Banking

List of Mobile Money Transfer Codes of Nigerian Banks

By Modupe Gbadeyanka

The financial technology world brought several innovations to the banking industry and in no time, many financial institutions were forced to embrace fintech.

Before now, customers had to rush to a banking hall or ATM point to make financial transactions like account balance checking, money transfer and others.

However, the introduction of fintech changed all these and with the punching of phone’s keypads, money can be transferred within a minute to a beneficiary.

With this in place, many banks operating in Nigeria came up with difference easy-to-remember USSD codes to make it easy for their customers to make financial transactions on their mobile phones.

Below are the USSD codes of banks in Nigeria.

GTB *737#

Zenith Bank *966#

First Bank *894#

UBA *919#

Access Bank *901#

Fidelity Bank *770#

Ecobank *326#

Union Bank *826#

Sterling Bank *822#

Polaris Bank *833#

Diamond Bank *426#

Stanbic Bank *909#

Wema Bank *945#

Heritage Bank *322#

FCMB *329#

Ja’iz Bank *389*301#

Unity Bank *389*215#

Keystone Bank *7111#

Banking

GTCO Unveils Waste for Gas Initiative for Cleaner Environment

By Modupe Gbadeyanka

One of the leading financial services institutions in Africa, Guaranty Trust Holding Company (GTCO) Plc, has launched an initiative to improve quality of life for households and empower women in underserved communities.

This scheme known as Waste for Gas is under its corporate social responsibility (CSR) and stakeholder engagement to reaffirm its unwavering commitment to improving outcomes for people and communities.

The initiative also introduces a structured Waste for Gas exchange programme that promotes responsible waste management, fostering a culture of sustainability.

The company intends to distribute 3,000 3kg gas cylinders with burners to low-income households in Obafemi Owode Local Government, Mowe, Ogun State.

By providing households with gas-powered cooking, the initiative simplifies daily routines, freeing up time for essential activities that support financial resilience.

The project will unfold in two key phases, ensuring that it reaches those most in need.

In the first phase, teams from GTCO, in collaboration with local government representatives, conducted door-to-door visits across 12 wards in Obafemi Owode Local Government from Monday to Friday, February 18 – 21, 2025.

These visits helped identify beneficiaries who currently rely on firewood and charcoal for cooking. Participating households collected and returned plastic waste in exchange for gas cylinders and burners.

In the second phase, which held on Saturday and Sunday, February 22 and 23, 2025, efforts shifted to monitoring and increasing adoption of the new cooking method among the beneficiaries.

The chief executive of GTCO, Mr Segun Agbaje, said, “At GTCO, we are committed to driving progress, not just through innovative financial solutions but by creating real impact in the communities where we operate.

“Waste for Gas is about making life easier for families, giving them more time for what truly matters—whether it’s education, meaningful work, or personal development.

“Beyond this initiative, our goal is to continually evolve sustainable platforms that empower people, strengthen communities, and contribute to socioeconomic progress.”

As GTCO continues to expand its CSR footprint, the Waste for Gas project serves as a blueprint for future interventions that drive meaningful, long-lasting impact in underserved communities.

Banking

Stanbic IBTC Bank to Gather Stakeholders on Gas, Infrastructure Opportunities

By Aduragbemi Omiyale

On Tuesday, February 25, 2025, stakeholders will gather in Lagos to discuss how energy and infrastructure can drive comprehensive economic development and resilience across Nigeria.

This programme is being put together by the Corporate and Investment Banking (CIB) division of Stanbic IBTC Bank, a subsidiary of the Standard Bank Group.

Global executives of the parent firm will join the others, including prominent industry leaders and regulatory authorities, to discuss theme, Driving Gas and Infrastructure Opportunities in Africa.

The event will welcome senior executives and key decision-makers, creating an intimate environment for meaningful dialogue. This focused gathering will enable participants to explore collaborative opportunities that promote economic diversification and expansion.

The comprehensive agenda will address critical aspects of integrated development, including innovative financing mechanisms for cross-sector projects, strategies for enhancing energy security while expanding infrastructure networks, and frameworks for public-private partnerships that maximise economic impact.

Discussions will focus on practical solutions for overcoming energy shortages while advancing infrastructure development across sectors.

The aim of the conference is to foster a holistic approach to development by exploring synergies between energy solutions and various critical infrastructure segments, including transportation, healthcare, and communications networks.

The innovative gas and infrastructure summit will also feature a distinguished panel session, during which industry experts will explore how integrated development approaches can address Nigeria’s infrastructure deficit while promoting economic diversification.

Key sector leaders from Standard Bank will also share expert views on how strategic collaboration in gas, power, and infrastructure can create sustainable opportunities for growth and development in Africa.

“Nigeria’s economic future hinges on our ability to develop integrated solutions that link our energy capabilities. This includes investment strategies for renewable energy projects and frameworks for financing green infrastructure, all while promoting broader critical infrastructure development.

“This conference unites visionaries who can transform these connections into tangible economic growth, job creation, and increased productivity across all sectors,” the Executive Director for CIB at Stanbic IBTC Bank, Mr Eric Fajemisin, stated.

“As we share insights and explore innovative solutions, we aim to forge partnerships that address challenges and unlock potentials for economic diversification,” the Head of Client Coverage at Stanbic IBTC Bank, Ms Joyce Dimkpa, noted.

Banking

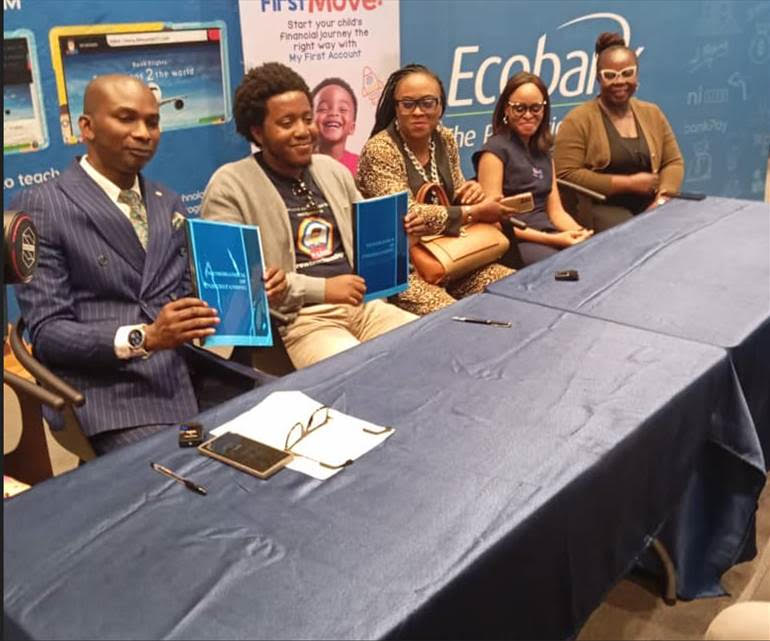

Ecobank, Code 14 Labs to Deepen Coding Education in Nigeria

By Modupe Gbadeyanka

Efforts are being made by Ecobank Nigeria and Code 14 Labs to deepen coding education in the country by providing affordable annual training and proficiency certification to students.

The lender, in a statement, said it would provide nationwide and pan-African access to coding education, utilizing its extensive operational network across the continent.

In turn, Code 14 Labs will supply its educational technology and trusted community to ensure high-quality teaching that delivers tangible learning outcomes for students and reassurance for parents.

Both parties recently met in Lagos to seal a Memorandum of Understanding (MoU) to kick off the partnership.

Parents and guardians wishing to have their wards participate in the programme are encouraged to open Ecobank’s MyFirst Account—a specialized high yield savings product designed for children under 16.

The Head of Consumer Banking at Ecobank Nigeria, Ms Aeola Ogunyemi, who represented the Head of Consumer Products and Segments, Mr Victor Yalokwu, said the collaboration reflects the bank’s commitment to bridging the digital divide, promoting inclusion, and preparing the next generation for a tech-driven future.

He also highlighted how the collaboration aligns with Ecobank’s mission to equip children with the skills necessary to thrive in an increasingly digital world.

“At Ecobank, we recognize that financial literacy and digital education are intertwined. This belief led to the creation of the MyFirst Account, a product aimed at children under 16 to encourage smart financial habits from an early age.

“By introducing students to coding through Code 14’s innovative mobile app, we’re not just teaching coding skills, but also nurturing problem-solving abilities, creativity, and digital confidence,” Mr Yalokwu noted.

The Executive Director of Research and Technology at Code 14 Labs, Mr Otaru Daudu, praised the partnership and expressed confidence that, with the support of additional partners like the British Council and the Teachers Registration Council of Nigeria (TRCN), they will achieve their goal of training 50,000 learners to proficiency level in HyperText Markup Language (HTML) and Cascading Style Sheets (CSS), essential programming languages for global internet communication.

He emphasised that Code 14 Labs is committed to scaling critical education components through technology-driven inclusion.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN