Media OutReach

Prudential launches plan to provide customers with daily income during hospitalisation and recovery

PRUHospital Care360, a hospital income insurance plan, offers additional financial security and peace of mind

SINGAPORE – Media OutReach Newswire – 19 May 2025 – Prudential Singapore (“Prudential”) has launched PRUHospital Care360, a hospital income insurance plan designed to provide financial support to individuals for their unexpected hospital stays and the subsequent recovery period. The plan provides a daily income if the life assured is hospitalised due to illness or injury, as well as lump sum benefits for post-hospitalisation recuperation and day surgery.

Dr Sidharth Kachroo, Chief Health Officer, Prudential Singapore, said: “Most people in Singapore have health insurance, but extended illnesses or injuries can result in periods of time where one cannot work, impacting your income. Unplanned hospitalisations entail additional expenses which are challenging for primary breadwinners with dependents, self-employed individuals and freelancers without fixed income. PRUHospital Care360 can provide individuals with the peace of mind knowing that they will have extra income to pay for unforeseen expenses.”

According to data from the Ministry of Health in Singapore, the average length of stay in public hospitals is about 7 days[1]. Depending on the ward and hospital type, daily charges can range from less than a hundred to a few hundred dollars or more. Hospital income plans give customers the flexibility to use the payouts according to their needs. It can be used to replace income for their daily expenses or cope with non-medical expenses such as caregiver help or home modifications to assist with rehabilitation.

Besides standard benefits like daily hospital income, PRUHospital Care360 is a unique plan that offers additional income for hospital stays due to an accident as well as infectious disease.

In addition, PRUHospital Care360 policyholders can access a range of value-added services with partner healthcare institutions to help them access quality healthcare more seamlessly. These include health screening and vaccination packages, chronic care management programmes, traditional Chinese medicine treatment[2] and teleconsultations to manage their health better.

Added Dr Kachroo: “Healthcare extends beyond coverage, and it is also about enabling people to proactively manage their wellbeing. We offer easy and affordable access to health screening and vaccinations to support preventive care and ongoing health maintenance. This approach contributes to a healthier population, reduces long-term healthcare costs and helps people live well for longer.”

Highlights of PRUHospital Care360:

- Daily Hospital Income Benefit: Daily income for each day of hospitalisation due to an illness or injury, up to the maximum of 500 days for each illness or injury.

- Daily ICU Income Benefit: Daily income for each day of hospitalisation in the Intensive Care Unit (ICU) due to an illness or injury, up to the maximum of 30 days for each illness or injury.

- Daily Accidental Hospital Income Benefit: Daily income for each day of hospitalisation due to an injury, provided that the life assured is hospitalised for at least three days. The benefit is payable up to the maximum of 30 days for each injury.

- Daily Infectious Disease Hospital Income Benefit: Daily income for each day of hospitalisation due to one of the 21 covered infectious diseases, up to the maximum of 30 days for each infectious disease that is diagnosed.

- Homecare Benefit: Lump sum payout to support post-hospitalisation care at home.

- Day Surgery Benefit: Lump sum payout for eligible day surgery procedures.

Customers will only need to answer three health questions to apply for PRUHospital Care360 instead of undergoing the full underwriting process.

For more information on PRUHospital Care360, please refer to:

https://www.prudential.com.sg/phc360.

Hashtag: #Prudential #PRUHospitalCare360

https://www.prudential.com.sg/![]() https://sg.linkedin.com/company/prudential-assurance-company-singapore

https://sg.linkedin.com/company/prudential-assurance-company-singapore![]() https://www.facebook.com/PrudentialSingapore/

https://www.facebook.com/PrudentialSingapore/![]() https://www.instagram.com/prudentialsingapore/?hl=en

https://www.instagram.com/prudentialsingapore/?hl=en

The issuer is solely responsible for the content of this announcement.

About Prudential Assurance Company Singapore (Pte) Ltd (Prudential Singapore)

Prudential Assurance Company Singapore (Pte) Ltd is one of the top life and health insurance companies in Singapore, serving the financial and protection needs of the country’s citizens for 94 years. The company has an AA- Financial Strength Rating from leading credit rating agency Standard & Poor’s, with S$57.7 billion funds under management as at 31 December 2024. It delivers a suite of well-rounded product offerings in Protection, Savings and Investment through multiple distribution channels including a network of more than 5,400 financial representatives.

Media OutReach

Desert Diamond Hues Take Centre Stage On The Red Carpet At The 79th British Academy Film Awards

In evocative shades of champagne, honey, cognac, brown, and whiskey, these unique colours were seen on some of our most beloved actors and actresses- showcased in an exquisite array of cuts and designs, they blended timeless elegance with contemporary style.

Gillian Anderson, together with Nathalie Emmanuel, led the Desert diamond way with striking diamonds by Brazilian jeweller Ara Vartanian. Gillian woreasymmetric stone earrings featuring exceptional brown and white diamonds with complementing rings, whilst Nathalie wore an elongated drop earrings punctuated with brown diamonds, a bracelet and rings. K-Pop Demon Hunter star Audrey Nuna wore Desert diamond ear climbers from ANANYA.

Once reserved for jewellery boxes, brooches have become a go-to on the red carpet amongst the most decerning of wearers- Rising Star nominee Archie Madekwe paired his custom Dior suit with Ara Vartanian white diamond brooch and Desert diamond vintage rings whilst Regé-Jean Page looked to fauna as his inspiration in a Desert diamond dragonfly brooch by Hirsh London.

Actress and Model Poppy Delevingne attended the British Vogue and GǪ Fashion and Film Party adorned in Desert diamonds by Ara Vartanian.

For the occasion, Poppy chose to wear a curated selection of pieces in Desert diamond hues, included a striking necklace from the new Empirea collection, set with 17.34 carats of brown diamonds.

These extraordinary moments on the red carpet remind us that natural diamonds are born of the wild, their enduring beauty and unique nature express both style and glamour, as well as timelessness and cultural legacy.

#adiamondisforever #naturaldiamonds #diamonds #BAFTA #DesertDiamonds

Hashtag: #DeBeersGroup #NaturalDiamonds #diamonds #Desertdiamonds #BAFTA #adiamondisforever

![]() https://www.debeersgroup.com/

https://www.debeersgroup.com/![]() https://www.linkedin.com/company/debeersgroup/posts/?feedView=all

https://www.linkedin.com/company/debeersgroup/posts/?feedView=all![]() https://www.facebook.com/DeBeersGroupOfCompanies

https://www.facebook.com/DeBeersGroupOfCompanies![]() https://www.instagram.com/debeersgroup/

https://www.instagram.com/debeersgroup/

The issuer is solely responsible for the content of this announcement.

About De Beers Group

Established in 1888, De Beers Group is the world’s leading diamond company with expertise in the exploration, mining, marketing and retailing of diamonds. Together with its joint venture partners, De Beers Group employs more than 20,000 people across the diamond pipeline and is the world’s largest diamond producer by value, with diamond mining operations in Botswana, Canada, Namibia and South Africa. Innovation sits at the heart of De Beers Group’s strategy as it develops a portfolio of offers that span the diamond value chain, including its jewellery houses, De Beers Jewellers and Forevermark, and other pioneering solutions such as diamond sourcing and traceability initiatives Tracr and GemFair. De Beers Group also provides leading services and technology to the diamond industry in the form of education and laboratory services via De Beers Institute of Diamonds and a wide range of diamond sorting, detection and classification technology systems via De Beers Group Ignite. De Beers Group is committed to ‘Building Forever,’ a holistic and integrated approach for creating a better future – where safety, human rights and ethical integrity continue to be paramount; where communities thrive and the environment is protected; and where there are equal

opportunities for all. De Beers Group is a member of the Anglo American PLC group. For further information, visit www.debeersgroup.com.

Media OutReach

Huawei to Announce the Open Source Project of A2A-T Software, Boosting the application of agent communication standards

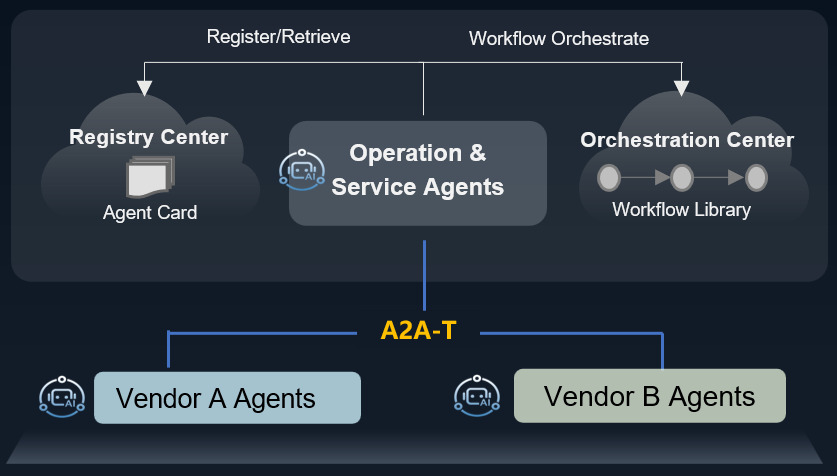

With the rapid development of artificial intelligence, highly Autonomous Networks are becoming a crucial direction for the communications industry, and the importance of industry collaboration is increasingly prominent. To this end, the A2A-T protocol, including the IG1453 beta version and the enhanced prompt meta-model IG1453A, was jointly released by global telecommunications industry partners at the TM Forum Accelerate Week on February 6, 2026. It aims to provide a unified interaction framework for multi-agent collaboration, addressing challenges faced by operators in automated production, such as collaboration efficiency, reliability, and security.

As a standardized agent interaction protocol, A2A-T marks a new stage in agent interaction, unlocking three major industry breakthroughs: a revolutionary improvement in integration efficiency, reducing the system integration cycle from “months” to “days”. Breaking the boundaries of task collaboration to support complex cross-domain, cross-vendor workflows; and accelerating industry ecosystem convergence by lowering interconnection barriers through unified standards, fostering a sustainable collaborative ecosystem.

While standards chart the course for the industry, open source is the optimal path to achieve widespread interoperability and rapid innovation. In line with the evolutionary consensus of the Autonomous Network industry, Huawei is going to open source the core supporting software for the A2A-T protocol, to practically propel this standard from industry consensus to global deployment.

This open source project will encompass key components for implementing the A2A-T protocol, including:

- A2A-T Protocol SDK: Provides integration tools for standardized interaction between agents.

- Registry Center: Enables authentication, addressing, and skill management for multiple agents.

- Orchestration Center: Supports low-code/no-code visual workflow orchestration, with pre-built high-value solution packages.

More detailed information will be officially announced during MWC 2026 at the Global Autonomous Network Industry Summit (14:30~16:00, March 2, 2026, Sofitel Barcelona Skipper Hotel). We cordially invite global industry partners to attend the launch event on-site or follow the project’s progress through online channels, working together to promote the prosperity of the Agentic Internet.

Hashtag: #Huawei

The issuer is solely responsible for the content of this announcement.

Media OutReach

Huawei will release the Agentic Core solution to accelerate the commercial use of agent networks

NE intelligence: As AI agents become a core capability of next-generation AI phones, the number of connected entities will increase tenfold, with connections extending from “humans” to physical AI (such as embodied robots and autonomous driving). This will require the introduction of key capabilities such as digital identity, agent registration and discovery, and A2A session management to build a low-latency, highly reliable network foundation, supporting the large-scale commercial deployment of physical AI.

Network intelligence: As service AI agents become more prevalent, they will generate diverse network experience requirements. For example, AI robots may require 100 Mbit/s bandwidth and 20 ms latency. Therefore, it is necessary to evolve from predefined rule networks to intent-driven networks, where network AI agents will understand the needs of different organizations, dynamically match resources, and implement a closed-loop process for policy generation, configuration, and delivery.

Service intelligence: Compared to OTT players, operators have more opportunities to provide inclusive intelligent services. Huawei supports operators’ service innovation through three key services, going beyond connectivity. AISF (Service Intelligence) will evolve from an interactive entry point to a full-featured personal assistant, integrating communication, content, and services. Communication experiences will shift toward immersive interactions, breaking through the boundaries of voice. The integration of computing and networks will continue to be commercialized, providing sustainable computing power support for AI inference and content generation.

Looking ahead, Huawei will continue to deepen the three-layer intelligent collaboration practice with operators, aiming to provide 7×24-hour inclusive intelligent connectivity, and work together to bring users a more efficient, convenient, and intelligent digital life, and create new value in the intelligent Internet era.

Hashtag: #Huawei

The issuer is solely responsible for the content of this announcement.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn