Technology

Paystack, Truecaller Partner to Boost Online Payments in Africa

By Modupe Gbadeyanka

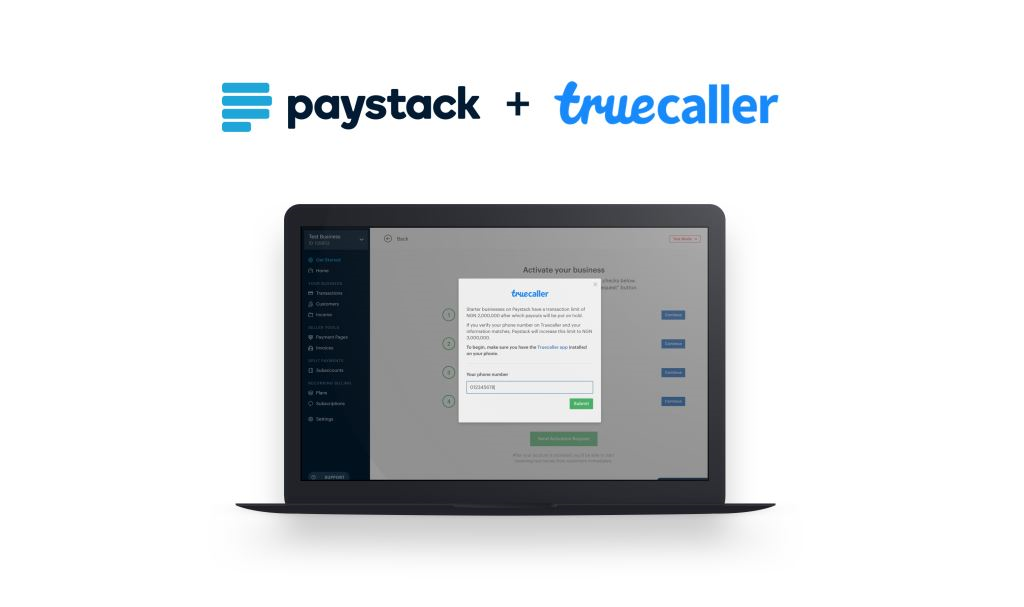

A deal has been struck between Paystack and Truecaller to allow more merchants across Africa accept payments online in a frictionless and secure manner by leveraging Truecaller’s mobile identity product, Truecaller SDK.

The partnership will also provide powerful tools that businesses and start-ups across Africa can use to verify the mobile identity of their customers, and in turn, further help in creating more trust in the online payments landscape on the continent.

Also, with the deal, unregistered local businesses can now receive online payments after being verified via Paystack’s in-house verification process, which now includes phone number identity verification powered by Truecaller

In addition, businesses and developers receiving payments via Paystack can now build customer verification tools on top of Paystack’s Truecaller phone number verification API.

Paystack is one of Nigeria’s largest payments startups, processing nearly 20 percent of all online transactions in Africa’s largest economy. The company (the first Nigerian startup to get into the celebrated Y Combinator Accelerator) aims to allow merchants in Africa accept payments from anyone, anywhere in the world.

Previously, all merchants who wanted to accept payments with Paystack had to be registered with various regulatory bodies. In Nigeria, where the vast majority of businesses are unregistered, the requirement to be registered prevented many legitimate offline businesses from realizing the benefits of online payments.

The Paystack-Truecaller partnership means that in addition to Paystack’s proprietary merchant risk assessment checks, merchants can now verify their mobile identity via Truecaller.

Integrating Truecaller’s mobile number identity product as a verification mechanism strengthens the Paystack platform’s merchant verification process and also makes it possible to open up Paystack to the millions of unregistered businesses who were previously unable to accept online payments with Paystack.

In the words of Paystack CEO, Shola Akinlade, “This partnership with Truecaller allows Paystack to deliver on our promise of trust as well as a frictionless experience. We want to be able to guarantee that all businesses paid via Paystack are thoroughly checked for legitimacy and credibility.

“In a low-trust environment like Nigeria where many people are paying online for the first time, it’s important to deliver a safe, fraud-free experience, and this is a responsibility that Paystack takes extremely seriously.”

Shola adds: “We needed to balance the strong desire to open Paystack up to unregistered business against the equally strong obligation to protect the interests of customers. Customers need the firm assurance that every Paystack merchant they pay is a vetted business, and our partnership with Truecaller ensures that we can continue to be worthy of customers’ trust.”

In addition to using Truecaller as part of the merchant verification flow, Paystack will also be introducing Truecaller as a verification option for local developers and startups who want to verify the identity of their own customers on Paystack’s developer platform.

Paystack already makes three verification options available to developers – the ability to verify the Bank Verification Number (BVN) of customers (BVN is an identifying number issued by Nigerian regulators), the ability to verify bank account details, and the ability to verify card details. Truecaller will be a fourth, new verification option, and the impact of this will be to create more trust in the payments flow for African businesses.

A typical use case would be a micro-lending app. In addition to their in-house customer verification steps and use of Paystack’s proprietary verification tools, the Paystack-Truecaller partnership now allows the makers of the lending app to verify the true identity of borrowers by their mobile identity, i.e. with their phone number.

Over 50 million Africans use Truecaller, and the app has helped helped Nigerian users block over 13 million calls and 25 million spam SMS, monthly.

In November 2017, Truecaller announced plans to deepen the collaboration with the business, startup and developer ecosystem in Africa, and the partnership with Paystack represents a strong move towards helping African businesses leverage the power of Truecaller’s mobile identity platform.

Truecaller Head of Global Developer & Startup Relations, Priyam Bose, underscored the importance of this ground-breaking partnership: “Paystack is enabling the growth of a vibrant online payment ecosystem and the digitization of businesses for Nigerian economy. Truecaller is excited to play a strong role in this vision by enabling tools that increase trust and enable frictionless payments across Africa, powered by Paystack.”

Technology

FG Eyes 21% ICT Contribution to Nigerian Economy

By Adedapo Adesanya

The Minister of Communications, Innovation and Digital Economy, Mr Bosun Tijani, has set a target of increasing the Information Communication Technology sector’s contribution to the Nigerian economy to 21 per cent from currently below 18 per cent.

Speaking during a visit to his alma mater, Anglican Grammar School, Onikolobo, Abeokuta, he said President Bola Tinubu was making significant efforts to raise Nigeria’s Gross Domestic Product (GDP) through increased contributions from the digital economy.

As of the fourth quarter of 2024, Nigeria’s ICT sector contributed 17.68 per cent to the country’s real GDP, marking an increase from 16.66 per cent in Q4 2023.

He said if the target is actualised, it would translate to further growth in Nigeria’s economy.

“This means more jobs and opportunities. For the first time in the history of this country, an administration is investing in 90,000 kilometers of fibre optic cables across the nation.

“This infrastructure will bring high-speed internet to schools through cables—not through jungles—enabling better learning environments,” he said.

Encouraging the students, Mr Tijani said background should not be a barrier to success.

“I once sat where you sit today. The lessons of kindness and empathy I learnt here shaped who I am.

“You can become ministers, ambassadors, governors, or even the President. You can shake the world,” he said.

To support education, Mr Tijani announced a fellowship programme for the top three students in JSS 1–3 and SS 1–2.

Each will receive N100,000 annually, along with laptops and school uniforms.

This will benefit around 70 students each year.

He also revealed plans to refurbish and digitally equip a school building and adopt the science laboratory.

The minister attended an ‘Innovation and Startups Roundtable’ with digital technology entrepreneurs and solution providers in Ogun State.

There, he underscored the need for technology-driven agriculture to address food insecurity and boost local food production.

“Given our large population and reliance on traditional farming, we cannot meet local food demand without embracing digital tools,” he said.

“Technology such as mobile apps, sensors, and drones can help farmers monitor crops, control pests, track soil changes, and ultimately improve productivity.”

Mr Tijani noted that countries like Ukraine had sustained agricultural output even amid conflict, due to their heavy investment in agricultural technology, encouraging Nigerian farmers to adopt similar innovations to reduce dependence on food imports and preserve foreign exchange.

Technology

Tijani Lauds Huawei on Driving Nigeria’s Digital Infrastructure

By Adedapo Adesanya

The Minister of Communications, Innovation and Digital Economy, Mr Bosun Tijani, has lauded the Chinese multinational corporation and technology company, Huawei Technology Company Limited, for its investment in Nigeria’s digital sector.

He highlighted Huawei’s strong commitment to building national digital infrastructure and commended the company’s efforts in launching an Innovation Centre and fostering local talent development at the Huawei Day Nigeria 2025 Government Forum, held in Lagos.

He expressed appreciation for Huawei’s ongoing contributions to Nigeria’s digital transformation and emphasized the importance of continued collaboration between the ministry and Huawei.

The Huawei Day Nigeria 2025 Government Forum brought together top government and industry leaders to explore the transformative impact of digital technologies on governance, security, and public service delivery.

The forum featured a series of presentations with key leaders sharing their vision for the future of Nigeria’s digital landscape and the pivotal role of ICT in driving national progress.

The government forum organised as part of the activities in the ongoing Huawei Day Nigeria 2025 had speakers from various government MDAs share insights and best practices on digital transformation urban security, intelligent traffic and video surveillance, and ICT talent cultivation.

On his part, Mr Olusegun Olulade, the Executive Director, Centricity and Marketing of Galaxy Backbone stressed the importance of E-Government Network & Cloud in enabling Nigeria’s digital services.

He disclosed that “Galaxy Backbone’s cloud infrastructure is crucial for supporting Nigeria’s digital programmes by enhancing secure communication and data exchange across government ministries and agencies.

“It enables seamless interoperability, real-time data sharing, and improved decision-making, while ensuring robust cybersecurity.”

Furthering the discourse, Huawei Global Public Sector BU Chief Technology Officer, Mr Augustine Chiew, highlighted the cruciality of smart cities for Urban Digital Transformation.

“Smart city initiatives are reshaping urban environments by leveraging AI-powered surveillance, IoT platforms, and scalable cloud solutions to enhance traffic management, public safety, and overall quality of life.

“Cities like Lagos and Abuja are benefiting from these innovations, with a strong focus on sustainability, energy efficiency, and real-time connectivity, driving more efficient and livable urban spaces.

“Huawei smart city solutions accelerate public service digitalisation, serving 700+ smart cities in 100+ countries across the globe.

“Taking Lagos as an example, Huawei’s intelligent traffic solution has increased traffic efficiency, reduced traffic accidents, and decreased economic losses, which boosts city service efficiency and citizen satisfaction.”

The event had other speakers including the Director of Lagos State Vehicle Inspection Service, Mr Akin-George Fashola, who examined the importance of creating effective transportation systems in Lagos State.

He emphasised the need for the integration of big data analytics with video surveillance to enhance security operations and build public trust.

“This will contribute to multi-agency collaboration and improve emergency response capabilities, particularly in high-traffic and densely populated areas,” he said.

The government forum was an interactive platform for discussions on the impact of digital technologies on governance and public services in Nigeria.

The event underscored the need for enhanced collaboration between the public and private sectors to overcome infrastructure challenges, accelerate digital adoption, and build a more inclusive digital ecosystem.

Other speakers at the event include Deputy Comptroller General (ICT), Nigerian Immigration Service, Mr Mohammed Tukur Umar; Head, Infrastructure and Operations, Federal Inland Revenue Service, Mr Lanre Olaifa; ICT Director of the Lagos State Ministry of Innovation, Science and Technology, Mr Adeyinka Sorungbe; Head of Computer Engineering Department, Ahmadu Bello University, Professor Muhammed Muazu; and top Huawei executives.

Technology

Hadron by Tether Integrates Chainalysis

By Aduragbemi Omiyale

Hadron by Tether has set a new standard for compliant tokenization with the integration of Chainalysis’ compliance and monitoring tools.

This upgrade brings institutional-grade oversight to Hadron by Tether by further strengthening its position as a trusted and regulation-ready marketplace for token issuance and asset management.

With this, the system can now monitor transactions to flag suspicious activity and enable ongoing compliance, and also streamlines onboarding and due diligence processes.

“With Hadron by Tether, we’re building the gold standard for compliant, secure, and scalable tokenization.

“By integrating Chainalysis directly into the platform, we’re offering institutional-grade transparency, compliance, and risk mitigation without compromising on decentralization or control,” the chief executive of Tether, Mr Paolo Ardoino, said.

“Chainalysis has always believed that trust is the foundation for the future of digital assets.

“We’re proud of this work with Hadron by Tether that will bring digital assets and blockchain technology to more institutions and organizations underpinned by our technology and blockchain intelligence that make the solution ready for a compliance-first world,” the chief executive of Chainalysis, Mr Jonathan Levin, stated.

Designed for institutions, corporations, and governments, Hadron by Tether enables the creation, management, and deployment of tokenized assets such as stablecoins, bonds, funds, and commodity-backed tokens across multiple blockchains.

With the integration of Chainalysis, participants now gain access to enhanced risk detection, real-time transaction monitoring, and full Know Your Transaction (KYT) support – ensuring adherence to global regulatory standards from day one.

This latest enhancement follows Tether’s broader commitment to security and accountability. As the issuer of USD₮, the most widely used stablecoin in the world, Tether has collaborated with over 255 law enforcement agencies across 55 countries and helped freeze more than $2.7 billion in illicit assets to date.

The same compliance ethos is now embedded in Hadron by Tether, empowering asset issuers to operate with confidence in an increasingly regulated environment.

The Chainalysis integration represents a major step in making Hadron by Tether not only a powerful platform for tokenization, but also a future-proof infrastructure layer for digital assets.

Tether previously announced it had adopted Chainalysis’ ecosystem monitoring solution to enhance surveillance across secondary markets and bolster compliance across all Tether tokens.

Now, those same advanced tools are directly accessible to Hadron participants, reinforcing a unified compliance standard across Tether’s expanding digital asset ecosystem.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN