Economy

Qfac Pick of the Week: United Bank for Africa (UBA) Plc

By Quantitative Financial Analytics Ltd

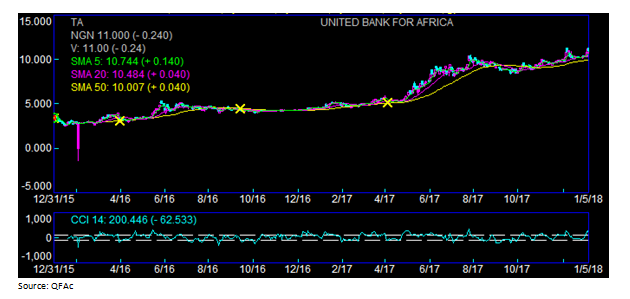

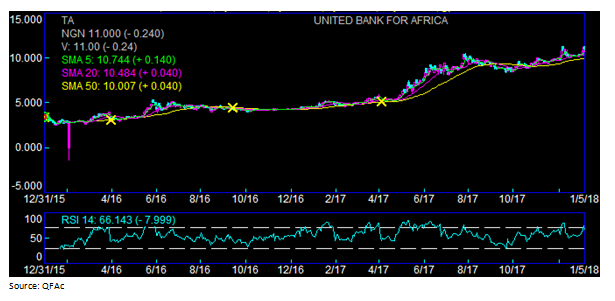

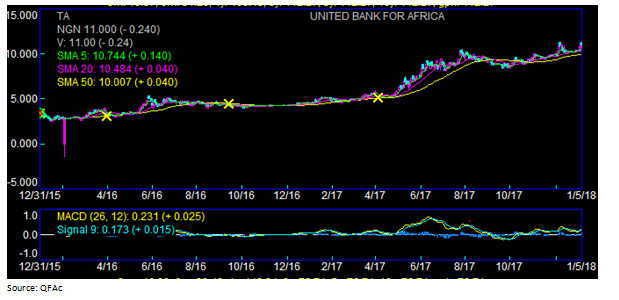

Though UBA Plc price fell from N11.24 to N11 during the last trading day, this week’s Qfac pick is United Bank for Africa, (UBA) Plc and our analysis is pointing to a buy signal.

United Bank for Africa Plc is a financial institution in Nigeria engaged in corporate, commercial and retail banking as well as trade services, cash management, treasury and custodial services with branches African countries. Our buy signal derives from the following:

Moving Average Analysis: The latest price of N11.00 beats its 5-Day, 5 5-Day, 50-Day, and 100-Day moving average prices. Most technical analysts use the moving average rule that recommends a buy when a market close crosses above x day moving average, while a sell is signalled when a market close crosses below x day moving average (where x could be any number of days)

Commodity Channel Index: Though most chartists use the CCI as an overbought/oversold oscillator, it could be used to signal buys or sells. CCI compares current price with average price over a period of time CCI readings of above 100 indicate a buy while those below -100 indicate a sell. Our CCI index for UBA based on a 14- week period is 200.45

Relative Strength Index (RSI): According to Welles Wilder, who introduced RSI in 1978, market tops are often completed when the RSI rises above 70 while bottoms are formed during periods when the RSI falls below 30. Most analysts prepare to buy as prices dip below 30 using a rise back to 30 as a buy signal and prepare to sell when the RSI moves above 70. This is premised on the notion that RSI of 70 and above indicate that a stock is becoming overbought or overvalued and could be getting ready for a reversal while an RSI value of 30 and below indicate an oversell or an upcoming reversal. Our chart shows that UBA has an RSI of 66.143 which is below the overbought mark, we call it a buy especially for the day traders but could be a hold for longer tern traders.

Moving Average Convergence Divergence (MACD): The MACD uses two lines to signal a buy or a sell, the faster line (MACD) and the slower line (signal). The actual buy or sell signals are given when the two lines cross, such that a crossing by the faster MACD line above the slower signal line indicates a buy while a crossing of the MACD line below the signal line indicates a sell. For UBA, the MACD line just crossed the signal line indicating a buy

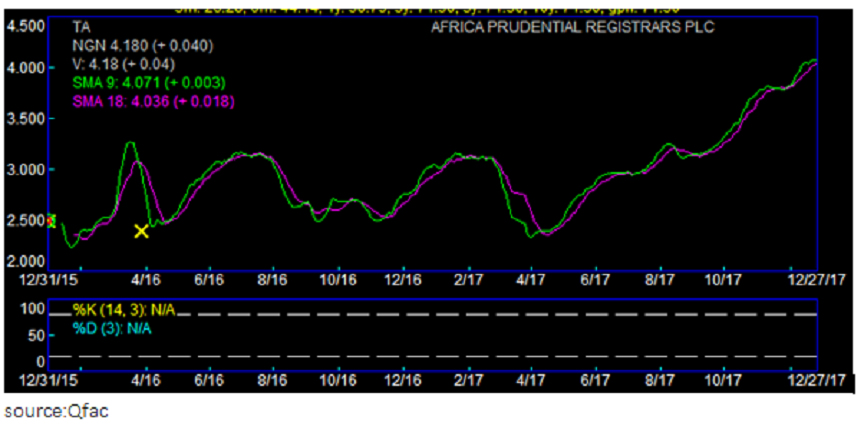

Stochastic Oscillator: The Stochastic indicator also uses two lines to signal buys or sells, the %K and %D lines. Buy signals are indicated when the fast %K line rises above 30 accompanied by a cross above the fast %D line while sell signals are indicated when the fast %K stochastic line falls below 80 and accompanied by a cross below the fast %D stochastic line.

As indicated above, the fast %K rose above 30 and crossed above the fast %D on December 27 indicating a buy.

Summary: Based on the above technical charts, we believe that the technical analysis is pointing to a buy signal for UBA.

For complete list of picks or for analysis of any stock of interest, contact Analytics@mutualfundsnigeria.com

Economy

NASD OTC Exchange Closes in Stalemate at Midweek

By Adedapo Adesanya

The NASD Over-the-Counter (OTC) Securities Exchange closed flat on Wednesday, April 16, as the market capitalisation remained unchanged at N1.915 trillion as well as the NASD Unlisted Security Index (NSI) at 3,271.02 points.

At the trading session, there was no price gainer or decliner.

The bourse’s data showed a decrease of 95.0 per cent in the volume of securities transacted to 36,757 units from the 736,215 units recorded in the previous trading day, the value of transactions slid by 83.6 per cent to N1.99 million from N12.1 million transacted on Tuesday, and the number of deals fell by 19.2 per cent to 21 deals from the 26 deals recorded a day earlier.

Impresit Bakolori Plc remained the most active stock by volume on a year-to-date basis with 533.9 million units worth N520.9 million, trailed by Okitipupa Plc with 153.6 million units sold for N4.9 billion, and Industrial and General Insurance (IGI) Plc with 71.2 million units valued at N24.2 million.

Also, Okitipupa Plc remained the most active stock by value on a year-to-date basis with 153.6 million units valued at N4.9 billion, followed by FrieslandCampina Wamco Nigeria Plc with the sale of 14.7 million units worth N568.1 million, and Impresit Bakolori Plc with a turnover of 533.9 million units sold for N520.9 million.

Economy

Naira Depreciates to N1,603/$1 at NAFEM, N1,620/$1 at Parallel Market

By Adedapo Adesanya

The Naira witnessed a N1.76 or 0.11 per cent depreciation on the US Dollar at the Nigerian Autonomous Foreign Exchange Market (NAFEM) on Wednesday, April 16.

During the trading session, the local currency was exchanged with the greenback at N1,603.16/$1, in contrast to the N1,601.40/$1 it was traded a day earlier, according to data from the Central Bank of Nigeria (CBN).

Also, the Nigerian currency weakened against the British Pound Sterling in the official market yesterday by N6.71 to quote at N2,121.97/£1 compared with the previous day’s value of N2,115.26/£1 and tumbled against the Euro by N9.28 to sell for N1,818.17/€1 versus Tuesday’s exchange rate of N1,808.89/€1.

In the parallel market, the Naira lost N5 against the Dollar to finish at N1,620/$1 compared with the preceding day’s N1,615/$1.

The pressure on the domestic currency came as the central bank sold over $30.00 million at rates between N1,590.00/$ and N1,601.50/$ this week to authorised forex dealers.

At the cryptocurrency market, things turned bullish as the US Federal Reserve Chairman, Mr Jerome Powell, dashed hopes for early rate cuts, citing the need to assess the impact of US tariffs on the global economy.

The Federal Reserve chair also mentioned that the US central bank needed more time to see the effects of tariffs play out in the global economy. The same is likely to be true of the economic effects, which will include higher inflation and slower growth.

Market analysts noted that the remarks disappointed rate cuts optimist by stressing focus on protecting against tariff-driven price hikes from driving a long-term rise in inflation expectations.

Solana (SOL) jumped by 7.2 per cent to trade at $134.28, Cardano (ADA) added 2.8 per cent to close at $0.6209, Dogecoin (DOGE) appreciated by 2.5 per cent to $0.1570, Ethereum (ETH) rose by 2.1 per cent to $1,602.70, Ripple (XRP) gained 1.9 per cent to close at $2.09, Bitcoin (BTC) increased by 1.5 per cent to $84,749.46, and Binance Coin (BNB) went up by 0.7 per cent to $583.08.

But Litecoin (LTC) declined by 0.7 per cent to finish at $75.38, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) remained unchanged at $1.00 each.

Economy

Nigerians Applaud Dangote for Further Reduction of PMS Price to N835

By Aduragbemi Omiyale

The further reduction in the price of Premium Motor Spirit (PMS), commonly known as petrol, from N865 to N835, effective from Wednesday, April 16, 2025, by Dangote Petroleum Refinery has been applauded by Nigerians.

The price slash was the second by the company in a week and it was in reaction to the decline in the price of crude oil in the global market due to the trade war between the United States and China.

In a statement yesterday by the Group Chief Branding and Communications Officer of Dangote Group, Mr Anthony Chiejina, it was stated that key partners, including MRS, AP (Ardova), Heyden, Optima Energy, Hyde and Techno Oil, will sell petrol to customers at N890 per litre, down from N920 in Lagos, while in the other South-West states, the price will be N900 per litre versus the previous N930.

In addition, Nigerians living in the North-West and North-Central will get the high-quality Dangote petrol at N910 per litre compared with the former price of N940, and those in the South-East, South-South, and North-East will buy at N920 per litre, down from N950 per litre.

Dangote expressed hopes that this latest reduction in PMS prices would generate a positive ripple effect throughout various sectors of the economy, providing much-needed relief to consumers and contributing to broader economic growth, particularly during the Easter season.

It stated that the slash in price reaffirmed its “commitment to providing high-quality petrol at affordable rates, benefiting consumers across the nation. In addition, we are working collaboratively with our partners to ensure equitable reflection of this price reduction.”

Dangote Petroleum Refinery has consistently worked to reduce the prices of petrol and other refined petroleum products, ensuring the continued benefit of Nigerian consumers.

For example, in February, the refinery reduced prices twice by N125. In addition, products such as diesel and Liquefied Petroleum Gas (LPG) have also experienced significant price reductions due to the refinery’s sustained efforts.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN