Media OutReach

Mainland China’s Luxury Market Poised for Growth: Insights from MDRi’s 2025 Consumer Forecast

Forecast Projected Growth of Chinese Luxury Market in 2025: A Shift Towards Experience, Innovation, Chinese Brands and Sustainability

1. Luxury Lifestyle & Experiences

Appendix

Categories Overview of Chinese consumers (Top 3 brand aware and brand purchased)

Luxury Watch

| China | Hong Kong | ||

| Brand aware | Brand purchased | Brand aware | Brand purchased |

| Cartier ▲2% | Rolex – | Cartier ▲8% | Rolex ▲1% |

| Bulgari ▲2% | Omega ▲1% | Rolex ▲7% | Omega ▲1% |

| Rolex ▲4% | Cartier ▼4% | Omega ▼2% | Longines ▲10% |

Luxury Jewellery

| China | Hong Kong | ||

| Brand aware | Brand purchased | Brand aware | Brand purchased |

| Cartier ▼1% | Cartier ▲1% | Gucci ▲14% | Cartier ▲8% |

| CHANEL – | CHANEL – | Cartier ▲10% | CHANEL ▲8% |

| Bulgari ▲3% | Bulgari ▲2% | CHANEL ▲11% | Gucci ▲3% |

Luxury Fashion

| China | Hong Kong | ||

| Brand aware | Brand purchased | Brand aware | Brand purchased |

| CHANEL ▲5% | CHANEL ▲2% | CHANEL ▲11% | CHANEL ▲5% |

| Balenciaga ▼6% | Balenciaga ▼1% | Balenciaga ▲2% | Balenciaga ▲4% |

| Dior ▲2% | Dior – | Gucci ▲9% | Gucci ▲5% |

Luxury Handbag

| China | Hong Kong | ||

| Brand aware | Brand purchased | Brand aware | Brand purchased |

| CHANEL – | CHANEL ▼2% | Balenciaga ▲4% | CHANEL ▼1% |

| Balenciaga ▼1% | Balenciaga ▼1% | CHANEL ▲9% | Balenciaga ▲1% |

| Dior ▲1% | Dior ▲1% | Hermes ▲12% | Dior ▲6% |

Beauty and Cosmetics

| China | Hong Kong | ||

| Brand aware | Brand purchased | Brand aware | Brand purchased |

| Dior Beauty ▲2% | Estee Lauder ▲7% | Lancôme ▲9% | Shiseido ▲6% |

| Estee Lauder ▲3% | Lancôme ▲1% | Shiseido ▲5% | SKII ▲1% |

| Lancôme ▲4% | Dior Beauty ▲5% | SKII ▲9% | Lancôme ▲1% |

Wine and Spirits

| China | Hong Kong |

| Brand aware | Brand aware |

| Chivas ▲2% | Rémy Martin ▲6% |

| Rémy Martin – | Martell ▲4% |

| Hennessy ▼1% | Hennessy ▲6% |

Consumer preferences of each luxury category

| Luxury Category | Mainland Chinese Preferences | Hong Kong Preferences |

| Watches | – Prefer multifunctional and jewellery watches

– 31% prefer Chinese-made watches – Value brand design |

– Favor simple, everyday styles

– 12% prefer Chinese watches – Consider resale value

|

| – Prioritize craftsmanship | ||

| Jewellery | – Favor yellow gold (55%) and diamonds (52%)

– Value easy recognition |

– Prioritize diamonds (61%)

– Emphasize craftsmanship

|

| – Resale value influences decisions | ||

| Fashion | – Recognize CHANEL and Balenciaga as top brands

– Prioritize quality of materials and comfort |

|

| Handbags | – Prioritize style and aesthetic appeal | – Emphasize brand awareness and material quality |

| Cosmetics | – Prefer international brands

– 55% purchase through e-commerce platforms |

– Favor Japanese brands |

| – Prioritize ingredients and efficacy | ||

| Wine

and Spirits |

– Prefer Chinese Baijiu (56%) and high-end whiskey (56%)

– Values brand awareness and taste |

– Prioritize high-end whiskey (53%) and red wine (45%)

– Values taste and cost-effectiveness |

| – Increases in high-end whiskey purchases | ||

Hashtag: #MDRi #SimonTye #ChinaLuxuryConsumerForecast #Luxury

The issuer is solely responsible for the content of this announcement.

MDRi

Based in Hong Kong and with operations in London and Singapore, MDRi is a leading provider of business insights, empowering organisations with data-driven advice to make informed decisions and drive growth.

Through advanced analytics, industry expertise, and innovative methodologies, MDRi uncovers strategic opportunities, mitigates risks, and helps businesses stay ahead in a rapidly evolving marketplace. With a commitment to excellence and client-centricity, MDRi is revolutionising the way organisations harness insights for success.

The Mishcon de Reya Group

The Mishcon de Reya Group is an independent, international professional services business with law at its heart, employing over 1450 people with over 650 lawyers. It includes the law firm Mishcon de Reya LLP and a collection of leading consultancy businesses that complement the firm’s legal services.

Mishcon de Reya LLP is based in London, Oxford, Cambridge, Singapore and Hong Kong (through its association with Karas So LLP). The firm services an international community of clients and provides advice in situations where the constraints of geography often do not apply. Its work is cross-border, multi-jurisdictional and complex, spanning seven core practice areas: Corporate; Dispute Resolution; Employment; Impact; Innovation; Private; and Real Estate.

The Mishcon de Reya Group includes consultancy businesses MDR Discover, MDR Mayfair (in London, Singapore and Dubai), MDR ONE, MDRi (in Hong Kong) and MDRx. The Group also includes MDR Lab, which invests in the most promising early stage legaltech companies as well as the Mishcon Academy, its in-house place of learning and platform for thought leadership.

Earlier this year, the Group announced its first strategic acquisition in the alternative legal services market, flexible legal resourcing business Flex Legal. It also acquired a majority stake in Somos, a global group actions management business.

Media OutReach

Desert Diamond Hues Take Centre Stage On The Red Carpet At The 79th British Academy Film Awards

In evocative shades of champagne, honey, cognac, brown, and whiskey, these unique colours were seen on some of our most beloved actors and actresses- showcased in an exquisite array of cuts and designs, they blended timeless elegance with contemporary style.

Gillian Anderson, together with Nathalie Emmanuel, led the Desert diamond way with striking diamonds by Brazilian jeweller Ara Vartanian. Gillian woreasymmetric stone earrings featuring exceptional brown and white diamonds with complementing rings, whilst Nathalie wore an elongated drop earrings punctuated with brown diamonds, a bracelet and rings. K-Pop Demon Hunter star Audrey Nuna wore Desert diamond ear climbers from ANANYA.

Once reserved for jewellery boxes, brooches have become a go-to on the red carpet amongst the most decerning of wearers- Rising Star nominee Archie Madekwe paired his custom Dior suit with Ara Vartanian white diamond brooch and Desert diamond vintage rings whilst Regé-Jean Page looked to fauna as his inspiration in a Desert diamond dragonfly brooch by Hirsh London.

Actress and Model Poppy Delevingne attended the British Vogue and GǪ Fashion and Film Party adorned in Desert diamonds by Ara Vartanian.

For the occasion, Poppy chose to wear a curated selection of pieces in Desert diamond hues, included a striking necklace from the new Empirea collection, set with 17.34 carats of brown diamonds.

These extraordinary moments on the red carpet remind us that natural diamonds are born of the wild, their enduring beauty and unique nature express both style and glamour, as well as timelessness and cultural legacy.

#adiamondisforever #naturaldiamonds #diamonds #BAFTA #DesertDiamonds

Hashtag: #DeBeersGroup #NaturalDiamonds #diamonds #Desertdiamonds #BAFTA #adiamondisforever

![]() https://www.debeersgroup.com/

https://www.debeersgroup.com/![]() https://www.linkedin.com/company/debeersgroup/posts/?feedView=all

https://www.linkedin.com/company/debeersgroup/posts/?feedView=all![]() https://www.facebook.com/DeBeersGroupOfCompanies

https://www.facebook.com/DeBeersGroupOfCompanies![]() https://www.instagram.com/debeersgroup/

https://www.instagram.com/debeersgroup/

The issuer is solely responsible for the content of this announcement.

About De Beers Group

Established in 1888, De Beers Group is the world’s leading diamond company with expertise in the exploration, mining, marketing and retailing of diamonds. Together with its joint venture partners, De Beers Group employs more than 20,000 people across the diamond pipeline and is the world’s largest diamond producer by value, with diamond mining operations in Botswana, Canada, Namibia and South Africa. Innovation sits at the heart of De Beers Group’s strategy as it develops a portfolio of offers that span the diamond value chain, including its jewellery houses, De Beers Jewellers and Forevermark, and other pioneering solutions such as diamond sourcing and traceability initiatives Tracr and GemFair. De Beers Group also provides leading services and technology to the diamond industry in the form of education and laboratory services via De Beers Institute of Diamonds and a wide range of diamond sorting, detection and classification technology systems via De Beers Group Ignite. De Beers Group is committed to ‘Building Forever,’ a holistic and integrated approach for creating a better future – where safety, human rights and ethical integrity continue to be paramount; where communities thrive and the environment is protected; and where there are equal

opportunities for all. De Beers Group is a member of the Anglo American PLC group. For further information, visit www.debeersgroup.com.

Media OutReach

Huawei to Announce the Open Source Project of A2A-T Software, Boosting the application of agent communication standards

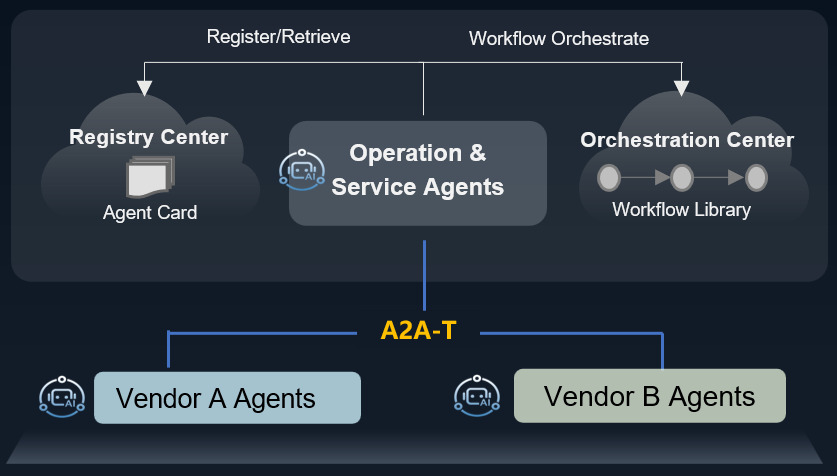

With the rapid development of artificial intelligence, highly Autonomous Networks are becoming a crucial direction for the communications industry, and the importance of industry collaboration is increasingly prominent. To this end, the A2A-T protocol, including the IG1453 beta version and the enhanced prompt meta-model IG1453A, was jointly released by global telecommunications industry partners at the TM Forum Accelerate Week on February 6, 2026. It aims to provide a unified interaction framework for multi-agent collaboration, addressing challenges faced by operators in automated production, such as collaboration efficiency, reliability, and security.

As a standardized agent interaction protocol, A2A-T marks a new stage in agent interaction, unlocking three major industry breakthroughs: a revolutionary improvement in integration efficiency, reducing the system integration cycle from “months” to “days”. Breaking the boundaries of task collaboration to support complex cross-domain, cross-vendor workflows; and accelerating industry ecosystem convergence by lowering interconnection barriers through unified standards, fostering a sustainable collaborative ecosystem.

While standards chart the course for the industry, open source is the optimal path to achieve widespread interoperability and rapid innovation. In line with the evolutionary consensus of the Autonomous Network industry, Huawei is going to open source the core supporting software for the A2A-T protocol, to practically propel this standard from industry consensus to global deployment.

This open source project will encompass key components for implementing the A2A-T protocol, including:

- A2A-T Protocol SDK: Provides integration tools for standardized interaction between agents.

- Registry Center: Enables authentication, addressing, and skill management for multiple agents.

- Orchestration Center: Supports low-code/no-code visual workflow orchestration, with pre-built high-value solution packages.

More detailed information will be officially announced during MWC 2026 at the Global Autonomous Network Industry Summit (14:30~16:00, March 2, 2026, Sofitel Barcelona Skipper Hotel). We cordially invite global industry partners to attend the launch event on-site or follow the project’s progress through online channels, working together to promote the prosperity of the Agentic Internet.

Hashtag: #Huawei

The issuer is solely responsible for the content of this announcement.

Media OutReach

Huawei will release the Agentic Core solution to accelerate the commercial use of agent networks

NE intelligence: As AI agents become a core capability of next-generation AI phones, the number of connected entities will increase tenfold, with connections extending from “humans” to physical AI (such as embodied robots and autonomous driving). This will require the introduction of key capabilities such as digital identity, agent registration and discovery, and A2A session management to build a low-latency, highly reliable network foundation, supporting the large-scale commercial deployment of physical AI.

Network intelligence: As service AI agents become more prevalent, they will generate diverse network experience requirements. For example, AI robots may require 100 Mbit/s bandwidth and 20 ms latency. Therefore, it is necessary to evolve from predefined rule networks to intent-driven networks, where network AI agents will understand the needs of different organizations, dynamically match resources, and implement a closed-loop process for policy generation, configuration, and delivery.

Service intelligence: Compared to OTT players, operators have more opportunities to provide inclusive intelligent services. Huawei supports operators’ service innovation through three key services, going beyond connectivity. AISF (Service Intelligence) will evolve from an interactive entry point to a full-featured personal assistant, integrating communication, content, and services. Communication experiences will shift toward immersive interactions, breaking through the boundaries of voice. The integration of computing and networks will continue to be commercialized, providing sustainable computing power support for AI inference and content generation.

Looking ahead, Huawei will continue to deepen the three-layer intelligent collaboration practice with operators, aiming to provide 7×24-hour inclusive intelligent connectivity, and work together to bring users a more efficient, convenient, and intelligent digital life, and create new value in the intelligent Internet era.

Hashtag: #Huawei

The issuer is solely responsible for the content of this announcement.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn