Economy

Dangote Employs Graduate Rice Farmers to Meet 1m Tonnes 2018 Target

As part of efforts to tackle unemployment in Nigeria and also hit the market with one million metric tonnes of its rice in 2018, Dangote Rice Limited has employed youth graduate for rice farming in Kogi State.

The multi-million Naira youth farming initiative will engage teeming unemployed Nigerian graduates in rice farming.

The Dangote Youth Rice Farm project, mainly an out-grower scheme for youths only was flagged off at the Lower Niger River Basin Authority, Kampe, Ejiba in Yagba West local government area of the state where youth have embarked on rice cultivation over 100 hectares of land.

The rice farm project, which was preceded by a special training for the youth farmers on the dynamics of the rice farming, will see the youths cultivating the rice paddy on a-100 hectares of land, which will then be bought over by the company for processing.

Under the scheme, the Dangote Rice Company provides the seedling, anti-pest-chemicals, and fertilizers while the Basing Authority provided the land for the young farmers.

The management of Dangote Rice led by the Group Executive Director, Mr Devakumar Edwin, flagged off the project while taking delivery of some rice paddy bags produced from the pilot project.

Mr Edwin explained that the project is a new dimension to the efforts by the pan-African conglomerate, the Dangote Group, at ensuring food security and creating job opportunities in Nigeria especially for the youths saying this Initiative is in line with the vision and commitment of Dangote Industries Limited to create a new generation of agri-preneur that will revolutionize the Nigerian agricultural sector.

“We believe skill, knowledge, enabling environment, collaboration and linkages along the value chain are driving forces for economic empowerment and social development in line with the Federal Government policies.

“This project will address the skills gap in local rice production among unemployed youths by providing technical, organisational and financial requirements,” he said.

He said it would also enhance domestic rice production to cover the large gap between demand and domestic production and to increase self-sufficiency of Nigeria and substitute imported rice by quality Nigerian rice brands.

Mr Edwin disclosed that most modern rice mills in Nigeria presently operate at not more than 20% capacity utilization due mainly to lack of good quality paddy and that Dangote Rice aimed to change this situation developing and adapting out-grower schemes.

According to him, the Dangote Rice Company plans to set up a 150,000 metric tons integrated rice mill and sale one million mt of parboiled rice by 2018.

The Dangote Group boss stated that the decision of the management to start the project was driven by two factors, one of which is the need for youth employment through empowerment to go into agriculture. “The youths are more vulnerable to crimes and other social vices when they have nothing to engage them and this in turn affect the nation negatively.

“The second factor is the need to strengthen the on-going efforts at producing rice for self-sufficiency so that we can save foreign exchange. By the time we will be doing one million metric tons of rice next year, no less than three million jobs would been created along the value chain.”

Mr Edwin said the Kogi pilot project will cover four season of two years and will be launched in four other states soon.

In his own remark, Managing Director of Dangote Rice, Mr Robert Coleman urged the youth farmers to concentrate on the project and pay attention to details so that they would come out with good paddy yield.

He congratulated the farmers for the decision to partner with Dangote Rice noting that they have a solid source of livelihood for themselves and members of their families if they give their all for the success of the scheme.

Coordinator of the youth farmers, Mr Umar Etudaye thanked the management of Dangote Rice for believing in them and engaging them for the project. He promised that they would deliver on the mandate given to them on the project.

He stated that the scheme is a practical step towards nation building because it’s the youths, who constitute 40 percent of the population, would build the nation and only the youths that are empowered and gainfully employed could do that.

Economy

Wema Bank Joins NGX Banking Index as Flour Mills Exits Consumer Goods, Others

By Aduragbemi Omiyale

The review of the market indices by the Nigerian Exchange (NGX) Limited has led to the removal of Flour Mills Nigeria from the NGX 30, industrial goods, pension, Pension board and the Meristem value indices.

The end-of-the-year review, according to a statement made available to Business Post, took effect at the opening of the market on Thursday, January 2, 2025.

The NGX 30 index saw the removal of Guinness Nigeria, Sterling Holdings, and Total Nigeria and the inclusion of Conoil, International Breweries, Oando and Transcorp Power.

Also, Golden Guinea Breweries joined the consumer goods index, as the banking index welcomed Wema Bank and witnessed the exit of Sterling Holdings.

Further, the insurance index recorded the addition of Guinea Insurance and

International Energy Insurance and the removal of Lasaco Assurance and Mutual Benefits Assurance, as the industrial goods remained unchanged.

It was observed that the energy index welcomed Aradel Holdings, MRS Oil and Oando and said goodbye to Japaul, as Aradel Holdings and Transcorp Power joined the pension index after Cadbury Nigeria left.

The NGX Lotus Islamic index had Aradel Holdings coming on board as Dangote Sugar left as the corporate governance and Afrinvest Bank Value indices remained intact, with Aradel Holdings added to the NGX Pension Broad index.

In the notice, the Afrinvest Div Yield index welcomed Red Star Express after FCMB Group and Dangote Cement exited, and FCMB Group joined the Meristem Growth index after the duo of Access Holdings and Zenith Bank were removed.

Lastly, the trio of Access Holdings, Dangote Sugar and Zenith Bank were put into the Meristem Value index and the quartet of AIICO Insurance, Nigerian Breweries, FCMB Group and Flour Mills exited.

The chief executive of NGX, Mr Jude Chiemeka, reiterated that the exchange continues to blaze the path to becoming Africa’s foremost Securities Exchange with innovation and product developments that deepen the market and boost liquidity, thus connecting Nigeria, Africa, and the world.

Also, the Head of Trading and Products at the bourse, Abimbola Babalola, emphasized that NGX indices are developed, managed, and rebalanced semi-annually to allow investors to track market movements efficiently and manage their investment portfolios properly.

Designed using the market capitalization methodology, the indices are rebalanced semi-annually on the first business day in January and July, respectively.

Economy

FMDQ Resumes Admission of Commercial Paper Issuance

By Adedapo Adesanya

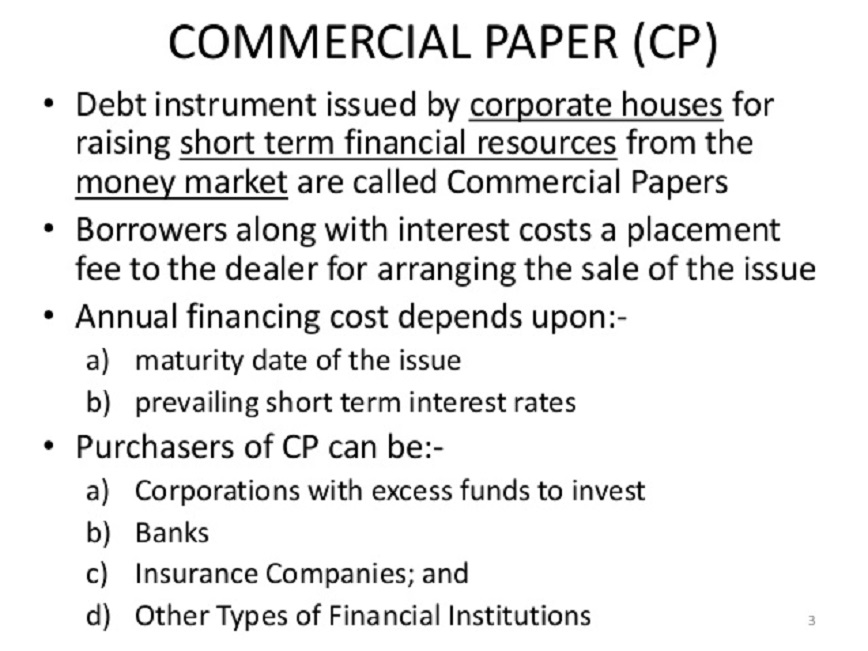

FMDQ Securities Exchange has resumed admission services in the Nigerian Commercial Paper (CP) market after an earlier suspension on December 30.

This followed the release of new rules on the issuance of financial instruments by the Nigerian capital regulator, the Securities and Exchange Commission (SEC).

“This Market Notice is issued as an update to MN-50 (Suspension of FMDQ Exchange’s Admission Services in the Nigerian CP Market), to notify all stakeholders of FMDQ Securities Exchange Limited (“FMDQ Exchange” or the “Exchange”) of the immediate resumption of the Exchange’s securities admission services in the Nigerian commercial paper (“CP”) market,” a statement on Friday said.

A commercial paper is short-term, unsecured promissory notes not backed by collaterals issued by companies to raise funds for immediate needs.

The SEC is now stepping in to ensure that there are some efficiencies in the issuance by approved bodies to avoid sharp practices and opacity.

The recent suspension applied to applications for which the filing of all relevant documentation has been completed, applications for which the filing of all relevant documentation is yet to be completed, as well as prospective and ongoing CP offers under active CP Programmes.

Now, FMDQ Exchange will immediately resume its securities admission services in the Nigerian CP market pending the finalisation of the ongoing engagements with the Commission on the operationalisation of the New Rule on the Issuance of Commercial Papers released by the market regulator.

The exchange also announced that it has returned to the status quo prior to the release of MN-50, and thus resumed the processing of new and ongoing applications in respect of prospective CP Programme registrations, revisions/extensions and issuances/quotations.

It added that it would provide relevant updates and further developments in respect of the above to market participants in due course.

Economy

Stanbic IBTC PMI Shows Rise in Business Activity First Time in Six Months

By Modupe Gbadeyanka

For the first time in six months, the Nigerian private sector recorded an improvement in business conditions, with a 52.7-point reading in the Stanbic IBTC Bank Purchasing Managers’ Index (PMI) in December 2024.

It was observed that overall business conditions improved as new orders increased for the second month running and renewed expansions were seen in output, employment and purchasing, though the inflation rate remained elevated.

Business Post reports that in the previous month, the index stood at 49.6 points signalling a solid improvement in the health of the private sector that was the most pronounced since January 2024.

“In line with the increase in economic activity usually associated with the festive season in Nigeria, the private sector activity moved above the 50-point psychological threshold for the first time in six months, settling higher at 52.7 in December from 49.6 in November – its most pronounced improvement since January 2024.

“This improved private sector activity reflects renewed expansions in output, purchasing, and employment level. New orders also increased for the second consecutive month, with the latest increase being the highest since May 2024, reflecting an improvement in consumer demand.

“Nonetheless, while some firms increased employment in response to the higher new orders, others reported having to let staff go due to difficulties paying wages.

“Elsewhere, output (54.8 points vs November: 49.6) ended a five-month sequence of decline, with survey participants linking the rise in activity to increased customer numbers. Growth was recorded across each of the four broad sectors covered by the survey. Meanwhile, input prices remained elevated in December – prices increased across all four monitored sectors, with the most pronounced increase in the manufacturing sector.

“As a result, output prices also remained elevated in December and ticked higher from that seen in November,” the Head of Equity Research West Africa at Stanbic IBTC Bank, Mr Muyiwa Oni, said.

“We maintain our expectation that the broad economy is likely to maintain the Q3:24 growth momentum in Q4:24, supported by a festive-induced increase in economic activity and sustained improvement in crude oil production.

“On balance, we estimate the economy to grow by 3.24% y/y in real terms in Q4:24 and adjust our 2024 growth estimate upward to 3.2% (previously: 3.1%). Over the medium term, some firms were optimistic of improvements in access to funding, helping them to invest in business expansions, while others were hopeful of an improvement in economic conditions in 2025, and a softening of inflationary pressures,” he added.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN