Media OutReach

Southco’s Blind Mate Floating Mechanism Empowers Efficient Cooling in Data Centers

Driven by global sustainability targets and the need for high-performance, energy-efficient infrastructures, new large data centers must achieve their targeted PUE values, accelerating the industry towards large-scale liquid cooling. However, reliability issues stemming from insufficient mechanical tolerances at the connection points of liquid cooling systems are becoming a critical bottleneck for energy efficiency upgrades and stable operation. Southco recognizes the severity of this challenge and is committed to providing breakthrough solutions.

Minor Deviations, Major Costs

During the large-scale deployment of liquid cooling technology, the reliability of connection interfaces is vital. According to key data from the Open Compute Project (OCP) “Rack-Mounted Manifold Requirements and Verification Guidelines,” a mere 1mm increase in mechanical deviation at liquid cooling interfaces can significantly raise system flow resistance by 15%, leading to a 7% increase in pump energy consumption! This is no trivial amount; in a hyperscale data center with thousands of interfaces, it translates to millions of kilowatt-hours of additional energy consumption and substantial operational costs each year. More concerning is that traditional rigid connection solutions typically offer only ±0.5mm of static tolerance, which proves inadequate in complex real-world environments like these:

- Accumulation of Multi-Dimensional Installation Deviations: In mixed deployment scenarios of widely used EIA-310-D standard racks and advanced ORV3 open architectures, rack installation tolerances can accumulate up to ±3.2mm, far exceeding the limits of traditional solutions.

- Dynamic Vibration Impacts: In ISTA 3-E vibration tests simulating real transportation and operating environments, interface displacement often exceeds 2.8mm, posing significant risks of leaks or connection failures.

- Material Thermal Expansion Effects: Under a typical temperature change of 55°C, copper alloy manifolds can expand approximately 1.2mm per meter, continuously challenging fixed interfaces.

These dynamic, multi-dimensional deviations underline the urgent need for an intelligent, reliable sealing connection solution to ensure the long-term, efficient, and safe operation of liquid cooling systems.

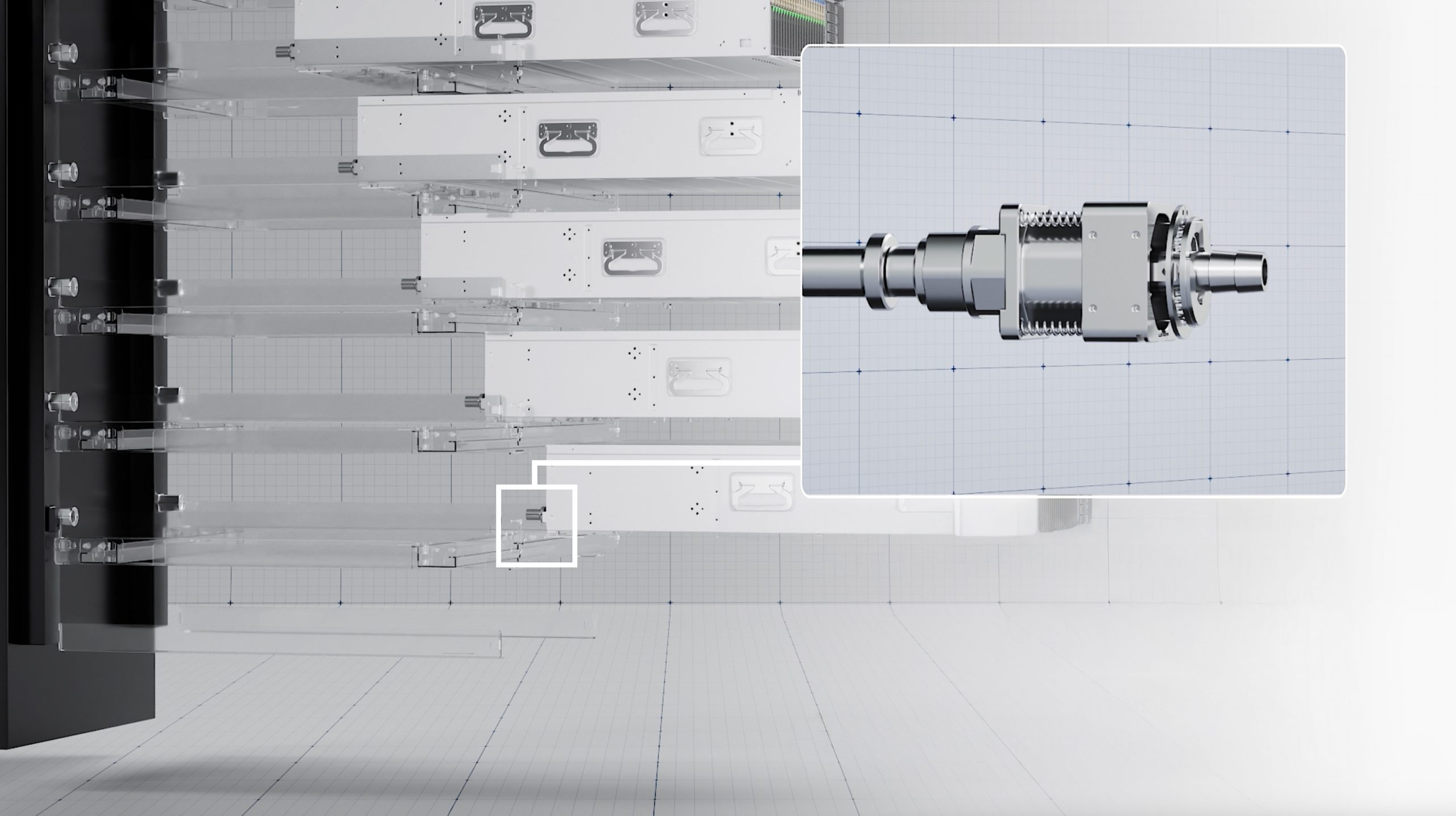

Blind Mate Quick Disconnect: A Connection for a Dynamic World

As a century-old expert in precision engineering, Southco confronts this challenge head-on with the launch of the revolutionary new “Blind Mate Floating Mechanism” liquid cooling connection solution. This innovation is not just a new product; it is a systematic response to profound insight into industry pain points.

Current Status and Trends of Blind Mate Floating Technology

Liquid cooling technology is rapidly gaining traction in high-performance computing (HPC), AI training clusters, and hyperscale data centers. Blind mate technology allows devices to connect without precise visual alignment, making it a core interface solution for rapid deployment and efficient maintenance in liquid cooling systems (especially cold plate systems). The development trends are clear:

- Higher Tolerance Capacity: Adapting to more complex rack environments and dynamic changes is essential.

- Increased Reliability: Zero leakage, long lifespan, and resistance to extreme conditions are basic requirements.

- Intelligent Integration: Integrating sensors for flow, temperature, pressure, etc., for real-time monitoring and predictive maintenance is a future direction.

- Standardization and Compatibility: Supporting OCP ORV3 and other open standards for seamless integration across platforms and manufacturers.

- Lightweight and Compact Design: Meeting the demands of higher density deployments.

Southco’s Blind Mate Floating Mechanism exemplifies innovative design centered around these core trends.

Advantages Over Traditional Solutions

Compared to traditional fixed or simple floating heat transfer connection solutions, Southco’s “Blind Mate Floating Mechanism” offers a qualitative leap with advantages evident across multiple dimensions.

- Three-Dimensional Dynamic Tolerance Control: Southco’s innovative design features a groundbreaking three-dimensional dynamic compensation mechanism: ±4mm of floating tolerance in the radial direction (2° tilt compensation) and 6mm of displacement absorption capacity in the axial direction. This far exceeds common static tolerances in the industry, effectively absorbing and adapting to all previously mentioned installation tolerances, vibration displacements, and thermal expansion deformations.

- Self-Centering Mechanism: When the liquid-cooled blind-plug connector is unplugged, the floating structure automatically resets to the center position, ensuring sufficient floating space for plugging and unplugging operations, fully meeting the strict tolerance requirements of OCP and ORV3 standards.

- Outstanding Sealing Performance for Long-Term Operation: Products endure rigorous ASME B31.3 standard 300psig burst pressure tests, ensuring over 10 years of service life, providing long-term stability for data centers, an achievement traditional solutions cannot match.

- Efficient Maintenance and Significant Cost Reduction: Featuring the Universal Quick Disconnect Blind (UQDB) interface, the design enables genuine “blind operations,” allowing server maintenance without precise alignment or specialized tools. Quick disconnect capabilities make server replacement or upgrades as convenient as “hot plugging,” reducing downtime and related losses by over 90%.

The Necessity of Blind Mate Floating Mechanism

In AI computing clusters and next-generation data centers, adopting advanced connection solutions like Southco’s “Blind Mate Floating Mechanism” is no longer optional, but essential.

- Key to Overcoming Cooling Bottlenecks: High power density is an inevitable trend; traditional cooling and rigid connections can no longer meet the demand. The Blind Mate Floating Mechanism is foundational for unleashing the full potential of liquid cooling and ensuring efficient, stable operation of cooling systems.

- Cornerstone of Business Continuity: The costs of data center downtime are immense. The rapid, reliable thermal maintenance supported by the Blind Mate Floating Mechanism is vital for ensuring uninterrupted operation of critical business activities 24/7.

- Core to Achieving Green and Low-Carbon Goals: Minor deviations in connectors leading to increased flow resistance can significantly elevate pump energy consumption. Its high-tolerance, low-flow resistance design directly contributes to lowering data center PUE values, making it an important element in energy conservation and emissions reduction goals.

- Flexibility for Future Expansion and Upgrading: Modular and standardized design enables data centers to expand capacity and upgrade equipment more flexibly, easily accommodating future increases in computing power demand and technological iterations.

Continuous Innovation, Intelligent Cooling Ahead

According to the “Open Rack V3” white paper, liquid cooling penetration in hyperscale data centers is expected to exceed 40% by 2025. Southco continues to invest in R&D to iterate floating mechanism technology:

* Exploring lightweight high-performance materials (like PPSU thermoplastic) to reduce weight while maintaining strength.

* Advancing intelligent sensor integration for real-time monitoring of key parameters like flow and temperature, providing data for predictive maintenance and energy efficiency optimization.

* Deepening ecosystem collaboration and standardization to promote liquid cooling interfaces in higher density, lower TCO, and broader applications.

As liquid cooling technology transitions from optional to essential, Southco’s “Blind Mate ” represents a precision engineering product innovation, and a profound understanding of cooling challenges in the data center industry. By integrating over a century of precision mechanical design expertise with innovative three-dimensional dynamic tolerance control technology, Southco strives to help global data centers break through cooling bottlenecks, building a more efficient, reliable, and greener foundation for computing power, empowering infinite possibilities in the digital age.

For more information, please click here for more details.

Hashtag: #southco #liquidcooling #EnterpriseComputing #innovations

The issuer is solely responsible for the content of this announcement.

About Southco

Southco, Inc. is the leading global designer and manufacturer of engineered access solutions. From quality and performance to aesthetics and ergonomics, we understand that first impressions are lasting impressions in product design. For over 75 years, Southco has helped the world’s most recognized brands create value for their customers with innovative access solutions designed to enhance the touch points of their products in transportation and industrial applications, medical equipment, data centers and more. With unrivalled engineering resources, innovative products and a dedicated global team, Southco delivers the broadest portfolio of premium access solutions available to equipment designers throughout the world.

Southco Asia Limited

2401, Tower 2, Ever Gain Plaza

88 Container Port Road, Kwai Chung

Hong Kong

Media OutReach

From Wardrobe Staple to 10-Year Icon: XIXILI’s Seamless Panties Get a Colour Update

The Secret to a Decade of Loyalty

A decade of consistent customer trust speaks for itself. XIXILI’s seamless panties have earned a loyal following of women who return to the same style, year after year.

Whether it’s a breathable cotton panty for everyday basics or a sleek seamless style for fitted outfits, comfort remains the priority. The appeal comes down to the essentials: no visible panty lines, no adjusting throughout the day, and lightweight comfort that holds up from morning to night. For women juggling busy schedules, that kind of reliability makes all the difference.

“Our customers tell us these are the panties they don’t have to think about,” says Tara Tan, spokesperson for XIXILI. “They just work. That’s why women keep coming back.”

Designed for Every Body, Built to Last

The Full Coverage Mid-Rise Knitted Boyleg Panty delivers moderate coverage with a relaxed fit, suited for those who want fuss-free comfort. The High-Waist Knitted Boyleg Panty sits higher on the waist with gentle tummy smoothing, a go-to for wearing beneath tailored pieces and fitted silhouettes.

The Lightweight Seamless Microfiber Panty remains the star of the range. Its soft microfiber construction sits flat against the skin, creating an invisible finish under any outfit. A bestseller for ten consecutive years, this fan-favourite now comes in new colours, giving loyal fans a reason to refresh their collection.

The Foundation of Every Outfit

What sits beneath an outfit often sets the tone for the entire day. It’s the layer no one sees but everyone feels, allowing women to move through their routines with confidence, whether at work, running errands, or out with friends.

XIXILI’s decade-long bestseller continues to deliver on that promise. With new colours now available, updating the essentials is as effortless as the panties themselves.

To discover the full panties collection, visit XIXILI’s website to shop online with delivery to Singapore, or find your nearest XIXILI boutique across Malaysia.

Hashtag: #XIXILI #SGLingerie

https://www.xixili-intimates.com/sg/![]() https://www.facebook.com/XIXILI.OfficialFanPage/

https://www.facebook.com/XIXILI.OfficialFanPage/![]() https://www.instagram.com/xixili_intima/

https://www.instagram.com/xixili_intima/![]() https://www.tiktok.com/@xixili_intima?

https://www.tiktok.com/@xixili_intima?![]() https://www.youtube.com/user/xixilipage

https://www.youtube.com/user/xixilipage

The issuer is solely responsible for the content of this announcement.

About XIXILI

A proudly Malaysian brand, XIXILI offers fashion lingerie and shapewear that combines elegance with all-day comfort. With one of the most inclusive sizing ranges between A to I cups and 65 to 110cm band sizes, XIXILI designs for every body type. The brand is known for its expert fitters, premium materials, and dedication to helping women feel confident and supported.

XIXILI is also the first Malaysian lingerie brand to launch a 3D Avatar Try-On Tool, enabling women to virtually try on lingerie tailored to their unique body type and measurements. From everyday basics to occasion-ready pieces, XIXILI celebrates the beauty of real bodies, every day.

Media OutReach

Huawei, Meralco, and SANXING Ningbo Launch Intelligent Distribution Solution and Lighthouse Initiative

Communication, digitalization, and AI: Emerging cornerstones of future power systems that will accelerate the intelligent evolution of distribution networks

David Sun, CEO of Huawei’s Electric Power Digitalization BU, highlighted four drivers for energy transition: green energy and diversity, resilient grids, transparent distribution, and load electrification. He called for policy changes toward dispatch-market coordination. He also emphasized that communication, digitalization, and AI are becoming core production systems, requiring stronger capabilities in digital transformation, cybersecurity, and sustainable development.

At the forum, Mr. Sun unveiled the White Paper on Communication Target Networks for the Future Power System, introducing a pioneering architecture that features an intelligent and robust main network, integrated medium-voltage and transparent low-voltage networks, high-speed secure connectivity, and space-ground integration. The paper also outlines key tech trends, from optical and wireless to carrier and satellite communications, and underscores their transformative value.

Huawei highlighted its focus on intelligence and digitalization, working with industry players to drive power transformation. Global industry leaders also shared their insights: Al’Louise van Deventer (Technology and Engineering General Manager, Eskom) on future-ready digital practices; Momar Awa Sall (Transmission Grid Director, Senelec) on private wireless networks accelerating power modernization; Deniz COSKUN (Deputy General Manager, TEİAŞ) on restructuring communication networks for grid resilience; and Andy Liu (Overseas Solutions and Marketing Director, SANXING Ningbo) on the application of Huawei IDS.

Global industry leaders and partners join to explore the future of power systems

Power distribution networks are evolving from mechanized to automated and intelligent systems, driving technological and business model innovation. Despite creating new challenges for O&M, they have unlocked further opportunities for improving grid reliability and resource allocation.

At the forum, Huawei, Meralco, and SANXING Ningbo, unveiled the IDS that delivers four core capabilities—reliable communication, edge computing, cloud-edge collaboration, and low-voltage transparency—based on a cloud-pipe-edge-pipe-device architecture. It enables an intelligent low-voltage (400 V) distribution network with controllable line loss, visualized distribution rooms, and manageable renewables, transforming fragmented digital silos into open, integrated digital systems. The three companies also announced a lighthouse showcase initiative, sharing replicable and scalable digital transformation best practices.

Advancing digital and intelligent integration for a greener, more reliable grid

Communication, digitalization, and AI are at the heart of future power systems. Huawei will deepen R&D in digital, intelligent technologies, integrating advanced intelligence into power production. Together with global partners, Huawei is committed to developing with the power industry toward greater reliability, stronger security, and a low-carbon future.

Hashtag: #Huawei

The issuer is solely responsible for the content of this announcement.

Media OutReach

Thailand Unveils Public–Private Alliance to Lead Asia’s Wellness Economy Revolution BDMS Wellness Clinic Rises as National Orchestrator of a Science-Powered, Luxury-Integrated Wellness Ecosystem

A Multi-Sector Coalition at Unprecedented Scale

Led and orchestrated by BDMS Wellness Clinic, this alliance represents one of the most holistic cross-industry coalitions in Thailand’s health and tourism landscape. As the central integrator, BDMS Wellness Clinic unites public agencies, aviation leaders, hospitality icons, financial institutions, and global biotechnology innovators into a single, strategically aligned Wellness Ecosystem. Key national partners include the Thailand Convention and Exhibition Bureau (TCEB), Thailand Privilege Card Co., Ltd., and the Thai Spa Association, with regional connectivity strengthened by Bangkok Airways. The luxury and lifestyle dimension features Sri panwa Phuket, CELES SAMUI, Mövenpick BDMS Wellness Resort Bangkok, Dusit Thani Bangkok, King Power Corporation, Siam Piwat Co., Ltd., and Lancôme by L’Oréal Thailand.

Healthcare infrastructure and precision diagnostics are reinforced by National Healthcare Systems (N Health), enabling advanced laboratory networks, cross-border clinical data integration, and continuity of care. This capability is further elevated through collaboration with global medical and biotechnology leaders — Straumann Group in advanced dental innovation, Illumina in genomic sequencing, Abbott in precision diagnostics, and Gene Solutions in next-generation molecular testing.

Through this convergence of genomics, biomarker analytics, regenerative technology, and preventive medicine, BDMS Wellness Clinic delivers data-driven health optimization—from early disease detection and biological age assessment to personalized longevity programs. Together, under BDMS Wellness Clinic’s leadership, these partners form a fully integrated, science-powered ecosystem that transforms preventive care into measurable outcomes—firmly positioning Thailand at the forefront of Asia’s Wellness Economy.

From Healthcare Provider to National Orchestrator

BDMS Wellness Clinic has evolved beyond the traditional role of a healthcare provider to become the strategic integrator of Thailand’s Wellness Ecosystem—serving as the “National Orchestrator” uniting public institutions, private enterprises, academia, and global partners under one coordinated vision. Its mission extends far beyond treatment: to optimize healthspan, precise longevity science, and build a sustainable ecosystem where wellness becomes both a national economic engine and a form of diplomatic soft power. By synchronizing infrastructure, policy, aviation, hospitality, finance, and biotechnology, BDMS Wellness Clinic is repositioning Thailand from a destination known primarily for leisure and elective care into a global epicenter of evidence-based preventive medicine and measurable health optimization.

BDMS Wellness Clinic with Wellness Literacy: The Foundation of Sustainable Global Leadership

Sustainable global leadership demands more than world-class facilities—it requires a new generation of visionaries, scientists, and industry leaders equipped to redefine the future of health. BDMS Wellness Clinic has therefore launched a transformative Wellness Literacy strategy designed to cultivate world-class human capital, elevate professional standards, and shape a knowledge-driven ecosystem that positions Thailand at the forefront of preventive medicine and longevity science in Asia and beyond.

Through strategic alliances with leading institutions—including Thammasat University and King Mongkut’s Institute of Technology Ladkrabang (KMITL) in Thailand, as well as the University of Sharjah (UAE) and Singapore Management University (SMU)—BDMS Wellness Clinic is co-developing advanced curricula in preventive medicine, longevity science, and wellness management. These collaborations are establishing a new Asian benchmark for preventive healthcare education while producing a future-ready workforce for the global wellness economy. Beyond academia, BDMS Wellness Clinic is empowering entrepreneurs and industry operators nationwide, equipping hospitality, spa, and lifestyle businesses with measurable wellness standards—elevating Thailand’s entire value chain to international levels of excellence.

From Thailand to the World: BDMS Wellness Clinic’s Global Wellness Network

Extending its ecosystem beyond national borders, BDMS Wellness Clinic has forged strategic alliances with Neem Hospital—a leading private healthcare institution in the Sultanate of Oman known for its integrated clinical services and patient-centered care—and the MODAWI Platform, a digital health coordination platform that streamlines medical referrals, clinical data exchange, and cross-border care navigation.

Together, these partnerships establish a seamless referral and clinical integration network linking the GCC region with BDMS Wellness Clinic services. By combining hospital-based clinical excellence with digital health infrastructure, the model ensures continuity of care across borders—enabling patients to transition smoothly from initial consultation in the Middle East to advanced diagnostics, genomics, and longevity programs.

The Proof of Concept: “The Journey Within”

The flagship initiative, “The Journey Within,” translates vision into execution—serving as the living blueprint of the Wellness Ecosystem envisioned by BDMS Wellness Clinic. Anchored in three seamlessly integrated pillars—Travel, Stay, and Scientific Wellness—the concept redefines how a nation can deliver holistic, outcome-driven health experiences.

- Travel: Luxury aviation partnerships, streamlined entry facilitation, and curated collaborations with lifestyle partners—ensuring effortless arrival and a seamless transition into an elevated wellness journey.

- Stay: Curated luxury hospitality designed to immerse guests in restorative comfort and elevated living.

- Scientific Wellness: Technological diagnostics, genomics, and precision-driven longevity programs delivering measurable health transformation.

For more information about The Journey Within, click https://bdmswellness.co/40LNk4v

Hashtag: #BDMSWellnessClinic #สุขภาพที่ดีเริ่มที่การป้องกัน #LiveLongerHealthierHappier #PreventiveMedicine #LifestyleMedicine #ScientificWellness #WellnessHubThailand

![]() https://www.bdmswellness.com/en

https://www.bdmswellness.com/en![]() https://www.linkedin.com/company/bdmswellnessclinic/

https://www.linkedin.com/company/bdmswellnessclinic/![]() https://www.facebook.com/bdmswellnessclinicinternational

https://www.facebook.com/bdmswellnessclinicinternational![]() https://www.instagram.com/bdmswellnessinternational/?hl=en

https://www.instagram.com/bdmswellnessinternational/?hl=en

The issuer is solely responsible for the content of this announcement.

BDMS Wellness Clinic

BDMS Wellness Clinic, a pivotal entity within the Bangkok Dusit Medical Services (BDMS) network—Thailand’s leading operator of private hospitals—embodies a forward-thinking approach to healthcare, prioritizing prevention over cure. Specializing in early detection and prevention of diseases, our clinic offers a holistic suite of services, including advanced dental care and fertility treatments. Leveraging cutting-edge science and technology, BDMS Wellness Clinic not only anticipates future health challenges but also enhances the quality of life, marking its stature as Asia’s premier healthcare facility dedicated to elevating both mental and physical well-being.

For more details:

Facebook: Facebook.com/BDMSWellnessClinic

Instagram: @BDMSWellness

Media Inquiries: Media Inquiries: Please contact Marketing and Communication Department, BDMS Wellness Clinic Co. Ltd.

Chanokphat Pawangkanan 098-369-5963 Email: ch***********@**********ss.com

Sasiwimol Techawanto 092-807-5893 Email: ![]() Sa**********@**********ss.com

Sa**********@**********ss.com

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn