Technology

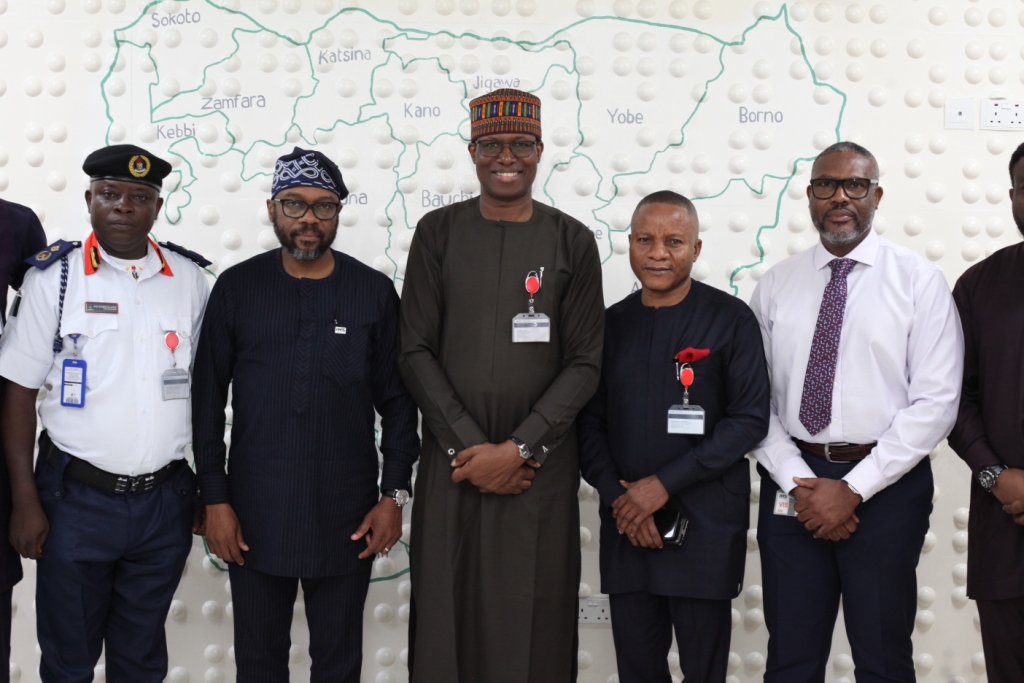

Zenith Bank to Build 100-Capacity ICT Centre in Niger State

By Dipo Olowookere

A Memorandum of Understanding (MoU) has been signed between the Niger State government and Zenith Bank Plc for the setting up of a 100-capacity Information and Communications Technology (ICT) centre in the northern state of Nigeria.

Niger State Governor, Mr Abubakar Sani Bello, while speaking at the signing ceremony on Friday, disclosed that project would go a long way to boost the Internally Generated Revenue (IGR) of the state.

He said further that when completed, the facility would be used to empower youths in the state, which would go a long way to boost the state’s economy.

Governor Bello commended Zenith Bank for partnering with the state government to provide more job opportunities to resident of Niger State.

“As part of your Corporate Social Responsibility (CSR), you have decided to give us a very special ICT centre and from the master plan it will have positive impact.

“We sincerely appreciate this support as it will engage the youths in terms of empowerment and at the same time improve education.

“Apart from increasing our IGR in the state it may also provide job opportunities for few people. “Whatever business or structure that comes into the state even if it employs one person it is something.

“It means taking one person out of the labour market. So we will try to encourage and support interventions like this,” the Governor said at the Government House in Minna, the state capital.

Also speaking at the ceremony, an Executive Director of Zenith Bank, Mr Umar Shuaib Ahmed, disclosed that proposed facility would enhance learning, youth empowerment and social development of the people of the state.

“This project, which is our CSR, will go a long way to empower youths in this state and we assure you that work would begin very soon,” he said.

Technology

OpenAI Raises $40bn to Boost AI Research

By Adedapo Adesanya

Artificial Intelligence (AI) company, OpenAI, on Monday announced that it closed one of the largest private funding rounds in history to boost AI research.

According to a blog post on the company’s website, OpenAI raised $40 billion in a round that values the company at $300 billion.

Japan’s SoftBank led the round, with other participants including Microsoft, Coatue, Altimeter, and Thrive, all of which are earlier backers in the outfit.

OpenAI said it plans to use the fresh capital to “push the frontiers of AI research even further” and scale its compute infrastructure, according to the blog post.

“[This new capital] enables us to push the frontiers of AI research even further, scale our compute infrastructure, and deliver increasingly powerful tools for the 500 million people who use ChatGPT every week,” OpenAI wrote in the blog post.

“We’re excited to be working in partnership with SoftBank Group — few companies understand how to scale transformative technology like they do.”

About $18 billion of the funding is expected to be used for OpenAI’s commitment to Stargate.

Recall that the joint venture between SoftBank, OpenAI and Oracle was announced by President Donald Trump in January.

The initial funding will be $10 billion, followed by the remaining $30 billion by the end of 2025, the person said. But the round comes with a caveat.

SoftBank said in an updated disclosure that its total investment could be slashed to as low as $20 billion if OpenAI doesn’t restructure into a for-profit entity by December 31.

This come amid pressure on OpenAI to pull off the for-profit conversion, a plan that will need the blessing of Microsoft and the California Attorney General, and has been challenged in court by Mr Elon Musk, who was one of the co-founders of OpenAI in 2015, when it was started as a non-profit research lab.

The company’s current and unusual hybrid structure includes a capped-profit limited partnership created in 2019. The original nonprofit is the controlling shareholder and would be spun out as an independent entity if the company can restructure.

OpenAI’s venture backers have received convertible notes that would turn into equity.

Technology

Stakeholders Move to Tackle Vandalization of Telecommunications Infrastructure

By Aduragbemi Omiyale

Stakeholders in the telecommunications sector in Nigeria have resolved to establish a working group dedicated to addressing key industry challenges, including the vandalization and theft of infrastructure, arbitrary shutdown of base stations, fibre cuts due to road construction and the denial of access by unauthorized individuals by leveraging technology for real-time monitoring and protection, strengthening security measures around telecommunication sites and collaborating more with the security and regulatory agencies to mitigate these challenges.

This followed extensive deliberations at an event organised by IHS Nigeria, part of the IHS Holding Limited, to develop a multi-stakeholder action plan for the protection of Critical National Information Infrastructure (CNII) assets in Lagos State.

The stakeholders underscored the need to prioritize deterrence and prevention of these incidents and highlighted the importance of public awareness campaigns to sensitize the host communities and public of the need to protect telecommunications infrastructure in their localities.

“The protection of Critical National Information Infrastructure (CNII) has been a critical concern for all industry stakeholders.

“We are experiencing daily losses of assets, which significantly impact on the quality of service delivered to subscribers.

“Addressing these issues is paramount to sustaining Nigeria’s digital ecosystem and meeting regulatory expectations,” the Senior Vice President and Chief Corporate Services Officer of HIS Nigeria, Mr Dapo Otunla, stated.

Recognizing the importance of communications infrastructure as the backbone of national security, economic growth and social cohesion, the stakeholders at the meeting convened under the umbrella of the Association of Licensed Telecoms Operators of Nigeria (ALTON) agreed on the urgent need for collaborative solutions to ensure the protection of these vital assets.

The meeting was attended by senior representatives from the telecommunications stakeholder groups and regulatory bodies, including the Nigerian Communications Commission (NCC), the Association of Licensed Telecoms Operators of Nigeria (ALTON), Association of Telecommunications Companies of Nigeria (ATCON) and the Lagos State Infrastructure Maintenance and Regulatory Agency (LASIMRA).

Also in attendance were representatives from the Mobile Network Operators (MNOs), and InfraCos as well as the Nigeria Security and Civil Defence Corps (NSCDC), the security agency tasked with the protection of Critical National Infrastructure across the country.

Technology

Airtel Africa, MTN Group to Share Network Infrastructure in Nigeria, Uganda

By Aduragbemi Omiyale

Two of the major telecommunications companies in Africa, Airtel Africa Plc and MTN Group, have entered into agreements to share network infrastructure in Uganda and Nigeria.

The idea behind this is to cost operating costs and improve network coverage for quality mobile services to millions of customers, particularly in remote areas.

However, this would be carried out in compliance with local regulatory and statutory requirements.

The initiative is part of a growing global trend toward network sharing. By collaborating, telecoms operators can explore innovative and pro-competitive solutions to improve service quality while managing costs more effectively.

The sharing of infrastructure has the potential to enable the delivery of world-class, reliable mobile services to more and more customers across Africa.

Already, MTN and Airtel Africa are exploring various opportunities in other markets, including Congo-Brazzaville, Rwanda and Zambia.

Among the types of agreements considered are RAN sharing and those aimed at establishing commercial and technical agreements for fibre infrastructure sharing and, if necessary, the construction of fibre networks.

“As we compete fiercely in the market on the strength of our brand, services and our offerings we are building common infrastructure, within the permissible regulatory framework, to provide a more robust and extensive digital highway to drive digital and financial inclusion at the same time avoiding duplication of expensive infrastructure to drive operational efficiencies and benefits for our customers,” the chief executive of Airtel Africa, Mr Sunil Taldar, said.

His counterpart at MTN Group, Mr Ralph Mupita, while commenting on the development, said, “As MTN, we are driven by the vision of delivering digital solutions that drive Africa’s progress.

“We continue to see strong structural demand for digital and financial services across our markets. To meet this demand, we continue to invest in coverage and capacity to ensure high-quality connectivity for our customers.

“That said, there are opportunities within regulatory frameworks for sharing resources to drive higher efficiencies and improve returns.”

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN