Feature/OPED

Six e-Commerce Website Features to Help You Find Best Products Online

By Olukayode Kolawole

eCommerce and its continuous explosion – thanks to the internet – has forever changed the way we shop for products and services. We have witnessed – in the last 6 years of eCommerce debut in Nigeria – many impactful changes, such as the rise of online marketplaces; the seamless shift to using mobile devices for online shopping; the incredible growth of online and digital marketing and advertising; and the use of digital modifications in sales and mainstream consumer shopping.

Despite this remarkable innovation, many still find it very challenging to use these eCommerce platforms because they hardly understand how the features of these platforms work.

This article explains some common 6 features of eCommerce platforms that can assist shoppers find the best products online. Please note that some of these features are ONLY peculiar to Jumia, Nigeria’s no.1 online shopping platform.

Star Rating (Seller’s Score)

Star Rating, also known as Seller’s Score, provides a first hand description of previous buyers experience with a product and/or seller. If the previous buyers’ experience with a product or seller was subpar, the rating might be very poor, almost between 1 & 2-star. Jumia has activated this review to prevent new buyers from buying a product or interacting with a seller with low quality products, and to assist new or returning buyers to find good products.

When you are shopping on Jumia, endeavour to – at all times – check the review score of each seller. More importantly, check for the number of shoppers per star rating. For instance, if 3 shoppers rated a seller 5-star, and about 16 shoppers rated same seller 2-star for the same product, you might want to avoid buying from such seller. When you shop on Jumia next time, endeavour to rate the seller based on the product quality and experience with the seller. This will guide other shoppers in making an informed decision on which seller to patronise.

Number of Successful Sales

Vendors do not sign up on eCommerce websites just for fun. They want to make sales and of course, Jumia has provided a platform for them to achieve this aim. So, for customers who want to find the best products, the number of successful sales is one of the points to look out for. The rule here is very simple: the higher the sales, the better the quality of products and/or customer experience with the seller, and vice versa. For Jumia, the number of successful sales is clearly shown on the website to enable customers make their buying decisions.

Warranty

A warranty describes the conditions under, and period during, which the producer or vendor will repair, replace, or compensate for a defective item without cost to the buyer or user. The caveat for the repair is that the damage must not be as a result of the buyer’s actions. This said, warranty generally give buyers the confidence that in the case of any fault, they are guaranteed repair or replacement at no cost. Hence, always look out for sellers who provide warranty for their products before shopping for an item. However, warranty does not apply to all products.

Delivery Speed

There is nothing like ordering a product and it is delivered same day. Fortunately, Jumia has decentralised its delivery process as you now have the option of same day delivery through Jumia Express depending on your location, provided you purchased the item before 12pm. Jumia Express also offers free delivery to Lagos, Abuja, Port Harcourt, Ibadan and Abeokuta on orders above N15,000 (excluding large items). Compared to others, Jumia Express provides the quickest delivery in Nigeria compared to other logistic companies. So, if a product sold by a vendor on Jumia has Jumia Express on it (as shown in the image below), it means the product will be delivered same day you made the order and free of charge.

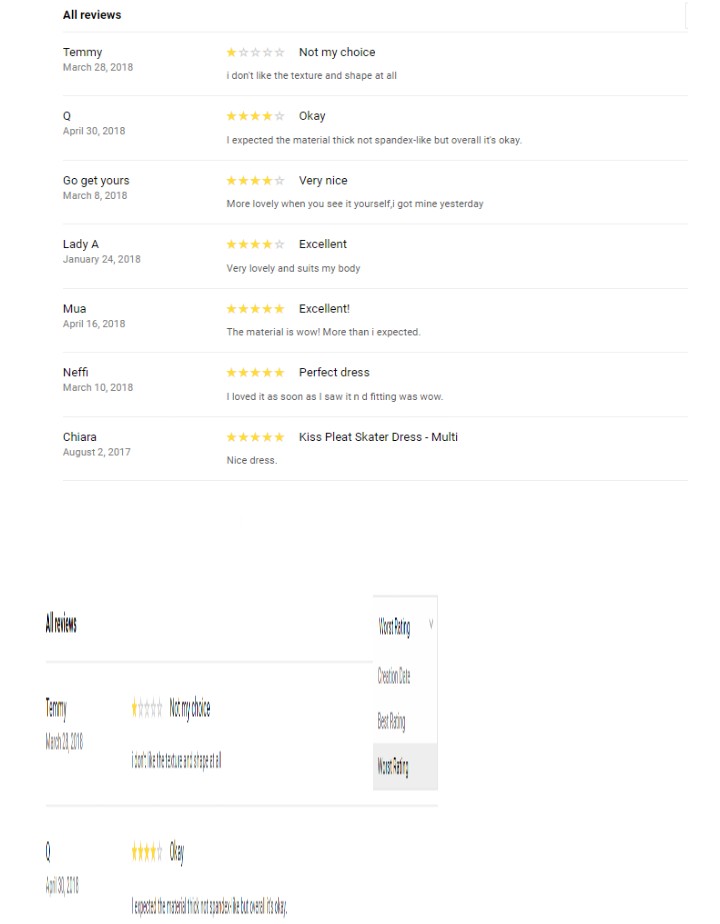

Written Reviews (Sort By)

This is arguably one of the easiest ways for online shoppers to make a buying decision. Whenever you buy a product on Jumia, you are always prompted to review whatever you bought. This will help other buyers determine whether to buy from a particular vendor or not. Due to the strict vetting process by Jumia, most of our vendors have very good reviews. Reviews are sorted by best and worst rating.

Free Return Policy (Within 7 Days)

Returning a product at no cost is one of the ways to know where to find best products online. This is because customers are more likely to shop on a platform that offers free returns within 7 days. This is exactly why Jumia is unique, as customers have a 7-day time frame to return a product at no cost.

Olukayode Kolawole is the Head, PR and Communications at Jumia Group Nigeria as well as the Head of Social Media and Offline Marketing at Jumia Travel.

Feature/OPED

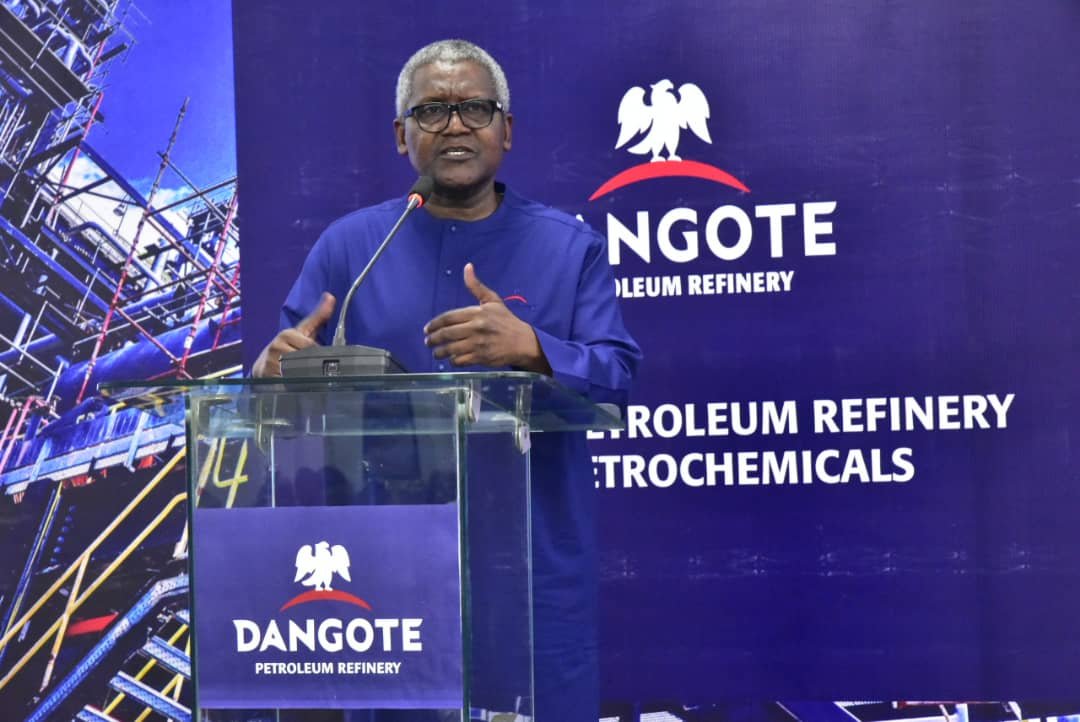

Dangote Refinery: One Year, One Refinery, A Nation Transformed

By Abiodun Alade

In just 12 months, the Dangote Petroleum Refinery has shifted Nigeria from fuel importer to regional energy supplier, stabilised its currency, slashed fuel costs, and sparked an industrial revival. As Africa’s largest refinery marks its first year of operation, it stands as a bold symbol of private ambition driving national transformation.

One year ago today, a long-standing paradox began to unravel in Nigeria.

For decades, despite being Africa’s largest oil producer, Nigeria was heavily reliant on imported refined petroleum products, particularly Premium Motor Spirit (PMS), commonly known as petrol. While the country exported crude oil, it re-imported fuel at a premium, creating a costly and unsustainable cycle. The result was predictable: fuel scarcity, long queues, ballooning import bills, subsidy scam, smuggling of petrol and a national economy perpetually tethered to global oil market volatility.

But on 3 September 2024, that story began to change with the commencement of production of petrol at the Dangote Petroleum Refinery, a privately built megaproject that has, in a single year, begun to redefine the country’s energy landscape and with it, much of the broader economy. The refinery is also producing diesel, jet fuel, and Liquefied Petroleum Gas (LPG) among other products.

From Scarcity to Surplus

Located on the edge of the Atlantic in the Lekki Free Trade Zone just outside Lagos, the $20 billion refinery is the largest single-train facility, capable of processing 650,000 barrels of crude oil per day. Its commissioning last year was heralded as a potential turning point for Nigeria. Twelve months on, such optimism was not misplaced.

Fuel shortages, once a near-ritual during holiday seasons and election cycles, have largely disappeared. Petrol as well as diesel, and cooking gas prices have dropped, stabilising transport and household energy costs. In a country where inflation has been stubbornly high, this has offered a rare and tangible form of relief.

Moreover, Nigeria has remarkably shed its label as Africa’s top fuel importer, a title it held for decades. That distinction now belongs to South Africa.

President Bola Ahmed Tinubu hailed the refinery as “a remarkable achievement” and “a phenomenal project of our time,” underscoring its significance to Nigeria’s industrial and economic growth.

“This is more than what you see; it’s about what you can envision and build,” says Pan African Banker and Fintech expert, Patrick Akinwuntan. “Dangote’s success with this refinery teaches us that audacious leadership can overcome the biggest obstacles.”

A Lifeline for the Naira

The refinery’s influence extends beyond fuel pumps and tank farms. By significantly reducing Nigeria’s reliance on fuel imports, the country has saved an estimated $25–$30 billion annually in foreign exchange, a staggering amount for an economy frequently grappling with currency crises.

This shift has helped stabilise the Naira, which has gained modest ground against major currencies for the first time in years. With less demand for dollars to pay for refined fuel imports, the Central Bank has found some breathing space in managing exchange rate volatility.

Furthermore, by exporting surplus refined products to neighbouring West African nations, the refinery has created a new stream of foreign exchange earnings, contributing to a rare surplus in Nigeria’s balance of payments in early 2025.

In September 2024, the governor of the Central Bank of Nigeria (CBN), Yemi Cardoso, stated that lifting petrol from the refinery can turn around Nigeria’s dollar-starved economy.

“This is also expected to moderate foreign exchange demand for importation of refined petroleum products, with a positive spillover on external reserve and improvement in the overall balance of payment position,” he added.

He added that CBN Monetary Policy Committee expressed optimism that it will moderate transportation costs and significantly support the easing of food price pressures in the short to medium term.

GDP Growth and Job Creation

The refinery is projected to add approximately $15 billion annually to Nigeria’s GDP, representing a vital infusion of real sector growth at a time when the economy is still recovering from the shocks of the COVID-19 pandemic, multiple currency devaluations, and a costly fuel subsidy phase-out.

On the employment front, over 570,000 direct and indirect jobs have been created through the refinery’s operations and its wider value chain, including logistics, supply services, maintenance, and construction. Entire communities have emerged around the facility, supported by new roads, power infrastructure, and water systems that were previously non-existent.

More Than Oil: A Platform for Industrialisation

Beyond the numbers, the Dangote Refinery is repositioning Nigeria for deeper industrial development. By producing key by-products such as polypropylene, base oils, and jet fuel, the facility is stimulating growth in manufacturing, plastics, aviation, lubricants, and agro-processing.

It has also become a centre for skills transfer and technological learning, offering on-the-job training to thousands of Nigerian engineers and technicians who previously lacked access to advanced refining technology. In a country where “brain drain” is a persistent issue, this represents a quiet but critical investment in human capital.

“The Dangote Group has become a nurturing ground for Nigerian engineers, scientists, and technicians, many of whom have gone on to work as expatriates in various countries,” noted Funmi Sessi, chairperson of the Nigeria Labour Congress, Lagos State chapter.

She noted that this is not just about oil. It’s about knowledge, competence, and sovereignty.

The Road Ahead

While the refinery’s first year has delivered much-needed progress, the road ahead is not without hurdles. Crude oil supply consistency, export logistics, and continued importation of substandard petroleum products persist.

Still, for many Nigerians, the shift from energy dependency to relative stability is nothing short of monumental.

“One year in, and it’s already hard to imagine going back to how things were,” says Energy analyst Ibukun Phillips. “For once, the future feels like something we can build not just wait for.”

A New Chapter for Nigeria and Africa

As the world’s energy landscape evolves, Nigeria’s success in refining its own crude and exporting surplus fuel offers lessons for other resource-rich but import-dependent countries across the Global South. The Dangote Refinery is no silver bullet, but it is a powerful demonstration of what can happen when ambition, capital, and execution align in the right place at the right time.

President of the Economic Community of West African States (ECOWAS) Commission, Dr Omar Touray, lauded the refinery as a “beacon of hope for Africa’s future” and a demonstration of what the private sector could achieve in driving regional industrialisation.

In one year, one refinery has shifted the trajectory of a nation. And it may only be the beginning.

Abiodun, a communications specialist, writes from Lagos

Feature/OPED

5 Tips to Make Back-to-School Hustle Smoother

By Diana Tenebe

September is here, and for many parents in Nigeria, that means the start of the back-to-school frenzy. The mornings become a blur of getting kids ready, packing lunch boxes, and making sure everyone has what they need for a successful day. The challenge begins with finding out what is on the menu for the kids to take to school for their meals. But with a little planning, you can turn the back-to-school hustle into a smooth, stress-free routine.

Here are five tips to help you get ready for the new school term and stay on top of things:

1. Stock Up on Pantry Essentials

Don’t wait until the last minute to stock up on foodstuff and everyday staples. A well-stocked pantry is your best friend during busy school weeks. Think about all the things you need for quick breakfasts, easy lunchbox fillers, and after-school snacks. Items like cereal, oats, bread, pasta, rice, and cooking oil are essential. You can also grab things like biscuits, juice, and canned goods for those days when you’re short on time. Buying in bulk can also save you money and ensure you don’t run out of key ingredients at a crucial moment.

2. Plan Your Meals Ahead of Time

One of the biggest time-savers is planning your meals for the week. This doesn’t have to be a complicated, rigid schedule. Simply jotting down a few ideas for breakfast and dinner can make a huge difference. By knowing what you’ll cook, you can ensure you have all the necessary ingredients on hand. This also makes grocery shopping more efficient, as you’ll only buy what you need. Consider prepping some ingredients in advance, like chopping vegetables or marinating meat, to make weeknight cooking even faster.

3. Set Up a ‘Grab-and-Go’ Station

Create a designated area for school essentials. This can be a shelf or a corner near the front door where kids can easily find their backpacks, lunchboxes, and water bottles. You can also use this space to store pre-portioned snacks, so they can quickly grab something on their way out. This simple trick eliminates the frantic search for missing items in the morning and helps teach your children responsibility.

4. Create a Family Calendar

A shared calendar, whether digital or a simple whiteboard, can be a game-changer. Use it to track school holidays, test dates, sports practices, and other family appointments. When everyone knows the schedule, it reduces confusion and helps the whole family stay organized. This is also a great way to help older kids manage their own schedules and responsibilities.

5. Involve the Kids

Getting your children involved in the back-to-school preparation can make a big difference. Let them help you with tasks like picking out what goes in their lunchboxes for the week or choosing which after-school snacks to stock up on. This not only makes the process more fun for them but also gives them a sense of ownership and responsibility. It’s also a great opportunity to teach them about making healthy food choices and understanding why organization is important.

By following these simple tips, you can take the stress out of the back-to-school season and create a smoother, more enjoyable routine for everyone in the family. The key is to start early, stay organized, and work together. Foodstuff Store is also here to help, as your partner in making back-to-school preparations seamless by offering a wide range of quality foodstuff and everyday essentials.

Diana Tenebe is the Chief Operating Officer of Foodstuff Store

Feature/OPED

Paradox of Profitability: Nigeria’s Banks, Bogus Earnings, and Recapitalisation Dilemma

By Blaise Udunze

Nigeria’s economy has been buffeted by storms in recent years with currency volatility, galloping inflation, surging interest rates, and dwindling consumer purchasing power. Yet, amid these macroeconomic headwinds, corporate organisations, especially banks, continue to post eye-popping profits.

Five of Nigeria’s top 10 banks reported a combined pre-tax profit of N4.6 trillion in 2024, a 70 per cent increase from the previous year with Zenith Bank and Guaranty Trust Holding Company crossing the trillion-naira mark for the first time.

This paradox raises a fundamental question: how are banks thriving on paper in an economy where businesses are shutting down, households are under severe strain, and government debt is ballooning?

As of the first half of 2025, the banking industry finds itself at a crossroads. Barely months after announcing staggering profit results, some in excess of N500 billion amongst commercial banks are now scrambling to meet the Central Bank of Nigeria’s (CBN) recapitalisation directive. Many are racing back-to-back to the capital market to raise fresh funds.

Behind the strong showing of the market leaders lies a deeper concern: a number of smaller commercial banks and regional players are still struggling to formulate credible recapitalization strategies.

Adding to the puzzle is the CBN’s decision to bar lenders from paying dividends and bonuses, insisting that earnings must be preserved to strengthen capital buffers.

For the average Nigerian, the contradiction is glaring: how can banks boast of record profits yet struggle to raise capital to meet regulatory requirements?

Analysts argue that much of these “profits” are not the outcome of robust productivity or genuine market expansion but rather accounting gains from naira devaluation, speculative positions, high interest rate spreads, loopholes in financial reporting, and arbitrary charges.

Profits on Paper, Weak Capital in Reality

Nigerian banks are witnessing a slowdown in profit growth in 2025 as the extraordinary windfalls from naira devaluation and high interest rates taper off.

Data from the Nigerian Exchange Limited (NGX) show that the combined after-tax profit of nine major lenders, including Zenith, GTCO, Access, UBA, Fidelity, Wema, Stanbic IBTC, FCMB, and FBN Holdco rose marginally by 0.74 per cent to N1.35 trillion in Q1 2025, compared to the record 274.3 per cent surge posted a year earlier.

Much of the earlier profit boom was driven by the floating of the naira in mid-2023 and subsequent devaluations, which allowed banks to book huge foreign exchange revaluation gains simply by holding dollar assets. However, analysts warn these paper gains were non-cash items that added little to banks’ real capital strength.

The apex bank has since barred lenders from deploying such gains for dividends or operating expenses, insisting they be held as buffers against future currency shocks.

With foreign exchange gains now normalising and credit expansion still sluggish, analysts say banks’ reliance on one-off windfalls has exposed underlying weaknesses in core operations such as lending, deposit mobilisation, and fee income.

“The era of abnormal profit growth is over,” said Tony Brown, a banking analyst in Abuja. “The numbers looked strong on paper, but the real test will be how banks sustain earnings through traditional banking activities.”

“The so-called profits are accounting gymnastics,” a Lagos-based analyst said. “They look good in shareholder reports but add little to the core equity needed for recapitalization.”

Banks Profit as Rate Hikes Widen Interest Spreads, squeeze Borrower

Nigerian banks are cashing in on wide interest rate spreads, boosted by the CBN’s tight monetary stance, which has kept the policy rate at 27.5 per cent into 2025. While lending rates have soared into double digits, deposit rates remain low, leaving savers shortchanged and borrowers under pressure.

Analysts say this asymmetric response allows banks to preserve profitability at customers’ expense. “Simply buying government Treasury bills with customers’ deposits was enough for banks to return profit with yields reaching 25 per cent,” said Abuja-based analyst, Chike Osigwe. “On top of that, they charge high lending rates while paying much less to depositors.”

Professor Uche Uwaleke, President of the Capital Market Academics of Nigeria (CMAN), noted that Tier-1 banks are declaring huge profits despite weak economic growth. He warned of a growing disconnect between banks’ fortunes and struggling sectors like manufacturing and agriculture, stressing the need to ensure customers and the real economy share in banking gains.

Mirage of profits powered by Arbitrary Charges

Nigerian banks’ record profits in 2024 have been linked not only to monetary policy tailwinds but also to a surge in arbitrary charges imposed on customers. Despite CBN’s repeated sanctions for breaching its Guide to Charges, lenders continue to rack up billions from fees on transfers, withdrawals, ATM use, account maintenance, SMS alerts, and other deductions.

With over 312 million active bank accounts, these charges now contribute more to profitability than traditional lending or FX operations. Five tier-1 banks alone posted N4.6 trillion in pre-tax profit in 2024, a 69.5 per cent jump from the previous year.

“Banks have turned customers into easy prey,” said financial reform advocate Dr Bruno Agbakoba. Consumer advocate Mrs Toun Adeniran added that households and SMEs are being “drained by unexplained deductions.” A former CBN official admitted enforcement is “a challenge” despite sanctions. In the words of one customer, Nigeria’s banking system has become “a pain in the neck” profitable for lenders, but punishing for households and enterprises struggling to survive in a hostile economic environment.

Critics also warn that this reliance on “blood profits” discourages innovation and credit expansion, further widening the gap between banks’ fortunes and the struggles of businesses and households. Michael Owhoko, a Public Policy Analyst, warned that instead of boosting their image, the massive profits of Nigerian banks are fueling negative public perception, as many views their practices as harmful to individuals and especially small and medium businesses.

Why Banks Are Quietly Rationing Liquidity

Towards month ends, Nigerians are been frustrated by stalled online transfers, frozen mobile apps, and endless queues at ATMs and banking halls. While banks blame “network issues,” analysts say the real problem runs deeper.

With naira devaluation, inflation, and the CBN’s tight monetary stance squeezing liquidity, banks are quietly restricting access to cash to stabilise their books. “When banks throttle withdrawals or delay digital transactions, it is often a survival tactic,” a Lagos-based analyst explained, noting that recapitalization pressures have worsened the strain.

The CBN’s new recapitalisation directive has raised minimum capital thresholds for banks, forcing many institutions to restructure their balance sheets. With dividend payouts curtailed and fresh capital requirements looming, banks are under immense pressure to conserve every naira they can. Restricting customer access through “network downtimes” has quietly become one of the industry’s unspoken strategies.

Banks Race to Meet New Capital Thresholds

With inflation and naira depreciation eroding the old capital base, the CBN has raised minimum capital requirements: N500 billion for international banks, N200 billion for national banks, N50 billion for regional and merchant banks, and N20 billion and N10 billion for national and regional non-interest lenders, respectively. All banks must comply by April 2026.

So far, nine (9) banks: including Access Holdings, Zenith Bank, Stanbic IBTC, Wema Bank, Lotus Bank, Jaiz Bank, Providus Bank, Greenwich Merchant Bank and GTBank have met the target. FirstBank’s oversubscribed rights issue brought in N187.6 billion, with a N350 billion private placement underway. GTBank recently surpassed the benchmark after a N365.85 billion rights issue, raising its capital to N504 billion.

Mid-tier lenders such as FCMB and Fidelity Bank are still raising funds, though analysts expect them to succeed given strong investor appetite. Fitch Ratings noted that most banks are likely to meet the new thresholds ahead of deadline.

While the policy aims to fortify Nigeria’s banking system against shocks, it has exposed the contradiction between glossy profit declarations and actual capital adequacy. If profits were as robust as reported, banks would not be racing to the capital market or wooing investors for fresh injections.

Dividend and Bonus Restrictions

To compound matters, the CBN recently restricted dividend payouts and executive bonuses. This move, while unpopular among shareholders, underscores the regulator’s concern that banks are not retaining enough earnings to build capital buffers.

This temporary suspension, according to the CBN, is part of a broader strategy to reinforce capital buffers, improve balance sheet resilience, and ensure prudent capital retention within the banking sector.

Meanwhile, Nigerian banks paid a record N951 billion in dividends to shareholders in 2024, representing an 87 per cent increase from the previous year.

For investors, it has been a rude awakening. Shareholders were promised juicy returns based on the record profits, but now the CBN is saying those same banks can’t afford to pay dividends. Something doesn’t add up.

Shadows of Creative Accounting in Banking Sector

Allegations of creative accounting continue to dog Nigeria’s banking sector, with analysts warning that dazzling profit numbers may not always reflect underlying reality. While not all institutions engage in such practices, the structural weaknesses of the financial system create room for manipulation.

“The financial sector regularly distorts earnings through creative accounting,” warns Bolatito Bickersteth of research firm Stears. “A significant portion of profit often lies in non-cash items, making true viability difficult to assess.”

One common tactic is the smoothing of earnings through frontloading expenses or deferring liabilities. Provisions for bad loans, for instance, are sometimes delayed, making banks appear healthier than they are. Similarly, loan books are often overstated, with risky credits classified as performing or backed by inflated collateral. This practice was central to the 2009 banking crisis that forced the CBN to sack several CEOs. Mercy Okon, Investment Research Specialist at Parthian Securities, emphasizes the systemic impact, “Huge profits seen in banks were due to unrealized FX gains, heightened interest income, and boosted transaction fees, not necessarily loan growth or real sector lending.”

Another area of concern is tax arbitrage, where lenders exploit gaps between tax rules and CBN guidelines to minimize taxable profits. Beyond that, some institutions reportedly use subsidiaries and offshore accounts to mask losses or inflate revenues, creating balance sheets that look stronger than reality.

Experts also fault the country’s weak auditing culture. Many banks rely on local audit firms with close management ties, raising doubts about independence and compliance with global reporting standards. As a result, governance lapses often escape scrutiny until crises erupt.

The big irony, analysts note, is that while Nigerian banks are declaring record profits, they are simultaneously racing to raise fresh capital under the CBN’s recapitalisation directive.

This contradiction, underscores the distortions created by weak oversight and questionable accounting practices.

The Public Illusion of Prosperity

The paradox points to a deeper credibility gap in Nigeria’s corporate financial reporting. To the public, banks appear prosperous, yet in reality, they are thinly capitalized and vulnerable to systemic shocks.

The irony is not lost on Nigerians who endure soaring lending rates, endless bank charges, and poor service delivery, only to be told that their banks are both profit-rich and capital-poor at the same time.

Way Forward:

To restore trust in Nigeria’s banking sector, regulators must enforce stricter consumer protection policies and closely monitor arbitrary charges. Agencies like the FCCPC and NGOs should actively safeguard customer interests, while the CBN ensures fair pricing and balance between lending and savings rates.

Some existing policies driving excessive fees need urgent review to avoid discouraging use of banking services and undermining the cashless policy, especially in an underbanked society.

Banks, on their part, must prioritize transparency, empathy, and integrity to rebuild reputation, while tighter financial disclosures, stronger corporate governance, and truly independent audits are essential for sustainable growth.

The recapitalization drive is long overdue, especially given the rising risks from a fragile economy, dollar shortages, and exposure to sovereign debt. However, unless transparency improves in financial reporting, the cycle of bogus profits and weak fundamentals will persist.

The recapitalization process should be paired with reforms in disclosure standards and stricter audit independence to ensure that profit figures reflect genuine financial strength.

Until then, the paradox remains: Nigerian banks that claim to be “rolling in profits” are the same institutions struggling to muster the funds needed to secure their future.

Blaise, a journalist and PR professional writes from Lagos, can be reached via: blaise.udunze@gmail.com

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology5 years ago

Technology5 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN