Technology

Comviva Introduces mobiquity Pay X

By Modupe Gbadeyanka

A platform designed to enhance all aspects of digital financial solutions called mobiquity Pay X has been introduced by Comviva, the global leader in mobility solutions.

A statement from Comviva said the new next-generation platform comes with enhanced security, simpler user lifecycle management & experience, among others.

The mobiquity Pay X is said to be completely built on microservices-based architecture with fully independent and reusable components.

The enhanced modularity facilitates faster time to market and greater scalability and has enabled Open APIs to easily integrate with third-party systems and extended financial ecosystem.

To enhance user experience, the platform now offers a revamped slicker mobile app for consumers, agents, merchants and other business users and provides an advanced User Management System (UMS) that allows back-office users to easily manage the complete lifecycle of consumers, agents, merchants, and other business users seamlessly. Its intuitive user interface, predefined templates and real-time feedback help quickly perform operations.

mobiquity® Pay is amongst the world’s largest digital financial services platforms, powering over 70 digital wallets and payment services for 130+ million consumers and processing over 7 billion transactions exceeding $130 billion annually in more than 50 countries.

“COVID has significantly accelerated the growth of digital financial services and the entire financial ecosystem is growing at its fastest pace ever.

“Customer demand and public health priorities are pushing contactless payment adoption and our next generation mobiquity Pay X platform shall help financial service providers scale their digital wallet and payment services faster and seamlessly.

“With this new platform, Comviva has completely automated the software delivery process. The time to market has improved significantly with continuous product development, integration, testing, release and deployment,” the EVP and Chief Growth and Transformation Officer at Comviva, Srinivas Nidugondi, said.

Technology

Google Partners African Universities to Launch WAXAL Speech Dataset

By Modupe Gbadeyanka

A speech dataset designed to catalyze research and build more inclusive Artificial Intelligence (AI) technologies has been launched by Google in partnership with a consortium of leading African research institutions, which are mainly universities.

The main universities involved in the project known as WAXAL are Makerere University in Uganda, the University of Ghana, and Digital Umuganda in Rwanda.

A statement from Google on Monday said the dataset bridges a critical digital divide for over 100 million speakers by providing foundational data for 21 sub-Saharan African languages, including Hausa, Luganda, Yoruba, and Acholi.

While voice-enabled technologies have become common in much of the world, a profound scarcity of high-quality speech data has prevented their development for most of Africa’s over 2,000 languages. This has excluded hundreds of millions of people from accessing technology in their native tongues.

The WAXAL dataset was created to directly address this gap. Developed over three years with funding from Google, the project features 1,250 hours of transcribed, natural speech, and Over 20 hours of high-quality, studio recordings designed for building high-fidelity synthetic voices.

The WAXAL dataset, which is available starting today, covers Acholi, Akan, Dagaare, Dagbani, Dholuo, Ewe, Fante, Fulani (Fula), Hausa, Igbo, Ikposo (Kposo), Kikuyu, Lingala, Luganda, Malagasy, Masaaba, Nyankole, Rukiga, Shona, Soga (Lusoga), Swahili, and Yoruba.

Commenting on the development, the Head of Google Research for Africa, Ms Aisha Walcott-Bryantt, said, “The ultimate impact of WAXAL is the empowerment of people in Africa.

“This dataset provides the critical foundation for students, researchers, and entrepreneurs to build technology on their own terms, in their own languages, finally reaching over 100 million people.

“We look forward to seeing African innovators use this data to create everything from new educational tools to voice-enabled services that create tangible economic opportunities across the continent.”

Also commenting, a Senior Lecturer at Makerere University’s School of Computing and Information Technology, Ms Joyce Nakatumba-Nabende, said, “For AI to have a real impact in Africa, it must speak our languages and understand our contexts.

“The WAXAL dataset gives our researchers the high-quality data they need to build speech technologies that reflect our unique communities. In Uganda, it has already strengthened our local research capacity and supported new student and faculty-led projects.”

An Associate Professor at the University of Ghana, Mr Isaac Wiafe, said, “For us at the University of Ghana, WAXAL’s impact goes beyond the data itself. It has empowered us to build our own language resources and train a new generation of AI researchers.

“Over 7,000 volunteers joined us because they wanted their voices and languages to belong in the digital future.

“Today, that collective effort has sparked an ecosystem of innovation in fields like health, education, and agriculture. This proves that when the data exists, possibility expands everywhere.”

Technology

Nigeria Grows Data Protection Industry to N16.2bn

By Adedapo Adesanya

The Nigeria Data Protection Commission (NDPC) has disclosed that the country’s data protection ecosystem has grown to N16.2 billion within just two years of formal regulation.

The disclosure was made by the chief executive of the data regulating agency, Mr Vincent Olatunji, during a media workshop and capacity-building engagement held in Lagos recently.

He further said the growth reflects rising enforcement, compliance activity, and increasing confidence in Nigeria’s digital governance framework, even though the NDPC was not designed as a revenue-generating agency.

Mr Olatunji explained that regulatory compliance fees and enforcement actions under the Nigeria Data Protection Act (NDPA), 2023, have created significant economic value while also contributing to government revenue and job creation across the country, noting that regulatory fees and sanctions after investigations have contributed over N16.2 billion to federal revenue while supporting an estimated 23,000 jobs nationwide.

“These investigations have resulted in 11 major enforcement actions, including significant financial penalties and corrective directives.”

“The message is clear: violations of data privacy will attract serious consequences, regardless of the size or status of the organisation involved,” Mr Olatunji stated, adding that the commission has concluded 246 investigations into data protection and privacy breaches across multiple sectors, signalling that enforcement will remain central to Nigeria’s data governance strategy.

Business Post reports that NDPC has over the last two years carried some sanctions against some top companies including a N766.2 million fine on MultiChoice Nigeria in July 2025 as well as Fidelity Bank, which was fined N555.8 million in 2024 for processing personal data without informed consent.

The NDPC Commissioner linked the Commission’s enforcement milestones to Nigeria’s broader ambition of building a $1 trillion digital economy.

He stressed that accountability and trust are foundational to digital transformation and long-term investment.

“Privacy enforcement is the foundation of digital confidence. By holding violators accountable, we are safeguarding citizens while creating the secure environment required for innovation, investment and sustainable growth,” he said.

He said the Commission has significantly expanded compliance structures across the economy to support this objective, moving beyond sanctions to system-wide institutional strengthening.

The NDPC has registered 38,677 Data Controllers and Processors of Major Importance, licensed 307 Data Protection Compliance Organisations, and received more than 8,155 Compliance Audit Returns.

In addition, the Commission has issued the General Application and Implementation Directive, which takes effect from September 2025, translated the NDPA into three major Nigerian languages, and launched a multi-sector compliance sweep covering banking, insurance, pensions, and gaming, with 1,348 entities already served with compliance notices.

Technology

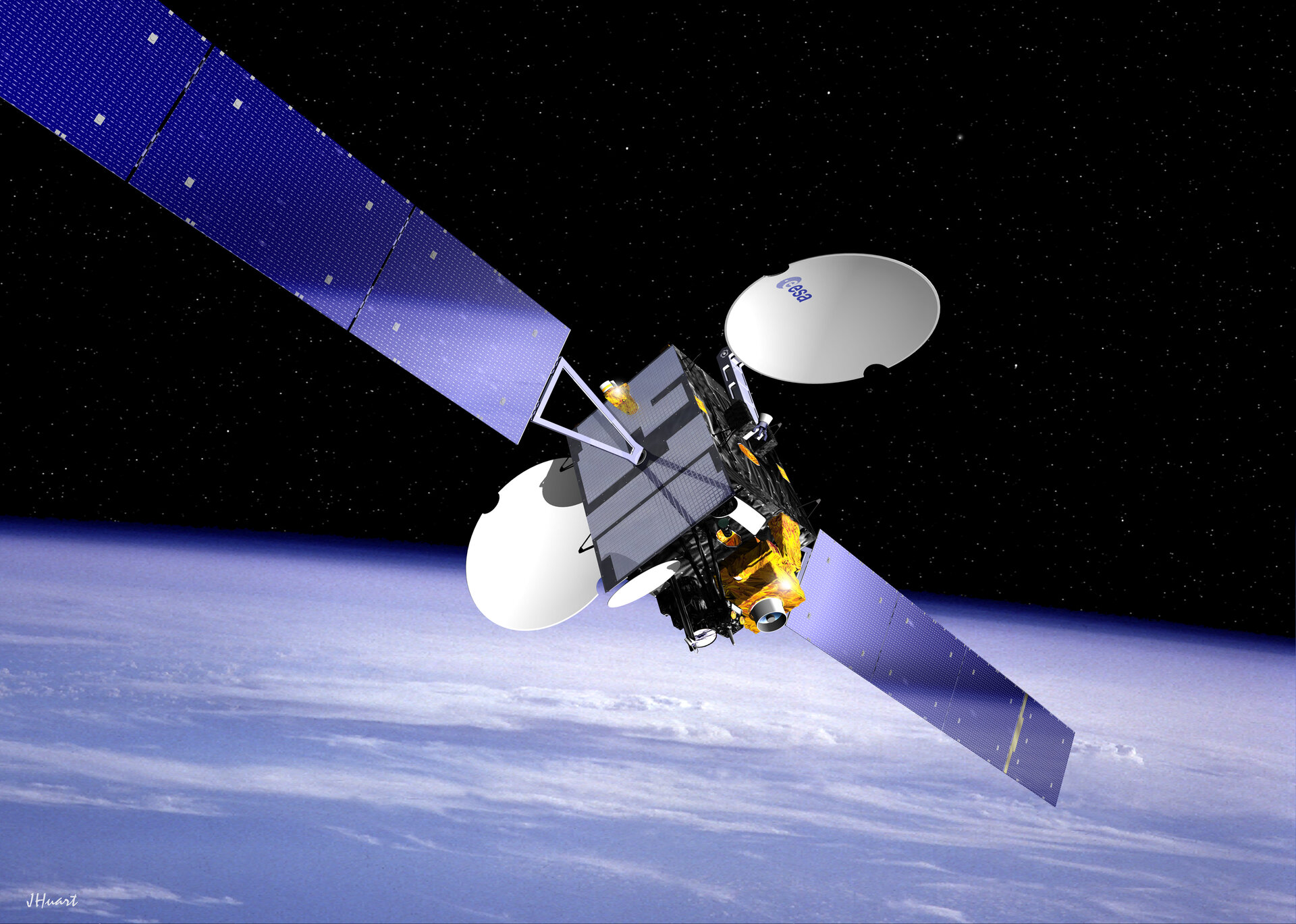

Nigeria to Buy Two New Communication Satellites to Drive Digital Growth

By Adedapo Adesanya

Nigeria will purchase to new communication satellites to boost Nigeria’s digital infrastructure as part of efforts to achieve President Bola Tinubu’s plan to grow the economy to $1 trillion.

The Minister of Communications and Digital Economy, Mr Bosun Tijani, disclosed this on Wednesday in Abuja at a press conference to mark Global Privacy Day 2026, organised by the Nigerian Data Protection Commission (NPDC).

Mr Tijani said the approval marked a significant shift in Nigeria’s digital strategy, noting that the country currently stands out in West Africa for lacking active communication satellites, a gap the new assets are expected to address.

“As you know, Mr President has been very clear about his ambition to build a $1 trillion economy, and digital technology is central to achieving that vision,” adding that, “The President has now approved that we should procure two new satellites. Nigeria today is the only country in West Africa with non-communication satellites. And we have been given the go-ahead to procure two new ones, ensuring that we can use that satellite to connect.”

He also said progress had been made on the Federal Government’s flagship 90,000-kilometre fibre optic backbone project, which is aimed at expanding broadband access across the country. According to the minister, about 60 per cent of the fibre project has been completed, while funding for the remaining work has already been secured.

“The 90,000 kilometres fibre optic project is not a dream. About 60 per cent of the work has already been completed, and the funding for the project is secure. As we bring more Nigerians online, connectivity without protection is incomplete. Privacy is the foundation of trust, safety, and sustainability in the digital world.”

“The success of Nigeria’s digital economy will depend not just on infrastructure and talent, but on trust, and the NDPC remains central to building that trust,” the minister said.

Mr Tijani said the Tinubu administration was positioning digital technology as a key driver of inclusive growth, improved public service delivery, and long-term economic expansion, adding that investments were also being channelled into digital skills, rural connectivity, and institutional reforms.

He stressed that the expansion of connectivity must be matched with stronger data protection, especially as Nigeria’s young and digitally active population continues to grow.

Recall that Nigerian Communications Commission (NCC) recently granted licenses to three global internet service providers – Amazon’s Project Kuiper, BeetleSat-1, and and Germany-based Satelio IoT Services – as part of efforts to strengthen internet connectivity via satellite and to boost competition among existing internet service providers in the country.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn