Economy

2018 Budget Implementation Less Than 5%—Lawmaker

By Modupe Gbadeyanka

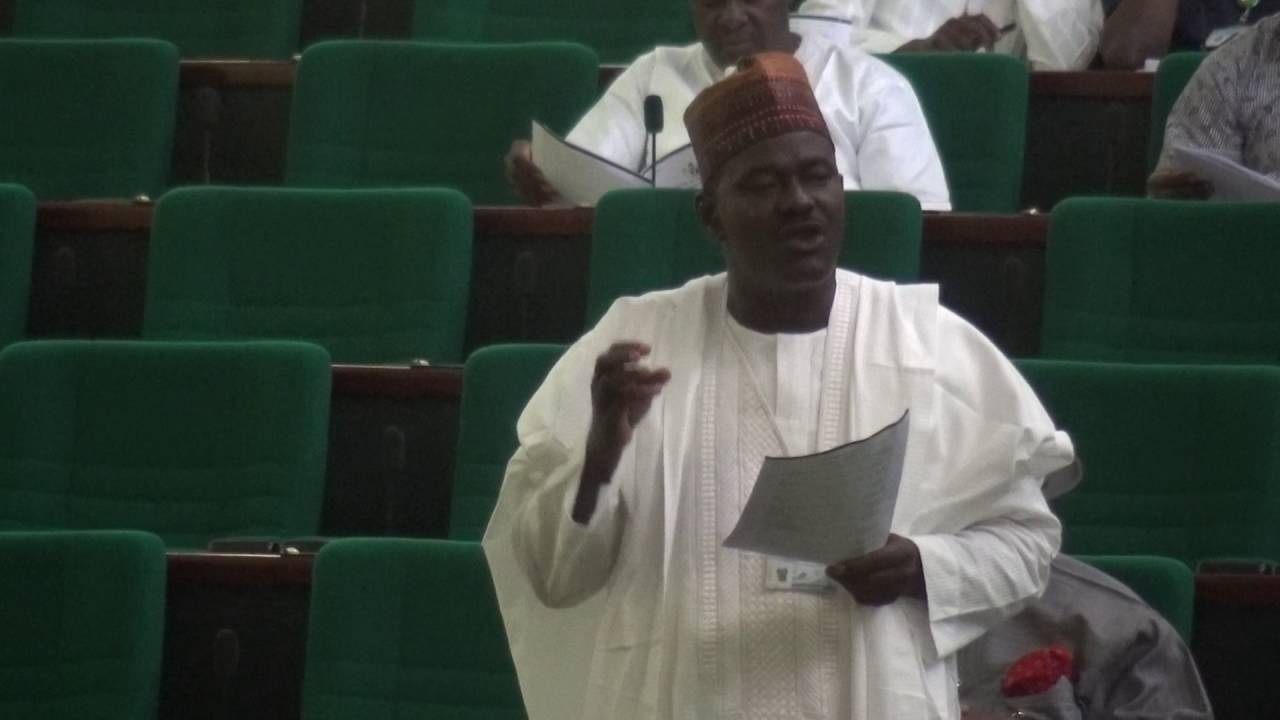

A lawmaker from Kwara State, Mr Aliyu Ahman-Pategi, has lamented the poor implementation of the 2018 budget by the executive.

The political economist, who is representing Edu/Moro/Patigi constituency at the lower chamber of the National Assembly, said the level of implementation of the 2018 budget was less than five percent, which he described as very poor.

Mr Ahman-Pategi, while contributing to the debate on the 2019 budget estimate of N8.8 trillion on Wednesday, said the executive was just making the efforts of the parliament a waste of time if the implementation was poor.

“The percentage of implementation of the 2018 budget is less than 5 percent, which means it was a wasted financial year.

“It is natural for lawmakers not to be encouraged to debate the 2019 budget and other budgets because we have it at the back our minds that the implementation would be poor after going extra miles to go through the documents and pass them,” the lawmaker said on the floor of the green chamber.

He therefore, called on the executive to ensure the budgets are ready for transmission to the parliament before October of the preceding year to allow input of legislators to be concluded in time for speedy passage and implementation.

Mr Ahman-Pategi lamented the continuous borrowing of the present administration without channelling the funds to developmental projects, noting that this keeps making the percentage of debt services to rise.

He also called that the money proposed for the social intervention fund be used to pay owed contractors so that they can return to site and engage Nigerians in carrying out the jobs so that wealth can be spread.

Corroborating his colleague, a lawmaker of Kaduna State, Mr Simon Arabo, said the level of implementation of the 2018 was inexcusably poor especially when aligned with the revenue that was generated.

He stated that the implementation was obviously deliberate to create artificial scarcity since the government bragged about increased revenue generation from the organs of government.

He stated that it was alarming that Nigerians do not even know how much oil is generated and sold daily, there is so much oil theft still going on, also frowning at the current administration’s penchant for excessive borrowing.

Economy

Oil Prices Close Lower on Oversupply Concerns

By Adedapo Adesanya

Oil prices closed lower on Friday as a supply glut and a potential Russia-Ukraine peace deal outweighed worries about any impact from the US seizure of an oil tanker near Venezuela.

Brent crude went down by 16 cents to trade at $61.12 a barrel and the US West Texas Intermediate (WTI) crude also declined by 16 cents to finish at $57.44 per barrel. For the week, both benchmarks lost more than 4 per cent this week.

Market analysts noted that the market continues to be weighed down by the crude oil supply situation. Oversupply has become the defining feature of the market, with traders questioning whether any upcoming catalysts are strong enough to offset the growing imbalance stretching into early 2026.

The US seized a sanctioned oil tanker off the coast of Venezuela, President Donald Trump said on Wednesday. The US is preparing to intercept more ships transporting Venezuelan oil after the seizure of a tanker this week.

However, traders and analysts largely shrugged off worries about the impact of the tanker seizure, pointing to ample supply in the markets.

The International Energy Agency (IEA) corrected its 2026 oil glut forecast to 3.84 million barrels per day in its latest monthly report, down 250,000 barrels per day from a month ago, hiking its demand growth forecast for next year to 860,000 barrels per day compared to 2.4 million barrels per day supply growth.

Meanwhile, data in a report by the Organisation of the Petroleum Exporting Countries (OPEC), indicated that world oil supply will match demand closely in 2026, in contrast to the IEA’s view.

Russian oil production increased to 9.367 million barrels per day last month, up by a mere 10,000 barrels per day compared to October, leaving the world’s third-largest producer 165,000 barrels per day below its OPEC+ quota as Ukraine’s drone strikes derailed crude loadings in November.

Also, Russia’s seaborne oil product exports in November fell by just 0.8 per cent from October, with the completion of refinery maintenance helping to offset a slump in fuel exports from southern routes such as the Black Sea and Azov Sea.

During the week, the US Federal Reserve has lowered the federal funds rate to 3.50-3.75 per cent.

Economy

Presco Acquires 10,000-Hectare Nsadop, Boki Plantations After $100m Deal

By Aduragbemi Omiyale

Days after announcing the injection of $100 million from SIAT NV, Presco Plc has acquired about 10,000 hectares across the Nsadop and Boki plantations in Cross River State.

The fully integrated edible oils group disclosed in a statement made available to Business Post on Friday that the strategic acquisition further consolidates its position as the dominant player in Nigeria’s palm oil industry.

The plantations is part of efforts to significantly expand Presco’s production footprint and strengthen its ability to meet the rapidly growing domestic demand for edible oil products.

By integrating these estates into the group, Presco will unlock new agronomic potential and secure a broader raw material base to support higher processing and refining throughput across its value chain.

By expanding its plantation base by 10,000 hectares, Presco advances national food security, reduces reliance on imports, and supports the federal government’s drive toward industrial self-sufficiency.

As these estates are upgraded and integrated, they are expected to generate meaningful productivity and profitability upside, delivering sustainable long-term value for shareholders while strengthening Presco’s role as a key driver of the country’s agro-industrial transformation.

Presco said it would apply its proven model of sustainable agriculture, community development, and responsible land stewardship to Nsadop and Boki.

The company plans to work closely with host communities, replicating its established social investment framework, supporting job creation, and ensuring a stable and mutually beneficial operating environment.

“This acquisition is a decisive execution of the commitments we made to our shareholders. During the launch of our recent Rights Issue, we pledged to accelerate our plantation expansion and position Presco for its next phase of growth.

“Today’s announcement delivers on that promise. Nsadop and Boki are strategically located estates that complement our existing operations and expand the scale required to power our mills and refineries at higher capacity,” the chief executive of Presco, Mr Reji George, said.

“This move is not only about expanding land, it is about strengthening our leadership, securing long-term supply, and reinforcing our belief in the future of Nigeria’s agribusiness sector,” he added.

Economy

FG Launches Platform to Settle Natural Gas Trade

By Adedapo Adesanya

The federal government has unveiled Africa’s first gas trading licence, clearing house and settlement leeway platform to ensure efficient and transparent trading of natural gas.

The government, through the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) in partnership with the Securities and Exchange Commission (SEC) granted a license to JEX Markets Limited to establish and operate the online platform for gas trading and exchange.

Minister of State for Petroleum Resources (Gas), Mr Ekperikpe Ekpo, at the launch said the platform would pave the way for easy natural gas business, transparent pricing and secure payment mechanisms hallmarks that align with the national energy policies and global best practices.

According to him, the initiative is critical for the success of the ‘decade of gas’, noting that the trading environment and the benefits that come with it will strengthen the level of industrialisation and ensure the injection of private investments into the gas processing and transport sectors.

“This launch is completely consistent with the Renewed Hope Agenda of His Excellency, President Bola Ahmed Tinubu, who stated that natural gas will play the central role in the energy security, industrialisation, and economic diversification. The President’s vision requires a regulatory environment that is predictable, trusted, and designed to unlock value,” he said.

Mr Ekpo said the country is richly endowed with natural gas reserves, among the biggest in the world, but if the underlying market where the gas will flow is not efficient, reliable, and well-regulated, it will not be possible for us to realise the ultimate potential of the resource.

“The gas trading licence introduced today is decisive on this front, paving the way for a new, regulated market where reliable traders will feel safe doing business, where businesses can plan, and where investors can invest, knowing that it will safeguard both their capital and the public interest.

“The licence is founded upon sound regulations and guidelines governing technical competence, commercial capability, financial soundness, and responsible operations. Among the responsibilities of the licence holders is the adherence to the various rules on gas measurement, tariffs, pricing, and assignments,” he said.

On his part, NMDPRA Chief Executive, Mr Farouk Ahmed, also said Nigeria holds over 209 trillion cubic feet (TCF) of proven gas reserves, which is the largest in Africa and an estimated 600 TCF of potential reserves.

He said despite the potential, Nigeria’s domestic gas market has remained underdeveloped and constrained by pricing opacity, high transaction costs, limited flexibility, market illiquidity, poor sanctity of gas contracts, restricted access to gas and low investments in the sector.

Mr Ahmed noted that the presentation of a Gas Trading License (GTL) and a Clearing House and settlement Authorisation to JEX Markets Limited is in compliance with the provisions of section 159 of the Petroleum Industry Act (PIA) 2021 for the trading and settlement of wholesale gas in Nigeria.

The implementation and full operationalisation of this provision of the PIA will further unlock the extensive opportunity and investment potentials of the gas industry through the improved supply and utilisation of the country’s vast gas resource in our strategic economic sectors of power, Industry and transportation.”

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn