World

AfDB Mobilizes Funds for Projects Via Integrated Platforms

By Kester Kenn Klomegah

The African Development Bank (AfDB), which sets its primary tasks of contributing to the continent’s economic and social development by providing the necessary concessional funding for projects and programmes, as well as offering and coordinating assistance in capacity-building activities, has now embarked on various post-COVID-19 initiatives throughout the continent, especially in the least developed African countries.

In the latest was the mid-March event where potential investors have examined more than $50 billion of curated bankable projects in key priority sectors identified in the Africa Investment Forum’s 2020 Unified Response to COVID-19 initiative.

The sectors include agriculture and agro-processing; education; energy and climate; healthcare; minerals and mining; information and communications technology and telecommunication; and industrialization and trade. Nine of these projects are women-led, with a potential value of $5 billion.

The AfDB has secured $32.8 billion in investment commitments for projects in Africa. The largest deal secured at the three-day Africa Investment Forum was $15.6 billion for the Lagos-Abidjan mega highway of about 1,200 km (745 miles) will have four to six lanes, connecting West Africa’s two major cities in Nigeria and Ivory Coast, said AfDB President, Mr Akinwumi Adesina.

“Africa is a very bankable continent. We’ve gone through hard times because of the Covid-19 situation but here we are on a rebound,” said Adesina. “Africa is back for investments.” The projects, part of the bank’s Covid-19 response, touch on sectors including agriculture and agro-processing, education, energy and climate, healthcare, minerals and mining, and information and communications technology.

Adesina said that on the health side, projects include a new medical city in Accra, Ghana, a fund for health services for low-income populations in South Africa, and two platforms for manufacturing pharmaceutical products: one in West Africa and one in Kenya.

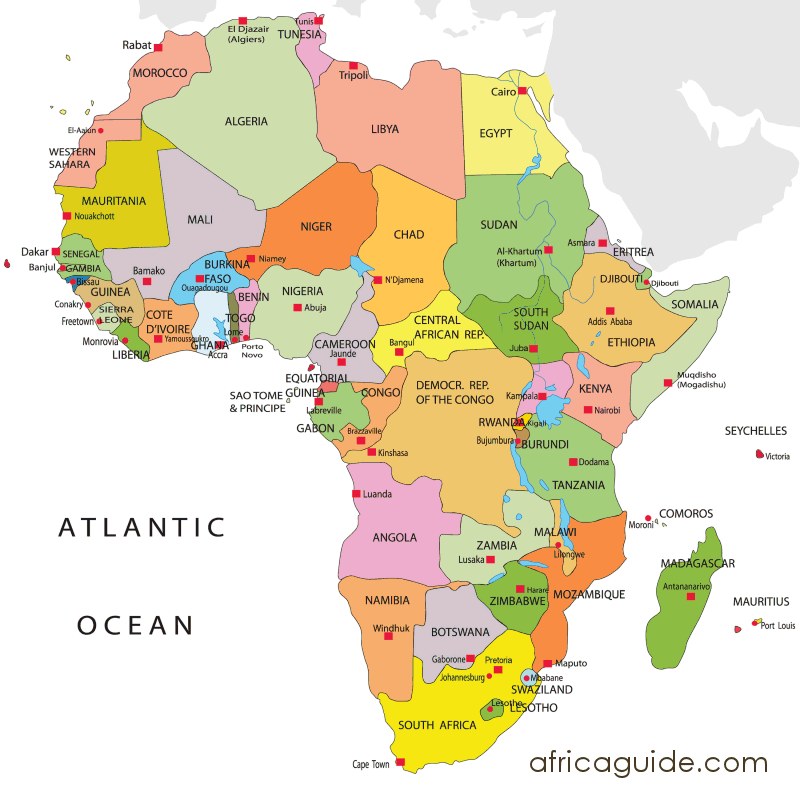

The African Continental Free Trade Area (AfCFTA), launched under the African Union, provides unique and valuable access to an integrated African market of over 1.3 billion people. In practical reality, it aims at creating a continental market for goods and services, with free movement of business people and investments in Africa.

The bank together with health giants has also set eyes on capitalizing on the advantages and conditions to push for healthcare issues. It, as well, is expected to advance the integration of African markets and standards for pharmaceuticals and other goods.

As a result, the Africa Investment Forum is curating several investment-ready transactions that align closely with the three healthcare pillars outlined by the AfDB President.

The investor boardroom sessions feature a $49 million transaction involving the construction of a pharmaceutical and biomedical hub in West Africa. The hub will incorporate a logistics platform, research and development facilities and an academic institution that could serve the region and the wider continent in vaccine manufacturing and drug and medical development.

A second vaccine-related transaction is a $45 million production plant in East Africa, which the World Health Organization (WHO) has pre-qualified. The plant will routinely produce three vaccines, including one for COVID-19.

It was no surprise that the WHO recently announced that Kenya, Senegal, Tunisia, South Africa, Egypt and Nigeria would be the first participants in its mRNA technology transfer hub initiative. The initiative paves the way for the manufacture and licensing of a range of pharmaceuticals in these six countries. It is likely to trigger strong investor interest in Africa’s burgeoning pharmaceutical sector.

The Africa Investment Forum and AfDB have championed two initiatives that are driving trade integration and regulatory harmonization throughout Africa. These are the African Medical Agency and the Africa Continental Free Trade Area.

In order to realize further its set goals, the AfDB has approved funding of $127.8 million to Niger. The funds approved by the Board of Directors of the African Development Fund, the Group’s concessional arm, will be used for a project to open up access to farming and pastoral lands in the east of the country, along its border with Nigeria.

It has also approved a $125.3 million loan to finance the first phase of the Dodoma Resilient and Sustainable Water Development and Sanitation Program in Tanzania.

Specifically, the loan from the African Development Fund will cover the construction of a dam and water treatment plant to address supply challenges in Dodoma City and the towns of Bahi, Chemba and Chamwino.

As a lead partner of the 9th World Water Forum, it plans to earmark more than $5.6 million to support the forum, billed as the world’s largest international water-related gathering. The event will be an opportunity for attendees to gain a deeper insight into how the bank provides technical and financial support to regional member countries to ensure water security for sustainable development in their territories through its Water Development and Sanitation Department.

“As one of the leading financing institutions on the continent with a commitment to the development of Africa’s water and sanitation sectors, it is a natural fit for the African Development Bank to support the Government of Senegal in co-hosting this Forum,” said Beth Dunford, the Bank’s Vice President for Agriculture, Human and Social Development. “Failure is not an option when it comes to mitigating the imbalance between water needs and water availability to boost economic development and stability,” she added.

Last month, for instance, it approved a $1.4 million grant for enhancing private sector engagement and capacity building for refugees and internally displaced persons in fragile areas of northern Mozambique.

The project will be implemented by the global refugee agency UNHCR, collaborating with the Government of Mozambique. The grant is from the Transition Support Facility Pillar III.

Mozambique is host to 28,000 refugees and asylum seekers and over 735,000 people displaced by ongoing violence in Cabo Delgado Province. The majority of the internally displaced people remained in the province. An estimated 69,000 people moved to Nampula, and the remaining moved to the provinces of Niassa, Sofala, and Zambezia.

As the United States and European sanctions broadened due to the “special military operation”, largely directed at “demilitarization” and “denazification” in Ukraine, there are, undoubtedly, terrible impacts on the African economy: increase in the price of gas, oil, agricultural raw materials…et cetera.

There is also some African ambiguity about Russia, with the public seeing Putin as a strongman who would therefore have the right to decide on a country’s future security alliances while being very concerned about their sovereignty.

The Russia-Ukraine crisis that started on February 24, to a considerable extent, has affected a number of African countries. The AfDB plans to raise $1bn (£759m) to support agricultural production in Africa and shield the continent from potential food shortages arising from the Russia-Ukraine crisis.

Agricultural trade between the continent’s countries and Russia and Ukraine is significant. African countries imported $4 billion worth of agricultural products from Russia in 2020.

About 90% of these products were wheat, and 6% were sunflower oil. The main importing countries were Egypt, which accounted for almost half of the imports, followed by Sudan, Nigeria, Tanzania, Algeria, Kenya and South Africa.

The UN also says at least 15 African countries get more than half their wheat from the two warring nations. Somalia, Benin, Egypt and Sudan are the most dependent. “The AfDB sees these increases in prices of wheat, maize and soya beans as potentially going to worsen food insecurity and raise inflation,” Mr Adesina said.

The bank intends to organize a meeting of African finance and agriculture ministers to roll out that plan. Through the fund, AfDB wants to increase the production of wheat rice, maize and soya beans using climate-resilient technologies, including heat-tolerant and drought-tolerant crop varieties. The heat-tolerant wheat variety has already been experienced in Sudan and Ethiopia.

The Africa Investment Forum, launched in 2018, is a multi-stakeholder, multi-disciplinary platform that advances private and public-private partnership projects to bankability. It raises capital and accelerates deals to financial closure.

The Africa Investment Forum is an initiative of the eight founding partners including the African Development Bank; Africa 50; the Africa Finance Corporation; the Africa Export-Import Bank; the Development Bank of Southern Africa; the Trade and Development Bank; the European Investment Bank; and the Islamic Development Bank.

World

Iranian Supreme Leader Ali Khamenei Dies After Air Strikes

By Dipo Olowookere

Iranian Supreme Leader, Mr Ayatollah Ali Khamenei, has died after coordinated airstrikes carried out by the United States and Israel on Tehran on Saturday morning.

His death was confirmed on Sunday morning by Iranian state media, which also disclosed that his daughter and grandchild were among those killed in the bombardment, which destroyed his compound.

Mr Khamenei was killed during a meeting with top leaders of the Middle East country yesterday, including the Defence Minister Amir Nasirzadeh and Revolutionary Guard commander Mohammad Pakpour, who reportedly died too.

His elimination has sparked mixed reactions, with some Iranians on the streets celebrating his demise, and others condemning the joint air strikes.

The President of the United States, Mr Donald Trump, described the late Iranian leader as “one of the most evil people in history,” expressing satisfaction at the action, which he said was “successful,” as it represented justice for both Iranians and Americans.

Meanwhile, Tehran has vowed to further respond to the attacks after initially firing missiles at six neighbours, including Qatar, Saudi Arabia, Kuwait, UAE, Bahrain, and Jordan.

Flight operations in the region have been disrupted because of the retaliatory action of Iran over the weekend, though most of the missiles were intercepted.

World

AfBD, AU Renew Call for Visa-Free Travel to Boost African Economic Growth

By Adedapo Adesanya

The African Development Bank (AfDB) and the African Union have renewed their push for visa-free travel to accelerate Africa’s economic transformation.

The call was reinforced at a High-Level Symposium on Advancing a Visa-Free Africa for Economic Prosperity, where African policymakers, business leaders, and development institutions examined the need for visa-free travel across the continent.

The consensus described the free movement of people as essential to unlocking Africa’s economic transformation under the African Continental Free Trade Area (AfCFTA).

The symposium was co-convened by AfDB and the African Union Commission on the margins of the 39th African Union Summit of Heads of State and Government in Addis Ababa.

The participants framed mobility as the missing link in Africa’s integration agenda, arguing that while tariffs are falling under AfCFTA, restrictive visa regimes continue to limit trade in services, investment flows, tourism, and labour mobility.

On his part, Mr Alex Mubiru, Director General for Eastern Africa at the African Development Bank Group, said that visa-free travel, interoperable digital systems, and integrated markets are practical enablers of enterprise, innovation, and regional value chains to translate policy ambitions into economic activity.

“The evidence is clear. The economics support openness. The human story demands it,” he told participants, urging countries to move from incremental reforms to “transformative change.”

Ms Amma A. Twum-Amoah, Commissioner for Health, Humanitarian Affairs and Social Development at the African Union Commission, called for faster implementation of existing continental frameworks.

She described visa openness as a strategic lever for deepening regional markets and enhancing collective responses to economic and humanitarian crises.

Former AU Commission Chairperson, Ms Nkosazana Dlamini-Zuma, reiterated that free movement is central to the African Union’s long-term development blueprint, Agenda 2063.

“If we accept that we are Africans, then we must be able to move freely across our continent,” she said, urging member states to operationalise initiatives such as the African Passport and the Free Movement of Persons Protocol.

Ghana’s Trade and Industry Minister, Mrs Elizabeth Ofosu-Adjare, shared her country’s experience as an early adopter of open visa policies for African travellers, citing increased business travel, tourism, and investor interest as early dividends of greater openness.

The symposium also reviewed findings from the latest Africa Visa Openness Index, which shows that more than half of intra-African travel still requires visas before departure – seen by participants as a significant drag on intra-continental commerce.

Mr Mesfin Bekele, Chief Executive Officer of Ethiopian Airlines, called for full implementation of the Single African Air Transport Market (SAATM), saying aviation connectivity and visa liberalisation must advance together to enable seamless travel.

Regional representatives, including Mr Elias Magosi, Executive Secretary of the Southern Africa Development Community, emphasised the importance of building trust through border management and digital information-sharing systems.

Ms Gabby Otchere Darko, Executive Chairman of the Africa Prosperity Network, urged governments to support the “Make Africa Borderless Now” campaign, while tourism campaigner Ras Mubarak called for more ratifications of the AU Free Movement of Persons protocol.

Participants concluded that achieving a visa-free Africa will require aligning migration policies, digital identity systems, and border infrastructure, alongside sustained political commitment.

World

Nigeria Exploring Economic Potential in South America, Particularly Brazil

By Kestér Kenn Klomegâh

In this interview, Uche Uzoigwe, Secretary-General of NIDOA-Brazil, discusses the economic potential in South America, particularly Brazil, and investment incentives for Brazilian corporate partners for the Federal Republic of Nigeria (FRN). Follow the discussion here:

How would you assess the economic potential in the South American region, particularly Brazil, for the Federal Republic of Nigeria? What investment incentives does Nigeria have for potential corporate partners from Brazil?

As the Secretary of NIDOA Brazil, my response to the questions regarding the economic potentials in South America, particularly Brazil, and investment incentives for Brazilian corporate partners would be as follows:

Brazil, as the largest economy in South America, presents significant opportunities for the Federal Republic of Nigeria. The country’s diverse economy is characterised by key sectors such as agriculture, mining, energy, and technology. Here are some factors to consider:

- Natural Resources: Brazil is rich in natural resources like iron ore, soybeans, and biofuels, which can be beneficial to Nigeria in terms of trade and resource exchange.

- Growing Agricultural Sector: With a well-established agricultural sector, Brazil offers potential collaboration in agri-tech and food security initiatives, which align with Nigeria’s goals for agricultural development.

- Market Size: Brazil boasts a large consumer market with a growing middle class. This represents opportunities for Nigerian businesses looking to export goods and services to new markets.

- Investment in Infrastructure: Brazil has made significant investments in infrastructure, which could create opportunities for Nigerian firms in construction, engineering, and technology sectors.

- Cultural and Economic Ties: There are historical and cultural ties between Nigeria and Brazil, especially considering the African diaspora in Brazil. This can facilitate easier business partnerships and collaborations.

In terms of investment incentives for potential corporate partners from Brazil, Nigeria offers several attractive incentives for Brazilian corporate partners, including:

- Tax Incentives: Various tax holidays and concessions are available under the Nigerian government’s investment promotion laws, particularly in key sectors like agriculture, manufacturing, and technology.

- Repatriation of Profits: Brazil-based companies investing in Nigeria can repatriate profits without restrictions, thus enhancing their financial viability.

- Access to the African Market: Investment in Nigeria allows Brazilian companies to access the broader African market, benefiting from Nigeria’s membership in regional trade agreements such as ECOWAS.

- Free Trade Zones: Nigeria has established free trade zones that offer companies the chance to operate with reduced tariffs and fewer regulatory burdens.

- Support for Innovation: The Nigerian government encourages innovation and technology transfer, making it attractive for Brazilian firms in the tech sector to collaborate, particularly in fintech and agriculture technology.

- Collaborative Ventures: Opportunities exist for joint ventures with local firms, leveraging local knowledge and networks to navigate the business landscape effectively.

In conclusion, fostering a collaborative relationship between Nigeria and Brazil can unlock numerous economic opportunities, leading to mutual growth and development in various sectors. We welcome potential Brazilian investors to explore these opportunities and contribute to our shared economic goals.

In terms of this economic cooperation and trade, what would you say are the current practical achievements, with supporting strategies and systemic engagement from NIDOA?

As the Secretary of NIDOA Brazil, I would highlight the current practical achievements in economic cooperation and trade between Nigeria and Brazil, alongside the supporting strategies and systemic engagement from NIDOA.

Here are some key points:

Current Practical Achievements

- Increased Bilateral Trade: There has been a notable increase in bilateral trade volume between Nigeria and Brazil, particularly in sectors such as agriculture, textiles, and technology. Recent trade agreements and discussions have facilitated smoother trade relations.

- Joint Ventures and Partnerships: Successful joint ventures have been established between Brazilian and Nigerian companies, particularly in agriculture (e.g., collaboration in soybean production and agricultural technology) and energy (renewables, oil, and gas), demonstrating commitment to mutual development.

- Investment in Infrastructure Development: Brazilian construction firms have been involved in key infrastructure projects in Nigeria, contributing to building roads, bridges, and facilities that enhance connectivity and economic activity.

- Cultural and Educational Exchange Programs: Programs facilitating educational exchange and cultural cooperation have led to strengthened ties. Brazilian universities have partnered with Nigerian institutions to promote knowledge transfer in various fields, including science, technology, and arts.

Supporting Strategies

- Strategic Trade Dialogue: NIDOA has initiated regular dialogues between trade ministries of both nations to discuss trade barriers, potential markets, and cooperative opportunities, ensuring both countries are aligned in their economic goals.

- Investment Promotion Initiatives: Targeted initiatives have been established to promote Brazil as an investment destination for Nigerian businesses and vice versa. This includes showcasing success stories at international trade fairs and business forums.

- Capacity Building and Technical Assistance: NIDOA has offered capacity-building programs focused on enhancing Nigeria’s capabilities in agriculture and technology, leveraging Brazil’s expertise and sustainable practices.

- Policy Advocacy: Continuous advocacy for favourable trade policies has been a key focus for NIDOA, working to reduce tariffs and promote economic reforms that facilitate investment and trade flows.

Systemic Engagement

- Public-Private Partnerships (PPPs): Engaging the private sector through PPPs has been essential in mobilising resources for development projects. NIDOA has actively facilitated partnerships that leverage both public and private investments.

- Trade Missions and Business Delegations: Organised trade missions to Brazil for Nigerian businesses and vice versa, allowing for direct engagement with potential partners, fostering trust and opening new channels for trade.

- Monitoring and Evaluation: NIDOA implements a rigorous monitoring and evaluation framework to assess the impact of various initiatives and make necessary adjustments to strategies, ensuring effectiveness in achieving economic cooperation goals.

Through these practical achievements, supporting strategies, and systemic engagement, NIDOA continues to play a pivotal role in enhancing economic cooperation and trade between Nigeria and Brazil. By fostering collaboration and leveraging shared resources, we aim to create a sustainable and mutually beneficial economic environment that promotes growth for both nations.

Do you think the changing geopolitical situation poses a number of challenges to connecting businesses in the region with Nigeria, and how do you overcome them in the activities of NIDOA?

The changing geopolitical situation indeed poses several challenges for connecting businesses in the South American region, particularly Brazil, with Nigeria. These challenges include trade tensions, shifting alliances, currency fluctuations, and varying regulatory environments. Below, I will outline some of the specific challenges and how NIDOA works to overcome them:

Current Challenges

- No Direct Flights: This challenge is obviously explicit. Once direct flights between Brazil and Nigeria become active, and hopefully this year, a much better understanding and engagement will follow suit.

- Trade Restrictions and Tariffs: Increasing trade protectionism in various regions can lead to higher tariffs and trade barriers that hinder the movement of goods between Brazil and Nigeria.

- Currency Volatility: Fluctuations in the value of currencies can complicate trade agreements, pricing strategies, and overall financial planning for businesses operating in both Brazil and Nigeria.

- Different regulatory frameworks and compliance requirements in both countries can create challenges for businesses aiming to navigate these systems efficiently.

- Supply Chain Disruptions: Changes in global supply chains due to geopolitical factors may disrupt established networks, impacting businesses relying on imports and exports between the two nations.

Overcoming Challenges through NIDOA.

NIDOA actively engages in discussions with both the Brazilian and Nigerian governments to advocate for favourable trade policies and agreements that reduce tariffs and improve trade conditions. This year in October, NIDOA BRAZIL holds its TRADE FAIR in São Paulo, Brazil.

What are the popular sentiments among the Nigerians in the South American diaspora? As the Secretary-General of the NIDOA, what are your suggestions relating to assimilation and integration, and of course, future perspectives for the Nigerian diaspora?

As the Secretary-General of NIDOA, I recognise the importance of understanding the sentiments among Nigerians in the South American diaspora, particularly in Brazil.

Many Nigerians in the diaspora take pride in their cultural roots, celebrating their heritage through festivals, music, dance, and culinary traditions. This cultural expression fosters a sense of community and belonging.

While many individuals embrace their new environments, they often face challenges related to cultural differences, language barriers, and social integration, which can lead to feelings of isolation.

Many express optimism about opportunities in education, business, and cultural exchange, viewing their presence in South America as a chance to expand their horizons and contribute to economic activities both locally and back in Nigeria.

Sentiments regarding acceptance vary; while some Nigerians experience warmth and hospitality, others encounter prejudice or discrimination, which can impact their overall experience in the host country. NIDOA BRAZIL has encouraged the formation of community organisations that promote networking, cultural exchange, and social events to foster a sense of belonging and support among Nigerians in the diaspora. There are currently two forums with over a thousand Nigerian members.

Cultural Education and Awareness Programs: NIDOA BRAZIL organises cultural education programs that showcase Nigerian heritage to local communities, promoting mutual understanding and appreciation that can facilitate smoother integration.

Language and Skills Training: NIDOA BRAZIL provides language courses and skills training programs to help Nigerians, especially students in tertiary institutions, adapt to their new environment, enhancing communication and employability within the host country.

Engaging in Entrepreneurship: NIDOA BRAZIL supports the entrepreneurial spirit among Nigerians in the diaspora by facilitating access to resources, mentorship, and networks that can help them start businesses and create economic opportunities.

Through its AMBASSADOR’S CUP COMPETITION, NIDOA Brazil has engaged students of tertiary institutions in Brazil to promote business projects and initiatives that can be implemented in Nigeria.

NIDOA BRAZIL also pushes for increased tourism to Brazil since Brazil is set to become a global tourism leader in 2026, with a projected 10 million international visitors, driven by a post-pandemic rebound, enhanced air connectivity, and targeted marketing strategies.

Brazil’s tourism sector is poised for a remarkable milestone in 2026, as the country expects to welcome over 10 million international visitors—surpassing the previous record of 9.3 million in 2025. This expected surge represents an ambitious leap, nearly doubling the country’s foreign-arrival numbers within just four years, a feat driven by a combination of pent-up global demand, strategic air connectivity improvements, and a highly targeted marketing campaign.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism10 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking8 years ago

Banking8 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn