Media OutReach

Mind the B-Gap: Telcos see a compelling case for digital inclusion powered by cloud technology

New research from CloudMosa shows digital inclusion is shifting from CSR to a core business strategy – and telcos stand to gain if they move quickly

- Majority (97%) of telco leaders say digital inclusion is now central to their business strategy, driven primarily by the need to bridge the digital divide (71%)

- With 92% of respondents seeing a strong alignment with government affordability initiatives as a key benefit of prioritizing digital inclusion

- Despite 2G network phaseouts progressing – with 62% of telcos completing the transition – 40% of Indian consumers still rely on 2G, exposing a critical gap in access

- 93% express confidence in cloud-powered solutions to help close the digital inclusion gap across high-growth markets

HONG KONG SAR – Media OutReach Newswire – 18 June 2025 – Millions of would-be customers remain offline across Asia’s fastest-growing digital economies. This is not a lifestyle choice; it’s because telcos are overlooking them — and a big growth opportunity in the process. In India, Vietnam, and the Philippines alone, over 600 million people still lack affordable access to the internet. CloudMosa, a leading cloud and mobile technology company, today released its inaugural B-Gap Barometer report, exploring the barriers keeping people offline in markets with network access as well as attitudes to potential solutions.

Based on insights from senior telecommunication leaders across the digitally ascending markets of India, Vietnam, and the Philippines, the report maps telcos’ 2G-to-4G migration, identifies persistent barriers to digital inclusion, and outlines how decision-makers are rethinking innovation and business strategies amid network transitions. The research also reveals the shift we’re seeing in digital inclusion becoming a strategic business priority, underscoring affordable access as the next frontier for growth.

“Telcos are racing to the future with 5G, but growth won’t come from the top alone,” said Shioupyn Shen, CEO of CloudMosa. “The real opportunity lies in those being left behind in the migration to 4G and beyond. This report is a call to action for industry leaders: those who move first to bridge the affordability gap will shape the next decade of the industry.”

Rising demands for affordable connectivity

Telcos are now at a crossroads. According to the B-Gap Barometer, 62% of operators across India, Vietnam, and the Philippines have already completed their 2G shutdowns, and another 26% are prepared for migration. Yet, despite the rapid progress in network infrastructure to support 4G, large populations still rely heavily on 2G networks. This is particularly evident in India, where 40% reported that up to half their company’s user base is still on 2G networks.

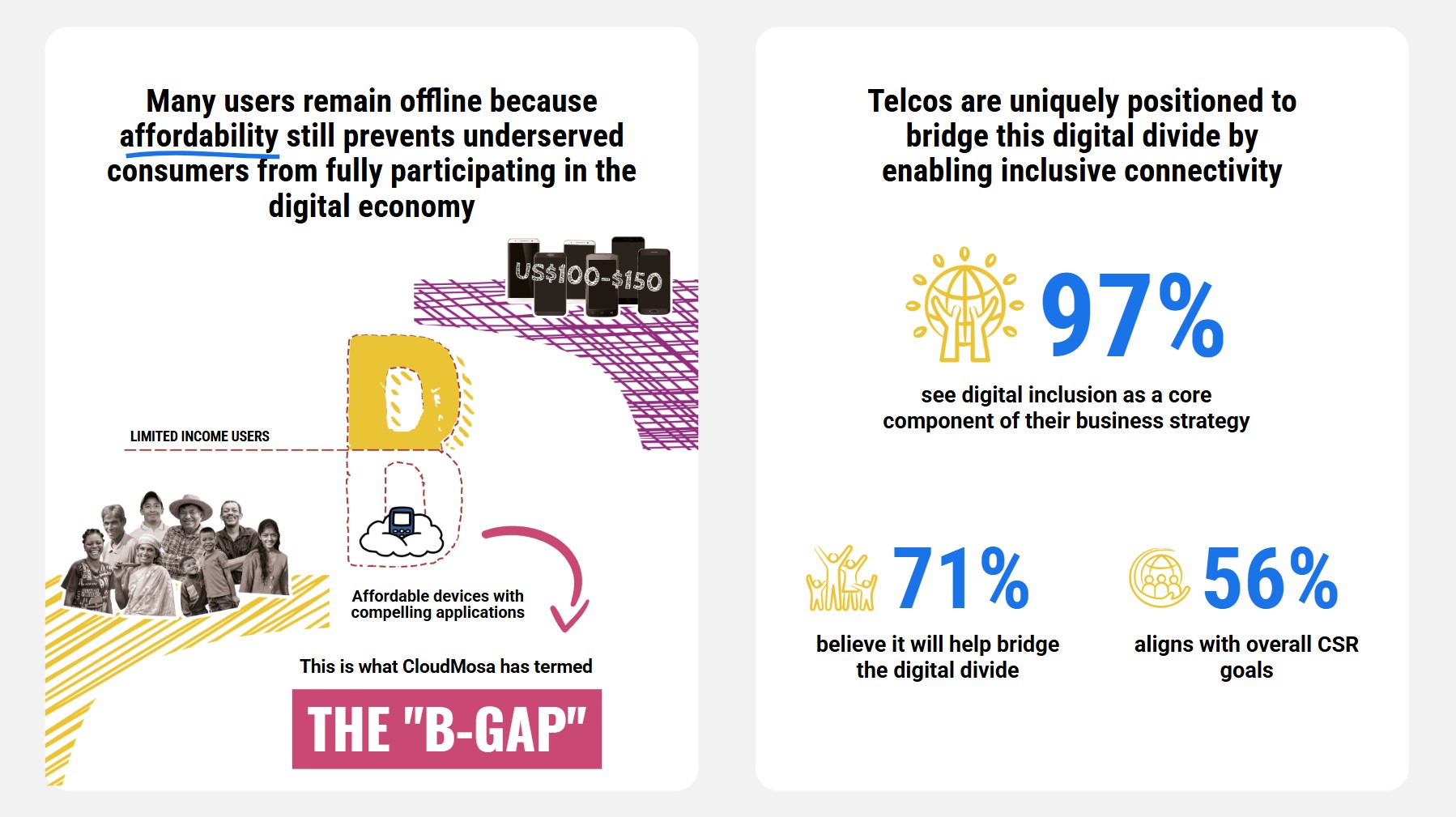

Despite existing network coverage, many users remain offline because affordability still prevents underserved consumers from fully participating in the digital economy – a challenge CloudMosa has termed the “B-Gap”.

In the Philippines, 66% of telco leaders cite costly data plans as consumers’ top barriers in transitioning to 4G and beyond. Vietnam and India follow closely, with 57% and 51% reflecting a similar sentiment. While more users are aiming to upgrade to smartphones – 73% in Vietnam and 62% in the Philippines – many still lean on feature phones given cost limitations. Seventy-five percent of Indian users still prefer traditional feature phones, driven by cost, simplicity, and reliability.

While the rest of the world is rushing towards 5G, these users present the region’s most overlooked commercial opportunity and telcos are uniquely positioned to move them up the value chain to ultimately close this gap. Doing so will unlock revenue, drive education, employment, economic mobility, and social inclusion.

Why inclusion is now a business imperative

As telcos continue to grapple with legacy network costs, stagnant average rate per user, or how to expand to underserved markets, digital inclusion is no longer a CSR initiative. It is becoming a critical commercial strategy to reach more users across digitally ascending markets.

A staggering 97% of industry players across three markets pointed to digital inclusion as a central component of their business strategy, with the biggest driver being bridging the digital divide (71%), followed by aligning with CSR goals (56%). More than half (53%) see inclusion helping with market expansion, customer retention and loyalty. The benefits are multifaceted, but the bottom line is clear: digital inclusion is a business growth engine that telcos can’t afford to ignore.

Driving the future of inclusive connectivity

While tech affordability has long been a challenge, key players are now presented with a solution in the form of cloud-based mobile devices to reach wider communities. Developed by CloudMosa, Cloud Phone is a breakthrough solution that transforms low-cost feature phones into modern, internet-capable devices. By shifting computing and data processing to the cloud, Cloud Phone delivers seamless online experiences that were previously out of reach for users on basic handsets.

In fact, telco leaders feel positively about this technology in helping to bridge the gap for billions of people worldwide that still lack crucial access. Ninety-one percent believe this solution can help close the B-Gap, with another 90% interested in its potential to dramatically improve UX for low-income users. Eighty-five percent have even cited running premium applications on low-cost devices as an attractive feature.

“We’re not just bringing the internet to feature phones — we’re unlocking opportunity for billions,” Shen added. “What we’ve built with Cloud Phone introduces a new growth model for telecom carriers, phone manufacturers and content providers. We want to show the mobile ecosystem how doing good doesn’t need to come at the expense of profitability. Telcos can still achieve commercial success while providing solutions that meet people where they are.”

What’s next: The business playbook for telcos

Traditionally viewed as low revenue customers, 2G feature phone users now represent a significant untapped opportunity. With cloud-based solutions reducing device and data costs, telcos can serve this segment profitably, offering app-based services on feature phones that operate like smartphones.

Solutions such as Cloud Phone offer a high-margin innovation platform to tackle the challenges telcos are facing by unlocking new growth while enabling digital transformation and wider business goals. Along with the right partnerships and business models, telcos can transform inclusion into real impact.

Download the B-Gap Barometer here: https://www.cloudphone.tech/b-gap-barometer.

For more information on CloudMosa, click here for the full press kit.

Hashtag: #CloudMosa

![]() https://www.cloudphone.tech/

https://www.cloudphone.tech/![]() https://www.linkedin.com/company/cloudmosa

https://www.linkedin.com/company/cloudmosa

The issuer is solely responsible for the content of this announcement.

About the B-Gap Barometer Report

About CloudMosa

CloudMosa is a pioneer in providing cloud computing and remote browser solutions for both the consumer and enterprise sectors. For over a decade, CloudMosa has developed products with unparalleled security, speed, and efficiency for its clients. With a suite of offerings powered by its flagship product, Puffin Cloud Avatar Technology, CloudMosa is committed to reshaping the digital landscape and empowering users for a faster, more secure mobile experience. To learn more about CloudMosa’s cloud-powered solutions, visit ![]() https://www.cloudphone.tech/

https://www.cloudphone.tech/

Media OutReach

Cregis to Explore the Next Phase of Digital Finance at Consensus Hong Kong 2026

Attendees can visit Booth 1808 at the Hong Kong Convention and Exhibition Centre to explore Cregis’ infrastructure offerings, including its crypto payment engine, self-custody MPC wallet infrastructure, and enterprise-grade self-custody solutions. According to the team, the event represents not just an industry appearance, but an opportunity to observe and contribute to a deeper question: how crypto assets can meaningfully integrate into real financial systems.

Digital Assets Enter Business Operations

Over the past few years, much of the industry conversation has centered on issuance and trading. But as institutional participation accelerates, the focus is shifting toward a more complex challenge: how digital assets are operated in secure, compliant, and efficient ways.

As financial institutions and payment companies begin using on-chain assets in real business workflows, asset management is no longer just about private key security. It becomes a system-level problem involving multi-party coordination, permission design, auditability, and risk governance.

Against this backdrop, Cregis plans to focus on:

- The security and coordination requirements of enterprise asset management in stablecoin and payment use cases

- How permissions, accountability, and auditability should function across multi-team, multi-system operations

- How automation and intelligent systems are redefining the requirements for underlying asset infrastructure

Stablecoins Move to the Center of Financial Infrastructure

Consensus Hong Kong 2026’s agenda reflects a broader industry shift. Compared with previous years, stablecoin-related discussions have expanded significantly, with the focus moving from whether stablecoins are viable to how they scale.

Topics around cross-border payments, settlement efficiency, liquidity movement, and regulatory frameworks are increasingly seen as the connective layer between crypto-native systems and traditional finance. For many industry participants, this marks a transition: crypto assets are no longer viewed primarily as speculative instruments, but as emerging components of financial circulation infrastructure.

The Debate Has Shifted

Disagreements around the future of crypto adoption remain. But the nature of the debate has changed. At Consensus Hong Kong 2026, the discussion is less about whether crypto will be adopted, and more about:

- What form adoption will take

- Whether infrastructure will become invisible to end users

- Who bears systemic risk, and who defines operational rules

In this context, the maturity of infrastructure is emerging as a key determinant of where the industry goes next.

Observing and Participating in an Inflection Point

The industry is transitioning from “exploring possibilities” to “building durable systems.” The evolving themes at Consensus Hong Kong 2026 are a clear signal of that shift.

As stablecoins, digital assets, and intelligent systems move deeper into real financial and commercial environments, the resilience, controllability, and compliance-readiness of infrastructure will determine how far adoption can go. During the event, Cregis will engage with participants across payments, financial institutions, and Web3, while continuing to focus on the evolution of enterprise digital finance infrastructure.

Cregis aims to provide enterprises with end-to-end digital asset management and operational infrastructure. By building security-first, flexible, and compliance-oriented systems, the company seeks to abstract complex onchain operations into standardized solutions that enterprises can easily integrate and manage — helping institutional clients navigate this industry transition with confidence.

Hashtag: #consensus2026 #cregis #Stablecoins

https://www.cregis.com

Cregis is a global provider of enterprise-grade digital asset infrastructure, delivering secure, scalable, and compliant solutions for institutional clients.

Its core offerings—MPC-based self-custody wallets, Wallet-as-a-Service, and a robust Payment Engine—help exchanges, fintech platforms, and Web3 businesses manage digital assets with confidence.

With over 3,500 businesses served globally, Cregis empowers businesses to accelerate their Web3 transformation and unlock new digital asset opportunities.

Media OutReach

HKCSS Releases Inaugural Data on Caring Business Practices in Hong Kong

3,500 Companies Recognized; Support for Working Caregivers Emerges as New Benchmark for Friendly Workplaces

HONG KONG SAR – Media OutReach Newswire – 22 January 2026 – 22 January 2026 – The Hong Kong Council of Social Service (HKCSS) held the 2024/25 Caring Company Scheme Recognition Ceremony today at the Hong Kong Convention and Exhibition Centre. Mr. Chris SUN Yuk-han, JP, Secretary for Labour and Welfare of the Hong Kong Special Administrative Region, attended as the Guest of Honour. This year, a total of 3,500 caring companies and organisations were recognised.

From left:Hon Grace CHAN Man-yee, Chief Executive Of HKCSS

Mr. CHAN Tsz Ming, Director, Analysts at Level 1, Department of Social Affairs, Liaison Office of the Central People’s Government in the HKSAR

Mr. Chris SUN, JP, Secretary for Labour and Welfare

Revd Canon Hon Peter Douglas KOON Ho Ming, SBS, JP, Chairperson of HKCSS

Mr. CHAN Charnwut, Bernard, GBM, GBS, JP, Vice-chairperson of HKCSS

Ms. CHAK Tung Ching, Yvonne, Vice-chairperson of HKCSS

For the first time, HKCSS released the major findings from the Caring Business Achievements Overview, providing an in-depth look at corporate trends in addressing social issues such as population ageing, workforce challenges, and climate change across four key pillars: Partnership, Social, Economic, and Environmental Sustainability.

Mr. Chris SUN Yuk-han, JP, Secretary for Labour and Welfare of the Hong Kong Special Administrative Region, congratulated the businesses and organizations recognized by the Caring Company Scheme. He emphasized that building a compassionate society requires collaboration with the business community, which plays a vital role alongside government and non-governmental efforts. By prioritizing employee welfare, employers not only uplift families but also drive growth, attract talent, and foster mutual benefits. Mr. SUN called upon the business sector to engage more proactively in this initiative, fostering a collective commitment to building a more caring society for all.

24 Years of Deep-Rooted Partnership: 28% of Collaborations Last 10 Years or More

The Caring Company Scheme has been running for 24 years. The Revd Canon the Hon. Peter Douglas KOON, SBS, JP, Chairman of HKCSS, stated in his speech: “The Scheme underwent a significant revamp recently to localise international sustainability frameworks. Through our inaugural data analysis, we can observe the business sector’s overall performance in tackling challenges like population ageing and climate change. We hope these trends will guide companies to transform a culture of care into concrete business decisions.”

Data indicates that business-social partnerships have built a solid foundation. Over 70% of companies have maintained partnerships with community partners for three years or more, while 28% have sustained collaborations for over a decade, reflecting a commitment to long-term stability in cross-sectoral collaboration.

New Frontier in the Workplace: Support for Working Caregivers Emerges as a Key Focus

Corporate performance in supporting caregivers has become a focal point. Data reveals that over 80% of companiess have popularised flexible work arrangements, and 104 companies received special “Caregiver-Friendly” commendations for their outstanding support measures this year.

Hon Grace CHAN Man-yee, Chief Executive of HKCSS, observed several innovative cases: “Some companies have implemented eight weeks of fully paid adoption leave, five days of leave for only-child caregivers, and even ‘Grandchild Leave’. Others provide patient companion service. Supporting caregivers does not necessarily require massive financial investment; as long as it starts from the employees’ needs, the possibilities for caring business are endless.”

Five Key Recommendations: From “Ad Hoc Actions” to “Policy Integration”

While companies excel in charitable donations and active participation, there is room for improvement in environmental data tracking (currently at approximately 30%) and workplace diversity. Consequently, HKCSS proposes five key recommendations:

- Deepen Caring Standards: Treat the Caring Company Scheme indicators as operational benchmarks to establish a systematic socially responsible business model.

- Promote Professional Sharing and Responsible Procurement: Encourage management to join NGO boards as volunteers to provide professional support and integrate NGO products into corporate procurement supply chains.

- Build Diverse and Inclusive Workplaces: Actively employ disadvantaged groups to tap into new talent pools and implement flexible work to support working caregivers.

- Sustain Investment in Talent Development: Recognize talent as a driver of economic growth, enhance staff training, and strengthen mental health support.

- Initiate Data-Driven Management: We recommend that companies immediately start tracking data related to sustainability performance to ensure that social initiatives are measurable and sustainable.

In 2024/25, the Caring Company Scheme received over 4,300 applications. Ultimately, 3,500 companies and organisations were recognised the Caring Company and Caring Organisation logos, comprising large corporations (42%), SMEs (51%), and organisations (7%). HKCSS emphasised that the data release aims to establish a long-term mechanism to guide the business sector in finding room for improvement and addressing future social challenges through collaboration.

Hashtag: #TheHongKongCouncilofSocialService #HKCSS #theCaringCompanyScheme #Caregiver-Friendly

The issuer is solely responsible for the content of this announcement.

Media OutReach

Strong wealth management and IPO pipelines to underpin Hong Kong bank growth in 2026, says KPMG

Digital assets, artificial intelligence, and cybersecurity top the transformation agenda

HONG KONG SAR – Media OutReach Newswire – 22 January 2026 – Hong Kong’s banking sector enters 2026 from a position of financial strength — well-capitalised, highly liquid, and supported by structural inflows and robust wealth management growth. Despite an evolving macroeconomic and investment environment, the sector remains well-positioned to pursue targeted growth opportunities.

KPMG’s latest report, the Hong Kong Banking Outlook 2026, expects Hong Kong banks to capitalise on the strong wealth management pipeline and a revitalised IPO market, deploying capital where risk-adjusted returns appear most attractive. The report also spotlights the key priorities for the year ahead: advancing digital assets, embracing AI innovation, and fostering closer collaboration between private banks and asset managers to strengthen Hong Kong’s position as a world-leading centre for offshore private wealth management.

Paul McSheaffrey, Senior Banking Partner, Hong Kong SAR, KPMG China, says: “As we enter 2026, KPMG is more optimistic about Hong Kong’s banking sector. The strong performance of Hong Kong’s equity market in 2025 has significantly lifted sentiment. Recent policy initiatives, including efforts to strengthen the city’s fixed-income market and to support Chinese Mainland enterprises in ‘going global’ through Hong Kong, provide further confidence in the future. We expect increased bank investment and hiring to follow.”

Jianing Song, Head of Banking and Capital Markets, Hong Kong SAR, KPMG China, says: “In 2026, AI will evolve from a support tool to a core driver of competitiveness for Hong Kong banks. Banks are increasingly focused on productivity gains, on measuring ROI, and on embedding AI across operations in a way that delivers tangible benefit. In corporate banking, this shift may finally see paper, physical signatures, and batch processing phase out.”

Tokenisation moves beyond proof of concept

Hong Kong is positioning itself as a global leader in digital assets, with banks conducting real-world transactions using tokenised deposits through the Hong Kong Monetary Authority’s Project Ensemble1. A wave of stablecoin licence applications is also underway, and tokenised gold is being issued. Looking ahead to 2026, KPMG expects traditional banks and the digital-asset ecosystem to move closer together. Banks will likely begin offering services such as digital-asset custody and a broader range of tokenised products as the regulatory framework becomes clearer.

Simon Shum, Head of Digital Assets, Hong Kong SAR, KPMG China, says: “The pace of change will only accelerate this year. Banks should focus on building their blockchain expertise, ensuring governance and controls are robust, and staying close to regulatory developments, particularly around AML, cybersecurity and risk management, as the digital asset ecosystem continues to evolve rapidly.”

Rising threats push banks toward automation-led cyber defence

As Hong Kong banks accelerate toward a digital-first future, the cyber threat landscape will remain a critical challenge in 2026. KPMG expects threat actors to increasingly leverage AI and automation to identify vulnerabilities with greater speed and precision, while attacks through third parties and the broader digital ecosystem continue to rise. For banks, this means cyber resilience will become an even more pressing board level priority. The HKMA will continue expectations around technology risk management, clear accountability for cyber risk, and the ability of banks to maintain critical services and recover swiftly when incidents occur.

Lanis Lam, Partner, Technology Risk, KPMG China, says: “As rising cyber risks, evolving technology, and shifting regulatory expectations redefine the landscape, banks in 2026 must strategically prioritise three areas: real-time threat detection, governance of third-party dependencies, and seamless integration between technology, risk, and business functions to drive cohesive and effective responses. Ultimately, automation should be a core enabler of cyber resilience, not just a tool for efficiency but a catalyst for proactive defence and operational agility.”

Hashtag: #KPMG

The issuer is solely responsible for the content of this announcement.

About KPMG

KPMG in China has offices located in 31 cities with over 14,000 partners and staff, in Beijing, Changchun, Changsha, Chengdu, Chongqing, Dalian, Dongguan, Foshan, Fuzhou, Guangzhou, Haikou, Hangzhou, Hefei, Jinan, Nanjing, Nantong, Ningbo, Qingdao, Shanghai, Shenyang, Shenzhen, Suzhou, Taiyuan, Tianjin, Wuhan, Wuxi, Xiamen, Xi’an, Zhengzhou, Hong Kong SAR and Macau SAR. It started operations in Hong Kong in 1945. In 1992, KPMG became the first international accounting network to be granted a joint venture licence in the Chinese Mainland. In 2012, KPMG became the first among the “Big Four” in the Chinese Mainland to convert from a joint venture to a special general partnership.

KPMG is a global organisation of independent professional services firms providing Audit, Tax and Advisory services. KPMG is the brand under which the member firms of KPMG International Limited (“KPMG International”) operate and provide professional services. “KPMG” is used to refer to individual member firms within the KPMG organisation or to one or more member firms collectively.

KPMG firms operate in 138 countries and territories with more than 276,000 partners and employees working in member firms around the world. Each KPMG firm is a legally distinct and separate entity and describes itself as such. Each KPMG member firm is responsible for its own obligations and liabilities.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn