Economy

BREAKING: CBN Keeps Interest Rate at 14% as Predicted

By Modupe Gbadeyanka

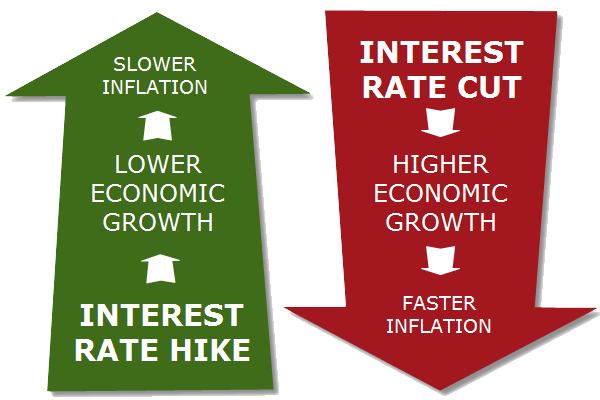

The Central Bank of Nigeria (CBN) has announced leaving its benchmark interest rate at 14 percent as predicted by analysts.

This was revealed on Tuesday by the apex bank’s chief, Mr Godwin Emefiele, while briefing newsmen on outcome of the CBN’s Monetary Policy Committee (MPC) meeting held on Monday and Tuesday in Abuja.

Before the commencement of the meeting, which holds every quarter, many analysts had said that the banking industry watchdog will not tamper with the Monetary Policy Rate (MPR) despite signs that the economy was on the path to recovery after being down for over a year.

At the end of the MPC meeting today, Mr Emefiele announced to reporters that the committee voted to retain the headline rate.

He said the cash reserve ratios for commercial banks was kept at 22.5 percent.

“In consideration of the challenges weighing down the domestic economy and the uncertainties in the global environment, the committee decided by a unanimous vote of eight members in attendance to retain the MPR at 14 percent,” Mr Emefiele told newsmen.

“We would prefer a convergence that will go southward rather than northward, but the fact that we have seen the convergence (going) southward gives us a lot of hope that things are working in the right direction,” he said further.

Economy

NASD Exchange Rises 0.26% as FrieslandCampina Share Price Grows

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange made a 0.26 per cent rise on Friday, May 2, after the share prices of two companies on the platform pointed northwards at the close of business.

During the trading session, the NASD Unlisted Security Index (NSI) was up by 8.59 points to 3,289.66 points from the previous session’s 3,281.07 points and the market capitalisation increased by N5.03 billion to close at N1.926 trillion compared with the N1.921 trillion it ended in the preceding session.

Yesterday, FrieslandCampina Wamco Nigeria Plc gained N1.90 to close at N40.00 per share compared with the previous closing value of N38.10 per share, and Afriland Properties Plc added N1.38 to trade at N16.00 per unit, in contrast to Wednesday’s value of N14.62 per unit after the bourse closed on Thursday due to the Workers’ Day holiday.

On the flip side, Geo-Fluids Plc went down by 13 Kobo to N2.00 per share from N2.13 per share, and IPWA Plc lost 5 Kobo to end at 50 Kobo per unit versus 55 Kobo per unit.

The volume of securities traded in the session was up by 175.4 per cent to 8.5 million units from the 3.1 million units transacted in the previous trading day, the value of securities slumped by 45.7 per cent to N15.7 million from N29.0 million, and the number of deals declined by 64.4 per cent to 31 deals from 38 deals.

At the close of business, Impresit Bakolori Plc remained the most active stock by volume (year-to-date) with 533.9 million units worth N520.9 million, followed by Okitipupa Plc with 153.6 million units sold for N4.9 billion, and Industrial and General Insurance (IGI) Plc with 71.2 million units valued at N24.2 million.

Okitipupa Plc was the most active stock by value (year-to-date) with 153.6 million units worth N4.9 billion, trailed by FrieslandCampina Wamco Nigeria Plc with 14.7 million units valued at N566.9 million, and Impresit Bakolori Plc with 533.9 million units sold for N520.9 million.

Economy

AXA Mansard Investments Renews Commitment, Financially Empower Women

In celebration of Women’s Month, AXA Mansard Investments Limited, a leading asset management firm has expressed its commitment to continue empower women financially in the country.

The company said this at its third edition of its flagship webinar series, Achieve Much More, held virtually.

This special Women’s Day edition, themed Women’s Wealth: How to Start from Where You Are, was designed to equip Nigerian women with practical knowledge and tools for achieving financial security regardless of their life stage or income level.

The virtual session featured seasoned financial advisor and Chief Executive Officer of MoneyStart, Mrs Ibi Ibru, as the guest speaker.

A respected content creator and influencer in the personal finance space, shared actionable strategies for saving, diversifying income, and getting started with investing—even with minimal capital.

Throughout the session, participants learned how to plan and adjust their finances across different life phases – singlehood, relationships, marriage, and parenting.

The session demystified a range of investment vehicles, from traditional savings to beginner-friendly options in the Nigerian financial landscape, helping women identify how to take control of their journeys towards financial freedom.

Speaking about the initiative, Mrs Adebola Surakat, Chief Marketing Officer of AXA Mansard Investments, emphasized the company’s dedication to fostering a financially literate population.

She stated that, “At AXA Mansard Investments, we strongly believe that financial education is not a luxury, it’s a necessity. Empowering women with financial knowledge not only transforms individual lives, but strengthens families, communities, and the broader economy.

“This webinar reflects our ongoing commitment to ensuring all Nigerians—regardless of gender, income, or background, have access to the tools they need to make informed financial decisions.”

The ‘Achieve Much More’ webinar series is part of AXA Mansard Investments’ broader efforts to provide accessible financial education through interactive sessions, expert-led discussions, and simplified investment tools tailored to everyday Nigerians.

“As 2025 progresses, AXA Mansard Investments remains dedicated to its mission of advancing financial literacy and supporting Nigerians on their journey to financial independence. By placing even greater emphasis on educating the public about smart money habits, we aim to empower more Nigerians to take charge of their financial future,” concluded Mrs Surakat.

For more information on financial literacy resources or to sign up for an upcoming webinar, please visit www.axamansard.com/investments or contact us via email clientservices@axamansard.com or call 0700AXAMANSARD (07002926267273).

Economy

Naira Slumps to N1,602/$1 at NAFEM, Firms to N1,605/$1 at Black Market

By Adedapo Adesanya

The Naira fell to N1,602.69/$1 in the American currency in the Nigerian Autonomous Foreign Exchange Market (NAFEM) on Friday, May 2.

Data showed that the Nigerian currency weakened against the US Dollar during the session by 0.02 per cent or N3.20 after it traded at N1,599.49/$1 in the previous trading session, which was on Wednesday, as the market closed on Thursday for Workers’ Day.

In the same vein, the domestic currency depreciated against the Pound Sterling in the same market segment by N3.64 to trade at N2,133.30/£1 compared with Wednesday’s value of N2,129.66/£1 and lost N5.92 on the Euro to sell for N1,820.24/€1, in contrast to the previous trading day’s N1,814.32/€1.

However, in the parallel market, the Nigerian currency appreciated against the greenback yesterday by N5 to quote at N1,605/$1 versus the preceding session’s N1,610/$1.

In the cryptocurrency market, news that the US and China are working on a trade deal swayed investors as it appears that the market is also skeptical that a deal will be reached this month.

According to a China state media post on social media, the US has proactively reached out to China through multiple channels, hoping to hold discussions on the tariff issue.

The speed and intensity of the tariffs the White House announced earlier this year panicked the market, leading to a significant drop in assets including cryptocurrencies.

So far, it is not clear what the eventual outcome will be but Litecoin (LTC) went down by 1.4 per cent to $86.81, Cardano (ADA) slumped by 0.7 per cent to $0.6981, Solana (SOL) declined by 0.5 per cent to $147.91, Dogecoin (DOGE) slid by 0.4 per cent to $0.1778, and Bitcoin (BTC) shed 0.1 per cent to sell at $96,336.57.

But Ethereum (ETH) rose by 0.6 per cent to $1,826.96, Ripple (XRP) grew by 0.4 per cent to $2.20, and Binance Coin (BNB) expanded by 0.3 per cent to $597.94, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) traded at $1.00 each.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN