By Adedapo Adesanya Nigeria’s financial inclusion goal, which seeks to bring the unbanked into the financial system, hit 64 per cent in 2023 from the 56...

More than half of African citizens, around 95 million people, do not have a traditional bank account. With 57% of the African population currently unbanked, challenges...

In today’s dynamic landscape of global economics and digital innovation, the rise of digital currencies has introduced a new paradigm of financial inclusivity and cross-border collaboration....

By Modupe Gbadeyanka A cost-effective software point-of-sale (SoftPOS) SDK solution has been deployed by Verve and Alcineo to enable merchants to use mobile phones or mobile...

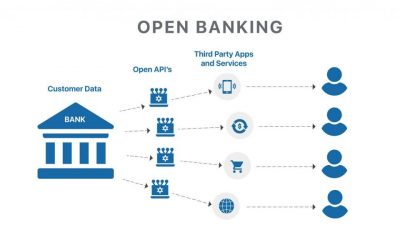

By Adedapo Adesanya The Central Bank of Nigeria (CBN) has approved the operational guidelines to open banking in Nigeria, kickstarting an open banking regime in Nigeria....

By Aduragbemi Omiyale The Director-General of the Securities and Exchange Commission (SEC), Mr Lamido Yuguda, has submitted that it would be impossible for Nigeria to achieve...

Nigeria has been rather slow to adopt the concept of mobile money, but with telecoms giants, MTN and Airtel formally commencing MoMo operations, the sector looks...

In today’s world, making financial services accessible is fast becoming a key area of concern to policymakers for the well-known reason that it has far-reaching economic...

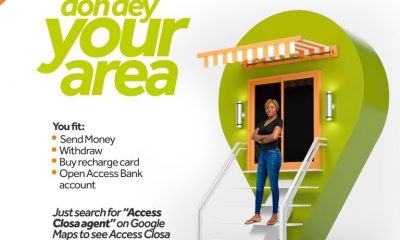

By Modupe Gbadeyanka Tier-one financial institution in Nigeria, Access Bank Plc, is not resting on its oars despite recently hitting a milestone of having 100,000 banking...

By Aduragbemi Omiyale The financial inclusion rate in Nigeria is almost at 70 per cent, the Governor of the Central Bank of Nigeria (CBN), Mr Godwin...