General

How to Obtain SCUML Registration from EFCC With Ease

By Modupe Gbadeyanka

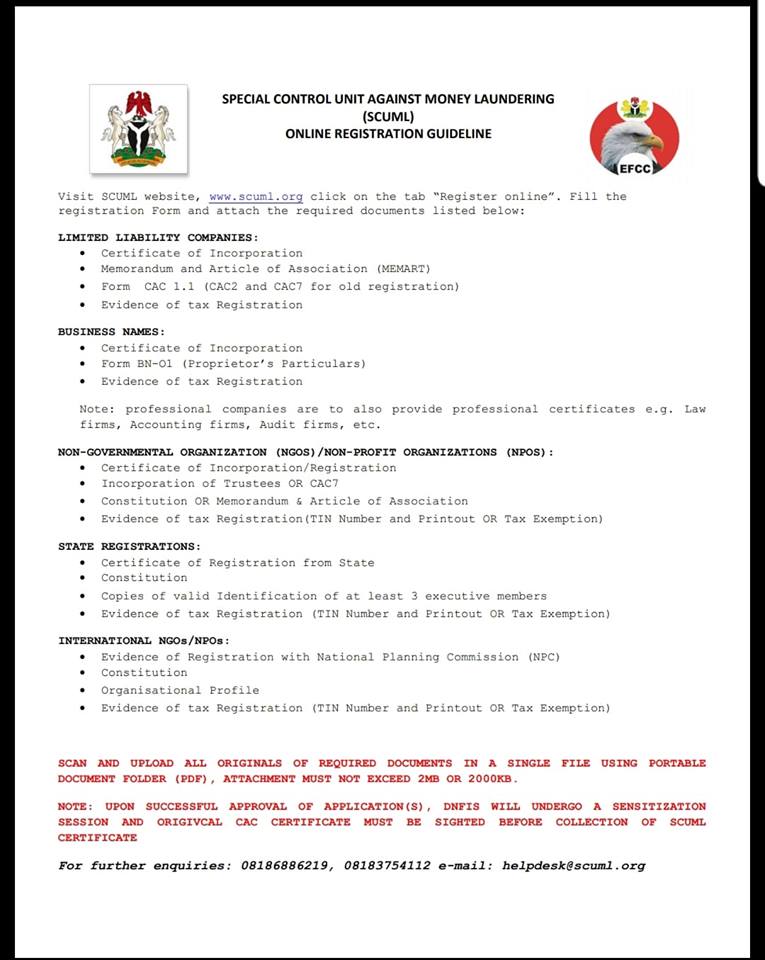

For those who have tried to open a corporate bank account in Nigeria, they must have come across the word ‘SCUML.’ In some cases, without this document in your possession, banks cannot complete the account opening process for you.

SCUML is an acronym for Special Control Unit Against Money Laundering and it is issued by the Economic and Financial Crimes Commission (EFCC).

If someone had in the past told you that obtaining the SCUML certificate costs a lot and difficult to obtain, we are here to let you know that all you need is a computer, internet access and a scanner to scan your documents, which must be less than 2MB and merged as one file.

SCUML is charged with the responsibility of monitoring, supervising and regulating the activities of Designated Non-Financial Institutions (DNFIs) in line with the Money Laundering (Prohibition) Act ML(P)Act 2011 and the Prevention of Terrorism Act (PTA) 2011.

Who are Designated Non-Financial Institutions?

Section 25 of the ML (P) Act defines DNFIs as dealers in jewellery, cars and luxury goods, Precious stones and metals, Real estate, Estate developers, Estate surveyors and Valuers, Estate Agents, Chartered accountants, audit firms, tax consultants, clearing and settlement companies, hotels, casinos, supermarkets, Dealers in Merchanised Farming equipment and machineries, Practitioners of Mechanised farming, Non-Governmental Organisations (NGOs) or such other businesses as the Federal Ministry of Trade and Investment or appropriate regulatory authorities may from time to time designate.

Does SCUML registration attract any fee?

No! Registration can be done on the SCUML website at NO COST.

What is a suspicious transaction?

A suspicious transaction is a transaction in which a DNFI suspects that it may involve proceeds of any of the offences specified in the Money Laundering (Prohibition) Act 2011 as amended, regardless of the value involved; or

(a) Appears to be made in circumstances of unusual or unjustified complexity; or

(b) Appears to have no economic justification or lawful objective; or

(c) Gives rise to suspicion that it may involve financing of terrorism.

STR has no threshold; it could be based on any amount. This report should be submitted to the Nigeria Financial Intelligence Unit (NFIU) solely.

What is Currency Transaction Report?

A CTR is a report that Designated and Non-Financial Institutions (DNFIs) are statutorily required to file with the Nigeria Financial Intelligence Unit (NFIU) on transactions that involve amounts in excess of N10,000,000 (Ten Million Naira) and N5,000,000 (Five Million Naira) for corporate bodies and Individuals respectively. However, based on the Memoradum of Understanding between Special Control Unit against Money Laundering and the Nigerian Financial Intelligence Unit, DNFIs are to report CTRs directly to SCUML.

What is Cash Based Transaction Report? This is a report that Designated Non-financial Institutions are required to file with the Special Control Unit against Money Laundering (SCUML) for each deposit, purchase or sale and other payments , by a customer to the DNFI, which involves cash transaction in excess of $1,000 or its equivalent in Naira or other currencies.

General

UKNIAF Marks Six Years Infrastructure Support to Nigeria

By Adedapo Adesanya

The United Kingdom–Nigeria Infrastructure Advisory Facility (UKNIAF), established in 2019 as part of a 16-year legacy of UK-funded infrastructure support to Nigeria, convened over 100 senior stakeholders on Tuesday, December 2, to review its progress and formally close out its current phase of operations.

The event brought together representatives from federal and state governments, development partners, development finance institutions, and the private sector to reflect on UKNIAF’s work across the power, infrastructure finance, and roads sectors. Discussions focused on institutional reforms, capacity development, and the sustainability of tools and processes introduced over the past six years.

Since inception, UKNIAF has delivered targeted technical assistance designed to embed evidence-based reforms, data-driven decision-making, and improved institutional performance. Its interventions have mobilised significant financing, strengthened regulatory and planning systems, and enhanced investor readiness across multiple infrastructure markets.

In the power sector, participants highlighted landmark achievements including the development of Nigeria’s first Integrated Resource Plan, which outlines a least-cost and low-carbon pathway for expanding electricity supply. UKNIAF also supported the Nigerian Electricity Regulatory Commission (NERC) in building advanced real-time data capabilities for tariff monitoring, grid management, and outage tracking. The programme enabled pioneering states to establish their own electricity markets following constitutional reforms.

In infrastructure finance, UKNIAF was recognised for strengthening project preparation systems and enabling access to capital. Notable accomplishments include supporting the mobilisation of $75 million from the African Development Bank to the Special Agro-Industrial Processing Zone (SAPZ) programme in two states, and accelerating mini-grid and solar deployment through improved technical standards at the Rural Electrification Agency (REA).

UKNIAF also designed a national project preparation facility, for which N21 billion was allocated in both the 2024 and 2025 budgets to build a pipeline of bankable projects.

Speaking on this, Mr Frank Edozie, UKNIAF Team Lead, described the programme’s close-out as a “handover for sustained delivery,” emphasising that strengthened institutions now hold tools that make Nigeria’s infrastructure landscape more transparent, climate-smart, and investor-ready.

On his part, the Minister of Power, Mr Adebayo Adelabu, commended the programme, noting that its technical assistance and advisory services had helped lay the foundation for a sustainable and inclusive electricity supply industry.

Mrs Cynthia Rowe, Head of Development Corporation at the UK Foreign, Commonwealth and Development Office (FCDO) in Nigeria, praised the partnership, highlighting achievements ranging from state-level electricity market reforms to unlocking major financing and designing Nigeria’s Climate Change Fund.

Enugu State Secretary to the State Government, Professor Chidiebere Onyia, underscored the lasting influence of the programme, stating that UKNIAF’s impact continues through the expertise and leadership transferred to national and sub-national institutions.

The close-out event reaffirmed stakeholders’ commitment to sustaining tools, reforms, and knowledge products developed under UKNIAF, while strengthening collaboration among public, private, and development actors in the infrastructure ecosystem.

Participants included federal and state agencies such as the Nigeria Governors’ Forum, Federal Ministry of Power, Ministry of Finance, NERC, REA, and the Transmission Company of Nigeria, alongside development partners including the African Development Bank, World Bank, and IFC, as well as private sector and civil society stakeholders.

General

Dangote Refinery Reduces PMS Pump Price to N699 Per Litre

By Aduragbemi Omiyale

The gantry price of Premium Motor Spirit (PMS), otherwise known as petrol, has been slashed by the Dangote Petroleum Refinery.

The Lagos-based oil facility brought down the ex-depot price of the petroleum product by 15.58 per cent or N129 per litre to N828 per litre.

Though the company had yet to release an official statement on this development, real-time market data on Petroleumprice.ng on Friday showed the new price.

Punch reports that data from the platform also showed fresh reductions across several private depots following the refinery’s latest review.

Sigmund Depot cut its ex-depot price by N4 to N824 per litre, Bulk Strategic dropped its price by N3, and TechnoOil slashed its by N15.

General

CBN Tasks New ACGSF Board on Tech-driven Agric Financing

By Adedapo Adesanya

The Governor of the Central Bank of Nigeria (CBN), Mr Yemi Cardoso, has inaugurated a new board for the Agricultural Credit Guarantee Scheme Fund (ACGSF) with a renewed push to expand agricultural lending through technology, innovation and deeper financial inclusion.

Speaking at the inauguration in Abuja, Mr Cardoso said the scheme, established in 1977, remains a critical instrument for de-risking credit to farmers nationwide.

“The ACGSF has demonstrated enormous value in supporting Nigeria’s food system. With repayment rates consistently between 90 and 98 percent, it is clear that farmers can deliver when given access to credit,” he said.

The CBN Governor stressed the need for a more modernised approach to agricultural finance.

“We must scale up innovation, deepen inclusion and deploy technology to ensure that more farmers, especially women and youth, can benefit from this scheme,” Mr Cardoso stated, charging the new board to strengthen collaboration with financial institutions while ensuring real-time tracking and monitoring of loans to improve productivity and safeguard the fund’s integrity.

The newly inaugurated Board is chaired by Dr Olusegun Oshin, with members including Professor Murtala Sabo Sagagi, Dr Nneka Onyeali-Ikpe, Mr Frank Satumari Kudla, Ms Olusola Sowemimo, Ms Adetoun Abbi-Olaniyan and Mr Wondi Philip Ndanusa.

Mr Cardoso expressed confidence in the team’s ability to reposition agricultural credit delivery.

“This Board comes at a crucial time. We expect stronger oversight, improved efficiency and a renewed focus on rural livelihoods,” he said.

According to a statement from the apex bank, Deputy Governors, Directors and senior officials of the bank were present at the ceremony.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

19 Comments