Media OutReach

Chubb Life Launches “Health Up” Insurance Plan to Foster a Wellness Lifestyle for the Tech-savvy Generation

Health Up is designed to offer term life coverage and accidental death protection1 with a comprehensive suite of health and wellness offers to customers aged 18 to 55. The annual Premium2 of Health Up is HKD800, around HKD2.19 per day, offering exceptional value to health-conscious individuals.

Upon enrollment, customers will receive exclusive access to a wide range of health and wellness offers, provided by health product and service providers such as Comvita, Doctor’s Choice, EC Healthcare, Eu Yan Sang, JP Partners Medical, Naturo Vita, and Vita Green. These services include medical and hearing checkups, dental scaling, and the opportunity to choose supplements such as cordyceps, chicken essence, probiotics, and immune system boosters.

In addition to promoting better health through diet and exercise, Health Up provides a new approach to fostering a healthy lifestyle through allowing customers to select one health and wellness service each year, tailored to their individual wellness needs.

For the younger, tech-savvy generation seeking a convenient, simple and fast digital application experience, Health Up provides an easy application process through Chubb Life Hong Kong’s digital platform. Starting in March 2025, Chubb introduces an exclusive discount offer with MoneyBack points reward for MoneyBack App members. Members can redeem a unique promo code through the MoneyBack App and make purchases on Chubb’s Health Up webpage to enjoy the offer. As one of the largest loyalty programs “Find It. Earn It. Get MoneyBack” – HK’s most rewarding loyalty platform is at the heart of this initiative in Hong Kong, this initiative aims to enhance traffic and digitally connect our community, and offer exceptional value to health-conscious individuals. There is no requirement for a health examination or financial background check.

Belinda Au, President of Chubb Life Hong Kong and Head of North Asia, said, “We recognise the importance of a comprehensive and holistic approach to personal protection, health, and well-being in today’s environment. With Health Up’s simplicity and seamless online application process, we believe Health Up will encourage our customers to adopt lifestyles that prioritise their personal well-being, and enhance their overall health and wellness.”

To promote a lifestyle focused on preventive protection, members of our Health Up partners3 will benefit from a consistent 30% discount using a special promotion code provided by the partners. Customers are able to access the Health Up webpage via our supporting partner4 s’ channels to take advantage of limited-time 30% discounts available from now to June 30, 2025, followed by a 20% discount starting on July 1, 2025.

Health up is powered by Chubb Studio, the company’s market-leading global digital integration platform, which created a simple and seamless customer journey for Health Up customers. For more details, please visit: https://ap.studio.chubb.com/v2/hk/chubb/healthup/pweb-healthup/en-HK.

Remarks:

1 While the Policy is in force, the Company will pay the Accident Death Benefit if the Insured sustains an injury which directly and solely results in his / her death within 12 months from the date of Accident.

2 Premiums do not include the levy which is collected by the Insurance Authority. The Premium is not guaranteed, and Chubb Life reserves the right to revise or adjust the Premium according to our applicable Premium rate upon each Policy Anniversary, subject to other terms and conditions, if any, as set out in the Policy.

3 Health Up Partners include Comvita, Doctor’s Choice, EC Healthcare, Eu Yan Sang, JP Partners Medical, Naturo Vita, Vita Green.

4 Supporting Partners included ESD Life, foodpanda Hong Kong, HK01, Midland Club, Moneyback, Shopback, Sportsoho and myTV SUPER.

5 This limited-time 30% discount is applicable from April 30 to June 30, 2025. Following the promotional period, a standard 20% discount will be reinstated.

“Disclaimer: **Important Note**: Health Up Insurance Plan is an insurance product underwritten by Chubb Life Insurance Hong Kong Limited (“Chubb Life”). As Watson MoneyBack (HK) Limited (“MBHK”) is not a licensed insurance intermediary. MBHK will not advise nor arrange the purchase of any insurance plan or provide any sales support under The Offer. MBHK Program Members hereby acknowledge and agree that they should not rely on any information, recommendation or advice provided by MBHK in making a purchase decision on Chubb Life’s online platform. MBHK is not in any way holding itself out as an insurance agent nor an insurance intermediary. MBHK is not advising, negotiating, arranging, inviting, inducing or attempting to invite or induce the MB Program Members to enter into an insurance contract or to make an application for an insurance contract. MBHK is not in any way attempting to carry out any regulated activities as defined under the Insurance Ordinance (Cap. 41 of Laws of Hong Kong).”

Hashtag: #Chubb

The issuer is solely responsible for the content of this announcement.

About Chubb

Chubb is a world leader in insurance. With operations in 54 countries and territories, Chubb provides commercial and personal property and casualty insurance, personal accident and supplemental health insurance, reinsurance and life insurance to a diverse group of clients. The company is defined by its extensive product and service offerings, broad distribution capabilities, exceptional financial strength and local operations globally. Parent company Chubb Limited is listed on the New York Stock Exchange (NYSE: CB) and is a component of the S&P 500 index. Chubb employs approximately 43,000 people worldwide. Additional information can be found at: ![]() www.chubb.com.

www.chubb.com.

Media OutReach

Money20/20 Asia Report: APAC Fintech Ecosystem Shifts from Experimentation to Scale as AI and Digital Assets Drive Regional Leadership

Based on insights from over 130 senior fintech leaders, the report highlights an industry moving beyond pilot programs toward enterprise-scale solutions that prioritize collaboration, digital trust, and financial inclusion as core business imperatives for 2026.

Key Findings

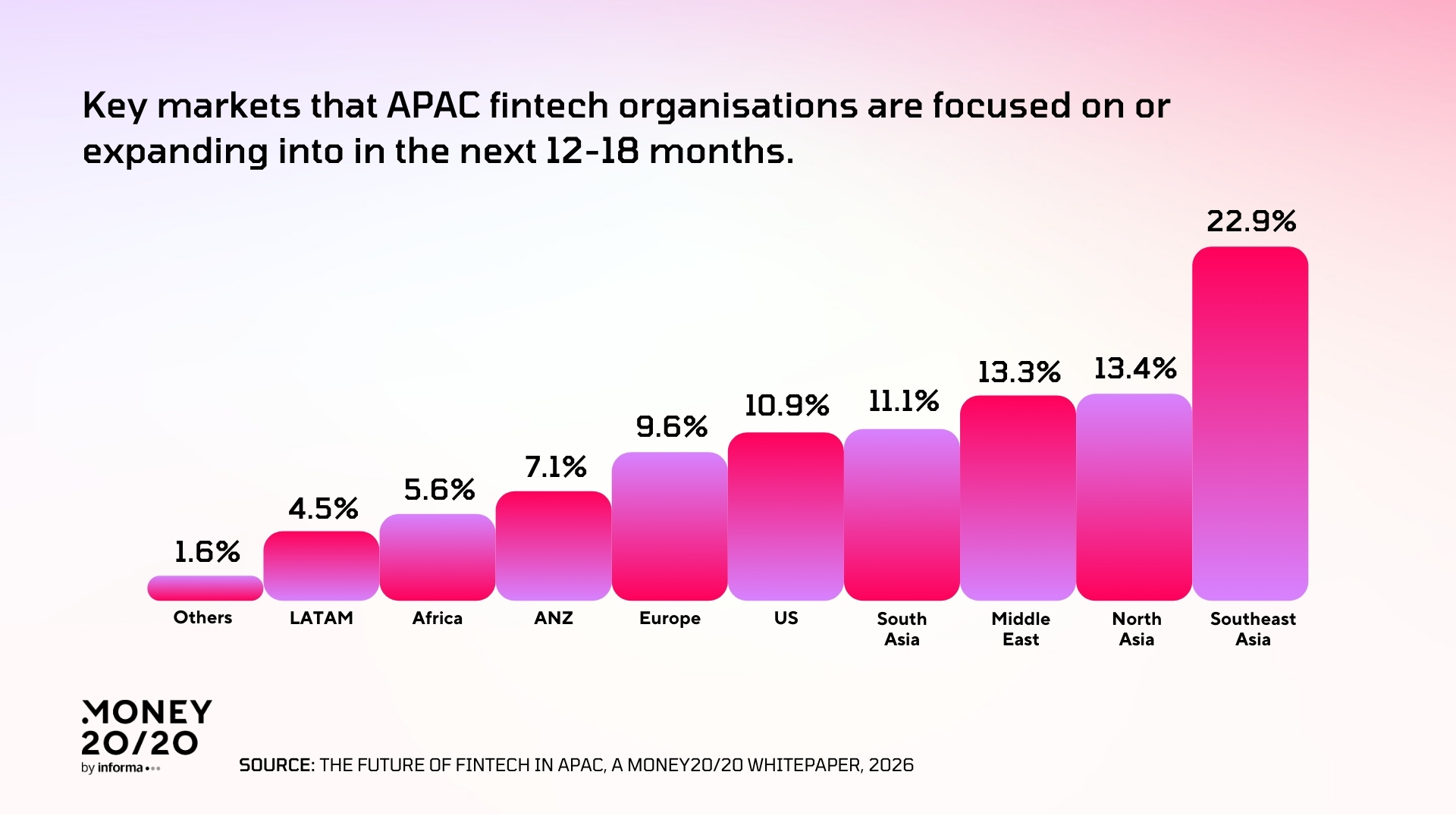

- 22.9% of respondents identify the region as their primary growth target, underscoring its continued dominance as the region’s growth engine.

- 90.6% of executives say social good initiatives are now embedded in corporate strategy — confirming impact has become a commercial imperative.

- 61.2% of organizations have already adopted AI or machine learning.

- New frameworks in Singapore, Hong Kong, and Japan are driving institutional adoption of stablecoins and tokenized assets.

- 63.5% of leaders cite fraud prevention as their highest operational priority.

“APAC is no longer experimenting — it’s executing,” said Ian Fong, VP of Content at Money20/20 Asia. “The region is building financial infrastructure that is faster, safer, and more inclusive than ever before. What happens here will influence the future of money globally.”

Digital Trust Becomes the New Currency

With digital adoption accelerating, 63.5% of leaders identify fraud prevention as their top priority. Regulators and industry players are now pivoting toward real-time risk intelligence and AI-driven security.

“The speed of digital adoption in APAC has outpaced traditional fraud models,” said Justin Lie, Founder & CEO of SHIELD. “What we’re seeing now is a shift toward real-time, device-level intelligence that operates silently in the background. Trust is the new currency of digital finance, and the companies that embed it in every interaction while delivering a frictionless experience will define the future of the industry.”

Stablecoins Move into Mainstream Financial Infrastructure

Institutional engagement with stablecoins and tokenized financial instruments has grown significantly, supported by clearer regulatory frameworks emerging across Singapore, Hong Kong, and Japan.

“Across Asia, stablecoins are already embedded in real economic activity from payments and cross-border settlements to treasury optimization,” said Yam Ki Chan, Vice President, Asia Pacific at Circle. “The region is demonstrating how digital assets can scale within financial systems, and the next phase is about interoperability and the development of an economic operating system for the internet”.

Digital Lending Expands Financial Access

The report highlights 72.9% of respondents believe SME-tailored fintech solutions are key to APAC’s economic growth, signaling a widening opportunity for inclusive financial innovation.

“Financial inclusion isn’t achieved by simply putting products online — it requires building for the realities of everyday consumers,” said Moritz Gastl, General Manager of Tala Philippines. “In markets like the Philippines, trust, transparency, and flexibility matter just as much as credit scoring. Digital lending works when it empowers people, not when it replicates old systems with new interfaces.”

Looking Ahead: Collaboration Will Define the Next Decade

As AI scales, payment rails interconnect, and digital assets enter regulated markets, APAC is emerging as a global blueprint for future financial systems.

“The next wave of fintech innovation will be defined by how well we balance technological advancement with social impact,” added Fong. “APAC markets are proving that financial innovation and inclusion can advance together.”

The Future of Fintech in APAC report can be downloaded HERE.

Hashtag: #Money20/20

The issuer is solely responsible for the content of this announcement.

Media OutReach

Huawei Highlights Digital Inclusion and Conservation Tech as AI Use Accelerates

About 80 guests attended the first day’s forum at the Leonardo Royal Hotel Barcelona Fira. In remarks published by Huawei, Yang Chaobin, CEO of Huawei ICT BG, said the digital divide “seems to be widening further” even as AI accelerates. “High-speed networks and robust computing facilities are essential foundations for an inclusive and sustainable AI era,” he said.

The International Telecommunication Union estimates about 2.2 billion people were still offline in 2025. Dr. Cosmas Zavazava, director of the ITU’s Telecommunication Development Bureau, said inclusion must be treated as a prerequisite for the AI era.

“AI must strengthen meaningful connectivity and support inclusive digital transformation. This requires responsible AI governance, investment in local talent and content, and capacity building, particularly for young girls, women, indigenous communities and marginalized groups.”

Huawei said it has fulfilled a commitment under the ITU Partner2Connect Digital Coalition to help expand connectivity in remote regions. By the end of 2025, the company said its initiatives had supported digital access for 170 million people in rural and underserved areas across more than 80 countries. In a Huawei news release, Jeff Wang, president of Huawei Public Affairs and Communications, said: “To bridge the digital skills gap, Huawei works closely with governments and partners to enhance digital access, deliver skills training, and advance STEM education for underserved communities.”

On March 2, the focus shifted to conservation with a visit to Spain’s Natural Park of Sant Llorenç del Munt i l’Obac. Here, digital monitoring tools are being used to support biodiversity protection, including efforts to safeguard the endangered Bonelli’s eagle alongside better managing potential impacts from outdoor activities like climbing on rock-dwelling birds and caving on protected bat species. The project forms part of the Tech4Nature initiative, developed with the International Union for Conservation of Nature (IUCN) to support digital tools in protected areas across 11 countries.

Sònia Llobet, the park’s director, said the project is helping managers balance visitor access with nature protection.

“As park managers, our challenge is how to make visitor access compatible with the conservation of this natural space,” she said. “This project is helping us answer some of the questions we face in balancing tourism and environmental protection.”

Hashtag: #Huawei

The issuer is solely responsible for the content of this announcement.

Media OutReach

Correcting and Replacing: Infinix NOTE 60 Ultra Ushers in New Premium Era

Thanks to powerful partnerships with industry leaders, NOTE 60 Ultra represents Infinix’s boldest entry in the flagship tier, debuting in Barcelona during MWC 2026

BARCELONA, SPAIN – Media OutReach Newswire – 5 March 2026 – Infinix is cementing its status within the premium smartphone segment in a bold new way with NOTE 60 Ultra, its landmark flagship debuting in Barcelona during Mobile World Congress 2026.

Co-developed with Italian automotive and design legend Pininfarina, NOTE 60 Ultra’s design is driven by an emotion-led aesthetic inspired by super cars. Beneath its bold design lies a fully realized flagship experience, integrating breakthrough in-house innovations with best-in-class partner technologies. A professional-grade 200MP ultra-high-definition imaging system, built-in multi-country satellite communication connectivity, and immersive audio precision-tuned by SOUND BY JBL come together to challenge expectations in the premium segment.

Supercar Design DNA in a Flagship, Shaped by Pininfarina

In the premium segment, the design language is a device’s opening statement. A user’s perception at first glance is shaped by aesthetics, long before a single specification is considered.

Drawing inspiration from the aerodynamic philosophy and pioneering spirit of high-performance sports cars, Infinix, in partnership with Pininfarina, takes a radical departure in sculpting a flagship. What stands out immediately is what’s missing: the camera bump. As premium handsets adopt larger sensors, they often sacrifice form with increasingly protruding camera modules.

True to the sports car heritage, NOTE 60 Ultra introduces a fully integrated, single-body rear: the Aluminum Unibody Design. At the heart of this craftsmanship is the World’s 1st Uni-Chassis Cam Module, formed a single, continuous sheet of CORNING® GORILLA® GLASS VICTUS that virtually conceals the presence of the camera. Much like a supercar sculpted for low-drag, the rear design maintains a smooth, uninterrupted silhouette. This also ensures a natural in-hand feel and unobtrusively slips into any pocket, while reinforcing the phone’s durability and structural integrity.

Paying homage to Italian cultural and racing heritage, NOTE 60 Ultra arrives in four striking colorways: Torino Black, Monza Red, Amalfi Blue, and Roma Silver. Each hue draws inspiration from the most iconic scenes and legends of Italy’s motorsport and cultural history, capturing the spirit of speed, lifestyle, and emotional beauty.

Just as a supercar announces its ignition through sound and light, NOTE 60 Ultra mirrors the ritual. A Floating Taillight signature spans the rear, illuminating as the device powers on. And as a final nod to automotive heritage, NOTE 60 Ultra features an Active Matrix Display reminiscent of a supercar dashboard at startup. Concealed within the rear surface, the hidden display lights up to reveal notifications, expressive icons, or a pixel-style virtual companion.

Dual Flagship Cameras for Detail, Zoom, and True-to-Life Imaging

Although discreet at first glance, Infinix makes no concessions on camera performance and earmarks a new era for Infinix’s imaging capability. Delivering performance on par with industry-leading standards, Infinix’s Dual Flagship Imaging Architecture marks several brand-first breakthroughs and improvements across three dimensions, reinforcing its position as a signature offering.

Under the hood, it’s clear that NOTE 60 Ultra refuses to settle for less. Discreetly integrated within the Uni-Chassis Cam Module is a powerful triple-camera array. Anchored by a next-generation 200MP Samsung ISOCELL HPE sensor, NOTE 60 Ultra delivers ultra-high-definition clarity. And ensuring flagship-grade versatility across focal lengths, the phone is complemented by a 50MP Samsung ISOCELL JN5 periscope telephoto lens and a 112° ultra-wide lens.

However, hardware alone does not define the full experience. For the first time, Infinix supports the XDR display standard with Ultra HDR Capture. Powered by a proprietary XDR Image Engine, Infinix’s advanced system delivers a superior dynamic range, ideal for true-to-life photos of bright lights at night or breathtaking sunset scenes.

The result is exceptional resolution that sets a higher bar for precise framing in daylight or after dark, while faithfully preserving details often lost in standard photography. Whether exploring daytime cityscapes or distant horizons, NOTE 60 Ultra excels with its advanced optical‑to‑digital zoom performance. Crisp, detailed shots are captured across a versatile zoom range, from a 2× optical crop and native 3.5× optical zoom to a 7× lossless digital zoom, extending up to 100× for extreme distances.

Expansive Satellite Calling and Messaging Coverage

Beyond what meets the eye, NOTE 60 Ultra carries a more subtle capability designed to accompany the user’s ambition, as far as and wherever the road leads. NOTE 60 Ultra is the first¹ to introduce dual-way satellite calling with expansive global coverage across a far greater number of countries¹. Powered by two-way messaging and calling beyond traditional terrestrial networks, NOTE 60 Ultra offers an added peace of mind whether navigating remote terrain beyond cellular coverage or facing large-scale network disruptions. The device bridges regional connectivity gaps to maintain communication and enables emergency location sharing when it matters most.

Ultra-Fast, Enduring Functionalities for an All-Around Flagship Experience

NOTE 60 Ultra combines category-leading performance and enduring power to support multi-sensory entertainment without interruption. Complementing this, its latest user experience delivers forward-looking innovations and AI-driven optimizations, making it more accessible and seamless for everyday use.

Impressively, Infinix debuted the Proprietary Battery Self-Healing Technology. Despite featuring a massive 7000mAh silicon-carbon battery within a slim, lightweight frame, NOTE 60 Ultra is engineered to restore up to 1%² of battery health every 200 charge cycles. Complementing this breakthrough, NOTE 60 Ultra supports wired 100W All-Around Fast Charge and 50W wireless charging, achieving a full charge from 1% to 100%² in only 48 minutes through a wired connection.

Even with a massive battery, Infinix pulls out all the stops to optimize for both speed and energy management. Featuring a 4nm all-big-core MediaTek Dimensity 8400 Ultimate chipset together with Infinix’s self-developed performance engine, NOTE 60 Ultra achieves up to 25%² faster multitasking, accelerated app responsiveness, and sustained smoothness.

NOTE 60 Ultra excels in its class with a captivating, 1.5K Ultra HDR cinematic display. Delivering fluid 144Hz responsiveness and exceptional 4500-nit peak brightness, visuals remain vibrant across most lighting conditions. Even in motion, intelligent predictive stabilization minimizes motion sickness, whether watching a film or playing games from within a car. And just as a high-performance vehicle demands calibrated acoustics, NOTE 60 Ultra doesn’t settle for less. It delivers high-fidelity audio through a stereo system with SOUND BY JBL, completing a truly compelling entertainment experience.

The NOTE 60 Ultra’s optimized performance enables its intelligent AI features to run fluidly and efficiently with minimal battery drain. Its integrated AI ecosystem focuses on practical daily-enhancing functions, including real-time vitals tracking via Advanced Health Monitor, personalized file organization and an adaptive AI-powered knowledge base, all evolving with user preferences. These AI capabilities are seamlessly woven into GlowSpace, a new interface debuting on XOS 16.³ Powered by Android 16, GlowSpace introduces a fully reimagined UI centered on fluid motion and luminous details that animate with every interaction.

Through co-engineering with leading technology and innovation partners, Infinix has aligned NOTE 60 Ultra around a unified vision of excellence. The outcome is a benchmark-setting flagship defined not by spectacle, but by deeply integrated and purposeful engineering, inside-out.

Product availability

NOTE 60 Ultra comes with a promise of 3 years of major OS updates and 5 years of security patches.

NOTE 60 Ultra is available in four colors: Torino Black, Monza Red, Amalfi Blue, and Roma Silver.

It will be available in two variants: 12GB + 256GB, 12GB + 512GB, with built-in eSIM⁴.

NOTE 60 Ultra comes with a deluxe gift box with automotive-inspired display stand design. A Supercar-Inspired MagCharge Base in Zinc Alloy, a Kevlar-Pattern MagPad, a Custom Kevlar MagCase, and a Track-Edition SIM Ejector Pin are included in the gift box.

Disclaimer

¹As of launch, this device is the first commercially available smartphone to support two‑way satellite calling across multiple countries. Feature availability, supported regions and coverage are subject to local certification, network deployment and market conditions.

²All data comes from Infinix laboratories. The testing data may vary slightly between different test versions and testing environments.

³The specific XOS upgrade plan for each model will be announced separately. Please note that availability of this upgrade may be limited in certain countries.

⁴eSIM availability is carrier and region-dependent; it may not be supported in all countries.

Hashtag: #Infinix

The issuer is solely responsible for the content of this announcement.

About Infinix

Established in 2013, Infinix is an innovation-driven brand dedicated to delivering cutting-edge technology, bold design, and outstanding performance. The brand provides smart, enjoyable mobile experiences that enhance everyday life. Beyond smartphones, Infinix has expanded its portfolio to include TWS earbuds, smartwatches, laptops, tablets, smart TVs, and more—building a comprehensive ecosystem of smart devices. Currently, Infinix products are available in over 70 countries and regions worldwide, including Africa, Latin America, the Middle East, South Asia, and Southeast Asia.

For more information, please visit: ![]() http://www.infinixmobility.com/

http://www.infinixmobility.com/

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn