World

ARED Boosts Ugandan’s Economy With Solar Powered Kiosks

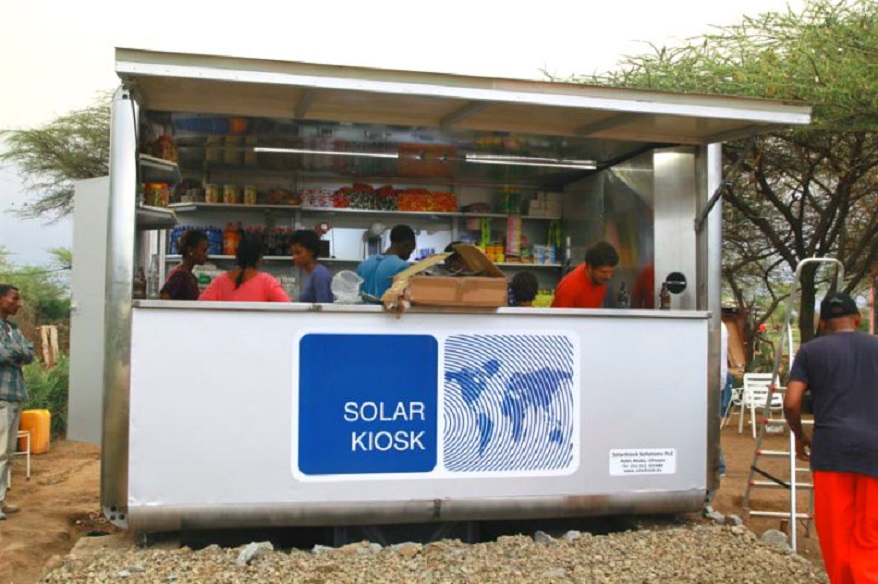

Rwanda-based service start-up known for its ‘Smart Business in a Box’ solar powered kiosks, ARED, has entered into the Ugandan market, its first expansion into an international market. The company announced that it has set up 10 solar powered kiosks with 10 women micro franchisees.

The solar kiosks known as the Shiriki Hubs are run by women and differently abled individuals on a micro-franchisee model. These have been set up in Kampala as well as in the refugee camps of Arua district through which citizens belonging to lower income groups can charge their mobile devices, buy air-time and WiFi connectivity for accessing the internet, make digital payments, besides availing a host of other intranet services offline.

This expansion into Uganda was funded by US-based impact investor Gray Matters Capital under its gender lens sector agnostic portfolio – coLABS in July 2017.

With its funding mandate met after piloting in Uganda for a little more than a year, and achieving impact with 48 kiosks is Rwanda – of which 41 are run by women and 2 by people with disabilities; ARED is now aiming to have 100 micro franchisees serving around 3000 customers a month by 2020 with this market expansion.

The start-up presently provides digital services and meets the connectivity needs of 55,000 customers in Rwanda and Uganda, using its solar powered kiosks.

Giving insights into his company’s development strategy for Uganda, Henri Nyakarundi – Founder and CEO, ARED Group said, “We will work with partners whom we call as area developers who will franchise our model in the different areas of Uganda. Our focus is on NGOs and private sector enterprises whom we’d like to be roped in. They will buy the hardware – the kiosk; train micro franchisees and use our licensed software. ARED will of course support them along the way.”

Apart from leasing the kiosks via the franchise model, ARED is also planning to partner telecom service providers in Uganda to build distribution channels at the community level.

While the rationale behind entering Uganda was the similarity of culture and proximity to Rwanda, ARED will be embarking on a far more challenging journey next year.

“We will be looking to target countries in Western Africa next year. While the cultural ethos may differ, what remains common pan-Africa is the unreliability of power supply. It is this adversity that we’d like to convert into an opportunity,” said Henri announcing that ARED has begun working on a pilot in Ivory Coast.

World

Africa Transcending into BRICS+ Orbit

By Professor Maurice Okoli and Professor Chinedu Ochinanwata

After the historic 16th BRICS summit held in October 2024, three African States Algeria, Nigeria and Uganda, among others in Europe (Belarus and Turkey), Asia and Latin America, recognizably became BRICS+ partner states. In total, 13 countries received BRICS partner status, according to declaration reports by the Russian Ministry of Foreign Affairs. This category of ‘partner states’ was primarily designated as part of the distinctive-focused leeway towards acquiring full membership status in the determined future.

The legitimate implications for being in this category are quite notable and provide colourful heterogeneity to the BRICS+ association. It also encompasses a growing influence, the bubbling upliftment of these countries on another level of the global stage. Of course, these cannot be underestimated in discussing BRICS+, especially in the era of shifting economic architecture and geopolitical situations.

Together, the BRICS members encompass nearly a third of the world’s land surface and almost half of the world’s population. BRICS is an informal association of emerging economies, comprising Brazil, Russia, India, China, and South Africa, with the latest additions Ethiopia, Egypt, Iran, Saudi Arabia and the United Arab Emirates. Argentina declined to join at the last moment.

Despite various criticisms raised against a number of countries that ascended into the category of ‘partner states’ for BRICS+, each has its strategic dimension. In assessing particularly African countries – Algeria (North Africa), Nigeria (West Africa) and Uganda (East Africa) – BRICS+ now, has, in the first place, a wider geographical representation across Africa. It is important to reiterate here that Ethiopia, Egypt and South Africa are full-fledged BRICS members.

Ethiopia, by all standards, is a reputable country in East Africa. The continental organisation African Union (AU) is headquartered in its capital, Addis Ababa. Egypt, considered to be a regional power, also plays invaluable roles within the Arab world, specifically in North Africa and in the Middle East region. Without much doubt, the new ‘partner states’ – Algeria, Nigeria and Uganda have indicated their collective commitment to the multifaceted ideals in the declaration adopted in Kazan, Tatarstan Republic.

BRICS’ numerical expansion and quality transformation in January 2024, and the creation of ‘partner states’ in October 2024, both under Russia’s BRICS+ chairmanship have undoubtedly opened doors to new partnership opportunities for Africa.

The strongest question centred on how BRICS’ African partnering states, Algeria, Nigeria and Uganda can strategically position themselves to benefit from the evolving dynamics within BRICS+ while, in this new geopolitical reality, simultaneously navigating for competing geopolitical interests in Africa. There are emerging challenges, but BRICS’s influence is growing and provides an impetus for strengthening relations and working systematically for economic growth, especially in the processes of reshaping economic architecture in this fast-rising multipolar world.

Nigeria and Uganda, as potential partners in the BRICS, could engage in several collaborative initiatives to enhance their economic political and social developments, including trade and investment.

For instance, Nigeria, with its natural resources and increasingly large market, and Uganda, with its agricultural potential, can collaborate to boost intra-BRICS trade and that of intra-Africa trade. In addition to this, exploring investment opportunities in sectors such as manufacturing, production innovation and technology has a clean basis to add value to the raw materials and transform them into exportable products.

Closing related to the above, are pertinent questions of ensuring energy security and infrastructure (transport logistics). Nearly all African countries are griffing for support in technology transfer, and fintech – these largely depend on sustainable energy supply. Consequently, joint initiatives could harness the capabilities of BRICS members, particularly China, India and Russia in these sectors.

By leveraging their respective strengths and, with a focused approach, Nigeria and Uganda could address these shortfalls and deficits, and further down extend assistance across West Africa, and in East Africa. One key advantage is that Uganda has Ethiopia and Egypt as BRICS members, a ready-made basis for BRICS collaboration despite the differences and persistent conflicts in the region. The basic requirement here is to find a common understanding and distinctive focused sectors for collaboration.

Comparatively, there is much-proven evidence and features, including its size of economic power and wealth, its leadership in Africa as an energy power, and its abundant supply of natural resources. This West African country ranks third behind Egypt and South Africa, and Nigeria is qualified for a full-fledged BRICS membership.

Nigeria is often referred to as the Giant of Africa by its citizens due to its large population (estimated at 220m) with a large economy and is considered to be an emerging market by the World Bank. It is, however, believed Nigeria’s foreign relations with the Western powers may be a major reason the country has not yet subscribed to BRICS membership.

Despite this identified political complexity authorities, however, maintain a concrete decision to be made over the next two years, Nigeria’s expected role in BRICS+ could augment Africa’s capability to influence regional trade, economics and politics.

Reports monitored indicated that Nigeria runs a deliberative democratic system. As part of a new foreign policy push to have its voice heard in important global organisations, the Federal Executive Council, and even the National Assembly have to make deliberations and official majority decisions towards joining the BRICS+ association.

Meanwhile, Nigeria is currently in the well-meaning and clearly defined ‘partner states’ category which guarantees collaboration and partnership with BRICS+ members. In addition, it has the possibility of balancing its national interests with the collective goals of the BRICS.

South Africa which ascended to BRICS more than a decade ago has noticeably benefited from its membership. Ethiopia, which was granted BRICS membership status in January 2024 along with Egypt, has significant working relations with China, Russia and India. Based on its strong partnership, China has financed the 20-story office complex, which is one of the most prominent political buildings in Addis Ababa. It was fully funded, designed, built, and furnished by China as a $200m gift to Africa. While India’s case need not be over-emphasized and reiterated, Russia has also followed suit by exploring and making economic investments in Ethiopia.

In November 2022, Algeria officially applied for membership in BRICS. But its official application for BRICS+ membership, at first, attracted debates, and experts raised controversial points in connection with its role with neighbouring Morocco and particularly the Sahel States, including Mali and Niger which are currently undergoing some tectonic political changes and reforms.

Algeria, located in the Maghreb region of North Africa, has strategic importance for external powers such as the United States, Europe, China and Russia as well as those in the Middle East. Its capital and largest city Algiers, situated in the far north on the Mediterranean coast, is considered as a gateway into North Africa, by foreign players. It has a budget of €15.4 billion and provides the bulk of funding through some programmes, as it is included in the European Union’s European Neighbourhood Policy (ENP) which aims at bringing the EU and its neighbours closer.

After studying various reports, Algeria has passed through a chequered journey, in fact handling it as a potential opportunity to balance its Maghreb regional position, at least, by obtaining BRICS ‘partner status’ in October 2024. There were serious reports that India vetoed Algeria’s BRICS+ entry at France’s request.

Tension arose over Burkina Faso, Mali and Niger geopolitical crisis in the region, Algeria opposed an ECOWAS military operation in Niger and emphasized the role of diplomacy in bringing about a peaceful solution to the crisis, and refused permission for French military aircraft to fly over Algerian airspace. It was further explained that Paris reportedly pushed New Delhi into using its veto as ‘revenge’ against Algiers for its growing influence in the Sahel and Maghreb region, and as a way to slow down burgeoning ties between Algeria and China.

Nonetheless, Brazilian President Luiz Inacio Lula da Silva also opposed Algeria’s entry, according to Anadolu Agency. But while Algeria surpasses Ethiopia in the size of the economy and oil production and, Ethiopia and Egypt in terms of the volume of gas exports, China backed by Russia pushed Algeria to be accepted for partnership status in BRICS+, with the future possibility of attaining full membership. China sees great potential due to its strategic location between Europe and sub-Saharan Africa. China is funding the rehabilitation of the strategic Port of El Hamdania, as Algeria remains an essential part of the Belt and Road Initiative (BRI).

On the sidelines of the ninth annual meeting of the BRICS New Development Bank (NDB) held in Cape Town, Algeria was authorized to become a member of this financial entity. With its ‘partner status’, Algeria intended to buy shares in the BRICS New Development Bank (NDB) for $1.5 billion. In the opinion of Dilma Vana Rousseff, Chair of the New Development Bank, the move to join the bank would mark Algeria’s integration into the global financial system as the ninth member of the multilateral development institution.

On the other hand, Algeria plans to use its fast-tracked initiatives and its ‘partner status’ to ultimately attract BRICS+ members to invest in the free industrial zone with Mauritania and Niger, and then with Tunisia and Libya. Algerian President Abdelmadjid Tebboune underlined this to have massive geopolitical ramifications and could be important to the emerging multipolar goals in the Global South.

Furthermore, Tebboune outlined his government’s plans for economic development over the next 12 months, including the possibility of boosting investments, improving human development, and shifting towards a more advanced export structure relying less on hydrocarbons to qualify for membership into BRICS. With this high desire to be in BRICS+, Algeria still considers Western countries as important partners in trade, security, and other economic areas.

Lately, the BRICS countries have been getting more involved in Africa. The New Development Bank (NDB) was set up to help fund infrastructure and sustainable development projects, not just in BRICS countries but now in other growing economies too. It’s seen as an alternative to big players like the IMF and the World Bank.

The NDB, founded in 2015 by the BRICS countries—Brazil, Russia, India, China, and South Africa—aims to mobilize resources for infrastructure and sustainable development projects in emerging economies. It complements the work of existing multilateral and regional financial institutions in promoting global economic growth. In 2021, the bank expanded its membership to include Bangladesh, Egypt, the UAE, and Uruguay.

Despite multiple obstacles within the Arab Maghreb Union, specifically persistent conflict between Algeria and Morocco, in August 2021, Algeria ultimately announced the break of diplomatic relations with Morocco. Besides this, Algeria’s relations are not very cordial with Ethiopia and Egypt which are BRICS members.

As a result, its request to join BRICS was slightly opposed by Ethiopia and Egypt. And of course, Ethiopia and Egypt have conflicts over the Grand Renaissance Dam (GERD) and the Nile River. While Algeria remains an inescapable candidate for BRICS+, both African and foreign experts have argued that with the completion of the Trans-Saharan Highway, it is well positioned to develop BRICS-Sub-Saharan trade. The possibilities are immense, and their sponsorship would make Algeria a truly indispensable member of the BRICS.

In June 2024, the World Bank’s 2024 report marks a turning point for Algeria, which joins the select club of upper-middle-income countries. This economic rise, the result of an ambitious development strategy, places the country in the same category as emerging powers such as China, Brazil and Turkey.

In recent years, the Algerian government has halted the privatization of state-owned industries and imposed restrictions on imports and foreign involvement in its economy. These restrictions would prevent them from benefiting largely from the BRICS+ trade and investment platform created during the summit in Kazan.

That, however, China and Russia have comparatively less practical investment than the Gulf States. For instance, Turkish direct investments have accelerated in Algeria, with total value reaching $5 billion. As of 2022, the number of Turkish companies present in Algeria has reached 1,400, far lower than Russia and China, and any other BRICS+ in an anticipated positive direction. Algeria has the 10th largest reserves of natural gas in the world and is the 6th largest gas exporter. Despite its huge natural resources, the majority of the country’s population (an estimated 45.6 million) is still noticeably impoverished, the overall rate of unemployment was 11.8% in 2023.

South Africa, Ethiopia and Egypt (full members of BRICS+), and Algeria, Nigeria and Uganda (as partner states) have the potential to bring various multifaceted economic and social advantages to the African continent and to a new level at the side of BRICS+ association. In many areas, the partnership could be delivered that are beneficial to Africa, although African members of BRICS+ need to utilize the partnership to the fullest in terms of the potential of the available resources, the potential usefulness of African Continental Free Trade (AfCFTA) and the emerging business opportunities. Last but not least, there is also the need to align these different kinds of partnerships to the common strategic objectives of the African Union.

Professor Maurice Okoli is a fellow at the Institute for African Studies and the Institute of World Economy and International Relations, Russian Academy of Sciences. He is also a fellow and lecturer at the North-Eastern Federal University of Russia. He serves as an expert at the Roscongress Foundation and the Valdai Discussion Club.

As an academic researcher and economist with a keen interest in current geopolitical changes and the emerging world order, Maurice Okoli frequently contributes articles for publication in reputable media portals on different aspects of the interconnection between developing and developed countries, particularly in Asia, Africa, and Europe. With comments and suggestions, he can be reached via email: markolconsult (at) gmail (dot) com.

Professor Chinedu Ochinanwata is a Nigerian academic and serial entrepreneur. He is a professor of digital economy and innovation, and is currently serving as pioneer director at Nasarawa State University, Keffi Enterprise Centre.

Vice President of African Development Institute of Research Methodology (ADIRM). Email: chineduochi (at) yahoo (dot) com.

World

AFC Gets AfDB’s $30m Equity Investment to Rollout Green Shares in Climate Projects

By Adedapo Adesanya

The Africa Finance Corporation (AFC) will get a $30 million equity investment from the African Development Bank (AfDB) for the rollout of innovative “green shares” aimed at mobilising resources for climate action projects across Africa.

Green shares are innovative financial instruments to unlock significant funding for high-impact projects.

AFC will leverage the green equity and mobilise debt funding from capital markets for on-lending to sub-projects.

The AfDB board approval took place on December 11, 2024, as it seeks to play a key role in establishing an ecosystem of sustainable financing which will bridge gaps needed to create economic opportunities and enhance Africa’s climate resilience.

The finance is expected to inject some of this funding into some projects including wind and solar power plants in Djibouti and Egypt and energy storage systems in Cabo Verde.

The investment is also projected to create over 1,600 full-time equivalent jobs by 2031, while also fostering regional integration, and generating clean, reliable energy to power millions of African households. It is also expected to drive inclusive growth and expand economic opportunities for marginalised populations, including women and rural communities.

Despite contributing less than 3 per cent of global carbon emissions, Africa faces severe climate impacts and an annual infrastructure financing gap of $170 billion.

Mr Solomon Quaynor, African Development Bank Vice President for Private Sector, Infrastructure and Industrialisation said the collaboration between the two institutions exemplifies the transformative power of strategic partnerships.

“The bank group’s first-mover investment in AFC’s green shares is expected to attract other regional and global investors, amplifying the impact of this initiative, and sending a strong signal to global investors that Africa is ready to lead the way in green growth,” he said.

“We are honoured to welcome the African Development Bank, Africa’s largest development finance institution, as the first investor in our Green Shares programme,” added Mr Banji Fehintola, Executive Board Member and Head of Financial Services at AFC.

“Their $30 million commitment highlights the critical role of sustainable financing in tackling Africa’s climate and infrastructure challenges while strengthening our shared mission to drive transformative change across the continent. By working with a like-minded partner who shares our vision for a prosperous and sustainable Africa, we are advancing impactful solutions that support the continent’s green transition and long-term development,” he added.

Mr Ahmed Attout, the Bank’s Director for Financial Sector Development, stressed that, “This partnership with AFC is a major milestone in our efforts to channel domestic, regional, and global capital into projects that build climate resilience and foster sustainable growth.”

World

G20 and Africa: Unique Platform for Transformative Economic Partnership

By Kestér Kenn Klomegâh

The Group of 20 (G20) is an intergovernmental forum comprising 19 sovereign countries, the European Union (EU), and the African Union (AU). It works to address major issues related to the global economy, such as international financial stability, climate change mitigation and sustainable development, through annual meetings of Heads of State and Heads of Government.

The G20 was created in 1999 in response to several world economic crises, and South Africa has been the only African member in the Group. However, in September 2023, at the 18th G20 Summit, Indian PM Narendra Modi announced that the African Union (AU) has been included as a member of the G20, making it the 21st member of the intergovernmental forum. South Africa will take over the G20 presidency in 2025.

In mid-December 2024, Brand South Africa’s General Manager Lefentse Nokaneng, discussed in this insightful interview, the significance of the G20 forum, the multifaceted prospects and unique opportunities G20 could offer Africa. Here are the interview excerpts:

What are the aspirations, as South Africa prepares to take over the G20 presidency from Brazil, for Africa?

As South Africa prepares to take over the G20 presidency from Brazil in 2025, our aspirations for Africa have always been clear and compelling. As a founding member of the G20, South Africa has played a pivotal role in advocating for Africa’s inclusion within this influential multilateral forum.

Under the theme “Solidarity, Equality, and Sustainable Development,” South Africa’s presidency presents a significant opportunity to advance crucial reforms in the global governance system, ensuring that it is more representative of and responsive to the developmental needs of Africa and the Global South. To this, by focusing on reforms to the multilateral trading system and the global financial architecture, we aim to effectively address the pressing challenges of underdevelopment and transform the fortunes of the most vulnerable communities, many of whom reside in Africa.

As the leading economy on the continent, South Africa is deeply committed to unlocking Africa’s vast potential and fostering inclusive growth through the African Continental Free Trade Area (AfCFTA). We envision a G20 agenda that not only amplifies Africa’s voice but also drives collaborative efforts toward sustainable development aligned with the aspirations of the Pact for the Future and the achievement of the Sustainable Development Goals (SDGs) by 2030. This vision aligns with the African Union’s Agenda 2063, which aims to realize “The Africa We Want,” ultimately improving the lives of all Africans.

But generally, how has Africa, as a continent, so far benefited from G20, and what concretely can we underscore as remarkable achievements?

The inclusion of the African Union (AU) as a permanent member of the G20 can be underscored as a key achievement for the continent, providing a crucial platform for African nations to have a voice and to engage directly with major economic powers on key issues, that affect them, such as debt relief, security, infrastructure development, pandemics, and climate change. Prior to the AU’s membership, South Africa was the only African representative in the G20, which limited the continent’s ability to influence discussions on issues affecting its nations.

Africa stands at a pivotal moment in its development journey, with the G20 providing a crucial platform to address pressing development challenges and unlock immense growth potential through the African Continental Free Trade Area (AfCFTA). The African Development Bank highlights a significant $70 to $100 billion deficit in infrastructure investment across the continent, underscoring the need for a substantial 6% of GDP investment to achieve growth rates of 3% to 3.5%, well above the current global average. Collaborating with G20 partners offers Africa the opportunity to mobilize essential resources and expertise to bridge this gap.

Central to this effort is the reform of the international financial architecture to create equitable opportunities for Africa to harness its vast potential. By embracing innovative financing mechanisms, the continent can effectively address critical infrastructure gaps, unlocking pathways to inclusive and sustainable development. It is also vital to advocate for fair climate policies that recognize the diverse developmental stages of African economies, ensuring that measures such as carbon taxes do not disproportionately impact emerging nations.

To this end, investments in Africa’s energy transition are crucial. Notably, Germany, under the G20 Compact with Africa Initiative, has unveiled a R76-billion investment package aimed at facilitating Africa’s green energy transition by 2030. Furthermore, the New Collective Quantified Goal (NCQG) is a vital component of the Paris Agreement, setting a new financial target to support developing countries in their climate actions post-2025. By building on the $100 billion target established in 2009, the NCQG seeks to address persistent gaps in climate finance and provides a more ambitious and realistic framework for sustainable development.

For Africa, the commitment of developed nations to these climate goals is integral to achieving success. By ensuring adequate financing and support, Africa can not only meet its climate objectives but also harness its natural resources for sustainable growth. These initiatives highlight the importance of G20’s commitments to fostering international partnerships that drive meaningful change for Africa’s development.

And now, within the context of geopolitical changes, what else can we expect from G20 as South Africa takes over from Brazil?

As South Africa prepares to take over the G20 presidency from Brazil, it will continue its commitment to being a responsible global citizen, particularly considering ongoing geopolitical changes. During its presidency, South Africa will amplify its advocacy for peaceful conflict resolution and the promotion of democratic principles and human rights on the international stage. This commitment is grounded in a foreign policy that emphasizes neutrality, respect for mediation, and the critical importance of peace.

Leveraging its leadership within the G20, South Africa aims to navigate and address pressing geopolitical tensions by fostering constructive dialogue among nations. It seeks to promote collaborative approaches that prioritize diplomacy and multilateralism, ensuring that diverse perspectives are acknowledged and that solutions are inclusive. In this way, South Africa will play a pivotal role in shaping a more stable and peaceful global environment.

South Africa has consistently been advocating for, both structural and operational, reforms at the multinational institutions, what about putting first the internal order at the African Union (AU)?

Advocating for reforms at multinational institutions and strengthening the internal order of the African Union (AU) are not mutually exclusive; rather, they are complementary efforts essential for effective continental and global governance, particularly in a fractured geopolitical landscape. Enhancing the AU’s governance and operational frameworks is crucial to addressing Africa’s pressing challenges, which the AU has prioritized and encapsulated in its Agenda 2063. Enhancing the AU’s governance and operational frameworks is crucial to addressing Africa’s pressing challenges, which the AU has prioritized and encapsulated in its Agenda 2063. Simultaneous engagement with global governance structures is necessary to ensure that they advance critical reforms, making the global governance system more representative of and responsive to the developmental needs of Africa and the Global South.

The AU’s commitment to good governance has been a priority for many years and is prominently featured in its Agenda 2063: The Africa We Want. This strategic framework outlines the AU’s vision for transforming Africa into a global powerhouse and emphasizes good governance, democracy, respect for human rights, justice, and the rule of law among its seven aspirations. According to the 2022 IIAG report, more than half of Africa’s population now resides in countries where overall governance has improved, reflecting the positive impact of these efforts.

As South Africa assumes the G20 presidency as a member of the AU and the Global South, it is uniquely positioned to drive the development agenda for both Africa and the Global South while advocating for essential reforms in global governance. This focus aims to address the pressing need for more inclusive and effective multilateralism that better represents the interests and aspirations of developing nations.

-

Feature/OPED5 years ago

Feature/OPED5 years agoDavos was Different this year

-

Travel/Tourism8 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz2 years ago

Showbiz2 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking6 years ago

Banking6 years agoSort Codes of GTBank Branches in Nigeria

-

Economy2 years ago

Economy2 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking2 years ago

Banking2 years agoFirst Bank Announces Planned Downtime

-

Sports2 years ago

Sports2 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn

-

Technology4 years ago

Technology4 years agoHow To Link Your MTN, Airtel, Glo, 9mobile Lines to NIN