By Aduragbemi Omiyale Money market investors in Nigeria have been assured that despite the current economic challenges, yields will remain high this year. According to analysts...

By Modupe Gbadeyanka The importance of income diversification has been emphasised to salary earners, individuals, self-employed and small business owners by some experts who spoke at...

By Dipo Olowookere The average money market rates depreciated on Thursday by 5.6 percent to settle at 10.14 percent, Business Post reports. This came on the...

By Dipo Olowookere The treasury bills market was bullish on Monday as investors prepare for the sale of the government’s debt instrument via primary market tomorrow....

By Dipo Olowookere On Tuesday, the average treasury bills yields depreciated by 0.07 percent as the market traded positive. A slight demand by investors was observed...

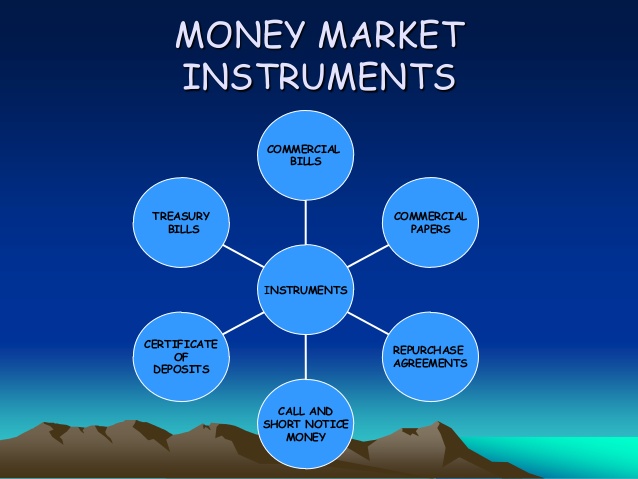

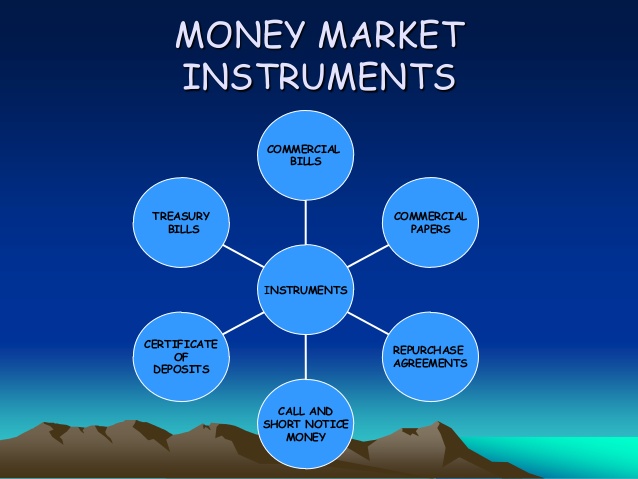

By Modupe Gbadeyanka Securities and Exchange Commission (SEC) has commenced a financial inclusion sensitization campaign aimed to ensure citizens get involved in the money market. The...

By Modupe Gbadeyanka Analysts at FSDH Research have warned that any attempt by the Monetary Policy Committee (MPC) to cut rate at its meeting next week...

By Cowry Asset In the just concluded week, the Nigerian Inter-bank Offered Rate (NIBOR) increased for most of the tenor buckets amid renewed liquidity strain. On...

By Cowry Assets Last week, 282-day bills worth N7 billion matured, however, interbank rates moved in mixed directions across the tenor buckets. NIBOR for overnight funds...