) and Singapore Management University (SMU)—BDMS Wellness Clinic is co-developing advanced curricula in preventive medicine, longevity science, and wellness management. These collaborations are establishing a new Asian benchmark for preventive healthcare education while producing a future-ready workforce for the global wellness economy. Beyond academia, BDMS Wellness Clinic is empowering entrepreneurs and industry operators nationwide, equipping hospitality, spa, and lifestyle businesses with measurable wellness standards—elevating Thailand’s entire value chain to international levels of excellence.

From Thailand to the World: BDMS Wellness Clinic’s Global Wellness Network

Extending its ecosystem beyond national borders, BDMS Wellness Clinic has forged strategic alliances with Neem Hospital—a leading private healthcare institution in the Sultanate of Oman known for its integrated clinical services and patient-centered care—and the MODAWI Platform, a digital health coordination platform that streamlines medical referrals, clinical data exchange, and cross-border care navigation.

Together, these partnerships establish a seamless referral and clinical integration network linking the GCC region with BDMS Wellness Clinic services. By combining hospital-based clinical excellence with digital health infrastructure, the model ensures continuity of care across borders—enabling patients to transition smoothly from initial consultation in the Middle East to advanced diagnostics, genomics, and longevity programs.

The Proof of Concept: “The Journey Within”

The flagship initiative, “The Journey Within,” translates vision into execution—serving as the living blueprint of the Wellness Ecosystem envisioned by BDMS Wellness Clinic. Anchored in three seamlessly integrated pillars—Travel, Stay, and Scientific Wellness—the concept redefines how a nation can deliver holistic, outcome-driven health experiences.

- Travel: Luxury aviation partnerships, streamlined entry facilitation, and curated collaborations with lifestyle partners—ensuring effortless arrival and a seamless transition into an elevated wellness journey.

- Stay: Curated luxury hospitality designed to immerse guests in restorative comfort and elevated living.

- Scientific Wellness: Technological diagnostics, genomics, and precision-driven longevity programs delivering measurable health transformation.

For more information about The Journey Within, click https://bdmswellness.co/40LNk4v

Hashtag: #BDMSWellnessClinic #สุขภาพที่ดีเริ่มที่การป้องกัน #LiveLongerHealthierHappier #PreventiveMedicine #LifestyleMedicine #ScientificWellness #WellnessHubThailand

![]() https://www.bdmswellness.com/en

https://www.bdmswellness.com/en![]() https://www.linkedin.com/company/bdmswellnessclinic/

https://www.linkedin.com/company/bdmswellnessclinic/![]() https://www.facebook.com/bdmswellnessclinicinternational

https://www.facebook.com/bdmswellnessclinicinternational![]() https://www.instagram.com/bdmswellnessinternational/?hl=en

https://www.instagram.com/bdmswellnessinternational/?hl=en

The issuer is solely responsible for the content of this announcement.

BDMS Wellness Clinic

BDMS Wellness Clinic, a pivotal entity within the Bangkok Dusit Medical Services (BDMS) network—Thailand’s leading operator of private hospitals—embodies a forward-thinking approach to healthcare, prioritizing prevention over cure. Specializing in early detection and prevention of diseases, our clinic offers a holistic suite of services, including advanced dental care and fertility treatments. Leveraging cutting-edge science and technology, BDMS Wellness Clinic not only anticipates future health challenges but also enhances the quality of life, marking its stature as Asia’s premier healthcare facility dedicated to elevating both mental and physical well-being.

For more details:

Facebook: Facebook.com/BDMSWellnessClinic

Instagram: @BDMSWellness

Media Inquiries: Media Inquiries: Please contact Marketing and Communication Department, BDMS Wellness Clinic Co. Ltd.

Chanokphat Pawangkanan 098-369-5963 Email: ch***********@**********ss.com

Sasiwimol Techawanto 092-807-5893 Email: ![]() Sa**********@**********ss.com

Sa**********@**********ss.com

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn