Banking

CBN Yet to Register Polaris Bank, New Owner of Skye Bank

By Dipo Olowookere

The Central Bank of Nigeria (CBN) is yet to fully register Polaris Bank Limited, the bridge bank it announced for the defunct Skye Bank Plc, Business Post has confirmed.

Last Friday, the apex bank withdrew the operating license of Skye Bank after running its affairs for over two years.

The CBN Governor, Mr Godwin Emefiele, had disclosed that Polaris Bank Limited would take over the assets and liabilities of the collapsed financial institution.

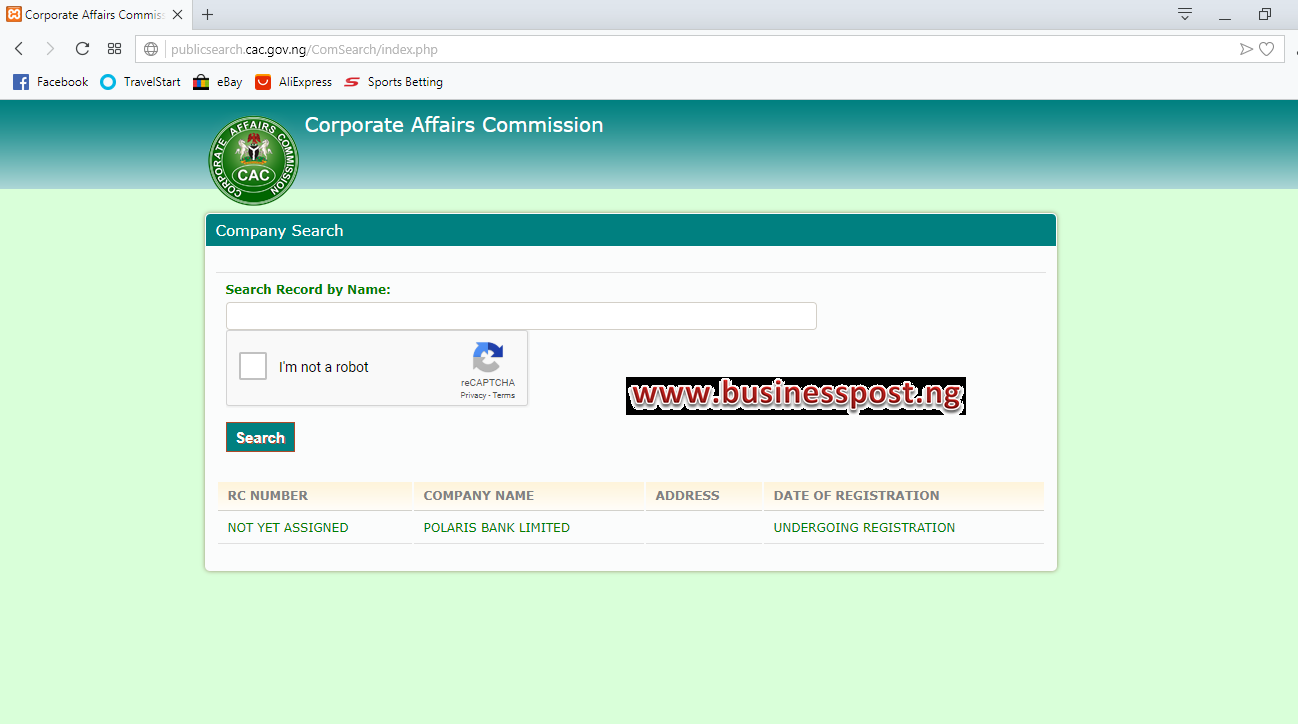

However, a check by Business Post on the registration status of Polaris Bank Ltd on Monday, September 24, 2018, showed that the bank was still undergoing registration with the Corporate Affairs Commission (CAC), the agency saddled with the responsibility of registering businesses in Nigeria.

A search on the online portal of the CAC showed that Polaris Bank Limited was yet to be assigned with a registration number.

Though federal government claims business registration takes about 48 hours to complete, in reality, it sometimes takes a week to finish the process, going by few this newspaper has witnessed.

Efforts by Business Post to reach out to the CBN through its spokesman, Mr Isaac Okorafor, on why the bridge bank was not fully registered before taking over Skye Bank were futile.

However, as at the time of filing this report, the former web address of Skye Bank Plc, www.skyebankng,com, was already redirecting to www.polarisbanklimited.com with the old name still visible on the new website as seen in the picture below.

Banking

Access Bank CEO Roosevelt Ogbonna Exits Access Holdings Board

By Adedapo Adesanya

Access Holdings Plc has announced that Mr Roosevelt Ogbonna, a Non-Executive Director, has stepped down from the board after three and a half years of service.

The announcement was made in a disclosure filed on the Nigerian Exchange (NGX) Limited and signed by the Company Secretary, Mr Sunday Ekwochi.

In the statement, the financial institution explained that although Mr Ogbonna is retiring from its board, he will continue to serve as the chief executive of Access Bank Plc, the banking subsidiary of the organisation.

His resignation is aimed at ensuring compliance with the Corporate Governance Guidelines of the Central Bank of Nigeria (CBN) for Financial Holding Companies (2023), which stipulate that no more than nine directors can sit on the board of a financial holding company.

The board expressed its gratitude for his “outstanding and continued contributions to the Access Group.”

Mr Ogbonna was appointed to lead Access Bank in May 2022, after serving as Deputy Managing Director from 2017 and Executive Director from 2013. He joined Access Bank in 2002 from Guaranty Trust Bank (GTBank) and has built up more than two decades of experience in the banking industry.

Beyond his role as CEO, Mr Ogbonna serves on the boards of Access Bank’s subsidiaries in the UK and South Africa and represents the Bank on the boards of Africa Finance Corporation and CSCS Plc.

His background combines both professional and academic achievements. He is a Fellow of the Institute of Chartered Accountants of Nigeria (FCA), an Honorary Member of the Chartered Institute of Bankers (HCIB), and a CFA charter holder.

As of August 2025, the Board of Access Holdings Plc consists of Mr Aigboje Aig-Imoukhuede (Chairman), Mr Bolaji Olaitan Agbede (Acting Group CEO), and Mr Lanre Bamisebi (Executive Director).

The independent non-executive directors are Mr Abubakar Aribidesi Jimoh, Mrs Fatimah Bintah Bello-Ismail, and Mrs Ibironke Adeyemi.

Other members include non-executive directors Mrs Ojinika Nkechinyelu Olaghere and Mr Olusegun Babalola Ogbonnewo.

Banking

Fidelity Bank Limits International Transactions on Naira Card to $1,000 Per Quarter

By Aduragbemi Omiyale

Customers of Fidelity Bank Plc can now “spend up to $1,000 quarterly for international POS and online transactions,” the lender’s Divisional Head of eBanking, Ms Ifeoma Onibuje.

She was quoted as revealing this in a statement issued to announce the bank’s resumption of international transactions on its Naira debit cards.

Due to foreign exchange (FX) liquidity squeeze in the country, the Central Bank of Nigeria (CBN) earlier stopped financial institutions from allowing their local debit cards to be used by customers for offshore spending.

This restriction was removed this year after over two years of suspension, giving customers the freedom to make seamless payments abroad, online, and at ATMs outside the country.

“We are delighted to inform the public that Fidelity Naira Cards are now enabled for global use. This means that our travelling customers can now utilize their Naira Debit cards outside the country to shop, spend and withdraw internationally without hassles.”

“Consequently, our customers can now spend up to $1,000 quarterly for international POS and online transactions; and withdraw up to $500 quarterly on international ATMs,” Ms Onibuje stated.

The announcement offers Fidelity Bank customers another way to complete international transactions, in addition to the Bank’s existing foreign currency debit and credit cards. This further reinforces Fidelity Bank’s commitment to delivering solutions that fit seamlessly into customers’ lifestyles. With Fidelity Bank’s VISA and Mastercard Naira Debit Cards, Nigerians can now enjoy effortless global access.

Beyond payments, Fidelity VISA cardholders, one of the variants of the bank’s card offerings, also enjoy premium travel and lifestyle benefits ranging from airport lounge and spa access via the Visa Airport Companion App, to fast-track immigration lanes and 20% discounts on SIXT car rentals worldwide.

This move reflects the bank’s commitment to provide secure, convenient, and reliable banking services that empower customers in Nigeria and beyond. The bank has deliberately made the process of getting a Fideity Naira card seamless. Customers can easily apply for their Fidelity VISA or Mastercard Naira Debit card via the Fidelity Mobile App or simply visit the nearest Fidelity bank branch to request for one and they can start transacting globally with ease.

Banking

CBN Gives Operators 60 Days to Geotag POS Machines

By Adedapo Adesanya

The Central Bank of Nigeria (CBN) has mandated Point of Sale (PoS) operators to geotag their terminals within 60 days or risk being shut down.

In a circular released on August 25, 2025, the regulator ordered all licensed operators, which includes Moniepoint, OPay, and PalmPay, as well as other banks with agency banking licenses, to geotag every PoS terminal before October 20, 2025.

This means that the millions of POS devices currently used by agents and merchants across Nigeria must now be registered with exact GPS coordinates showing where each device is being used.

According to the CBN, the move is meant to curb fraud, stop the use of cloned or “ghost” terminals, and make it easier to track transactions in real time.

Under the new rule, all existing POS machines must be updated with built-in GPS systems and connected to the National Central Switch, which will monitor locations through a special software development kit (SDK).

Merchants will only be allowed to process payments within a 10-metre radius of their registered business address. Any device that is not geo-tagged within the deadline will no longer be allowed to operate.

The directive also applies to newly deployed POS devices, which must be geo-tagged before activation. Operators such as Payment Terminal Service Providers (PTSPs) and mobile money companies will be responsible for ensuring that all devices in their network comply.

The directive also aims to reduce fraud and unauthorised POS activity by ensuring each terminal’s location is verified and continuously monitored.

The central bank said it would begin compliance checks from October 20, 2025, a development that gives operators just about two months to upgrade.

This could come as a challenge with Nigeria having an estimated 2 million POS agents> The number is also growing daily.

The increasing number of POS agents and terminals is a major reason why the apex bank is introducing new directives for their operation.

In 2024, the CBN required that POS transactions be routed through licensed Payment Terminal Service Aggregators (PTSA) to improve tracking and transparency. That same year, POS operators were mandated to register their devices with the Corporate Affairs Commission (CAC).

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology5 years ago

Technology5 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN

2 Comments