Banking

Moody’s Downgrades Access Bank’s BCA Rating to b3

By Dipo Olowookere

Access Bank’s baseline credit assessment (BCA) has been downgraded by Moodys’ Investors Service to b3 from b2, with its long-term CRRs dropped to B2 from B1, its long-term CRA lowered to B2(cr) from B1(cr) and the national scale CRRs dropped to Aa3.ng from Aa1.ng.

In a release by the rating agency, it was explained that the decision to lower the Nigerian lender’s rating was because of the possible weakening of the bank’s credit profile following the merger with Diamond Bank, despite the immediate improvement to Access Bank’ funding structure and long-term profitability.

It said following the merger, Access Bank’s capital and asset risk metrics will deteriorate given Diamond Bank’s weaker credit profile (though much smaller than Access Bank, Diamond Bank had a BCA of caa3 before the merger was completed).

“Following the BCA downgrade to b3, we now incorporate 1 notch of rating uplift on Access Bank’s BCA to align its local currency deposit ratings of B2 with that of Nigeria’s issuer rating,” Moody’s said.

Meanwhile, Moody’s has confirmed Access Bank’s long-term local currency deposit rating of B2, long-term foreign currency deposit rating of B3, long-term issuer ratings of B2, local currency senior unsecured rating of B2, local currency national scale deposit ratings of A1.ng/NG-1, foreign currency national scale deposit ratings of A3.ng/NG-2 and national scale senior unsecured rating of A1.ng.

Furthermore, Moody’s has affirmed the financial institution’s short-term bank deposit ratings, issuer ratings and counterparty risk ratings (CRR) at Not-prime and affirmed the short-term counterparty risk assessment (CRA) at Not-prime(cr).

The outlook on the bank’s long-term deposit ratings, long-term issuer ratings and senior unsecured rating was changed to stable from ratings under review.

It was stated that the confirmation of Access Bank’s long term deposit ratings with a stable outlook reflects Moody’s view that the deterioration in Access Bank’s standalone credit profile, as a result of the merger, is balanced against our assumption of a high likelihood of Access being supported by the government of Nigeria (B2, stable), if needed.

Banking

Nedbank Sells 21.22% Stake in Ecobank to Bosquet Investments

By Aduragbemi Omiyale

The private investment vehicle of a Cameroonian banker, Mr Alain Nkontchou, Bosquet Investments Limited, has acquired a 21.22 per cent stake of Nedbank Group in Ecobank Transnational Incorporated (ETI), the parent company of the Ecobank Group.

A statement from Ecobank on Friday said the sale followed the decision of Nedbank to realign its strategy towards its core markets in Southern and Eastern Africa.

However, the transaction remains subject to regulatory approvals, according to the notice filed to the Nigerian Exchange (NGX) Limited.

“I am very pleased to have come thus far with the Ecobank Group, and I look forward to supporting the institution in advancing its strategic objectives of growth, transformation and returns.

“I am confident that, together, we will seize the opportunities ahead and lead the organisation into a new era of sustained success,” Mr Nkontchou, who owns Enko Capital Management LLP, which served as the lead advisor for the transaction, stated.

The chief executive of Ecobank Group, Mr Jeremy Awori, while commenting on the deal, said, “We are pleased to welcome Bosquet Investments Ltd. as a significant shareholder of ETI.

“This important milestone reflects a deep and enduring commitment to our group’s growth and success. Their investment is a strong vote of confidence in our Growth, Transformation and Returns strategy, our performance, and our people.”

“Having been part of the bank’s journey for many years, initially joining as a member of the board, then serving as ETI Chairman, Alain has demonstrated unwavering dedication, strategic vision, and leadership that have significantly contributed to the bank’s achievements, bringing the bank to an era of profitability”, he added.

“I am grateful for his continued trust and partnership, and I look forward to working together to realize a shared vision of growth, innovation, and excellence. I also take the opportunity to extend deep appreciation to Nedbank for 17 years of constructive partnership. They remain a valued commercial partner of Ecobank,” Mr Awori added.

It was disclosed that Absa Bank Limited, acting through its Corporate and Investment Banking division, was the co-financial advisor to the acquisition.

Banking

AltBank Takes Financial Inclusion to Traders, Farmers

By Modupe Gbadeyanka

One of Nigeria’s leading non-interest banks, the Alternative Bank (AltBank), has ramped up its efforts to promote economic empowerment and financial inclusion for market traders and smallholder farmers across the country.

With a focus on improving access to banking services, the bank is providing critical financial support to some of Nigeria’s most underserved communities.

The initiative, undertaken through an agreement between Sterling Financial Holdings Company and the Association of Market Women/Men and Farmers of Nigeria (AMWMF), aims to address the challenges faced by millions of market women, men, and farmers who have long been excluded from formal banking systems.

According to the Central Bank of Nigeria (CBN), approximately 26 per cent of Nigerian adults or about 28.8 million people, remain financially excluded, with rural communities and informal sector workers being particularly affected, and the company is working to change this by making essential financial services accessible to these groups, particularly women.

Through this new initiative, the Alternative Bank is opening access to formal financial services for over 16 million members of the AMWMF.

The collaboration is designed to provide members with access to a range of banking services, including zero-fee accounts, microloans, and SME funding, aimed at fostering business growth and financial independence.

“To adequately bridge the financial inclusion gap, financial institutions must continue to devote resources towards removing the barriers that have historically hindered large segments of our population. For the unbanked and underbanked, the challenges go beyond the lack of physical infrastructure and extend to deeper issues of trust, financial illiteracy, and systemic exclusion from mainstream financial services.

“At the Alternative Bank, we are committed to breaking these barriers by offering tailored solutions and championing programs that empower people to take control of their financial futures. We believe that by simplifying access to financial services and addressing these long-standing obstacles, we can unlock the potential of millions of grassroots entrepreneurs and contribute to broader economic growth,” an Executive Director at the Alternative Bank, Ms Korede Demola-Adeniyi, said.

Recognising education as a key factor in the country’s financial literacy gap, the Alternative Bank is offering the association’s members access to financial literacy training and personalised business support, aimed at empowering them with the knowledge and skills to manage and grow their finances effectively.

In addition, the lender is supporting business growth by offering no initial fees for point-of-sale (POS) terminals to vendors, making it easier for them to accept electronic payments.

The drive, which began in Oyo State, will extend to 15 other states across Nigeria’s geopolitical zones throughout the course of the year and has since received strong support from AMWMF’s leadership.

The leader of AMWMF, Ms Becky Olubukola, praised the collaboration as a crucial step towards realising the association’s vision of creating an environment where every member has the opportunity to thrive.

She emphasised that, by working with financial institutions like the Alternative Bank, the group could vastly expand opportunities for its members and help drive local economic development.

Banking

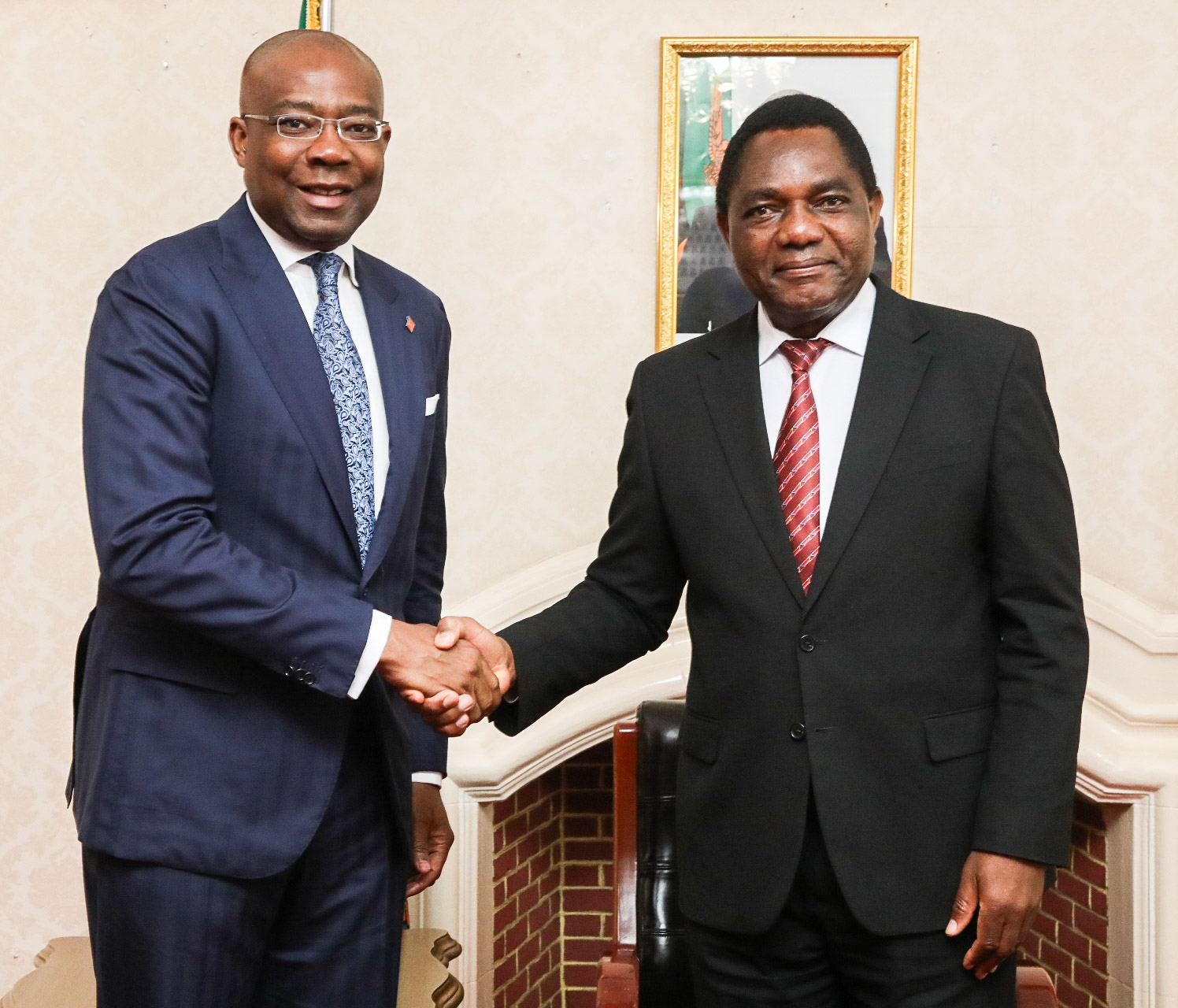

Access Holdings to Finance Transformative Projects in Zambia

By Aduragbemi Omiyale

Nigerian financial services provider, Access Holdings Plc, has reaffirmed its support for Zambia’s economy, promising to finance transformative projects that will strengthen the country’s power generation, transmission, and distribution capacity.

This assurance was given by the chairman of Access Holdings, Mr Aigboje Aig-Imoukhuede, during a courtesy visit to the President of Zambia, Mr Hakainde Hichilema, at the State House in Lusaka on Wednesday.

“Access Holdings stands ready to finance transformative projects that will strengthen Zambia’s power generation, transmission, and distribution capacity.

“Our financing arrangements of up to $100 million are designed to catalyse development in sectors that matter most to the economy,” Mr Aig-Imoukhuede stated.

He commended the Zambian government for its bold economic reforms, particularly in the energy sector, noting these measures had created conducive environment for strategic investments, unlocking new opportunities for growth.

With energy playing a pivotal role in enabling industrial growth, particularly in mining, where copper production is projected to hit 1 million metric tonnes by year-end, it was disclosed that Access Holdings’ investments would help ensure reliable power supply and drive broader economic expansion.

Beyond energy, the group reaffirmed its commitment to supporting Zambia’s agriculture sector and advancing digital transformation, in line with the country’s growth agenda.

Also speaking, the chief executive of Access Bank Zambia, Mr Lishala Situmbeko, said the bank was already partnering with IDC subsidiaries and is evaluating an investment of 450 million kwacha into critical infrastructure projects.

President Hichilema, in his remarks, noted that Zambia currently faces a shortage in power generation and transmission, and emphasised the need for increased investment following the recent open access reforms.

He also highlighted the potential for banks to support other key sectors such as agriculture and digital transformation, which are central to Zambia’s growth strategy

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology5 years ago

Technology5 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN